Category Focus

Energy market thrives during pandemic

New flavors, functionality help category compete with outside categories

As his siblings, Libby and Buck, have made their mark on the family’s corn silo (a mud footprint), Arlo the Apatosaurus struggles to reach the same accomplishment in the Disney PIXAR movie “The Good Dinosaur.” After tragedy strikes the dinosaur family, Arlo finds himself on a journey with Spot, a curious cave boy. Arlo’s journey eventually leads him back to his family, where he finally gets to leave his mark on the silo. In today’s beverage market, the energy drinks and shots category is leaving its mark as more consumers are relying on the product’s key attribute ― energy ― to get through the day.

During the past year, the lack of travel reduced convenience store traffic, which simultaneously had an adverse effect on the energy drink market. However, experts note that the category still performed well as consumers relied on energy-supporting products to get through the challenging year.

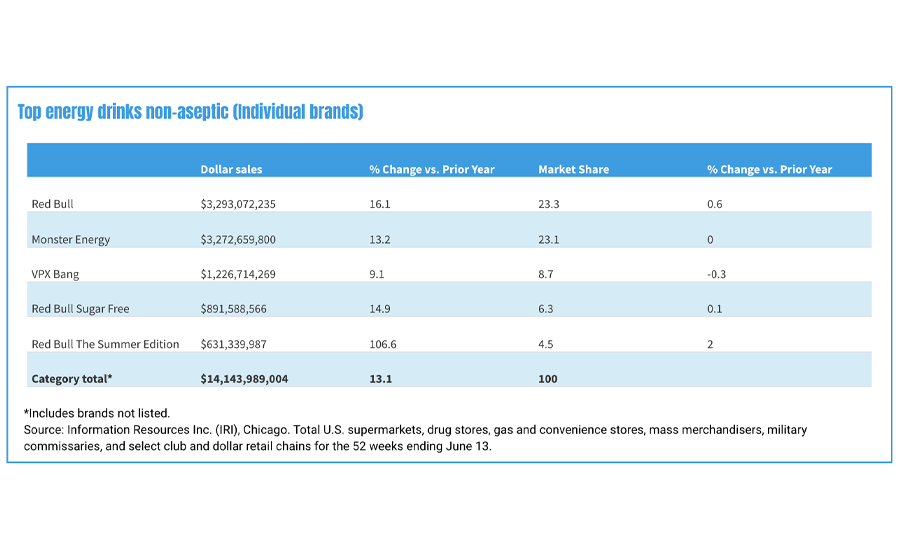

In a May report titled “Energy Drinks – US,” Chicago-based Mintel reports that total energy drink sales were up 9.2% in 2020 with dollar sales of approximately $14.3 billion. This sales total is up 37.4% from where the category stood in 2015 when sales totaled $10.4 billion, the report states.

“The energy drink market thrived in 2020 despite the drop in c-store traffic, as consumers relied on energy drinks to help them overcome challenges brought on by the pandemic,” said Caleb Bryant, associate director of food and drink reports at Mintel, in the report. “Consumers’ energy needs will remain elevated even as the pandemic fades, as many consumers continue to face increased workloads, more consumers return to the workforce and as the reopening of the country brings back the need for energy during travel and social occasions.”

Mintel’s report forecasts the category will near the $20 billion annual sales mark by 2025 because of consumer need states and a recovering economy.

“A period of economic expansion would greatly benefit the energy drink market as workers’ energy needs increase and as more consumers travel and socialize, opening the market up for more social/leisure energy occasions,” the report states.

Roger Dilworth, senior analyst at New York-based Beverage Marketing Corporation (BMC), also pinpoints the characteristics that have helped elevate the category with consumers.

“Energy continues to be one of the most prevalent needs among consumers, along with hydration and refreshment,” Dilworth says. “Energy drink marketers continue to recruit new consumers through ties to music, sports and eSports.”

Competition from all sides

Although energy drinks have flourished this past year, experts note that the category has seen increased competition from other beverage categories.

“New energizing beverages threaten the market’s growth, but energy drinks can remain competitive by prioritizing flavor innovation and creating new products that address the functional needs of core category consumers,” Mintel’s Bryant said within its report.

