Category Focus

Convenience, premiumization continue to positively impact wine segment

Alcohol-free, direct-to-consumer among innovations from wine brands

Photo by Elena Photo/courtesy of Canva

In basketball, rebounding is an essential facet to the game. Rebounding can allow teams to maintain possession or gain it back. Because as the clock winds down, whomever has possession might ultimately determine who wins or loses. Rebounding in basketball requires strategy, physical acumen and a concerted effort from its players. For the U.S. wine category, rebounding is more nuanced as it looks to rebound from 2020 dollar sales losses, while keeping the category relevant and exciting through emerging styles, formats and usage, experts note.

Mintel’s “U.S. Wine Market Report 2021” notes that, despite on-premise closures that shook the wine market in 2020, circumstances surrounding the COVID-19 pandemic allowed the category to further solidify its place in at-home casual and relaxing occasions, which helped close the gap between wine and beer purchases for off-premise consumption.

“While some U.S. wine trends established during this time will endure in the near term, as consumers’ grapple with fluctuating and varying stages of re-emergence readiness, continued improvements in COVID-19 case rates and comfort with venturing away from home will continue to benefit wine, as consumers are eager to raise a glass to a return to normalcy,” it states.

Yet, as the quest for health represents the strongest challenge to the wine category, 26% of U.S. alcohol drinkers aged 22-plus report reducing consumption in 2021, according to the report.

“The leading reason for cutting back is in effort to improve health. Further, three in 10 retail alcohol shoppers aged 22-plus say drinking less alcohol is the fastest way to improve their health,” it continues. “The acceleration of low-alcohol and alcohol-free wine purchase and interest, as well as wine offerings that create permissibility through ‘less-but-better,’ natural ingredients and a clean label have a strong chance to vie for those who are limiting consumption occasions.”

In line with this trend, Stella Rosa, a brand of the Los Angeles-based Riboli Family Wines, released Stella Rosa Non-Alcoholics, which is made with real fruit flavors, and is naturally gluten free, vegan, and low calorie, it says. The semi-sweet, semi-sparkling Italian non-alcohol wine is available in four of the brand’s most popular flavors: Stella Rosa Non-Alcoholic Black, Red, Rosé and Peach.

Miller Family Wine Co., Santa Maria, Calif., also entered the non-alcohol wine market with Hand on Heart, a collection of premium, non-alcohol wines developed in collaboration with Iron Chef Cat Cora.

“As health and wellness considerations have cemented themselves as key factors in consumers’ purchase decisions, the alcoholic beverage industry has responded with an influx of innovation aimed at meeting our consumers' changing needs,” said Tommy Gaeta, director of marketing for Miller Family Wine Co, in a statement. “While there are an increasing number of premium non-alcoholic spirit and beer offerings out there, non-alcoholic wine options continue to be extremely limited.”

However, as non-alcohol wines still account for only about 4% of overall wine sales, they are having a minimal impact on overall wine trends, according to Mike Wyatt, consultant at Chicago-based Information Resources Inc. (IRI).

Remaining competitive

As on-premise sales indices are still below 2019 levels so the struggles for wine are primarily due to the consumer shift toward spirits, hard seltzers and premixed cocktails, IRI’s Wyatt explains.

“The off-premise wine market declined 4% in dollar sales and 9% in volume sales the past year due to lapping the initial COVID outbreak and subsequent ‘panic buying’ in 2020 coupled with many beverage alcohol consumers opting for spirits, hard seltzers and premixed cocktails instead of wine,” Wyatt says. “[Yet], the trends of lighter flavor profiles and bubbly refreshment are positively impacting the sparkling wine segment.

“These trends have driven the success of hard seltzers and have carried over to sparkling wine with the growth of premium sparkling wine even outpacing value sparkling wine as consumers are willing to pay more for perceived quality and superior taste,” he continues.

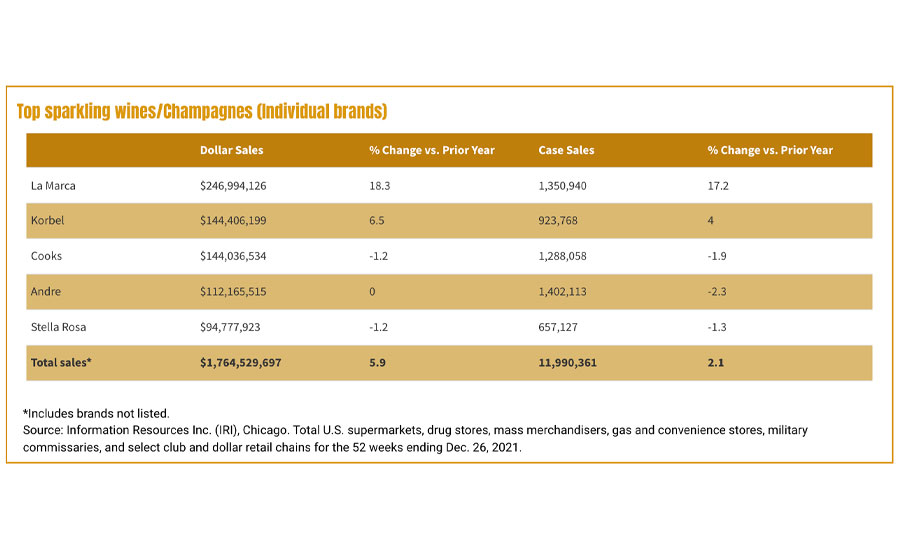

According to data from Chicago-based Information Resources Inc. (IRI) the sparkling wine/Champagne segment generated dollar sales of $1.7 billion, a 5.9% year-over-year (YoY) increase for the 52 weeks ending Dec. 26, 2021, in total U.S. multi-outlets.

The No. 1 brand, La Marca Sparkling Super Premium, a brand of E. & J. Gallo Winery, generated dollar sales of nearly $247 million, a 18.3% YoY increase. With dollar sales of $144 million, a 6.6% increase, Brown Forman Corp.’s Korbel Sparkling Premium ranked No. 2, while the No. 3 brand, Cooks Sparkling, within the Constellation Brands’ portfolio, had dollar sales of $114 million and a slight 1.2% decline.

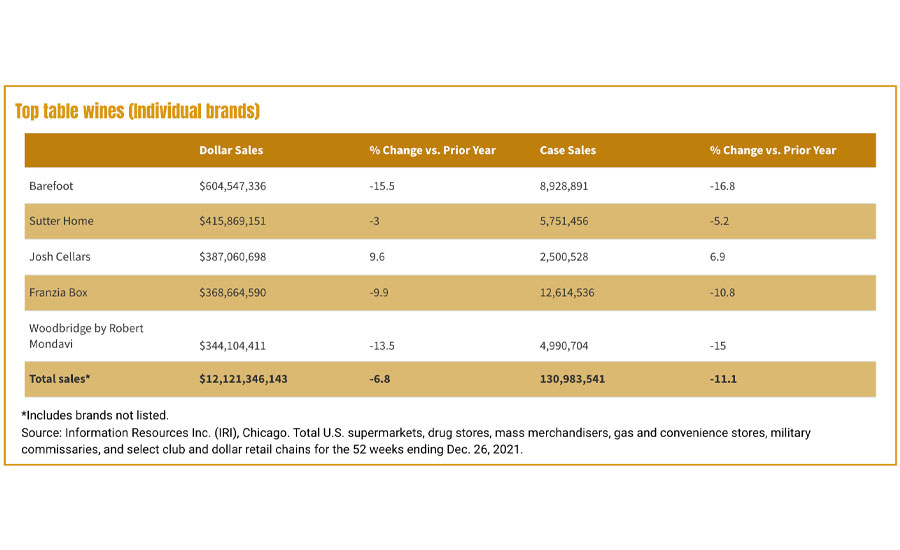

Overall, table wines did not perform as well as the smaller sparkling wine and Champagne segment. Posting sales of $12.1 billion in multi-outlets, this represented a 6.9% decrease for the 52 weeks ending Dec. 26, 2021, according to IRI data.

Moreover, shifting priorities within the industry have helped increase overall volume sales, Wyatt notes.

“Convenience, premiumization and approachability are trends that have had a positive impact on the wine category,” Wyatt says. “These trends are best evidenced by canned and boxed wine growth outpacing traditional packaging, $20 plus per bottle sales growth outpacing lower price points, and sweeter wines outpacing traditional and bolder flavored wines.”

Global players

As growth continues to skew to the premium segments of the U.S. market, there are few wine markets around the world that offer more attractive options, experts note.

Utrecht, Netherlands-based RaboResearch’s “Rabobank Wine Quarterly Q4 2021” notes that, given the uncertainty in the Chinese market, much of the critical merger and acquisition (M&A) activity in the global wine industry will likely remain focused on the premiumization trend.

“Given the ongoing premiumization trend and value growth in the U.S wine market, we believe that much of the critical M&A activity in the global wine industry will likely remain focused on that market,” it states. “That said, it should also be noted that the disruption in the Chinese wine market may well trigger meaningful investments as players adjust to different terms of trade. This could be driven by the Australian companies investing in alternative production regions (e.g., China or Chile) to leverage their existing position and relationships in the Chinese market or by Chinese wine companies investing in Chilean or European wineries with similar goals.”

As the Chinese wine market is going through some important transitions, weak consumption exacerbated by the pandemic as well as tariffs introduced on Australian wine imports have left a gap in the market, creating opportunities for others to fill, according to Rabobank.

“French wine, as one of the biggest beneficiaries, has seen strong growth, both in value and volume. Along with more affluent and sophisticated consumers, demand for Burgundy and Bordeaux wines continue to increase,” it states. “Champagne and Rhone Valley have also benefited from this good dynamic.”

Yet in the United States, Oregon is driving the most growth, IRI’s Wyatt says.

“The positive trend of these geographies is due to the strong correlation with the primary offerings of each location and current consumers preferences,” he explains “For example, Rosé, Prosecco and Sauvignon Blanc are primary offerings from France, Italy and New Zealand, respectively, while Oregon is a heavy producer of Pinot Noir.”

Healthy take

Experts note that within the beverage industry, consumer interest in products that are declared healthy transcend demographics.

Meanwhile, as many consumers overall are shifting their preferences toward a healthy lifestyle, the use of natural and chemical-free products has increased, leading to a surge in demand for organic wines, according to a September 2020 report by New York-based The Insight Partners.

“This trend has led to a surge in demand for organic wine” it states. “Organic wine is produced and processed under specific standards, which prohibit the use of synthetic fertilizers, pesticides and several other synthetic additives.

“Consumption of wine in social gatherings and celebrations has become a status symbol in developed countries, which is the primary reason for the increase in demand for wine,” it continues. “Furthermore, high disposable income of consumers and growth in the promotional and marketing strategies has accelerated the demand for organic wine. Moreover, wine manufacturing companies in North America are continuously enhancing their organic wine portfolio to meet the customers’ demand.”

In fact, the organic wine market in North America is expected to reach $3.9 billion in size by 2027, The Insights Partners states.

As a result, organic wines are becoming more available on store shelves. In response to unprecedented demand from consumers, Los Angeles-based Winc Inc., announced the growth and expansion of its organic wines in major national retailers including Walmart, Whole Foods, Albertsons, HEB, Central Market and HyVee.

“In a recent Winc customer survey, 73% of respondents ranked health factors, including organic, as a top driver for initial purchase,” the company said in a statement. “The growing demand for healthier options is also closely aligned with millennials prioritizing sustainability and a March 2021 Wine Intelligence Report indicated that organic wine was the highest opportunity type of wine among younger consumers.”

In celebration of its 40th anniversary celebration, Sonoma-Cutrer, located in the heart of the Russian River Valley in Windsor, Calif., recently released two new sustainable certified wines:

- 2019 Russian River Valley Pinot Noir: Aged in a mix of new, one-year and two-year old French oak barrels for 11 months, this 13.9% ABV wine offers a balanced acidity, juicy core, and a long finish, the company says.

- 2019 The Cutrer Chardonnay: Layered and balanced, this wine was aged eight months sur-lies in French oak barrels, then blended in tanks and racked into three-year-old French oak barrels for five months and allowed to bottle-age for three months prior to release. The 14.1% ABV wine features flavors of white peach, nuts, toasted oak and baking spice with light caramel, brown sugar and cedar notes, the company says.

Despite consumer preferences having slightly shifted away from wine, the wine market is predicted to grow in 2022, Wyatt says.

“Positive momentum from eCommerce and direct-to-consumer (DTC) channels coupled with additional on-premise reopenings should carry over into upside for off-premise as well and ensure the wine market continues to expand,” Wyatt concludes.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!