2015 New Product Development Outlook

Survey-takers report using nearly 12 flavors in 2014

Click here to see an infographic about the top flavors of 2014 and the anticipated top flavors of 2015.

If the groundhog’s ability to predict the end of winter held true on an annual basis, it would make planning the last six weeks of winter much easier for many people. Although not as temperamental as the weather, many beverage-makers probably wish they had an ability to see into the beverage market future to predict the latest trends. However, the database of marketplace analytics, company sales information and more have helped beverage manufacturers gain a deeper insight into what to expect for the coming year.

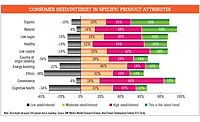

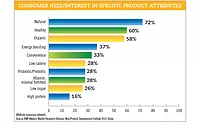

According to respondents of Beverage Industry’s annual New Product Development Outlook survey, “high protein” and “natural” are most likely to be the latest trends for 2015. Last year, “healthy” was the leader of consumer need/interest in specific product attributes and fell only two spots this year. However, “high protein” made significant strides in this year’s survey, moving up from the No. 10 spot to the No. 1 spot, with 42 percent of survey-takers listing the product attribute as a latest trend.

One area that saw significant contraction was “organic.” With 27 percent of respondents naming this attribute as a latest trend last year, only 18 percent listed it as such this year, dropping it from No. 3 to No. 8. This year’s survey also saw “low glycemic” (No. 7 last year) and “low fat” (No. 9 last year) drop out of the Top 10, being replaced with “probiotic/prebiotic” (No. 6) and “vitamin, mineral fortified” (No. 10).

Although “low glycemic” was not in the Top 10 for latest trends, it still was recognized by many survey-takers as a high need/interest for consumers. Other attributes also receiving this designation were “beauty enhancing,” “cognitive health,” “country of labeling,” “ethnic,” “Fair Trade,” “low salt,” “indulgent” and “portion controlled.”

Attributes that ranked as having a low need/interest were “bone health” and “relaxation benefits.”

The right flavor mix

With all of the flavors that are out there, beverage-makers are not at a loss for options from which to choose. According to Beverage Industry’s survey, each respondent reported using on average 11.5 flavors in 2014.

When selecting which flavors they wanted to utilize, survey-takers opted for more traditional options in 2014, with orange, vanilla, lemon, strawberry and peach rounding out the Top 5. This is slightly different from last year’s survey in which the top flavors were vanilla, lemon, strawberry, mango and peach. Orange’s usage jumped up eight percentage points this year to 49 percent, compared with last year’s 41 percent. Tied with orange at 49 percent, vanilla’s usage remains fairly consistent with last year’s survey, seeing an increase of one percentage point.

Other flavors that also saw modest growth were lemon (up one percentage point), strawberry (up two percentage points), peach (up one percentage point) and chocolate (up four percentage points). Flavors from last year’s Top 10 that saw contractions in 2014 were mango (down three percentage points), raspberry (down eight percentage points), apple (down four percentage points) and fruit punch (down 17 percentage points).

Making up for some of these drop offs were lime (up seven percentage points), berry (up eight percentage points) and coffee (up six percentage points).

Although orange was the most-used flavor in 2014, it did not come in as the top-selling flavor for the year. Taking the top spot was chocolate at 29 percent. Although chocolate moved up only one spot from No. 2 to No. 1 compared with last year’s survey, its percentage point increase was 15. Taking a hit, however, was strawberry. Last year’s No. 1 top-selling flavor dropped out of the Top 10 as the percentage of respondents listing it as a top-selling flavor dropped from 25 percent to 7 percent.

However, not all flavors saw such a strong drop off in 2014. Vanilla moved up one spot to the No. 2 top-selling flavor after seeing its percent usage increase from 14 percent to 24 percent. Mango also had a positive year, jumping from No. 10 to No. 3. The tropical flavor saw its reported sales status increase from 10 percent to 22 percent.

This year’s survey also saw a handful of new flavors make the Top 10 list. Raspberry, coffee, black tea, orange and peach all made the top-selling flavors in 2014 list, knocking out apple, berry, fruit punch, lime and, as previously mentioned, strawberry.

As beverage-makers prepare for 2015, the top sellers for 2014 are expected to carry over into the next calendar year. Chocolate is listed as the No. 1 anticipated top-selling flavor for 2015, with 29 percent of respondents naming the indulgent variety. This is a strong increase from last year’s survey results in which only 17 percent of respondents listed it as a top-selling flavor. Also making significant gains is coffee, which entered the Top 10 in the No. 2 spot after being left off last year’s list. Making a more modest increase, vanilla’s anticipated selling performance increased one percentage point from 19 to 20 percent to round out the Top 3.

Developing for the masses

As beverage-makers prepare for 2015, many Beverage Industry survey-takers indicated that dairy-based and dairy-alternative drinks will be a category of focus.

Forty-two percent named the category as an area of new product development. This is up from the 35 percent that listed the category last year. Sports and energy drinks declined six percentage points to take the No. 2 position, while coffee and tea declined nine percentage points to round out the Top 3. Seeing double-digit declines in new product development were the water and juice categories, with only 24 percent of respondents listing the categories compared with 41 percent last year.

When it comes to deciding what areas of influence drive the development of new product ideas, more than three-quarters of respondents said they use consumer trends. Sixty-four percent noted customers/customer demand, while 62 percent listed research and development (R&D) departments. Marketing and sales and consumer research/testing filled out the Top 5 with

60 and 58 percent, respectively.

Natural attributes are of interest for many beverage-makers in 2015. Approximately 70 percent of survey-takers stated they will incorporate natural flavors into their new products. Of those respondents, nearly half indicated that this is an increase from last year’s portfolio. Respondents were allowed to leave an open-ended response for their reason for this increase, and many listed cleaner labels and consumer demand as the influences.

Colors usage also shows an affinity for natural sources, with more than two-thirds of respondents planning to use natural colors in their new product development this year. Of those who plan to use natural colors, 43 percent named this as an increase from the previous year. Consumer demand and clean labels also were the Top 2 reasons for this increase.

Team effort

Compared with last year’s survey, this year’s respondents represent the more entrepreneurial side of the business.

For instance, the mean and median of the number of employees for this year’s survey are 201 and 63 employees, respectively. However, last year’s survey-takers reported a mean 1,278 employees and a median of 180 employees.

This team size also affected the number of employees who are working on developing new products. Last year, the survey found a mean of 60 employees and a median of eight employees working on new product development. This year, the teams are much smaller, with the mean and median at 10 and four employees, respectively.

Although the company sizes and new product development teams of respondents are from a smaller base than last year, their outsourcing portions did not differ too much. Twenty-nine percent stated they outsource a portion of their new product development versus the 35 percent that said the same last year. However, the main difference was the areas of new product development that they outsourced.

Sixty-two percent of respondents reported outsourcing prototype development, followed by 46 percent for concept and product testing, and 38 percent for market research. Last year, market research and prototype development tied for first with

46 percent naming those as areas

of outsourcing. Concept and product testing rounded out last year’s Top 3, with 42 percent naming this as an area of new product development.

Holding steady with last year’s numbers, though, was the amount of respondents stating that a team approach is utilized in new product development. Ninety-three percent (the same number as last year) indicated using a team environment. Among those who use a team approach, 81 percent said sales and marketing are involved, while 79 percent listed R&D. This is slight flip from last year’s survey in which 80 percent of respondents named R&D, and 77 percent reported sales and marketing.

Upper management also remains a constant for survey-takers, with 62 percent listing their involvement compared with last year’s 61 percent.

Slightly higher than last year’s survey results, nearly nine out of 10 respondents whose upper management is regularly included on new product development projects have involvement from their chief executive officers. This is up from last year’s more than three-quarters of respondents. This variation could be reflective of the significant difference in the company size mean and medians between the two years.

Fifty-eight percent of survey-takers also indicated supplier involvement in new product development, compared with last year’s 61 percent.

The length of time to develop a new product also saw an uptick in this year’s survey, with mean time from inception to launch equating to 11 months. This is up from last year’s nine months; however, one-third of this year’s respondents noted that this is faster for them than in previous years.

Perhaps reflective of the company size decrease from last year’s survey-takers, the mean number of products developed in 2014 was 24, compared with 40 in 2013. Following suit, the mean number of those released decreased from 17 in 2013 to nine in 2014. The number of successful new product launches also experienced contraction, with the mean equating to five in 2014 versus 11 in 2013.

What the future holds

Looking ahead to 2015, respondents remained optimistic about their new product releases, with more than half indicating that they plan to launch more new products in the market in 2015 versus 2014.

Planning and assessments also will be staples with survey-takers, as 60 percent said they have a defin-itive new product development plan. Post-launch assessment was even higher, with 76 percent having that in place. This is an increase from last year’s results in which 62 percent indicated they had a definitive new product development plan, and 65 percent reported having a post-launch assessment.

Total cost to new product development also experienced some fluctuations between the two surveys. This year’s had a mean and median of $209,080 and $37,500, respectively. Last year’s respondents had a mean of $348,717 and a median of $20,000.

However, when it came to R&D budget comparisons, the numbers were fairly similar, with 44 percent listing an increase in their budget versus 41 percent last year.

Beverage Industry’s New Product Development Outlook survey was conducted by BNP Media’s Market Research Division. The online survey was conducted between Sept. 29 and Oct. 13, 2014, and included a systematic random sample of the domestic circulation of Beverage Industry and its sister publications Dairy Foods and Prepared Foods.

Of the respondents, 44 percent process juice and juice drinks, 40 percent process coffee and tea, 33 percent process dairy-based drinks, 29 percent process sports drinks, 24 percent process water, 22 percent process energy drinks, 18 percent process spirits, 13 percent process carbonated soft drinks, 13 percent process wine, and 9 percent process beer.

Thirty-one percent of respondents were from companies with less than $10 million in annual revenue. Another 31 percent of respondents were from companies with revenue between $10 million and $50 million. A total of 9 percent were from companies in the mid-size range of $50 million to less than $100 million. Thirteen percent were from companies with revenue between $100 million to less than $500 million. In the $500 million to less than $1 billion range were 9 percent of respondents. Representing the large-size range of more than $1 billion in company revenue were 9 percent of respondents.

Males accounted for 67 percent of the respondents, and the average age equated to 43. For industry experience, 20 percent indicated one to three years; 18 percent reported four to 10 years; 33 percent said 11-20 years; 20 percent listed 21-30 years; and 9 percent had 31-40 years of experience.

Regionally, 33 percent said they currently live in the South, 27 percent indicated the Northeast, 24 percent listed the Midwest, and 16 percent reported living in the Western portion of the United States.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!