Supermarket channel must adapt to appeal to consumers

Digital age being embraced by more traditional grocers

In the same way that SKU proliferation has given consumers an abundance of food and beverage choices, omnichannel shopping has resulted in more diverse retail shopping. Because of this, emerging channels have benefited, but traditional outlets, like supermarkets, have experienced challenges.

In Mintel’s November 2017 report titled “Grocery Retailing – US,” the Chicago-based market research firm highlights how these retailers are faced with numerous challenges in reaching today’s consumer.

“As consumers’ shopping and eating preferences continue to evolve, retailers in the industry face pressure to keep up with change,” the report states. “Collectively, the industry has been too slow to adapt to a digital age and is still by and large, playing catch-up. The next couple of years ahead are pivotal as the implications of retailers’ many major initiatives that are being tested and initiated now are realized.”

Although all grocery retail outlets are experiencing the effects of this changing marketplace, traditional supermarkets have been tested as their market share has decreased since 2012, when its yearly sales no longer outperformed the collective sales of all other multi-outlet (MULO) channels, Mintel highlights.

“Other MULO channels such as mass merchandisers, warehouse clubs and drug stores continue to steal share from and outperform supermarkets, which are not expected to gain traction again this year,” the report states. “This trend is only predicted to continue; [estimated year-over-year] annual average growth for supermarkets for 2018-22 is 1.4 percent, compared to 2 percent for other MULO channels.”

Click chart to expand

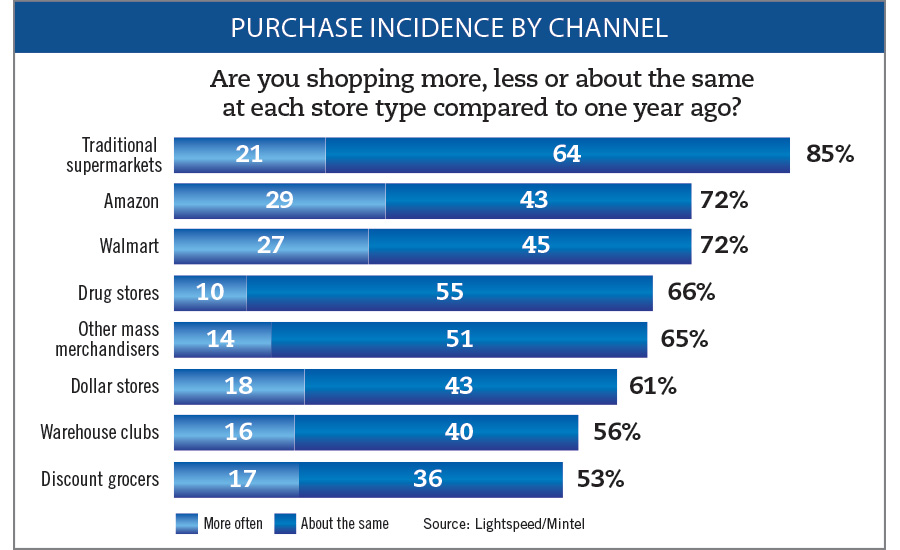

Purchase incidence by channel, according to data from Lightspeed and Mintel

Jon Hauptman, senior director of retail for Long Grove, Ill.-based Inmar Willard Bishop Analytics, also highlights the challenges that supermarkets face as more grocery retail outlets compete for consumers’ dollars.

“Traditional supermarkets continue to lose sales and share to a wide range of other formats [that are] selling food,” he says. “In fact, food retailers enjoying significant growth are low-price operators such as limited-assortment stores (e.g., Aldi, Lidl), dollar stores and supercenters. Shoppers are looking for value and are increasingly shopping at stores that help them stretch their weekly shopping budgets.”

Susan Viamari, vice president of Thought Leadership for Chicago-based Information Resources Inc. (IRI), says that during the past year, dollar sales within supermarkets were essentially flat, growing at 0.2 percent; however, unit sales were down 1.1 percent. Viamari notes that this performance is a result of consumer purchase patterns, including those impacting beverage shopping, and channel migration.

“Unit sales continue to remain flat/down as a result of conservative purchase behaviors — consumers are balancing needs and wants and doing more just-in-time shopping, as opposed to large stock-up trips,” she says. “There is also increased competition for share of thirst across [consumer packaged goods] (CPG) and non-CPG channels — think quick-service restaurants, coffee shops, etc.”

Responding to the shift

Although competition across grocery retailing remains fierce, industry analysts highlight the importance of recognizing and adjusting to today’s shopping patterns.

“Omnichannel shopping is having a profound impact on supermarket sales and sales across brick-and-mortar channels,” Viamari says. “Consumers have more choices for where to shop and what to buy. They are bombarded with messages everywhere via mobile and traditional advertising platforms. They are also being introduced to a variety of new shopping options, such as click-and-collect, home delivery and direct-to-consumer purchasing.”

To remain competitive, more supermarkets are rethinking their go-to-market strategies and are utilizing a mixed bag of tactics, Viamari says.

