Beverage Alcohol: Gloom and Doom versus Irrational Exuberance

Traditional beverage alcohol categories experience waves of success, decline

Photo by Kar-Tr/iStock courtesy Getty Images Plus via Getty Images

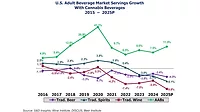

Recently, much has been written about brand successes in ready-to-drink (RTD) spirits. For instance, the explosive growth of Long Drinks, Surfside, BeatBox and BuzzBallz, to name a few. Not to mention the extremely fast rise of White Claw, to more than 3% share of beer, and High Noon, the original spirit brand to reach national scale and prominence. It almost sounds too easy.

Comments like this are what the consumer wants: authenticity, satisfying an unmet need, beer too much of a flavor challenge and authentic cocktails too inconvenient. I guess it is time to roll over and embrace the inevitable. Before we do this, let us take a look at the proclaimed death of traditional beverage alcohol categories in the past.

Beer

The New York Times in 2002, The Wall Street Journal in 2004, USA Today, Ad Age and “Time Magazine” all wrote about the death of beer and the rise of sweet alc-pops and craft beer. The future is in flavored malt beverages (FMBs) and craft beer.

From 2018 to 2025, hard seltzers and RTDs are killing beer. It is ironic how craft is no longer written as the future of beverage alcohol.

Spirits

In 1980, per capita for spirits peaked and declined every year until 1997. Spirits were declared dead in many leading news publications and trade journals, its share of beverage alcohol dropped from plus-40% to under 30%.

The Wall Steet Journal in 1982, The New York Times in 1985, “Beverage Industry News” in 1988, “Time Magazine” in 1991 and Fortune “Can Spirits Survive the 1990s” are some examples.

Wine

The Wall Street Journal in 1985, “The Wine Spectator” in 1987, Fortune in 1994 and “Time Magazine” in 1996 all declared wine dead.

While national media was writing the obituary for beer, spirits and wine; the choirs in regional and trade press further proclaimed the end of these categories at different times.

Today, the darling segments of hard seltzer and craft have died. All these categories have been raised from the dead several times over the past 50 years. The RTD push in 2010 got nowhere as well as hard cider.

Now RTD’s are back with significant resources being placed behind them, similar to spirits just a decade ago. Finally, NA Beer is another darling category. It was in the 1990s that it was written about as the next frontier.

What does this all mean? A couple of themes exist throughout all of these proclaimed market shifts and deaths.

In each case, the emerging segment/category was viewed as new and exciting, and addressing long-term needs of consumers with endless runway.

In nearly each case, a variation on healthy lifestyle followed by indulgence and back to healthy lifestyle occurred.

Brands rose and peaked in a relatively short timeframe of five to 10 years before flattening or declining in most cases.

Money chased these segments/categories causing market fragmentation and saturation.

Market leaders entered the game through a combination of new product launches and acquisition only to retrench at a later date.

Younger consumers embraced the new beverage types driving performance before fatigue set in and they moved on.

I am not suggesting that the growth of RTDs will end in a short period of time over the next year or two. Nor am I suggesting that NA Beer is destined to hit the wall shortly. What I am trying to convey is that beer, wine and spirits categories have been declared dead at multiple times over the past 50 years only to be reborn and experience solid if not sustained strong growth over the following decade or, in some cases, longer.

There will be many changes in the market in terms of market structure, value systems and preferences. Some of which is beginning to occur today. So before declaring any category the ultimate winner or other categories as dead, realize the sun will shine on traditional beer, wine and spirits again at some point in the not-too-distant future and new heroes will be born.

Markets are not static, and one needs to look deep against several societal, product, consumer and market dynamics to name a few to gain a perspective as to where it is heading. I can share several presentations I gave more than 10 years ago that points to where we are today that was against popular opinion at the time. Now is the time to look forward to where we are going, not where we are as the sun will shine again.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!