Predicting the next functional ingredients in 2019

Social data offers insights to beverage formulators

Social media is supercharging conversation and the spread of consumer trends. Shifts in consumer attitude, which typically have evolved over years now can grow and spread within a matter of months. But how as a marketer or innovator can you stave off the competition and stay ahead?

By observing millions of social media conversations, you can gain invaluable insight into consumers’ actual behavior — their needs, desires and beliefs. But it’s not enough to have insight into what consumers are thinking and doing now. To successfully launch an innovative product, brand owners need foresight on what consumers will think and do next.

Predicting the unpredictable

Trendscope is Black Swan Data’s innovation platform, which uses Machine Learning models to isolate and contextualize trends within social data. By continually analyzing relevant social media conversations, it claims to identify and predict emerging trends earlier and more accurately than any other research tool.

PepsiCo, McDonald’s and Google, among others, have all used this platform to gain a first-mover advantage in their innovation and communication programs, using this insight to make faster, data-driven marketing and innovation decisions.

By way of example, we’ve used Trendscope to review the U.S. non-alcohol beverages category to understand how functional benefits, one of the most important topics in 2018, will develop in 2019. The supporting data comes from more than 240 million consumer generated, social data points during the past two years and contains analysis and predictions about 320 themes and benefits; 2,300 brands and products; and 1,400 ingredients.

Functional benefits: Food as medicine

Consumers are increasingly seeking additional qualities from their everyday food and drink products. No longer can a beverage’s sole purpose be to hydrate and refresh. It also needs to improve your mental well-being (by reducing your stress levels), aid your digestion (by cleansing your gut) and even enhance your ability to recall facts and figures (by boosting your memory).

Of particular interest are conversations about ingredients that have, or at least are perceived to have, medicinal (ranked No. 5 TPV of 130 category benefits). Health conscious consumers are increasingly seeking natural ingredients to boost their overall wellness.

Historically, this has manifested itself in do-it-yourself (DIY) drinks, like adding lemon and ginger to hot waters. Notably, out of the Top 10 ranked beverage ingredients within Trendscope, seven are strongly associated and known for their health associations or properties.

Trendscope isolates a category’s trends and places them into context. For example, a new ingredient growing 100 percent year-over-year (YoY) appears interesting, until you discover 100 other ingredients that are growing even faster. By using data science to analyze a trend’s likelihood to grow in the future (not just its current growth), Trendscope provides a ranking of each and every category trend based on its relative maturity and Trend Prediction Value (TPV).

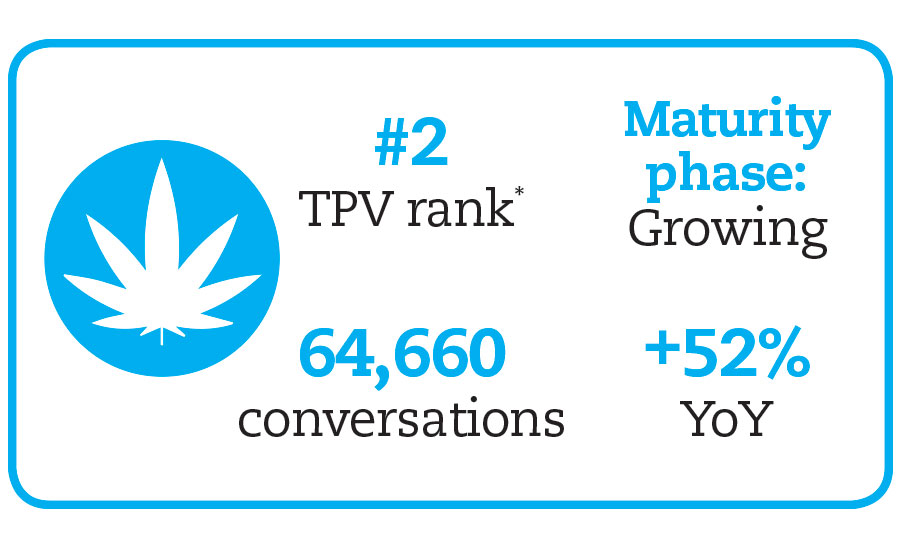

Cannabidiol: The poster example of the movement

It’s no surprise that cannabidiol (CBD) dominates consumer conversation surrounding ingredients with perceived medicinal benefits. Tetrahydrocannabinol (THC) is the compound in marijuana that has a psychoactive effect, while CBD is deemed to provide a wide range of health-related benefits including pain relief, preventing dementia and anti-inflammatory components. In terms of the number of conversations, it’s still relatively small (versus coconut for example at 1.675 million) but in terms of predicted growth in conversation, and therefore interest to product innovators, it ranks highly.