“[Grocery retailers] are experimenting with click-and-collect, for instance, and partnering with home delivery (think Instacart) providers,” she says. “They are opening smaller format stores, stores in more urban locations, opening in-store kiosks/prepared food/fountain beverage/coffee shops, etc., to be where the shopper is when the shopper wants to make a purchase.

“The industry will continue to evolve rapidly in coming months/years, as ‘the right fit’ grabs hold and less effective strategies fall by the wayside,” she continues.

Inmar’s Hauptman also highlights the various ways in which supermarkets actively are trying to attract consumers.

“First, they’re getting into eCommerce grocery as quickly as they can,” he says. “Second, they understand the need to sell ‘solutions’ to satisfy shopper needs for meals and occasions, rather than simply selling ingredients.

“Third, they’re focusing on fresh departments such as produce, meat, bakery and deli because those are areas in which they often have a quality and assortment advantage over low-price competitors,” Hauptman continues. “Fourth, they’re looking for ways to neutralize price vulnerabilities by expanding their assortment of value-oriented items such as economy tiers of store brands, to provide options for shoppers who want to save money in certain categories and are willing to trade to economy offerings to do so.”

In relation to click-and-collect models, Hauptman highlights the positive results that supermarket retailers have realized from the eCommerce-inspired tool. Yet, he also points out that the system is not without its share of obstacles.

“Click-and-collect is having a very strong impact on supermarkets,” he explains. “Most retailers are either in the eCommerce click-and-collect business or are looking for ways to quickly enter it. A key challenge for supermarkets is how to make a profit on click-and-collect orders. It’s highly unlikely that any traditional supermarket is doing so. Simply picking from grocery shelves requires substantial labor, which is not nearly offset by eGrocery fees.”

Similar to how beverage manufacturers are developing new products to fit the custom needs of consumers, grocery retailers should do the same, analysts state.

“Personalization emerges as a key theme when studying the desired improvements consumers are interested in,” Mintel’s report states. “Customized offers and coupons are an obvious way to use customer data effectively and shoppers want more of this. Not only can it demonstrate that retailers understand their customers’ shopping habits, but it can foster discovery of new products based on a keen understanding of behaviors and preferences.”

Pricing the competition

Among the factors that have impacted dollar sales within supermarkets has been the deflation of various commodities and products.

“The current deflationary market is already causing price wars across the sector, which cut into grocers’ profits,” Mintel’s report states. “While this is a positive benefit for shoppers, it’s leading to channel shifting and represents an ongoing threat for supermarkets.”

This pricing obstacle also has been exacerbated by competition from other retail outlets.

In Mintel’s report, the market research firm notes that consumers still are shopping at supermarkets, but spending fewer dollars there in comparison with past years.

“Mintel’s grocery shopping data shows that 93 percent of consumers are shopping the same or more at supermarkets or grocery stores (even higher than last year’s reported figures) but differences in frequency or spending (likely due to lower food prices) could be impacting sales,” it states. “Amazon and Walmart are seeing the highest percentages of consumers claiming to ‘shop more’ — 29 and 27 percent, respectively.”

Additionally, the report states that more consumers are embracing value-oriented stores as they seek out the best prices.

“Forty-five percent are shopping collectively more at mass merchandisers, dollar stores or discount grocers such as Aldi,” it states.

Mintel also highlights that fewer consumers have loyalty to grocery retailers, contributing to the channel migration and value-added shopping habits.

Beverage boost

Although supermarkets have their fair share of challenges to address, the channel has realized some benefits from the beverage market.

In comparison to the overall supermarket channel, IRI’s Viamari says that “beverage performance was stronger, with dollar sales climbing 0.8 percent and unit sales down 0.2 percent.”

She adds that in the supermarket channel, five of largest 10 beverage categories realized dollar growth in the past year: bottled water is up 6.5 percent, energy drinks are up 4.6 percent, coffee is up 0.6 percent, ready-to-drink coffee and tea are up 3.1 percent, and canned and shelf-stable juices are up 2.2 percent.

“These categories are benefiting from consumers’ focus on healthier-for-you beverage options, as well as the push for on-the-go energy,” Viamari says. “There has been a good deal of innovation in these categories, including flavor and texture — think sparkling water, for instance — excitement, healthier-for-you ingredients, exotic or new/different flavor combinations.

“Carbonated soft drinks continued to see sales decline (dollars down 0.9 percent), struggling against the above trends and the fresh push of innovation coming to beverage shelves,” she continues. “Center-store, shelf-stable beverages are also struggling against refrigerated options, particularly cold-pressed juices, which are viewed as healthier/more nutrient packed.”

Whether it is new product innovations from markets like beverage or other factors, analysts expect supermarkets will remain competitive as they aim to regain market share.

Inmar’s Hauptman notes that if supermarkets want to be competitive, they need to continue to seek methods for reaching up-and-coming generations.

“Supermarkets will need to rethink how they can better serve the needs of their most attractive shopper segments (typically younger households with children) by combining the best of in-store shopping and eCommerce shopping,” he says. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!