Urbanization, eCommerce impact mass merchandisers

Supercenters increase sales, share

Where and how consumers shop for food and beverages continues to evolve as eCommerce reshapes the path-to-purchase. Despite growth in supercenters, mass-format stores experienced the sharpest decline of all the channels and formats, with sales down 12.5 percent and store counts decelerating by 7.3 percent, according to Long Grove, Ill.-based Willard Bishop’s “The Future of Food Retailing, 2017” report.

Willard Bishop’s Senior Director Jon Hauptman also notes the decreases experienced by mass merchandisers, but highlights that overall supercenters have performed well. “Grocery and consumables sales within traditional mass merchandisers (not including supercenters) has declined significantly (down 12.5 percent) over the past year, with mass merchandisers losing half a point of market share for these products,” he explains. “Supercenters continue to increase sales and share. Additionally, we’re seeing significant growth in both the limited assortment channel (e.g., Aldi, Lidl) and among fresh formats.”

Supercenters continue to be a “bright light” among mass merchants. Supercenters likely could replace traditional mass merchandisers in major markets, while traditional mass merchants could be left to serve smaller trade areas, Hauptman adds.

Laurie Rains, group vice president of U.S. retail commercial strategy at New York-based Nielsen, also highlights the comprehensive shopping experience supercenters provide to shoppers, allowing one-stop shopping for time-starved consumers.

Excluding hypermarkets, warehouse clubs and cash-and-carry stores, Chicago-based Euromonitor International notes that store-based mass merchandisers had 2016 sales of $970.8 billion, a decline of 7.2 percent for the 2011-2016 time period.

Susan Viamari, vice president of Thought Leadership at Information Resources Inc. (IRI), Chicago, also points to a decline in the mass merchandiser channel. “The mass/super channel saw dollar sales decline 3 percent and unit sales slide 5.5 percent during the past year,” she says. “During the past three years, the channel has declined an average [of] 4.6 percent in dollar sales and 7.5 percent [in] units each year.

“The entire [consumer packaged goods] (CPG) industry has been struggling to establish consistent growth,” Viamari continues. “Consumers are taking a cautious approach to shopping [and] prices have fallen, negatively impacting dollar sales growth. We also see a shift to value channels, like dollar and club channels. Dollar [outlets] saw dollars sales [increase] 2.5 percent yearly and unit sales [increase] 1.3 percent yearly, on average, during the past three years.”

Market analysts note that several factors are impacting the mass merchandising channel, including fierce competition among channels and the fact that 76 percent of all shipping trips begin online.

When it comes to the beverage market, grocery and warehouse clubs are among the closest competitors to the mass merchandiser channel, Nielsen’s Rains notes.

The trends that are impacting beverage sales in the mass merchandiser channel are aligned with those impacting beverage sales across most U.S. retailers. “Emerging beverages, like [ready-to-drink] (RTD) energy and RTD tea, are still high in growth and opportunity,” Rains says. “Beverage manufacturers should also be aware of a growing popularity of functional beverages among millennials. Similar to other categories, millennials are looking for beverages with clean packaging and clean attributes for healthier beverage products.”

The urbanization conundrum

In addition to competition for consumer dollars, urbanization, particularly the cost and availability of real estate in urban environments, is impacting retailers.

“Traditional large-square-footage stores do not work in high-priced urban environments,” Rains explains. “Limited availability of mass merchandiser stores in urban areas has resulted in consumers living in these areas to shop across different channels such as convenience, drug or supermarkets.”

More than 90 percent of store growth is coming from increasing store count, particularly in the form of small-format stores, with retailers focused on competing with the right store format in the right geography at the right time, says IRI’s Viamari, citing IRI’s Omnichannel Journey report.

For example, the expansion of Kroger’s Marketplace format, which averages from 100,000 to 130,000 square feet, as compared with the 165,000 square feet of the average Kroger store, grew from 86 stores in 2013 to more than 128 stores in 2016, Viamari says.

Other retailers also are making store-format adjustments. “Target and Walmart are looking to increase profitability and efficiency by rolling out more Target Express and Walmart Neighborhood Markets, respectively, looking to tap into existing urban markets and cater to customers that do not want to invest the time and effort to shop big-box stores,” Viamari says.

Retailers also are balancing the need for efficiency against the drive for store sales growth and return on investment, Viamari says.

“Above all, these models must stay in lockstep with evolving shopper behaviors and trip patterns, so retailers are investing to establish and maintain a 360-degree understanding of consumer shopping behavior,” she says. “Supercenters play an important role for mass merchandisers because food and beverage do a lot to drive traffic, frequency and basket size.”

In response to urbanization, small-format stores might hold the key, Nielsen’s Rains says. “Major big-box retail chains across the U.S. are starting to open small formats as part of their strategy to grow in dense suburban and urban markets, as well as on college campuses,” Rains explains. “For other major retailers, offering an ‘express’ version of their larger store formats is one example of how to expand in big cities and small towns, offering the appeal of more convenience.”

The eCommerce effect

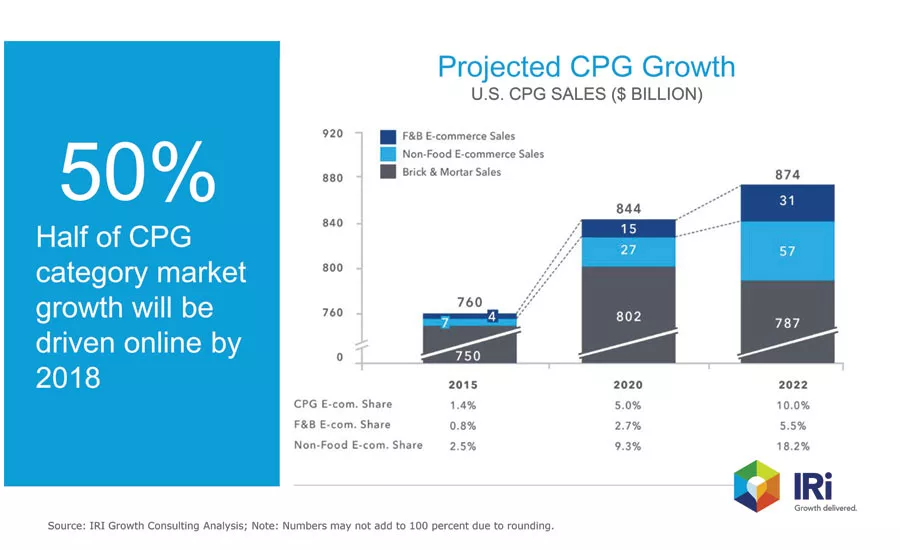

ECommerce continues to impact not only the mass merchandiser channel but also every part of the beverage industry. “In 2016, eCommerce sales accounted for $33 billion (4 percent) of the $795 billion in food and beverage sales. By 2021, food and beverage sales will grow to $930 billion, and online sales will account for 8 percent of sales, or $70 billion,” states Willard Bishop’s report.

An infographic from IRI shows that digital will influence 77 percent of all retail sales, while 50 percent of CPG category market growth will be online by 2018.

Willard Bishop’s Hauptman notes that grocery sales from eCommerce increased 24 percent versus a year ago. “I’d expect most food retailers to focus on establishing three- to five-year eCommerce plans in 2018,” he says.

When it comes to the future of the mass merchandising channel, Willard Bishop’s report estimates that by 2021, the number of supercenters will rise to 4,560 stores, an increase of 11.1 percent. However, store counts for mass merchandisers will decrease from 2,775 stores in 2016 to 1,904 stores in 2021.

Euromonitor also points to an expected decline in U.S. sales for store-based mass merchandisers. The market research firm forecasts sales of $94.6 billion by 2021, a decline of 3.3 percent for the 2016-2021 time period.

Mass merchandisers will continue to be challenged in the future, Willard Bishop’s Hauptman says. “CPG manufacturers are disproportionately investing in growth channels — and mass does not appear to be one of them,” he says.

In the face of increasing competition, IRI’s Viamari suggests that mass merchandisers reinvent themselves to support omnichannel shopping and the demands of time-starved consumers. “Footprints will likely continue to shrink, at least in new store openings, as mass merchandisers try to be ‘where the shopper is,’” she says. “Dialing in assortment for each and every store based on the shopper that frequents that store is essential to ongoing growth.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!