For its 2021 Summer Edition, Red Bull Energy Drink, a brand of Santa Monica, Calif.-based Red Bull USA, released a Dragon Fruit variety. Delivering bursts of red berries with a hint of plum and notes of florals, Red Bull Summer Edition Dragon Fruit features a bright magenta color, the company says.

MTN DEW GAME FUEL, a brand of Purchase, N.Y.-based PepsiCo, also is showing its ability to reach new consumers in its recent limited-edition variety: CouRageous Sherbet.

Launched in collaboration with video game streaming personality Jack "CouRage" Dunlop, rainbow sherbet-flavored CouRageous Sherbet comes in both zero-sugar and mid-calorie beverages and is exclusively available on GameFuel.com, the brand's one-stop eShop.

Beyond flavors, MTN DEW also is expanding its portfolio with energy drinks featuring expanded functionality. Together with NBA icon, businessman and philanthropist LeBron James, MTN DEW announced the creation of MTN DEW RISE ENERGY, an energy drink specifically formulated with ingredients to kick off the morning with a mental boost, immune support and zero grams of added sugar, the company says.

MTN DEW RISE ENERGY contains 180 mg of caffeine, vitamins A and C, antioxidants and fruit juice. With citicoline and caffeine to boost mental clarity and zinc for immune support, MTN DEW RISE ENERGY is designed to awaken ambition and help people conquer the day, according to the company.

Other brands also are adding new product attributes to next generation energy drinks. For example, Riff, Bend, Ore., released Riff Energy+ Immunity, the brand’s first sparkling energy drink focused on plant-powered energy and immunity benefits. Each variety contains antioxidants like elderberries, pure ingredients and immunity boosting vitamin C.

Image courtesy of Riff

Another segment emerging within the energy drinks market has been performance energy, experts note.

“This has motivated entrepreneurial players to try to carve out their niche in this sub-segment,” BMC’s Dilworth says. “A related trend is creating energy drinks with no calories but not necessarily promoting them as diets.”

In a July 2020 blog post titled “Performance Energy Drinks See Rapid Growth as Sport Drinks Struggle to Keep Up,” Aga Jarzabek, a research analyst at Chicago based Euromonitor Interantional, also identified the mark that performance energy is leaving on the category.

“Performance energy is a fast-emerging segment within the overall category,” Jarzabek wrote. “Energy drinks include added ingredients such as B vitamins, taurine, L-carnitine and guarana that serve as an additional boost to the already-high caffeine content. Performance energy drinks combine aspects of energy drinks, sports drinks and workout supplements. These beverages contain creatine, BCAAs, zero sugar and upwards of 300 mg of caffeine — nearly twice the levels of most energy drinks.”

An early entrant within this segment, Jarzabek identifies, is Bang Energy, a brand of Vital Pharmaceuticals (VPX) Inc., Weston, Fla. Bang now is the No. 3 non-aseptic energy drink, behind only Red Bull and Monster, with sales of $1.2 billion for the 52 weeks ending June 13 in total U.S. multi-outlets, a 9.1% increase.

Jarzabek highlights that the brand’s performance helped propel the future of the performance energy segment.

“Bang’s unprecedented performance and new entrants are driving rapid segment growth, further expanding the broader energy drinks category,” she wrote. “As of 2019, the segment had an 11% share of total energy drink sales in the U.S., totaling more than $1.6 billion, according to Euromonitor International.”

However, all new energy drinks aren’t about what’s added, but what isn’t. Experts highlight that mature energy drink consumers (millennials and Generation X) are interested in products without added sugar.

“While energy drink consumers are tepid toward natural energy drinks, consumers are interested in energy drinks with [better-for-you] (BFY) claims, particularly zero-sugar energy drinks,” Mintel’s report states. “BFY claims are key for keeping older millennials and Gen X consumers engaged within the energy drink market.”

Earlier this year, Monster Energy, a brand of Monster Beverage Corp., Corona, Calif., announced its latest addition to the Monster Energy Ultra family: Ultra Gold. The new energy drink evokes the tastes of biting into a ripe golden pineapple but with zero sugar, the company says. Containing 10 calories and 150 mg of caffeine in each 16-ounce can, Ultra Gold joins the lineup of Ultra Family products ― a portfolio of zero sugar, full flavor beverages made with Monster Energy’s unique energy blend.

Image courtesy of Monster Beverage Corp.

Although the energy drinks category is ripe with innovation, experts note that it still remains a challenge for new entrants to garner significant market share.

“There seems to be little room for up and coming brands to gain much traction in the regular energy drink space, although new frontiers of performance energy and what may come after it present an opportunity for these smaller brands,”

A continued decline

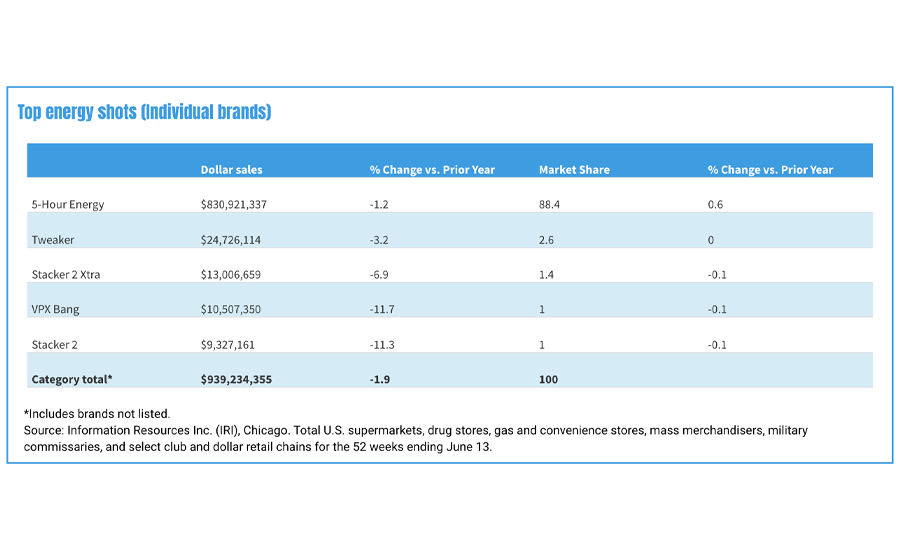

Despite the rosy picture forecast for energy drinks, experts do not have the same predictions for energy shots. In Mintel’s report, the market research firm highlights the hard hit the segment took because of convenience store traffic declines. For 2020, energy shot sales were down 5.1% totaling just over $1 billion, Mintel reports.

“Energy shots were a declining category prior to the pandemic and the segment is projected to fall even further given the slow recovery of c-store traffic and increased competition from other energizing beverages,” the report states. “Though energy shots are a declining category, the shot format lives on with the growth of juice shots and nootropic beverage shots.”

Image courtesy of Uncle Matt’s Organics

BMC’s Dilworth echoes similar sentiments. “Energy shots have been hampered by not having the same competitive dynamics as the energy drink category in which two fierce competitors (Red Bull and Monster) ensure new innovation,” he says. “Unfortunately, there’s not much innovation that can be done with a 2-ounce shot. Thus, there is little prospect of an energy drink turnaround. Instead, juice shots with digestive and other benefits should grow strongly, albeit from a very small base.”

In this niche segment, Uncle Matt's Organic, Clermont, Fla., launched its Ultimate Shots line. Crafted with a multitude of functional ingredients and powerful probiotics, Uncle Matt's Organic Ultimate Shots aim to aid specific functions such as immune support, digestion and energy. Available in Ultimate Defense Shot, Ultimate Immune Shot and Ultimate Energy Shot, the juice-based shots are packaged in 2-ounce bottles and are available on shop.UncleMatts.com and will be rolling out to select retailers nationwide over the next few months, the company says.

“Our organic functional juices are what consumers have been turning to for their daily immune support, so it was a natural progression for us to enter into the functional shots category by providing potent formulas and convenient options made from organic and multi-functional ingredients to address things like immune support, gut health and vitality,” said Susan McLean, vice president of marketing and innovation at Uncle Matt's Organic, in a statement.

As energy shot manufacturers look to diversify, BFY functionality could be a new avenue for these manufacturers.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!