Home » Keywords: » beer sales

Items Tagged with 'beer sales'

ARTICLES

Beer brand unveils strategic relaunch, partnerships

Read More

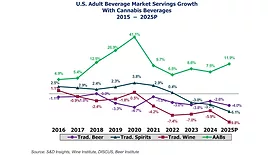

Beverage Alcohol: Gloom and Doom versus Irrational Exuberance

Traditional beverage alcohol categories experience waves of success, decline

December 12, 2025

NACS Show breaks Chicago record

Beverage-makers debut new, upcoming releases for c-stores

November 14, 2025

The beverage alcohol shuffle

Companies looking to capitalize on adult alternative beverage trends

September 19, 2025

NielsenIQ report find total beverage alcohol sales -3% for 2025 first half

‘The Halftime Report’ examines 26 weeks ending July 5

July 16, 2025

2024 Wholesaler of the Year: Silver Eagle Distributors Houston

Community engagement, diverse portfolio keep beer distributor at forefront of market

November 7, 2024

As July 4 approaches, beer manufacturers prep for holiday sales

Predictive pricing offers brand owners insights into consumer spending habits

June 13, 2024

Between Drinks

Drizly releases drink trends to watch in 2024

Beer category expected to see resurgence

February 5, 2024

2023 Wholesaler of the Year: Breakthru Beverage Group

Consumer-centric approach supports wholesaler’s adaptability for today’s beverage market

September 8, 2023

Between Drinks

Alcohol brands acting more cautious with ad spends

Data shows tequila brand ad spends up the most in past year

May 17, 2023

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2026. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing