Category Focus

Foodservice closures impact tea sales

Herbal teas outperform during COVID-19 as consumers seek immune support

From a picturesque meadow — The Picnic Meadow — in the Salzburg Austrian Alps in 1959’s “The Sound of Music,” Governess Maria (Julie Andrews), strumming her guitar, patiently teaches the Von Trapp children how to sing in "Do-Re-Mi." From the first strains of “Doe, a deer, a female deer, Ray, a drop of golden sun” all the way to “T,” the music scale’s highest note, in “Tea, a drink with jam and bread,” the youngsters learn how to sing “a million different tunes by mixing up the notes.”

Another category striving to “hit the high notes” and “mix things up” is the tea and ready-to-drink (RTD) tea category, which offers a plethora of options for every style and taste, including bagged, bottled, loose-leaf, hot, iced and cold brew.

Image courtesy of The Wonderful Co.

New York-based Nielsen reports $70 billion in tea beverage sales for the 52 weeks ending April 17, an 11.3% year-over-year increase. Among the sub-segments, liquid tea notched $3.4 billion in dollar sales (11.1% growth); RTD tea saw sales of $142 million (of which chai tea and iced tea were top sellers with $49 million and $42 million, respectively); and kombucha, $597 million (5.5% growth).

Within the $1.5 billion packaged tea segment that experienced 7.9% growth, black teas were No. 1 with $639 million in dollar sales and a 2.8% increase, Nielsen data reports. Other top-grossing packaged teas were herbal teas at $593 million (up 15.3%); green teas at $240 million (up 7.2%); and red teas at $31 million (up 16%). There’s also more ways to enjoy a good cup of tea, as teas are packaged in up to six formats: concentrates, loose-leaf, pods, powdered, pyramid or tea bags.

Although black tea remains the No. 1 tea varietal, with about 85% of U.S. imports in 2019, green tea is surging in popularity because of its “good for the body and mind” healthy halo. Green teas are the least oxidized when processed, contain less caffeine, have the most flavonoids — plant-based antioxidants — which could improve fat burning, brain function and help prevent type 2 diabetes and cardiovascular disease, experts note.

Roger Dilworth, senior analyst at New York-based Beverage Marketing Corporation (BMC), suggests that matcha could continue to grow, but likely will not evolve beyond a niche segment. “There could be a mild upturn in tea due to yerba mate,” he notes.

Image courtesy of Top Tree Herbs

Naturally caffeinating

Indigenous to South America, yerba mate is derived from the naturally caffeinated leaves of the holly tree, Ilex paraguariensis. Looking to capitalize on the use of its USDA certified organic yerba mate and Fair Trade Certified ingredients sourced from Brazil, Honest Tea, a brand of The Coca-Cola Co., Atlanta, recently launched Honest Yerba Mate in three organic flavors: Strawberry Pomegranate Matcha, Peach Mango Green Tea and Lemon Ginger Black Tea.

Each 15.5-ounce slim can contains real brewed yerba mate, which provides the same amount of caffeine as an 8-ounce cup of coffee, 13 grams of sugar, 1% juice and 60 calories. Honest Yerba Mate is rolling out into select grocery retails nationwide including Publix, Fresh Direct, Hannaford and Dave’s and also is available on Amazon.com.

In addition to RTD teas brewed with yerba mate, other tea styles include herbal, fruit, white, chai, oolong, rooibos and post-fermented, i.e., kombucha, along with hard tea varietals. According to “The Tea Enthusiast’s Handbook: A Guide to the World’s Best Teas,” there are more than 20,000 different teas in the world.

In fact, tea is the second most preferred beverage in the world after water and is found in more than 80% of households, notes Kritika Mamtani, senior research analyst for chemical, materials and food at Global Market Insights, Selbyville, Del.

In 2016, approximately 84 billion servings of tea — the equivalent to 3.8 billion gallons — were consumed in the United States, Mamtani says. “Rising consumer awareness regarding health benefits of tea along with the availability of variety of flavors has increased the sales of hot tea more than 15% in the past five years,” she says. Between 2017 and 2019, wholesale tea sales in the United States generated incremental growth of $12.5 billion, $12.66 billion and $12.67 billion, respectively.

When discussing which teas are resonating, Sally Lyons Wyatt, executive vice president and practice leader at Information Resources Inc. (IRI), Chicago, suggests that herbal, black and green teas were the top favorites in dollar sales versus a year ago.

“Consumers sought out tea offerings with additional functional benefits, as well,” Wyatt says. “As consumer mobility continues to increase, we expect volume to shift to immediate consumption channels and away from home as share of consumer spend shifts back to dining out and return to work scenarios.

“As with other [food and beverage] (F&B) products, premiumization has been a trend for consumers who are wanting an out-of-home experience in the home,” she continues. “Premium teas provided that benefit plus wellness benefits to consumers and these products will likely continue growing throughout 2021.”

Image courtesy of Mike’s Hard Lemonade Co.

Tea’s vulnerability

The pandemic and the shuttering of cafés and restaurants, however, has impacted on-premise tea sales. “The consumption of foodservice tea in the U.S. has experienced a downfall of approximately 40% in 2020,” Mamtani explains.

A July 15, 2020, blog post from Matthew Barry of Chicago-based Euromonitor International also supports the notion that the pandemic has made the tea category vulnerable.

“The United States faced the largest drop in tea consumption of any Euromonitor-researched market in 2020,” Barry wrote. “Sales of bagged and loose tea are expected to fall 13% and ready-to-drink (RTD) formats are projected to fall 11%. This is a sharp reversal of the recent past, in which tea growth was modest but consistently positive.”

Foodservice closures were the root of tea’s most serious challenges, primarily because Americans drink iced tea at extremely high rates, often while eating meals outside of the home. “In 2019, that proportion [on-premise] was 48%, compared to 13% in the UK and 6% in Germany,” the post stated. “…This has been somewhat counterbalanced by a 16% rise in retail sales but given that foodservice and retail are nearly perfectly balanced in total consumption this translates to a major decline in net sales.”

Roger Dilworth, senior analyst at New York-based Beverage Marketing Corporation (BMC), also notes the disparity. “The overall tea market performed poorly in 2020 in terms of wholesale dollars due to the pandemic impacting on-premise outlets,” he explains. “Volume-wise, tea was down nominally and actually improved upon 2019’s performance. This was due in part to pantry loading in the first quarter of 2020, although the effect was not as pronounced as with bottled water and CSDs. Tea bag volume performed better in 2020 than in 2019.

“Iced tea mixes had an uncharacteristic volume increase during the year,” he continues. “However, RTD tea declined in volume for the third straight year due to a lack of excitement in the category, not to mention lost sales on-premise.”

In multi-outlets and convenience stores for the 52 weeks ending April 18, the top sub-segment — RTD canned and bottled teas — generated dollar sales of $4.1 billion, a 5.4% year-over-year increase, states data from Information Resources Inc. (IRI), Chicago. Other sub-segments with stable growth were refrigerated teas, with sales of $1.8 billion, a 7.8% increase, and bagged and loose-leaf tea, with 7.5% growth and sales of $1.3 billion.

From a smaller base, cold-brew teas and instant tea mixes climbed 35.9% and 14.1%, respectively, while generating sales of $308 million and $298 million, IRI data shows.

Image courtesy of Nude Beverages

Immune-support positioning a boom

Health and wellness has long been a driver of tea consumption as consumers often drink hot tea with lemon while sick. Mental wellness also is driving up tea consumption of herbal and green teas, experts state.

Citing their immunity-enhancing properties, herbal teas including chamomile and valerian are becoming increasingly popular for promoting calmness and boosting the immune system, Global Market Insights’ Mamtani notes. “Rising importance on mental wellness due to pandemic is one of the major factors driving the growth of herbal and green teas,” she explains.

Euromonitor’s Barry agrees, noting that herbal teas were doing well pre-pandemic, and their strong functional positioning became even more evident during the pandemic as consumers were stockpiling pandemic essentials.

“Immune support will remain top of mind for a long time for consumers, which should keep herbal tea sales brisk,” he says. “The pandemic has pushed American tea into two vastly different directions: segments, where most consumption took place outside the home, are struggling as never before, while other teas better-suited for the new normal, such as those with immune support positioning, are experiencing a boom.”

There’s no shortage of new product development in the flavorful, functional tea market. In May, Top Tree Herbs, a Denver-based specialty tea company on a mission to make kratom tea accessible, launched a line of kratom-based functional teas, it says. Available in five herbal blends — Passion Fruit Maeng Da Morning Blend, Peach Afternoon Bali Blend, Peach Maeng Da Evening Blend, Cinnamon Apple Spice Kratom Tea and Chocolate Mint Rooibos Kratom Tea — the infused kratom teas bridge the gap between tea drinkers and the kratom community, creating a new category of functional teas.

In a statement, Top Tree Founder Sam Weber said: “We're extremely proud to be able to share our new line of functional tea blends with the kratom community. It isn't reflected in the kratom products you see on shelf today, but people have been brewing kratom tea for hundreds of years; we wanted to create a product that respected this tradition.”

Reduced sugar and zero-sugar options also are proliferating in the tea category. In March, Lipton, a brand of PepsiCo, Purchase, N.Y., unveiled its first national innovation in more than five years: Brisk Zero Sugar Lemon Iced Tea. The new beverage has the same bold, refreshing flavor of Brisk with zero grams of sugar and aims to inspire creators to authentically express themselves through the tag line “All Great Things Start from Zero,” it says. Brisk Zero Sugar Lemon Iced Tea is available in 1-liter bottles at retailers nationwide and 12-packs of 12-ounce cans are available in select markets.

On the alcohol hard iced tea side, Nude Beverages, Vancouver, British Columbia, following a successful Canadian debut, is launching its American-style hard iced tea with zero carbohydrates, zero sugar, zero caffeine and zero carbonation nationwide in July. Brewed with black tea leaves, the vodka-based, 5% ABV Nude Hard Iced Tea is packaged in its signature matte gold can in three flavors: Lemon, Peach and Raspberry.

"We tested over 500 formulations of the iced tea before landing on our final formula, and it's that attention to detail that makes us a category leader," said Nude Beverages CEO and Founder Julius Makarewicz, in a statement. "We saw that consumers were wanting more sugar-free options, and so we knew the next step was to bring Nude Hard Iced Tea to the U.S. We're excited to introduce our American fans to a new line and expect even more expansion to come this year."

The hard tea market is ripe for innovation and is growing exponentially. “Total ‘tea alcohol’ has realized significant dollar growth of plus 45.3% in MULOC,” IRI’s Wyatt says. “We have seen innovation across new entrants and/or flavors. When many categories saw a decrease in the number of new items entering in 2020, tea alcohol saw an increase.”

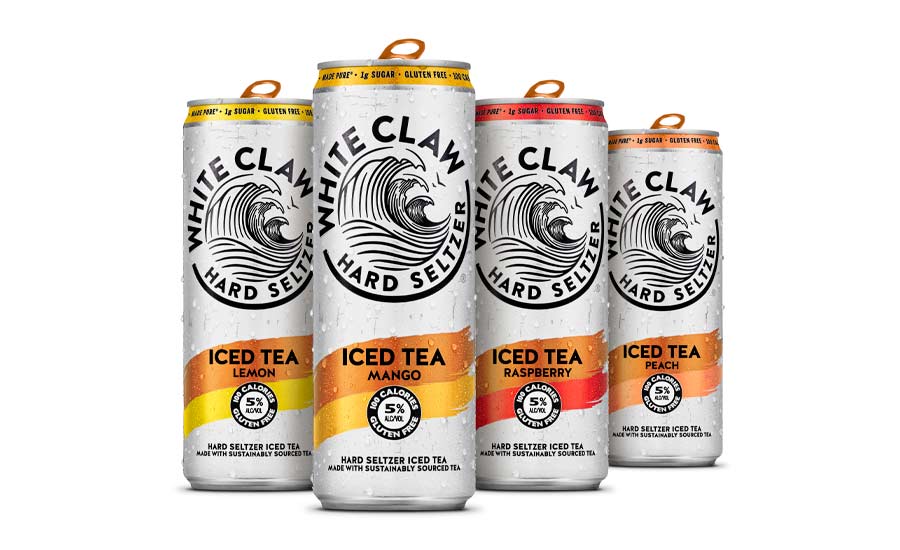

First released in 2016, White Claw Hard Seltzer Iced Tea, a brand of Chicago-based Mike’s Hard Lemonade Co., released a new 12-can variety pack in time for summer sipping. Available in Lemon, Raspberry, Mango and Peach, the 5% ABV hard iced teas are crafted with cold-pressed lemon zest and contain 100 calories, 1 gram of sugar and are gluten free, the company says.

To keep the tea category successful, BMC’s Dilworth advises beverage-makers to consider higher-caffeine teas, possibly by stacking the natural caffeine in tea with guarana or green tea extract.

Global Market Insights’ Mamtani suggests tea manufacturers focus on developing innovative tea products to attract new and existing consumers in the market. “The demand for tea is driven by major factors such as convenience, variety, easy availability, health benefits, and introduction of unique flavored and high-end specialty tea,” she explains. “Tea manufacturers should consider the above-mentioned factors to maintain sales and attract customers in the market over the forecast period.”

Moving forward, Dilworth predicts small year-over-year growth. “The tea market should grow wholesale dollars by about 0.5% per year compounded to 2025,” Dilworth says. “Getting new users into the category is difficult. Innovations such as tea/juice hybrids have not panned out.”

However, the U.S. tea market is characterized by the presence of some of the leading tea manufacturers such as Associated British Foods Plc., Hain Celestial Group Inc, Nestlé S.A., Unilever Group, Tata Consumer Products Ltd., The Republic of Tea Inc., Reily Foods Co., Bigelow Tea Co., Yogi Tea and Mighty Leaf Tea, among others, Mamtani says.

“The key players in the U.S. tea market are adopting business expansion and new product launches as their key development strategy to increase profitability,” Mamtani says. “Additionally, the stable demand for tea also rely on the adoption of tea by new consumers looking for healthy beverage options. The addition of functional ingredients such as ginger, cardamom, cloves and cinnamon in tea products is projected to attract health-conscious consumers in the market.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!