Category Focus

Consumer engagement, demographic shifts impact the wine market

Premiumization, sparkling wine segment spur growth for the category

Image courtesy of Force & Grace

Known for his distinctive hairstyle, abundant gold jewelry and tough-guy persona, American actor Mr. T is quoted for saying, “To have a comeback, you have to have a setback.”

During the past couple years, where the wine industry witnessed setbacks due to the COVID-19 pandemic, experts note that the U.S. wine drinking population is making a comeback thanks to the revival of on-premise.

In its “Key trends driving the US wine market in 2023” report, London-based IWSR notes that, since the pandemic, overall wine participation rates in the United States have bounced back with the number of regular wine drinkers growing by 14 million between 2021 and 2022.

“This momentum is mainly coming from those under the age of 40, and the wine industry is seeing a growing influence not just of the most engaged consumers (aged 25-54), but also of [legal drinking age] (LDA) Gen Z to an extent,” it states.

However, despite this boost to the U.S. drinking population, overall wine consumption volumes in the United States dipped 2% in 2022, and IWSR forecasts that the trend of gentle decline will continue.

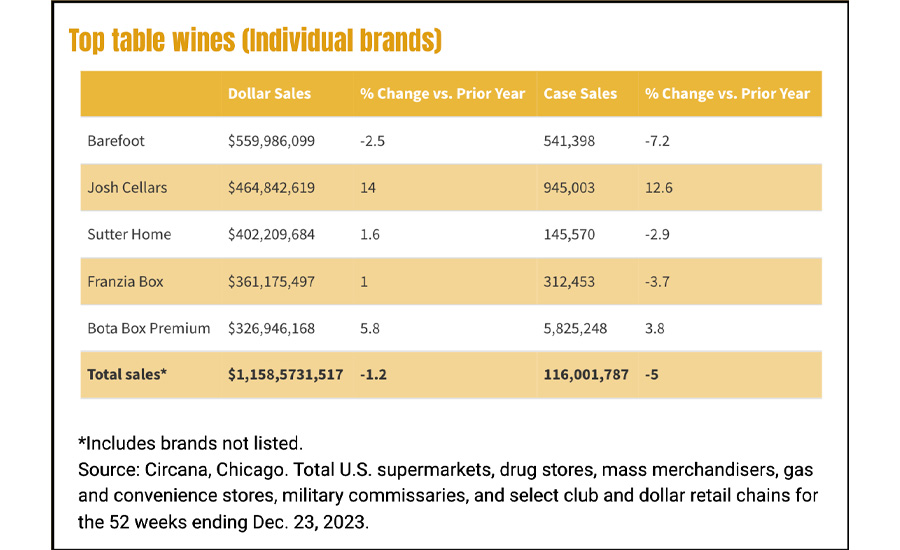

Mike Wyatt, client insights consultant for Chicago-based Circana, notes that the U.S. wine market struggled in 2023, as evidenced by dollar sales being down 1.2% and volume sales being down 4.9% versus the previous year.

“The average price for wine increased 3.9% this past year, which is slightly above the U.S. inflation rate over the same time period,” Wyatt says. “This price increase coupled with overall consumer shifts to RTDs [ready-to-drink] and spirits created continued challenges for wine producers and sellers.”

Yet, where more engaged wine drinkers are driving premiumization, Wyatt points to this trend as helping spur growth within the category.

“Collectively, the super-premium and ultra-premium segments performed the best across table and sparkling wine,” he explains. “This growth can be attributed to an ongoing shift to premiumization within the wine category as loyal consumers are willing to pay a premium for perceived quality and go-to brands.

“Essentially, the $13-$19.99 range proved to be the sweet spot with regard to growth and consumption,” Wyatt continues.

IWSR drinks market analysis also points to premiumization as a noticeable trend across the U.S. wine landscape.

“Within this landscape, the $10 price point per bottle is a clear divide. Below this level, volumes are falling and are forecast to continue to do so; above it the reverse is true,” it states.

Aside from engagement, IWSR notes that disposable income is another key factor driving premiumization, pointing to regular wine drinkers as being more likely to have a higher combined income compared with the income they had in 2018.

“The number of those who are highly involved in the category (as defined by curiosity, commitment and willingness to spend more) has increased from 24% in 2019 to 32% in 2022,” it states. “By contrast, those with low involvement has dropped from 23% to 17% over the same period.”

Sparkling wines continue to shine

Where the total wine category witnessed slight declines in 2023, experts note that the sparkling wine segment remains a bright spot in terms of growth.

According to Circana data, the total wine category reached $14 billion in sales in U.S. multi-outlets and convenience stores for the 52 weeks ending Dec. 23, 2023. Overall, still wines did not perform as well as the smaller sparkling wine segment, posting sales of $12.3 billion, representing a 1% decrease. In comparison, sparkling wine reached $1.7 billion in sales, with a slight increase of 0.1% for the same time period.

Although both sparkling wine and still wine experienced similar challenges in the past year, Circana’s Wyatt points to performance within the sparkling wine/Champagne segment as noteworthy.

“The notable exception is the super-premium tier ($13-$17.99), which grew 7.1% offsetting some of the declines in other tiers and was driven primarily by Prosecco from top producers,” he explains.

IWSR notes that, although volumes for still wine — and the total wine category — witnessed declines, sparkling wine recorded its 21st consecutive year of both value and volume growth in 2022.

“The more premium segments ($40 plus for Champagne, $10 plus for other sparklers) are forecast to see the strongest growth over the next five years,” it states.

As far as consumers experimenting with different wine varietals, Circana’s Wyatt points to white, lighter-bodied reds, sparkling and sweeter wines as having seen the highest levels of trial and experimentation.

“Sweeter wines encompass many flavor profiles not indicative of traditional varietals and are considered more approachable, especially for non-core wine consumers or those looking for a light beer or RTD alternative,” Wyatt explains. “However, Sauvignon Blanc, Beaujolais and Prosecco experienced notable trial and growth among white, lighter-bodied reds and sparkling respectively.”

Shifting demographics

Although engagement with different wine varietals is a key trend for all age groups, experts note that demographic shifts are significantly impacting the market.

“Increasingly, the U.S. is becoming a two-pronged wine market, where less-engaged, more price-sensitive (and often older) consumers are reducing their activity or leaving the category altogether, and more engaged, regular (typically younger adult) consumers exert an ever-greater influence,” IWSR states. “While the most engaged Gen X and millennial consumers make up just under 30% of total regular U.S. wine drinkers, they account for nearly 60% of the total wine spend.”

Further, IWSR notes that, among consumers under the age of 55, very few are sticking to what they know — impacting their purchasing decisions.

“This willingness to experiment has meant that the big established names of the wine world — whether countries, grape varieties or brands — no longer have the resonance with U.S. wine drinkers that they once did,” it states. “The return of the on-premise and the addition of newer wine drinkers post-pandemic has brought in people who are less familiar with established mainstream brands and are increasingly purchasing wine outside of grocery and chain stores, where those brands are more visible."

Circana’s Wyatt points out that younger LDA consumers are not engaging with the wine market to the degree that many expected.

“Lighter, sweeter and conveniently packaged wine products were intended to attract and retain younger LDA consumers, but these consumers continue to opt for RTDs as their primary beverage of choice,” Wyatt says.

Wyatt notes that this has resulted in a much higher percentage of younger LDA consumers consuming RTDs versus wine.

IWSR, meanwhile, describes younger LDA wine drinkers as more adventurous, but less knowledgeable, noting that “these consumers are open-minded but yet to develop a knowledge base.”

Moreover, as younger LDA wine drinkers are becoming less interested in well-known brands and varietals, IWSR points to no/low-alcohol wine as having a positive outlook.

“Though the overall no/low sector (across all alcohol categories) is still very small (just 1% of total U.S. beverage alcohol volumes), more than half of all U.S. beverage alcohol drinkers state they want to moderate their intake,” it states. “Wine leads in share of the low-alcohol category in the U.S and is the only low-alcohol segment showing growth.”

As the wine market looks to rebound from its volume declines, experts highlight that the playbook that worked before to engage with consumers has shifted and it is important for companies to adjust their approach.

“Brand owners looking to tap into the momentum driven by younger adult consumers who are (re)discovering the wine category will need to adjust go-to-market strategies,” it states. “The relationships younger LDA wine drinkers hold with alcohol differ from previous generations.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!