Home » Keywords: » spirit sales

Items Tagged with 'spirit sales'

ARTICLES

Association reports on trade impacts, policy wins and goals

Read More

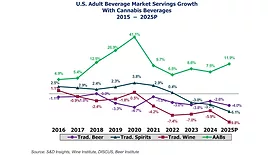

Beverage Alcohol: Gloom and Doom versus Irrational Exuberance

Traditional beverage alcohol categories experience waves of success, decline

December 12, 2025

The beverage alcohol shuffle

Companies looking to capitalize on adult alternative beverage trends

September 19, 2025

Southern Glazer’s structures portfolio for success

Wholesaler looks for right opportunities to expand offerings

September 12, 2025

2025 Wholesaler of the Year: Southern Glazer’s Wine & Spirits

Family-led wholesalers’ passion continues with next generation leadership

September 10, 2025

SipSource report highlights challenging half year for wine, spirits

RTDs remain category driver, but at decelerated rate

August 20, 2025

NielsenIQ report find total beverage alcohol sales -3% for 2025 first half

‘The Halftime Report’ examines 26 weeks ending July 5

July 16, 2025

UrFriendCharles launches platform for Black-owned spirits brands

eCommerce platform shipping to 44 states

April 28, 2025

DISCUS releases American Spirits Export Report

Sales reached $2.4 billion in 2024, report shows

April 24, 2025

Report shows spirits market navigating marketplace challenges

Distilled Spirits Council highlights category maintains market share, cautions of tariffs

February 11, 2025

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2026. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing