Category Focus

Juice manufacturers take conscious approach to new products

Sugar reduction, added nutrients among ways manufacturers retool juice

In the love bop “Sugartime,” Kitty Wells sings, “Sugar in the morning, sugar in the evening, sugar at suppertime/Be my little sugar and love me all the time.” But as consumers are more conscious about the food and beverages they consume, products associated with a high sugar content are not singing upbeat tunes. Juice manufacturers, however, are taking a proactive approach to develop products that satisfy taste and health and wellness goals.

In New York-based IBISWorld’s February 2023 report titled “Juice Production in the US,” the market research spotlights this market shift.

“Health trends have hampered demand for juice. Health-conscious consumers are concerned about the high sugar content of juice,” the report states. “Juice producers have looked to new products to attract consumers. Large companies have introduced new juice varieties and purchased smaller competitors to gain access to niche product segments.”

Recognizing this trend, Tropicana, a brand of PAI Partners and PepsiCo, announced its relaunching its Trop50 offering as Tropicana Light. Tropicana Light orange juice beverage delivers 100% of your daily dose of vitamin C and is a good source of potassium, but with 50% less sugar than regular orange juice, the company notes. Packaged in 52-ounce bottles, the release is available in four varieties: Tropicana Light No Pulp, Tropicana Light Some Pulp, Tropicana Light No Pulp Calcium + Vitamin D, and Tropicana Light Vitamin C + Zinc.

But some juice manufacturers are taking health consciousness to another level with zero sugar entrants.

Boston-based Ocean Spray Cranberries Inc., the agricultural cooperative owned by roughly 700 farmer families, has announced the launch of Ocean Spray Zero Sugar Juice Drink, the first beverage from Ocean Spray with bold flavor, zero grams of sugar, and no artificial sweeteners.

Containing stevia leaf extract that has been further processed, Ocean Spray Zero Sugar Juice Drink is available in two flavors: Cranberry flavor and Mixed Berry, a new flavor to the brand’s beverage portfolio.

“From full flavor blends to refreshing diet and now bold zero sugar, Ocean Spray is committed to developing product innovations that continually meet the needs and desires of consumers who are seeking out more options for their juice drink,” said Trinh Le, vice president of next generation beverages and omnichannel marketing at Ocean Spray, in a statement. “We’re excited to be the first brand to introduce this new innovative product in the shelf stable aisle and continue our legacy of beverage innovation.”

Ocean Spray Zero Sugar is the latest in the brand’s developments to create more health-conscious options for today’s shoppers. Earlier this year, Ocean Spray launched another “better-for-you” juice line, which includes Immunity Cranberry Blueberry Acai, Immunity Orange Mango, and Ocean Spray Revitalize Cranberry Pineapple Juice Drink.

Although juice manufacturers are actively addressing health and wellness concerns, analysts note that their impacts on the juice category have been minimal.

Roger Dilworth, senior analyst at New York and Wintersville, Ohio-based Beverage Marketing Corporation (BMC), notes that beverage-makers still are searching for what formulation will resonate with consumers.

“[Sugar reduction trends] haven’t taken full hold yet, as 50% orange juice blends have faded in the marketplace,” he says. “Similarly, reduced sugar hasn’t pushed the needle in fruit drinks either. Marketers continue to try to crack the code, as with Ocean Spray’s newly announced Ocean Spray Zero Sugar Juice Drink.”

Yet, research shows that, although sugar content is on consumers’ minds, juice still appeals to their wellness and pleasure motivations. In Chicago-based Mintel’s 2023 report “Juice and Juice Drinks – US,” the market research firm highlights that dual associations exist for the category.

“Forty-eight percent of those who say they consumed more juice as a treat also say they have consumed more juice for health reasons, and 43% of those who have consumed more juice for health reasons say they have also consumed more as a treat,” the report states.

And when it comes to sweetener preferences, Mintel research found that consumers’ familiarity with sweetener carries more weight than its wellness attributes as shoppers want to avoid overthinking purchases.

“White sugar’s netted ranking over naturally non-nutritive monk fruit and allulose further suggests this thinking pattern; meanwhile, honey’s perceptions as ‘whole’ may afford it even more acceptance and remind brands of the importance of flavor experience within juice and juice drinks,” the report states.

In its survey of 1,397 Internet users aged 18 and older who purchased juice or juice drinks in the past three months (February 2023), “Honey,” “No added sweeteners” and “White sugar” comprised the Top 3 preferred sweeteners.

[Click images to enlarge]

Inflation looms over category

As juice manufacturers look to find the sweet spot, or lack thereof, between juices and consumer tastes, analysts note that another factor is impacting the market.

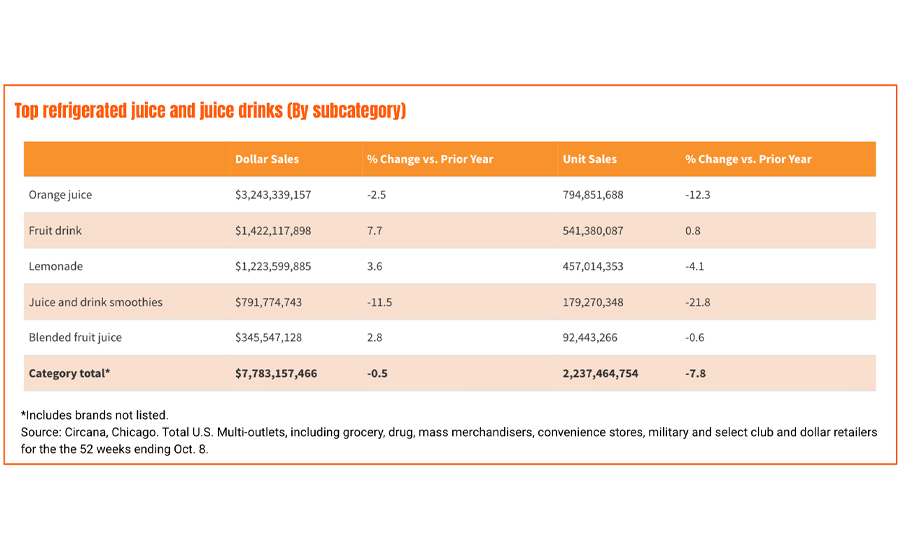

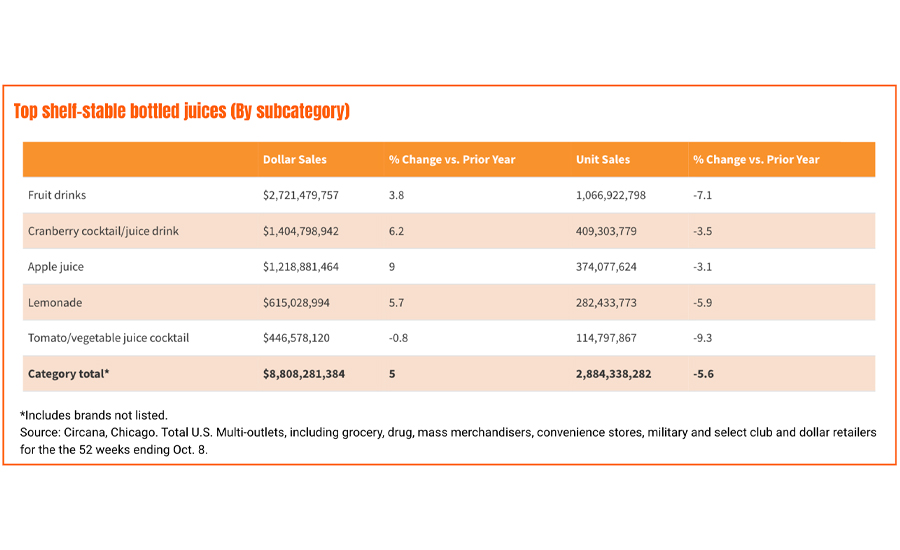

“Fruit beverage volume is estimated to be down in the 3% range for 2023, based on preliminary data, with revenues up by a similar amount due to inflation,” BMC’s Dilworth explains. “Juice drinks have been performing nominally better than juice.”

Building on his inflation references, Dilworth notes that the rise in prices is causing a shift in consumer purchase patterns.

“… [T]he higher price points have influenced some shoppers to trade down from chilled to shelf-stable, while news of the spiking price of orange juice futures have even reached the mainstream financial press,” he says.

Beyond traditional juice and juice drink segments, inflation also is impacting premium segments like cold-pressed/high-pressure processed (HPP) juices.

“There is a niche consumer who buys these products but their high price points, especially continuing into the near term, will present challenges particularly if a recession should finally hit in 2024,” Dilworth says.

Despite these challenges, Dilworth notes that as consumers see a deceleration of inflation within juice, it could help the category stave off volume attrition.

“If inflationary pressures continue to subside, volume may improve ― barring a recession ― but will likely still be flat to slightly negative,” Dilworth says. “On the flip side, revenue growth may decelerate to the 0 to 1% range.”

Yet, some research shows that consumers still view juice and juice as an accessible avenue to consume necessary nutrients.

“Even as inflation watered down juice and juice drink category performance in 2022, its blanket presence on all food and drink products positioned juice and juice drinks as affordable nutrition and enjoyment,” Mintel’s report states. “More consumers increased juice consumption over the last six months for either health or enjoyment than decreased due to prices … and 63% say that juice can be a cost-effective way to add nutrients in place of produce.”

Health-conscious niche

With consumers still finding value in juice and juice drinks ability to deliver nutrients, research shows the potential for emerging entrants.

“There is some innovation in the juice shot segment, which is generally classified in the no-alcohol shot category (rather than fruit beverages), as marketers fortify them with probiotics and herbs targeting immune support, digestion and even energy via caffeine,” BMC’s Dilworth says.

Meanwhile, IBISWorld’s report denotes that a niche of health-conscious consumers are turning to vegetable juices that often are combined with fruit juices to sweeten the taste.

“The high level of nutrients and antioxidants present in vegetable juices has led to greater consumer interest alongside rising health consciousness, enabling this segment to secure a strong and growing niche,” the report says.

In terms of innovation, Mintel’s report signals the importance of enhancing flavor and nutrition in juice, but manufacturers should not try to change the identity of the juice category.

“Classic flavors and functionality will always have a crowd; presenting these with a twist can make the core base do a double take,” the report states. “Add flavor dimension and connect ingredients to functionality to gently flip the script while remaining true to juice’s dual draws of wellness and enjoyment.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!