2021 Beer Report: Beer market in state of flux as consumer preferences change

Domestic beer segment sees strong performance from super-premium sectors

Much like how the caterpillar undergoes one of nature’s most notable transformations as it emerges from a chrysalis to become a butterfly, the U.S. beer market also seems to be in a state of transformation thanks to a host of factors.

“The current U.S. beer market is in a state of flux,” says Chris Lombardo, team lead and senior analyst for New York-based IBISWorld. “Though the craft beer boom has normalized, relatively, breweries now contend with consumers that increasingly demand a diverse array of alcoholic beverages and not just the traditional culprits like wine or spirits — think spiked seltzers, spiked teas, [ready-to-drink] (RTD) mixed drinks, cider, etc. Beer is still the largest alcoholic beverage segment in the United States, but its years of complete domination seem to be dwindling.

“Younger demographics entering the legal age to consume alcoholic beverages are the greatest drivers of this change, in addition to increased attention on health and dietary concerns,” he continues. “As a result, over the past five years, the industry’s largest players, such as AB InBev and Molson Coors, have increasingly diversified their product catalogue, introducing many products that diverge from their traditional beers.”

Brian Sudano, managing partner for New York-based Beverage Marketing Corporation (BMC), also highlights the transitions permeating throughout the beer market as well as the implications from those changes.

“The U.S. beer market is going through a transformation,” he explains “After decades of consolidation, the emergence of craft beers began to create fragmentation. Major brewers tried to play via acquisition but the segment continued to fragment. Now the rapid growth of FMBs, particularly hard seltzer, has further supported fragmentation although the leaders in FMBs are fairly concentrated. Via this fragmentation, we are beginning to see fragmentation of the leading beer brands.

“At one point, the Top 5 beer brands commanded over 50 percent of the market and now sit around 30 percent,” Sudano continues. “In addition, Michelob Ultra and Modelo Especial are now Top 5 brands and former leading brand, Budweiser, is no longer in the Top 5.”

Although the state of the beer market already was in a state of transition, analysts note that the pandemic escalated the change rate.

“The pandemic helped accelerate trends that were already taking hold in the hard seltzer business, which skew to the off-premise,” Sudano says. “It also had an impact on the rapid growth being experienced in craft beer taprooms, which resulted in a slowdown in the number of craft breweries opening each year as well as more closings. Due to clout at retail, the pandemic helped major beer brands improve their overall trends, although they continue to decline.”

Danelle Kosmal, vice president of beverage alcohol practice for Chicago-based NielsenIQ, also has identified changes within beer packaging since the pandemic hit the United States.

“There are some new trends within the category that developed from the onset of the pandemic,” she says. “Among these shifts includes a surge in sales for large pack sizes. Twelve-packs and large gained 3.6 dollar share points during COVID months in 2020, compared to those same months in 2019.

“Nearly every pack size ― small and large ― in the category grew in off-premise sales, but some of the larger packs really outpaced the growth of six-packs and singles,” she continues. “During COVID months of 2020, 12-packs grew 31 percent in off-premise dollars, 24-packs grew 26 percent, and 30-packs grew 19.5 percent, compared to six-packs that grew by only 7.4 percent and singles, which grew 4.7 percent.”

Kosmal adds that eCommerce alcohol sales also seemed to flourish as a result of the pandemic, benefiting beer as well.

“In 2020, total online alcohol sales grew by 232 percent, with online beer sales pacing about the same, up 233 percent,” she says.

Nathan Greene, consulting analyst for BMC, explains that depending on a brand’s footprint pre-pandemic has impacted how brands have navigated the eCommerce boom.

“eCommerce and [direct-to-consumer] (DTC) channels are also having concurrent opposing effects on consumers experience and access to brands/products depending on digital platform,” he says. “Mainstream last-mile delivery apps (i.e., Drizly and Minibar) generally offer fewer, yet high-volume, brands/SKUs in comparison to a full store set of offerings, potentially reducing experimentation.

“Conversely, many small suppliers, often craft, have expanded their pool of consumers by setting up online ordering (sometimes on in-house platforms while others on established services) for on-site pick up, delivering locally, and/or wider in/out-of-state shipping where regulations permit,” he continues. “This expanded offerings within reach via digital platforms allow discernment-conscious consumers to experience suppliers previously inaccessible.”

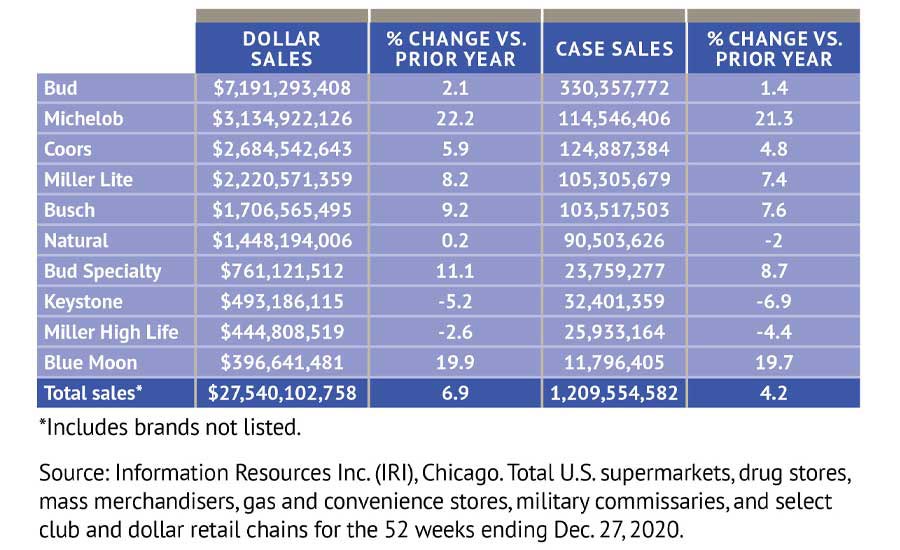

In terms of overall performance, beer sales totaled more than $43.7 billion in total U.S. multi-outlets, a 14.7 percent increase, for the 52 weeks ending Dec. 27, 2020, according to data from Chicago-based Information Resources Inc. (IRI). Case sales also were up 10 percent during that timeframe. Total domestic beer also was up, totaling $27.5 billion, a 6.9 percent increase.

However, when looking at the four sub-segments that IRI combines to make up total domestic (premium, super-premium, sub-premium and craft) performance was modest for domestic premium and domestic sub-premium with dollar sales up 3.7 and 0.5 percent, respectively.

BMC’s Greene also details the varying performance among the factions of the domestic beer market.

“Total domestic beer shipments declined 0.5 percent in 2020, a slight improvement over 2019 performance, which saw a decline of 0.8 percent,” he says. “Among price-tier sub-segments, super-premium saw the strongest growth, driven by hard seltzer and a continuing market-wide trend toward premiumization. The premium and sub-premium segments saw the largest impact from COVID, with occasion shifts and bulk purchasing having positive effects on some brands, while on-premise closures hurt others. BMC estimates that super-premium volume growth was between 4 and 6 percent, while both the premium and sub-premium saw segment-wide performance between -1 and +1 percent.”

In its November 2020 report “Beer: Incl Impact of COVID-19 – US,” Chicago-based Mintel also notes that the move toward premiumization is affecting performance of the category.

“While beer has historically been appreciated for affordability, the expansion of accessible options in other alcohol categories, combined with the demand for higher quality beer, has leveled the playing field and led to sales declines among value brands,” the report states. “Beer can’t as easily compete for price as it once did, nor should it rely on low price as its strong selling point in the long-term. Low price is just one aspect of ‘big v’ value that’s so important to consumers.”

Yet, the market research firm notes that the shifts in purchase patterns could serve as an opportunity for the beer market.

“The struggling beer category could look to the disruption of the pandemic as a bit of a reset,” it states. “Twenty-eight percent of drinkers report increasing their alcohol consumption due to the COVID-19 pandemic. Increased stress is given as the leading reason for drinking more. While beer’s role in relaxation answers one need, the category needs to move beyond mitigating the bad toward nurturing the good, boosting appeal for fun and indulgence.”

In line with the notion of fun, Bud Light, a brand of St. Louis-based Anheuser-Busch, recently unveiled Bud Light Legends, a new exclusive rewards program and a legendary Super Bowl LV advertisement that reunites notable Bud Light characters in one epic commercial.

This year, the brand is bringing the nostalgia with legendary appearances by iconic Bud Light friends including Grammy-nominated artist Post Malone, Cedric the Entertainer, the “I Love You, Man” guy, the Bud Knight, Oracle Susana and more, as they all come together to save Bud Light.

In Bud Light’s 60-second Super Bowl LV TV commercial, Bud Light Legends, fan-favorite characters joined forces to help a delivery driver save an overturned Bud Light truck, and ensure the ice-cold Bud Light makes it to the convenience store. Leveraging their combined superpowers, the Legends celebrate and recreate some of the best moments in the history of Bud Light advertising, the company says.

The commercial also serves as the formal launch of the new Bud Light Legends program, which recognizes the fans that have supported Bud Light over the years, and encourages them to ‘Join the Legendary’ at BudLightLegends.com for exclusive rewards, custom merchandise and legendary experiences. Before the big game, fans also are invited to revisit some of their favorite Bud Light commercials from years past by checking out BudLight.com/Vault.

“Fans have loved and celebrated Bud Light’s role in the Super Bowl for decades, and this year, we’re excited to reunite iconic characters in the most epic way with this new spot,” says Andy Goeler, vice president of marketing for Bud Light, in a statement. “Bud Light Legends rewards those that always go the extra mile for Bud Light, the friends that bring the fun wherever they go, and those who understand the importance of good times. Today, we invite our Bud Light Legends to come along with us for the journey.”

Domestic beer brands also are using their reach to alleviate stress for consumers. This past holiday season, Miller Lite, a brand of Chicago-based Molson Coors Beverage Co., gave away $50,000 worth of food and beer, and donated an additional $50,000 to UnidosUS' pandemic relief efforts through the Give Back 12-Pack program. The brand gifted people $25 to create a "12-pack:" six items to be used to prepare a Nochebuena dinner and maybe even a six-pack of Miller Lite.

“The holidays are going to look very different with people not being able to get together for some holiday Miller Time. We can't change that, but we can at least make them a little brighter with the Give Back 12-Pack,” said Allison Wallin, marketing manager for Miller Lite, in a statement. “This gift is meant to help families worry less about dinner and focus more on connecting with their loved ones. We also hope that, through our partnership with UnidosUS, we bring some meaningful relief to the communities most affected by the pandemic.”

Domestic brewers also are finding strength in numbers during this transformative time. In 2020, D.G. Yuengling & Son Inc., Pottsville, Pa., and Molson Coors Beverage Co. launched a long-term brewing partnership, which will bring Yuengling's beer to millions more people outside of its East Coast footprint.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!