Home » Keywords: » organic retailers

Items Tagged with 'organic retailers'

ARTICLES

Grocer identifies food, beverage products that support trends

Read More

Natural, organic retailers share shopper insights

Sustainability, functionality among trends resonating with consumers

August 26, 2024

Channel Strategies

Natural retailers challenged by inflation, competition

Experts suggest natural retailers promote specialty offerings to appeal to consumers

October 3, 2023

Channel Strategies

Dedicated shoppers keep natural and organic channel afloat

eCommerce options add more convenience for shoppers

September 21, 2021

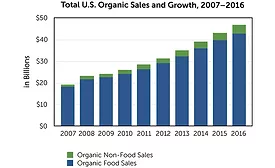

Natural, organic retailers continue upward path

Online retailers also helping channel grow

October 16, 2019

Natural, organic retail channel continues to post growth

Refrigerated juices, functional drinks command most market share among beverages

October 3, 2018

Amazon’s acquisition of Whole Foods Market impacts industry

Beverages No. 4 in organics market

October 11, 2017

Natural, organic retailers address price point concerns

Channel receiving increasing competition from eCommerce

October 10, 2016

Technomic provides coverage for total food industry channel

Will cover all channel in $1.74 trillion US food industry

August 19, 2016

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2026. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing