Cover Feature

Hard seltzers comprise 7% of total beverage alcohol

Large and small companies invest in hard seltzers

The Calypso-inspired song “Feeling Hot Hot Hot” by Montserratian musician Arrow has people dancing and singing along to “Ole ole – ole ole, hot, hot, hot” as it extols party people to join the celebration. Recognizing a good thing, over the past 25 years the fun party song has been played on cruise ships and re-released by countless artists including Buster Poindexter and His Banshees of Blue and Puerto Rican reggaeton artist Don Omar. Within the beverage category, hard seltzers are sizzling “hot hot hot,” with dollar sales of $4.3 billion and a nearly 70% year-over-year (YOY) growth for the 52 weeks ending June 13, according to data from Chicago-based Information Resources Inc. (IRI).

Scott Scanlon, executive vice president for BevAl Vertical at IRI, notes that the ready-to-drink (RTD) hard seltzer category had experienced triple-digit growth from 2018-2020, with no signs of cooling down. “Total hard seltzers are up 33% in 2021 and had $0.5 billion in growth year-to-date thru June 20, 2021,” he says. “They are now a 7% share of total beverage alcohol (TBA) dollars with sales totaling $2.1 billion. This was despite the cycling COVID panic buying/channel shift in 2020.

“…The seltzer category grew by $2.5 billion in 2020, $1.1 billion in 2019 and $0.3 billion in 2018,” Scanlon continues. “So, while the category is down in percent growth, absolute dollar growth remains strong. Beer malt-based brands make up 96.5% of total hard seltzer dollars in 2021.”

Market research analysts continue to keep a close eye on the hard seltzer category, which in a short amount of time has solidified their position as a staple category that continues to grow.

“A few years ago, hard seltzers showed strength in penetration when they were first introduced, and over time, they have shown strength through strong repeat purchasing,” says Kaleigh Theriault, client manager at New York-based NielsenIQ Beverage Alcohol. “In the latest 52 weeks ending 5/22/21, hard seltzer penetration is 13.2%, up 3.7 points from the same weeks a year ago. Of these hard seltzer buyers, close to 60% are purchasing hard seltzers two or more times throughout the year.”

Experts note that flavored malt beverages (FMBs) like hard seltzers are bolstering growth in a beer market which has seen only small pockets of growth. New product development and innovation within the thriving FMB space also is strong.

Image courtesy of Mighty Swell

“Today there are nearly 700 malt-based seltzer brands in the market, which reflects the number of companies that are investing in this segment,” Scanlon explains. “Hard seltzers are a win because they have delivered growth YOY for the last 3-4 years, so big beer companies that traditionally aren't in the flavored beer space can't afford to ignore this market shift. Additionally, hard seltzers offer versatility as a product; they serve as a vehicle to deliver interesting flavors and ingredients, and play into trends around health and wellness through low calorie/sugar/carb attributes.”

Yet, the FMB/seltzer segment took a big hit for June, falling 25 points from 94 in June 2020 to 69 in June 2021, according to the Beer Purchasers’ Index (BPI) from the National Beer Wholesalers Association (NBWA), Alexandria, Va. In May 2021, the segment, with a BPI reading of 82, had outperformed all other segments, but was still a few points below the May 2020 reading of 90. However, since January 2019, the FMB/seltzer segment has consistently outperformed all other segments, it said.

In a statement, NBWA Chief Economist Lester Jones explained: “The ‘at-risk’ inventory measures for FMB/seltzers continued to break new milestones as it is still expanding and growing, as indicated by the above 50 reading. The lower index relative to June 2020 indicates that more distributors are reporting they are ordering ‘about the same’ amount of product as the same time last year. This is not a big surprise as the segment has experienced significant amounts of distribution growth over the past 12 months.”

Image courtesy of Buenavida

Summer and seltzers go together

While the hard seltzer category is really just over four years old, it continues to grow in the 40% to 50% range off a very high base, Brian Sudano, managing partner of New York-based Beverage Marketing Corporation (BMC), points out.

“[Hard seltzers comprise] 214 million cases, around 8% of beer market — making it still the hottest category in the beer market,” he explains. “Although slower as a percentage versus the past three years, its absolute growth numbers are comparable to last year. The FMB market has driven beer growth at different times since the mid-1990s. Since 2008, the category has consistently driven beer, growing over 300% from 2008 to 2020.”

Summer sunshine and low-calorie, low-ABV hard seltzers seemingly go together like cold beer and hot wings, as consumers are finding them a perfect way to celebrate summer at barbeques, the beach and outdoor parties.

In fact, ahead of the pivotal Fourth of July holiday, San Francisco-based Instacart, which operates grocery delivery and pick-up services through its website and mobile app, was predicting an all-time high in hard seltzer sales for the company’s three top-performing brands: White Claw, a brand of Mike’s Hard Lemonade Co., Chicago; Truly, a brand of the Boston-based Boston Beer Co.; and Bud Light Seltzer, a brand of St. Louis-based Anheuser-Busch.

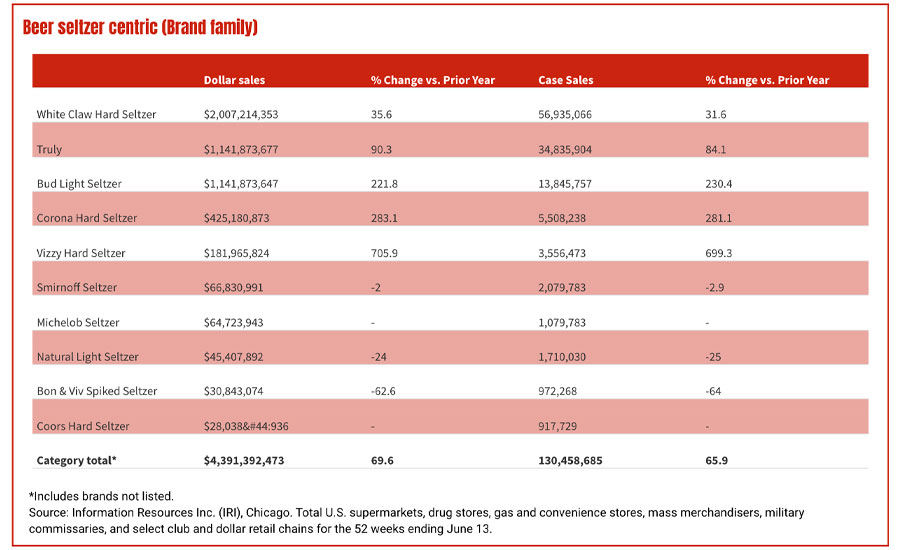

In the beer seltzer centric category, IRI data reports that White Claw, Truly and Bud Light seltzers were the Top 3 brands, registering dollar sales of $2 billion, $1.1 billion and $425 million, respectively, in multi-outlets and convenience stores for the 52 weeks ending June 13. These brands saw steady YOY growth of 35.6%, 90.3% and 221.8%, respectively, for the same timeframe.

Albeit from a smaller base, Vizzy Hard Seltzer, a brand of Chicago-based Molson Coors, generated strong YOY growth of 705.9% and dollar sales of $113 million.

Proving there’s plenty of room for new product innovation in hard seltzers, several up-and-coming brand families notched quadruple YOY growth. These include Lone River Hard Seltzer, with 5,184% YOY growth and $9.1 million in sales; Kona Spiked Seltzer with 1,156.8% growth and $9.6 million in dollar sales; and Labatt Blue Light Hard Seltzer with a 1,128.8% rise and sales of $9.1 million.

According to Instacart’s Trends Expert Laurentia Romaniuk, “The hard seltzer craze shows no sign of slowing down this summer. With more brands releasing hard seltzer offerings of their own, consumers looking for a refreshing beverage have more choices than ever before. We’ve seen Instacart sales in the hard seltzer category consistently peak during the lead up to the 4th of July. If current trends hold, this year’s July 4th seltzer sales peak will reach an all-time high.”

Image courtesy of Mike’s Hard Lemonade Co.

Coming out of the long four-day Fourth of July weekend (July 2-5), Boston-based eCommerce alcohol delivery platform Drizly detailed what consumers were ordering to celebrate. The winners were hard seltzers, RTDs, tequila and champagne, according to Liz Paquette, head of consumer insights at Drizly.

“Sales spiked on Sunday, up 27% than the average of the previous four Sundays. High Noon maintained its position as the No 1 RTD, but newcomer On the Rocks had a big weekend, jumping from No. 11 to No. 4,” Paquette says. “White Claw outsold Corona and Bud Light, maintaining its status as a signature summer drink. Champagne continued to have a bigger weekend too, accounting for 24% share this year compared to 20% share in 2020.”

Hard seltzer sales at convenience stores also are trending high. A “CStoreDecisions” report from National Retail Solutions (NRS), Newark, N.J., reports that hard seltzer sales increased by 50% in their stores from Q1 2021 compared to Q1 2020, while traditional beer sales were up 5.6%, explains Brandon Thurber, director of media measurement and scan data insights at NRS.

“This has continued to be quite the phenomenon. It goes to show that merchants will continue to make space for what is selling,” Thurber says. “The hard seltzer gains are the biggest increase across any segment in the stores. In small-format stores with limited shelf space, the growth of hard seltzer has compressed some non-alcoholic beverage segments … like soft drinks, fruit drinks, liquid tea and sports drinks, which have seen a decline in the number of items carried. Not only have merchants taken notice, but everyone seems to want in on the latest seltzer fizz.”

Image courtesy of HEINEKEN USA

Joining the hard seltzer party

Several big beer companies like Molson Coors, HEINEKEN USA and Anheuser Busch are climbing on board the hard seltzer bandwagon. In fact, Molson Coors recently invested $100 million in its RTD hard seltzer expansion and its Proof Point hard seltzers (5% ABV, 10 proof) now are available in 27 states. To differentiate itself, the brand is using four different spirits — vodka, rum, tequila and whiskey — with a squeeze of real juice such as lime, mango pineapple, blackberry lemon and grapefruit. The spirited seltzer pours clear with a natural haze from the real fruit juice and contains zero sugar, 100 calories and zero carbohydrates, it says.

In January 2020, the 5% ABV Bud Light Seltzer began hitting store shelves nationwide in four fruit flavors: Black Cherry, Lemon-Lime, Strawberry and Mango. Amid its success and popularity with triple-digit growth, about a year later, the brewer announced the nationwide release of another hard seltzer iteration: Bud Light Seltzer Lemonade. The new 12-ounce slim can variety 12-packs feature four new flavors: Original Lemonade, Black Cherry Lemonade, Strawberry Lemonade and Peach Lemonade. The 5% ABV Bud Light Seltzer Lemonade is brewed with loads of lemonade flavor, cane sugar, natural fruit flavors and clocks in at 100 calories with less than 1 gram of sugar, the company says.

"After launching Bud Light Seltzer last year, it quickly became one of the top innovations in the entire category and in the history of the brand. We are excited to continue expanding our portfolio with the new Bud Light Seltzer Lemonade variety pack," said Andy Goeler, vice president of marketing for Bud Light, in a statement at the time of launch. "Our Seltzer Lemonade marries the bold flavors of lemonade with the refreshing bubbliness of seltzer; this new offering is perfect for both established seltzer fans and those who are looking to give seltzer a try."

Within the entire food and beverage consumer packaged goods’ category for 2020, IRI announced Bud Light Seltzer as the No. 1 New Product Pacesetter (NPP), marking the first-time in the market research firm’s 26-year history of releasing its NPP report that an alcohol brand earned the top spot, IRI stated.

There is no shortage of new product innovations within the fizzy hard seltzer category. For instance, market share leader White Claw, which owns about 51% of the category, launched two new innovations just in time for summer sipping. These include the brand’s highest alcohol volume product, White Claw Hard Seltzer Surge, an 8% ABV spiked sparkling seltzer available in Blood Orange and Cranberry flavors.

Knowing that consumers crave variety, the brand also introduced three new flavors as part of its new White Claw Hard Seltzer Variety Pack Flavor Collection No. 3, which features Strawberry, Pineapple and Blackberry flavors along with fan-favorite, Mango in 12-ounce slim cans. Crafted using a proprietary BrewPure process, the variety pack offers consumers a new way to enjoy the same gluten-free, 100-calorie, 5% ABV White Claw Hard Seltzer is beloved for, the company says.

NielsenIQ’s Theriault notes that there are more than 120 manufacturers competing in the hard seltzer space, with some producing more than one brand. “From a brand perspective, 150 brands are competing to gain share within hard seltzers, and that number grows each day. Hard seltzer is a winning space and is the only growing segment of Total Beer/FMB/Cider year to date.”

In July, White Plains, N.Y.-based HEINEKEN USA and Hornell Brewing Co., an affiliated entity of AriZona Beverages, Woodbury, N.Y., teamed up to bring AriZona SunRise Hard Seltzer to market. Designed to bring authenticity, AriZona SunRise Hard Seltzer is available in four flavors: Cherry Punch, Lemon, Grapefruit and Mucho Mango. Each gluten-free, 4.6% ABV varietal contains 100 calories, no added sugars and 2-4 carbohydrates per 11.5-ounce slim can.

Drizly’s Paquette points out that the hard seltzer category is ripe for innovation. “On Drizly, several new product innovations have broken into the Top 10 hard seltzer brands in 2021 to date, including Michelob, Topo Chico and CACTI,” she says. “Each of these new brands have resonated with consumers for different reasons whether it be brand name recognition, unique flavor offerings or celebrity collaboration.”

In the first half of 2021, hard seltzers accounted for 23% share of the beer category, up from 19% during the first half of 2020 and 9% during the first half of 2019, Paquette adds.

Image courtesy of Molson Coors

Innovation opportunity

To stand out from the sea of hard seltzers on shelf and noting that the barrier for entry in the space is “quite low” for large beer companies that already have the infrastructure in place, Provi CEO Taylor Katzman suggests an “incredible innovation opportunity” for all players, including craft brewers.

“Most interesting is the emergence of craft hard seltzers, being released by craft breweries throughout the nation,” Katzman explains. “The evident play in the hard seltzer space comes down to flavor differentiation, with craft breweries such as Upslope Brewing out of Colorado showcasing strong on-premise successes in recent months with its tangerine-flavored craft hard seltzer.”

Smaller brands also are carving out market share in a hard seltzer market once dominated by a handful of brands. For instance, Austin, Texas-based Mighty Swell offers a Spiked Seltzer Tropic Pack featuring Mango Raspberry, Grapefruit, Pineapple and Blood Orange. Each 5% ABV, gluten-free drink contains 2.5% juice, 3 grams of carbohydrates, 3 grams of total sugar and 100 calories.

A brand of Boston-based Mass. Bay Brewing Co., Artic Chill has a 5% ABV Day Tripper mix pack in four 100-calorie flavors: Fresh Lime, Strawberry Watermelon, Mandarin Orange and Cranberry Lime.

Given the proliferation of seltzer brands, market analysts advise that it’s critical to differentiate at shelf with a bold flavor profile and stand out packaging.

“Truly has been a great example of this, once it started to innovate across different flavor platforms like lemonade, iced tea and punch,” IRI’s Scanlon says. “This is further supported by its No. 2 position on IRI's New Product Pacesetters list. Bud Light Seltzer and Corona Hard Seltzer have also gone in this direction with lemonade forward launches.”

While traditional hard seltzer flavors of lime and black cherry are faring well, NielsenIQ’s Theriault suggests that further flavor innovation may be necessary to drive sales and set brands apart.

“The large hard seltzer brands continue to capitalize through emerging flavors, such as lemonade seltzers, hard tea seltzers, and ranch water seltzers,” Theriault explains. “Lemonade seltzers are $453 million (up 777% versus a year ago). Hard tea seltzers are $67 million (new versus a year ago). Ranch water seltzers are $13 million (new verus a year ago).”

Capitalizing on its success in Texas, Dos Equis Ranch Water Hard Seltzer, a brand of HEINEKEN USA, announced the brand now is available in several new markets including Alabama, Colorado, Illinois, Tennessee and Wisconsin. Inspired by the flavors of the classic West Texas drink ― tequila, sparkling mineral water and lime ― Dos Equis Ranch Water is a 4.5% ABV hard seltzer with country soul, the company says.

Due to continued flavor and formulation innovation along with convenient RTD packaging, hard seltzers are expected to surpass $5.1 billion in retail sales in 2021 with expected annual growth of high single-digit to low double-digit growth from 2022 to 2024, IRI’s Scanlon says.

BMC’s Sudano concludes that the explosive growth trajectory of hard seltzer is unique. “The beverage alcohol marketplace has not seen such sustained high level of growth that hit sizable scale this quickly in the market since light beer in the 1980s,” he explains. “Hard seltzer has built on a trend toward alternatives to traditional beer, wine and spirits that has been in place for several decades to only explode with hard seltzer. It is unknown as to whether the category will continue to follow a trajectory similar to light beer or a more modest trajectory. Regardless the category is a true success story.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!