Home » Keywords: » mass merchandisers

Items Tagged with 'mass merchandisers'

ARTICLES

Channel attracts consumers with prices and array of offerings

Read More

Affordability helps mass merchandisers resonate with shoppers

Price, partnerships draw consumers to mass market retailers

October 21, 2024

Channel Strategies

Mass merchandisers capitalize on grocery items, services

Consumers spending more on food and drink, reducing discretionary spend

October 26, 2023

Channel Strategies

Mass merchandisers struggle amidst inflation

Competitive prices have caused the channel to fall flat

October 31, 2022

Jones Soda expands footprint with Meijer agreement

210 Meijer stores to carry flavored soft drink brands top flavors

October 28, 2021

Channel Strategies

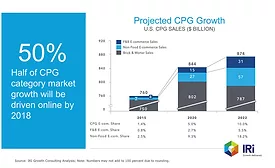

Mass merchandisers capitalize on one-stop-shop format, eCommerce

Physical retail continues to play a crucial role in omnichannel shopping habits

October 22, 2021

Channel Strategies

Mass merchandisers capitalize on ease, convenience

Strategic product placement, eCommerce complements are driving sales

October 29, 2020

Mass merchandisers focus on grocery, pickup options

Bottled water, craft beer and emerging ready-to-drink beverages popular solutions for channel

November 18, 2019

Mass merchandisers decrease footprint, expand online presence

Walmart reaches milestone in grocery deliver and grocery pickup

November 15, 2018

Urbanization, eCommerce impact mass merchandisers

Supercenters increase sales, share

November 9, 2017

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2026. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing