Cover Feature

Beverage supply chains, consumer trends continue to evolve as pandemic continues

eCommerce’s market share for beverage alcohol projected to grow through 2025

Photo by Polina Tankilevitch from Pexels/courtesy of Canva

For novice dancers, one crucial move to learn is the pivot turn in which the person’s body rotates without actually leaving their spot. Following two years of significant change, the term pivot has resonated throughout the beverage industry not to signify a simple rotation, but at how nimble manufacturers, suppliers and distributors are adjusting during the COVID-19 pandemic.

No aspect of the beverage market has been immune to the effects, particularly the supply chain. For instance, a report from IndexBox, Los Angeles, noted that the U.S. glass bottle and container market increased 0.6% in 2020 ― approximately $6.7 billion in value.

“Despite imports rising to $1.6 billion in the first 10 months of 2021 (plus 22% compared to the same period in 2020), the U.S. is facing a glass bottle deficit,” a January release from IndexBox states. “Beverage producers must search for alternatives such as plastic packaging. The key factors causing this shortfall are the high demand for alcohol and the increasing number of recycled bottles used for producing glass vials for vaccines. Another factor inciting the scarcity of glass bottles is the supply chain disruption in Asia, rising from a deficit in shipping containers.”

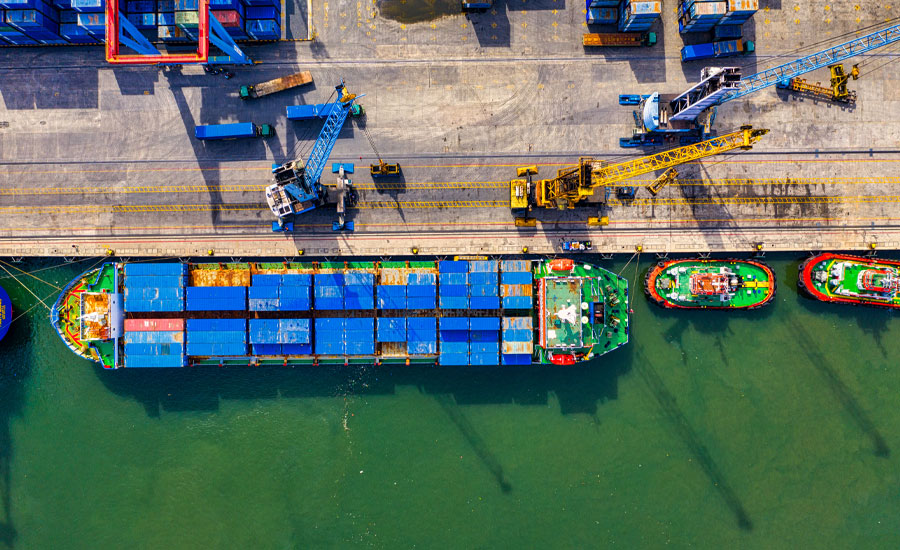

Photo by Tom Fisk from Pexels/courtesy of Canva

The AI-powered market intelligence firm adds that approximately 25% of the U.S. glass containers come from foreign markets.

Glass bottles are not the only market challenged by shipping woes. Bill Swindell of The Press Democrat wrote in early January that a study released in late 2021 by UC Davis researchers estimated that agricultural exports for California were down $2.1 billion from May to September, citing shipping container deficits. In particular, Swindell’s article noted that the report found that California’s wine industry lost more than $250 million last summer, again citing supply chain disruptions.

The craft brewing market also is adjusting to changes within its supply chain. In its supply chain updates from November 2021, the Brewers Association (BA), Boulder, Colo., noted that compared with the spirits industry, brewers have not experienced the same challenges with glass bottle supplies.

“Glass users are seeing some delays in shipping and long lead times, but at this time there doesn’t appear to be a major shortage for brewers,” the BA report states. “The spirits industry is facing some serious supply interruptions. Flint glass seems to be in tighter supply than amber glass.”

However, the shortage of another precious commodity — aluminum cans — is another story. In November 2021, Ball Corp. issued a notice that starting Jan. 1, 2022, the minimum order for printed aluminum cans, pending available supply, increased from one to five truckloads for each SKU for non-contracted customers. The Broomfield, Colo.-based company also announced that it no longer will warehouse inventory on behalf of customers and has suggested that most non-contract customers connect with certain distributors for future orders. The supplier has since delayed this change to take effect March 1, as it further engages with the brewing community for solutions.

“Overall aluminum can shortages appear likely to continue deep into 2022 and perhaps further, as there is more competition for aluminum and more demand for this package type from customers,” the BA’s November report states.

Despite these challenges, Chuck Skypeck, technical brewing projects director at the BA, says the brewing community is adjusting to ensure continued service to dedicated consumers.

“The craft beer industry has proven resilient in the face of supply chain disruptions, labor and material shortages, and the pandemic,” he says. “Through innovation and adaptation, small and independent craft breweries have continued to serve their communities in creative ways.”

Image courtesy of Cutwater Spirits

Adjusting for the shoppers

Although supply chain and shipping concerns cannot be minimized for the beverage industry, the market also is adjusting to not only the types of beverages consumers are craving, but how they are being purchased.

According to a new study from London-based IWSR Drinks Market Analysis, ready-to-drink (RTD) beverage alcohol products are expected to outperform the overall beverage alcohol market during the next five years, increasing its market share to 8% by 2025 (from about 4% share in 2020) in top RTD markets.

“RTDs are still growing at higher rates than spirits, wine, and beer, signaling a major shift in consumer interest in this category across all demographics,” said Brandy Rand, chief operating officer of the Americas at IWSR Drinks Market Analysis, in a statement. “But it’s important to note that RTDs aren’t only stealing share from beer, they’re also attracting spirits consumers in markets such as Australia and the UK, and cider drinkers in South Africa. We’re also seeing a significant premiumization trend in RTDs as more and more new brands enter the space.”

U.S.-based wholesalers are taking keen notice of the growing RTD beverage alcohol space. In a December 2021 release, New York-based Breakthru Beverage Group noted how the COVID-19 pandemic’s impact on beverage alcohol evolved from at-home cocktail experiments to restaurant alcohol delivery and now has landed on the RTD category.

“Consumers’ booming interest in RTDs is driving rapid growth and premiumization in the category,” said Drew Levinson, Breakthru Beverage Group vice president of business development for emerging brands, in a statement. “We’re predicting a continued and sustained acceleration in the ultra-premium RTD space based on consumers’ desires for greater convenience, innovation and elevated flavor choices.”

In a release, the wholesaler noted that staffing shortage among other factors are influencing the hospitality industry on-premise space.

“With limited or no in-room dining, hotels and resorts needed to pivot and provide guests with the elevated, sophisticated drink options they are accustomed to while making it as easy as possible on their reduced staffs,” said Sharon Charny Woschitz, Breakthru’s national accounts headquarter director for the East, in a statement. “It’s not just at hotels and resorts ― where we've seen a 332% growth. Due to quality, innovation and sustainability, RTD’s popularity is also rising in new occasion areas such as weddings, golf courses and concerts.”

This all comes as IWSR research notes that total beverage alcohol volume in 2020 for the United States was up 2%, its largest gain since 2002. A June 2021 release from the market research firm also notes that the U.S. market’s beverage alcohol was expected to finish 2021 up 3.8% in volume and 5.5% in value.

IWSR also found that wine had outperformed its 2019 numbers during the earlier part of the pandemic. In 2020, total U.S. wine was up 0.7% in volume and 1.5% in value.

“Despite a non-celebratory 2020, sparkling wine managed to post growth, with Prosecco (especially rosé expressions) making up for declines in Champagne consumption,” the IWSR release stated.

Changes in path to purchase

Yet, consumers’ beverage alcohol choices are not the only shifts that the beverage market is adjusting to. The venue in which consumers are purchasing beverage alcohol continues to shift.

In an analysis, IWSR is projecting a sharp increase in beverage alcohol eCommerce. In the report “Led by the US, beverage alcohol eCommerce value expected to grow +66% across key markets 2020-2025,” the market research firm projects that eCommerce will account for 6% of all off-premise beverage alcohol volume share.

“The greatest forecast eCommerce value growth will come from the U.S., thanks to average annual growth in the country of about plus-20%, which will see it become the top global market for online beverage alcohol,” IWSR states. “China, which currently accounts for a third of total eCommerce value, is expected to expand less rapidly, but still contribute substantial value.”

The market research firm identified two eCommerce models that have emerged for beverage alcohol: traditional omnichannel online shopping and the modern app-driven eCommerce for rapid delivery and premium brands.

“Given the pandemic and overall changing consumer shopping behavior, it’s certainly not surprising that alcohol eCommerce is growing very quickly. But what’s interesting is to see the significant variations that have developed both across and within markets in how different consumer groups shop via eCommerce and what their priorities are,” said Guy Wolfe, strategic insights manager for IWSR Drinks Market Analysis, in a statement in the release. “eCommerce has clearly become engrained for many consumers, cementing its place as the third sales channel for beverage alcohol purchase.”

Yet, eCommerce is not the only channel experiencing systemic changes following the pandemic. The on-premise and foodservice markets continue to pivot as guidance evolves or new variants of the virus emerge.

In the Insights titled “2022: The Year of the Climb,” Lizzy Freier, director of menu research and insights for Chicago-based Technomic, and Aimee Harvey, senior managing editor for the market research firm, anticipate that recovery will continue in 2022. Yet, there will still be various pandemic hurdles to overcome.

In terms of the supply chain, operators will likely innovate with ingredients already available versus expanding menu choices with new SKUs, they opine. The labor challenges, however, will require more proactive measures.

“The desperate scramble for adequate staffing has led restaurants to address recruitment and retention challenges with new and creative strategies designed to improve the image of restaurants as desirable places to work,” Freier and Harvey stated in the October 2021 release. “The next year will bring a surge in the number of restaurant companies hosting virtual hiring events, upping hourly wages system wide, offering referral and signing bonuses, implementing 401(k) and healthcare benefits, dropping educational requirements for managerial roles and providing emergency child care, all in an effort to snag workers from the retail sector, gig jobs and other highly competitive channels.”

As the pandemic continues to challenge the beverage market and its partners, the leaders in the space continue to show that they are more than capable of pivoting.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!