Clearly, CBD presents a compelling opportunity for product innovators to add a known and highly recognized functional ingredient to their product portfolio.

But are beverage-makers interested in it for its pain relief purposes? This is a niche benefit and unlikely to appeal to a teenager wanting something to go with their burger and fries.

More than likely, they are most interested in some of the lesser well-known wellness benefits, which we see consumers talking about with reference to CBD — like vitality, calming and mental focus. By adding CBD as an ingredient to an existing product or brand, they have the potential to appeal to a new segment of the market altogether. For example, CBD conversations resonate most highly with 30-34 year olds and peak between 9-10 a.m. Will CBD infused smoothies and juices be the new healthy pick-me-up for Gen X?

However, CBD is hardly new news to innovators. Several products already have launched, and as a trend it’s showing signs of moving into maturity. This, coupled with the ongoing uncertainty surrounding legislation restrictions, means that if you’re a food and drink innovator looking to gain a first-mover advantage, you should perhaps turn your attention elsewhere.

This is where Trendscope can help by giving you an overview of all the category themes, benefits and ingredients — allowing you to determine between what’s a short-term fad and a long-term trend. Your business can then prioritize the fast growing trends that will sustain growth into the future.

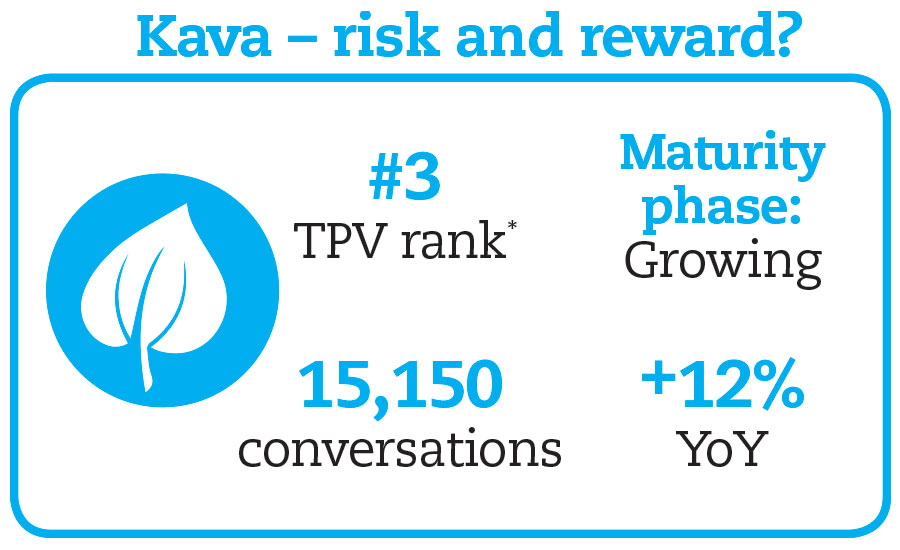

Although three times smaller than CBD, mentions of kava in beverage conversations are growing. Described as “chamomile on steroids,” it’s been historically brewed in hot drinks as a cure for insomnia. But other interesting benefit associations include stress reduction, mood boosting, gut-friendly and even increasing one’s libido.

Ranked just behind CBD in Trendscope at No. 3, we predict it has a high likelihood of mirroring cannabidiol’s rise. Whilst clearly one to watch, a note of caution regarding kava: excessive usage has been linked to negative health effects. As a result, kava has been banned from Europe and Canada (but not in the United States). Thus, much like CBDs, legislation uncertainty might lead you to look elsewhere for a safer and more stable big ingredient innovation.

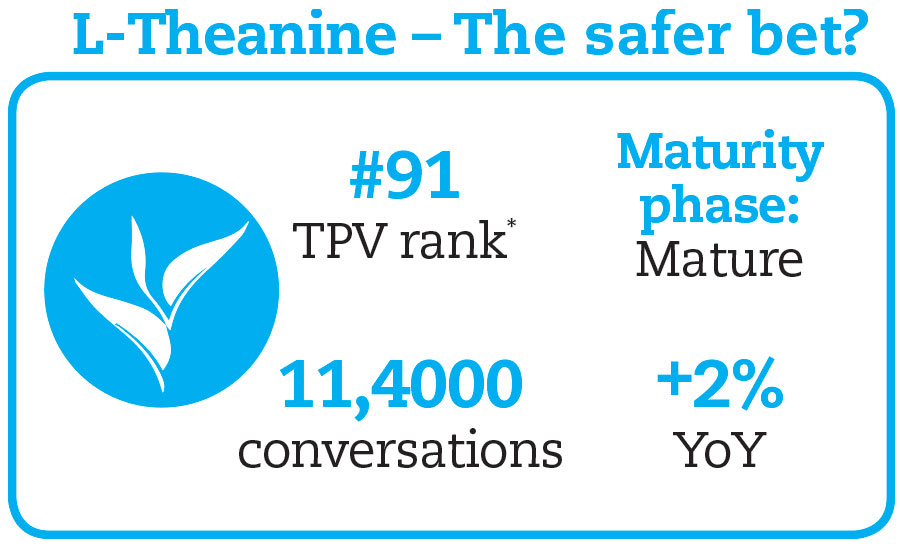

L-theanine is an amino acid found most commonly in green and black tea leaves but also in small amounts in bay bolete mushrooms. Classified by Trendscope as a mature ingredient trend, meaning it’s sizeable but has a low rate of conversation growth, L-theanine ranks lower in the tool than CBD and kava (although still in the top 10 percent of overall ingredients).

Like CBD, consumers associate its benefits with treating anxiety and high blood pressure. But it’s main interest point for beverage marketers should be its strong perception of delivering mental energy, focus, memory and alertness with an extremely high sentiment and therefore trust (L-theanine overall net sentiment is 78 percent compared with CBD at 48 percent).

This net sentiment is particularly interesting in comparison to said ingredients when you consider some of the negative associations and hang-ups consumers still perceive CBD and kava to have. Could L-Theanine be a safer ingredient that can be added to beverage products to deliver on the plant-based and nootropics macro-trends we see growing?

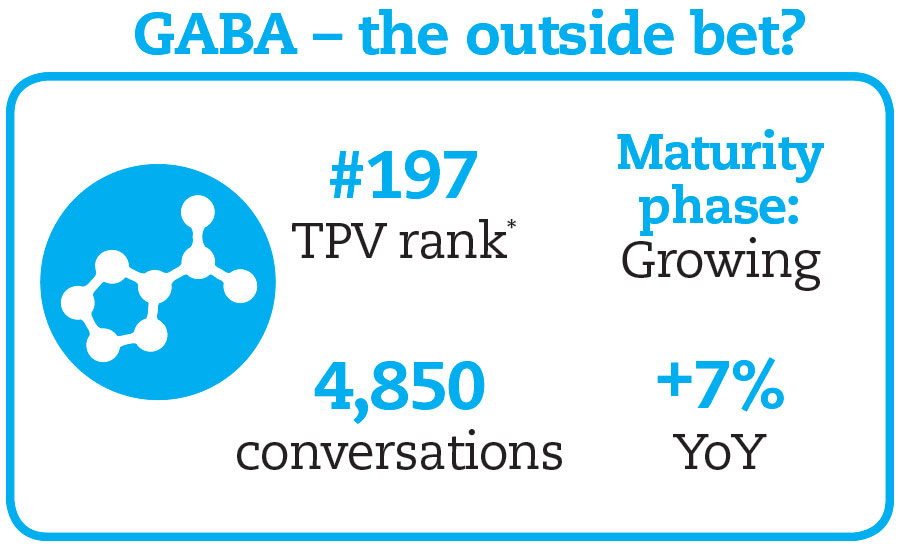

Although smaller in volume, GABA – a chemical naturally made in the human brain — has a high conversation growth rate, which is predicted to continue in the next sixmonths at least. Again, GABA has similar sleep aid and stress reduction benefits to the ingredients previously mentioned but like L-theanine, it is strongly associated with a healthier brain, mental energy and performance.

Of all ingredients mentioned, GABA is the least well known, ranking just inside the Top 200 ingredient trends. Whilst it typically ranks beyond where we would normally place emerging new trends, Trendscope predicts growth is set to continue in the next sixmonths. Therefore, it could be of interest if you’re looking to exploit a niche or get ahead of the market.

CBD latte, anyone?

From analyzing social data we’ve seen, it’s highly likely that we’ll all soon be enjoying CBD infused lemonades, lattes and lagers. However, product innovators on the front foot already know that this is yesterday’s news.

Instead, Trendscope identifies alternative ingredients such as kava, L-theanine and GABA, which are less well-known, and still relatively small, but predicted to accelerate in 2019 and beyond.

This is valuable information for innovators and brand managers as it removes uncertainty and speeds up decisions by using data science to predict which ingredient “bets” you should be placing your innovation dollars on. Ultimately, helping you develop better products, that satisfy genuine consumer needs of the future, sooner. BI

With thanks to Black Swan Data for the data and analysis provided.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!