The beverage alcohol shuffle

Companies looking to capitalize on adult alternative beverage trends

Much has been written about the acceleration of declines in beer during 2025 along with spirit ready-to-drink (RTD) growth and wine softness. In fact, Suntory and Pernod have/are establishing separate route-to-market organizations for RTD spirits. At the same time, ABI has become a major player in the space and emerging brands like Surfside are projecting more than 10 million cases for its business. Gallo remains a leader in RTD spirits with High Noon and continues to bring other brands to market. At the same time all this noise is taking place in RTD spirits; Mark Anthony and Boston Beer continue to dominate the flavored malt beverage (FMB)/hard seltzer markets (malt based).

This all brings to a head what has been occurring for the past decade and is now maturing. That is the outperformance of non-traditional beverage alcohol offerings in an easy to drink format primarily sweetened.

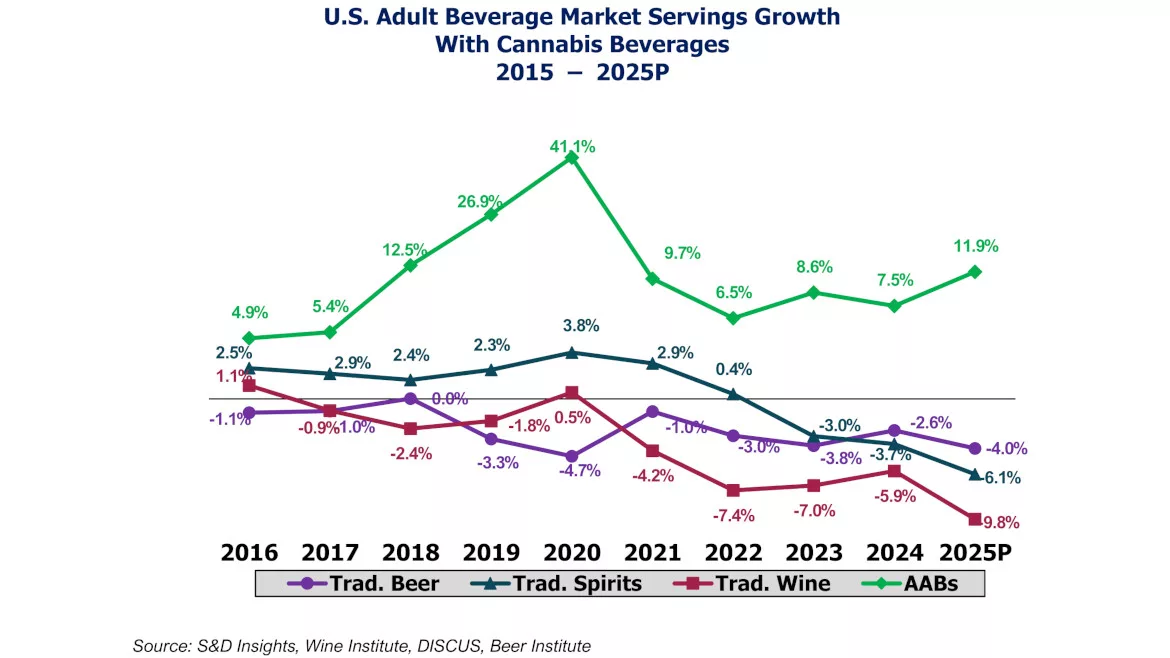

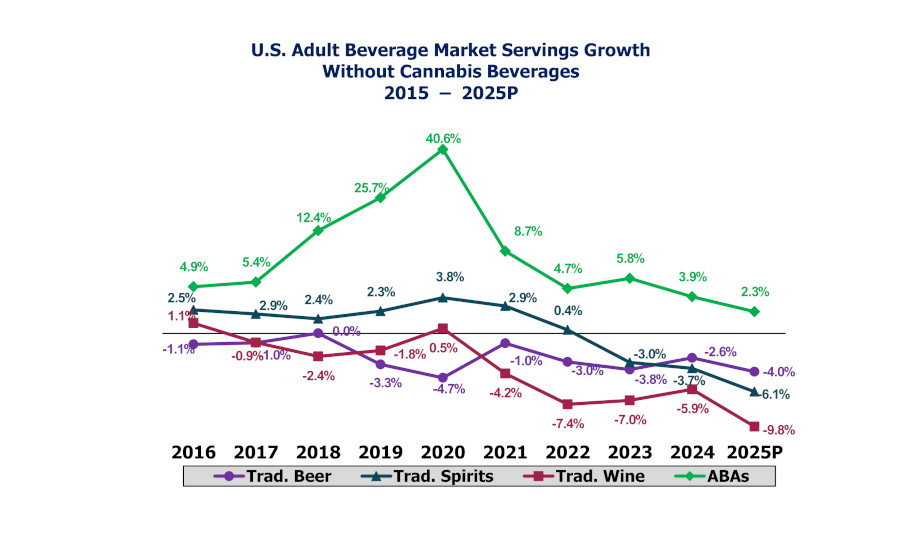

At S&D Insights LLC, we began tracking this segment in 2000 and named it alternative beverage alcohol. With all the activity around cannabis beverages, we changed the name to alternative adult beverages (AAB) to incorporate cannabis beverages in 2019. Others such as Boston Beer use beyond beer to address this market. In looking at the dynamics of beverage alcohol market, AAB has been the leader in the adult beverage for the past 10 years.

On a servings size basis in which RTD spirits equals 8 ounces; FMB equals 12 ounces; traditional wine equals 5 ounces; traditional beer equals 12 ounces; and traditional spirits equals 1.5 ounces, AAB with cannabis has a 15.8% share of the market, which total 127.9 billion servings. When removing cannabis beverages, the story does not change as alternative alcoholic beverages have also outperformed over the past 10 years. Although share for AAB drops to 13.4%.

A couple of interesting points begin to emerge.

The first is that traditional beer trends have not dropped significantly despite the recent pressure on the Hispanic consumer, as it has generally declined between 3% and 4% since 2019. One could argue that the market has found a floor on which to build off.

The second interesting point is that traditional beer in 2025 will outperform traditional spirits for the second consecutive year. Much of the reported noise around beer’s decline accelerating is due to the tough year for FMBs which are captured in AABs. The recent changes suggest that the market is shifting, and beer is competitively in its best position in over a decade versus traditional spirits and wine.

From the viewpoint of which companies are best positioned currently to exploit the AAB trend and traditional beer’s recovery, this would be ABI. ABI has lost more than 15% share of the beer market since 2008 but now is a leader in the RTD spirit market. This combined with the strength of Michelob Ultra positions the company well based on trends. This showed up in their results last month.

A second company is Boston Beer who is experiencing strong growth of its RTD spirit offering Sun Cruiser which is gaining a foothold in the RTD marketplace. A recovery in the beer market also will benefit Constellation Beer, which continues to be a top performer within traditional beer.

Finally, the opportunity for entrepreneurs that entered the market early with differentiated positioned brands based on packaging, e.g. BuzzBallz and Beatbox, continue to penetrate the RTD space. Recent successes in RTDs have piggy backed off of strong segments within FMBs such as hard seltzer or tea.

Although the market has experienced cycles of success among individual brands and/or styles, leading to overblown narratives of “fads,” the overall segment continues to expand and outperform the remainder of beverage alcohol. For those considering entering the space today, it is important to differentiate based on targeting new taste segments and / or packaging delivery: better for you drinks; convertible packaging with multiple uses; recovery drinks.

Based on consumer focus for greater functionality and differentiated experience, opportunities remain. Just don’t become a copycat beverage in this fast-paced environment.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!