2021 State of the Industry: Tea’s versatility, healthfulness appeals to the masses

Four in five consumers drinking tea, Tea Association says

On any given day, more than 159 million Americans are consuming and enjoying refreshing, flavorful, functional tea. In fact, four in five of consumers drink tea, further cementing its status as a go-to beverage for the masses, states the Tea Association of the USA, New York. Because of its popularity and healthy attributes, the tea and ready-to-drink (RTD) tea category is hitting all the right notes as it offers a multitude of options for every style and taste, including bagged, bottled, loose-leaf, hot, iced and cold brew.

In Beverage Industry’s June eMagazine, New York-based Nielsen reported $70 billion in tea sales for the 52 weeks ending April 17, an 11.3% year-over-year increase. Among the sub-segments, liquid tea notched $3.4 billion in dollar sales (11.1% growth); RTD tea saw sales of $142 million (of which chai tea and iced tea were top sellers with $49 million and $42 million, respectively); and kombucha, $597 million (5.5% growth).

Within the $1.5 billion packaged tea segment that experienced 7.9% growth, black teas were No. 1 with $639 million in dollar sales and a 2.8% increase, Nielsen data reported. Other top-grossing packaged teas were herbal teas at $593 million (up 15.3%); green teas at $240 million (up 7.2%); and red teas at $31 million (up 16%). There’s also several ways to enjoy a good cup of tea, as teas are packaged in six formats: concentrates, loose-leaf, pods, powdered, pyramid or tea bags.

In multi-outlets and convenience stores, the RTD tea/coffee category grew 10.2% for the 52 weeks ending May 16, according to data from Chicago-based Information Resources Inc. (IRI). This equates to $7.5 billion in sales.

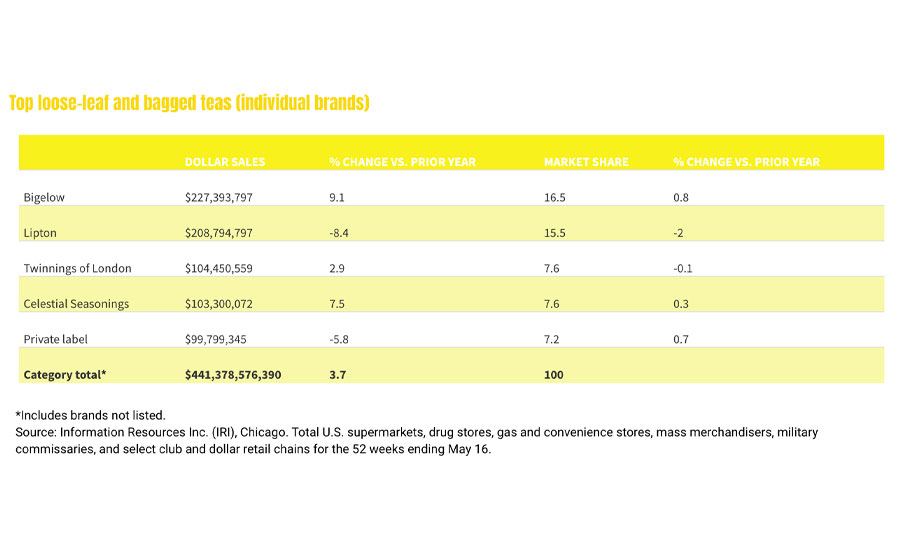

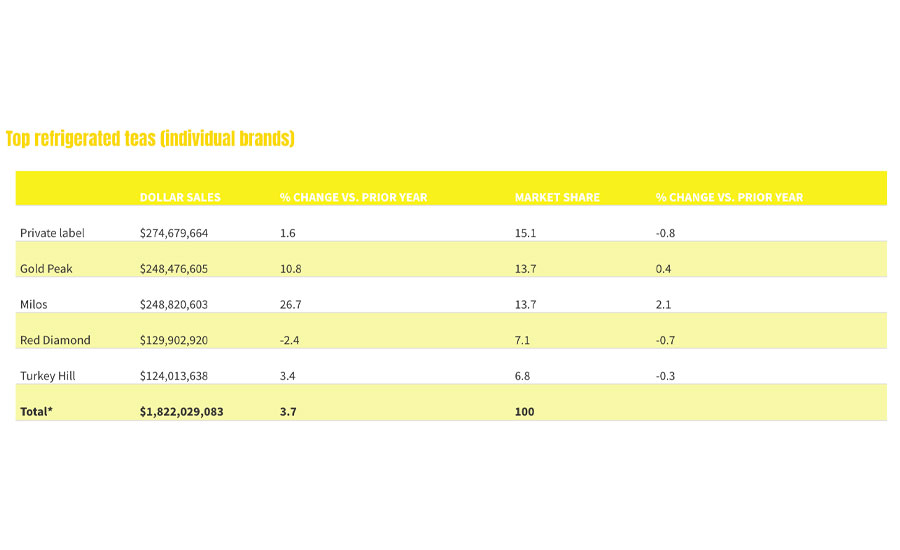

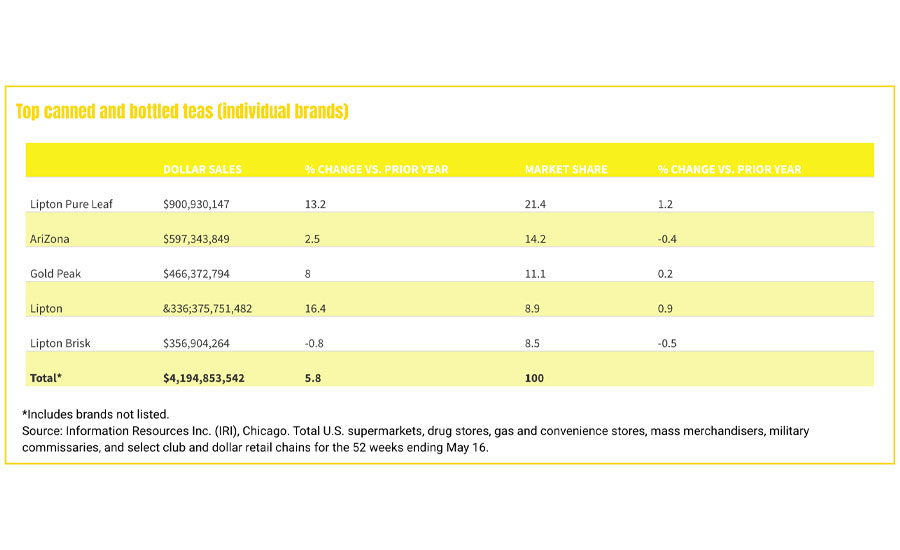

Canned and bottled teas, the largest subcategory, generated year-over-year dollar sales of $4.1 billion, representing a 5.8% increase, IRI reports. Other subcategories with strong growth were refrigerated teas with sales of $1.8 billion (up 7.2%) and tea bags/loose-leaf teas saw sales of $1.3 billion (up 3.7%).

From a much smaller base, kombucha post-fermented teas didn’t fare as well with a 25.8% deceleration (sales of $33 million), while single-cup tea posted sales of nearly $77 million, a 7.7% decline. However, some brands continued to shine bright, including Better Booch with triple-digit growth of 183.3% (sales just north of $1 billion) and Celestial Seasonings, which posted growth of 63.3% and sales of $5 million.

Although black tea remains the No. 1 tea varietal, with about 85% of U.S. imports in 2019, green tea is surging in popularity because of its “good for the body and mind” health halo. Green teas are the least oxidized when processed, contain less caffeine, have the most flavonoids — plant-based antioxidants — which could improve fat burning, brain function and help prevent type 2 diabetes and cardiovascular disease, experts noted in the June eMagazine.

Roger Dilworth, senior analyst at New York-based Beverage Marketing Corporation (BMC), suggested that matcha could continue to grow, but likely will not evolve beyond a niche segment. “There could be a mild upturn in tea due to yerba mate,” he noted.

Indigenous to South America, yerba mate is derived from the naturally caffeinated leaves of the holly tree, Ilex paraguariensis. Looking to capitalize on the use of its USDA certified organic yerba mate and Fair Trade Certified ingredients sourced from Brazil, Honest Tea, a brand of The Coca-Cola Co., Atlanta, launched Honest Yerba Mate in three organic flavors: Strawberry Pomegranate Matcha, Peach Mango Green Tea and Lemon Ginger Black Tea.

Each 15.5-ounce slim can contains real brewed yerba mate, which provides the same amount of caffeine as an 8-ounce cup of coffee, 13 grams of sugar, 1% juice and 60 calories. Honest Yerba Mate is available at select grocery retailers nationwide including Publix, Fresh Direct, Hannaford, Dave’s and Whole Foods Market.

In addition to RTD teas brewed with yerba mate, other tea styles include herbal, fruit, white, chai, oolong, rooibos and kombucha, along with hard tea varietals. According to “The Tea Enthusiast’s Handbook: A Guide to the World’s Best Teas,” there are more than 20,000 different teas in the world.

In fact, tea is the second most preferred beverage in the world after water and is found in more than 80% of households, noted Kritika Mamtani, senior research analyst for chemical, materials and food at Global Market Insights, Selbyville, Del., in Beverage Industry’s June eMagazine.

“Rising consumer awareness regarding the health benefits of tea along with the availability of variety of flavors has increased the sales of hot tea more than 15% in the past five years,” she said. Between 2017 and 2019, wholesale tea sales in the United States generated incremental growth of $12.5 billion, $12.66 billion and $12.67 billion, respectively, she added.

The pandemic and the shuttering of cafés and restaurants, however, has impacted on-premise tea sales. “The consumption of foodservice tea in the U.S. has experienced a downfall of approximately 40% in 2020,” Mamtani explained.

“The United States faced the largest drop in tea consumption of any Euromonitor-researched market in 2020,” Matthew Barry of Chicago-based Euromonitor International wrote in a July 15, 2020, blog post. “Sales of bagged and loose tea are expected to fall 13% and ready-to-drink (RTD) formats are projected to fall 11%. This is a sharp reversal of the recent past, in which tea growth was modest but consistently positive.”

Yet, there’s no shortage of new product development in the flavorful, functional tea market. Designed for consumers who crave iced tea, Lipton, through the Pepsi Lipton Partnership with PepsiCo and Unilever, introduced caffeine-free, RTD Lipton Herbal Teas in Strawberry & Mint and Orange Blossom flavors. The 16.9-ounce bottles are packaged in 12-packs and are available at major retailers including Walmart, Target, Publix, Food Lion, Giant Eagle and Meijer for a suggested retail price of $5.99.

Image courtesy of The Coca-Cola Co.

In June, Bigelow Tea, Fairfield, Conn., added two new Bigelow plus Vitamin C bagged teas to its portfolio. Available in 18-count multipacks: Bigelow Green Tea with Elderberry Plus Vitamin C, is a smooth green tea with a slightly tart berry flavor and a smoky finish, and Bigelow Lemon Echinacea Black Tea Plus Vitamin C, is a robust black tea with tart lemon and earthy Echinacea.

In the June eMagazine, Global Market Insights’ Mamtani suggested tea manufacturers focus on developing innovative tea products to attract new and existing consumers in the market. “The demand for tea is driven by major factors such as convenience, variety, easy availability, health benefits, and introduction of unique flavored and high-end specialty tea,” she explained. “Tea manufacturers should consider the above-mentioned factors to maintain sales and attract customers in the market over the forecast period.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!