Consumer demand for non-alcohol cocktails on the rise, study shows

‘Sober curious’ movement brings opportunity for brands

As January often is a time for making new resolutions for the year ahead, I always try to start changing particular habits early, before we ring in the “New Year.”

For instance, instead of telling myself I’ll eat better and workout more after the holidays, I try to do those very things early. Yes, I do this before Thanksgiving, but it’s all part of my effort to make a lifestyle change and avoid fad diets.

For those who look to January as a way to reduce alcohol intake, new research from consumer insights platform Veylinx suggests that abstinence events like “Dry January” are more than just a fad.

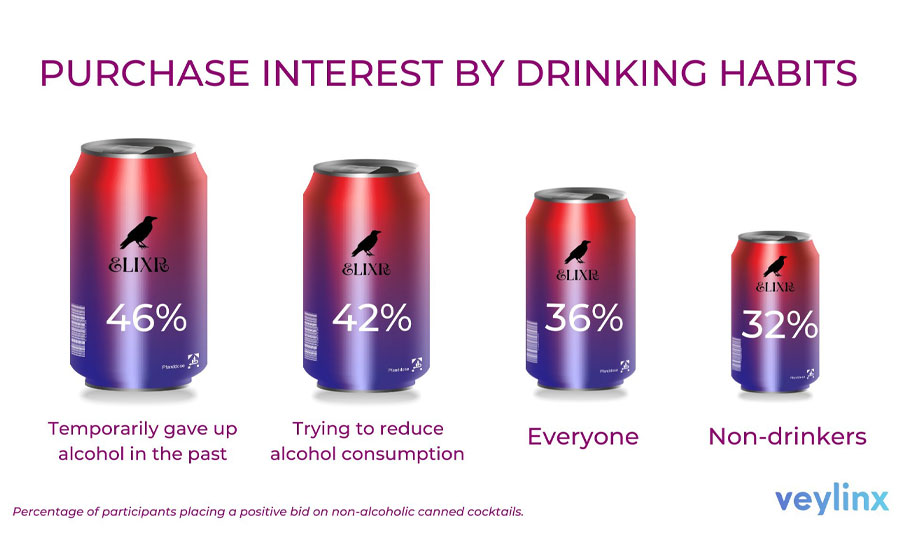

Veylinx, which uses behavioral research to measure consumer purchasing habits, tested the fast-growing non-alcohol canned cocktails market to learn who is buying these drinks and why, it says. The study also measured demand for versions enhanced with functional benefits like mood boosters, detoxifiers and CBD, it adds.

Released in late November, the Veylinx research revealed that more than three-quarters of Americans say they have temporarily given up alcohol for at least a month in the past.

“Almost half (46%) of drinkers are trying to reduce their alcohol consumption right now, and 52% of them are replacing alcohol with non-alcoholic beverages,” it says. “Consumers identified improving their physical health and mental wellbeing as the main reasons for drinking less.”

Further, people who currently drink alcohol are actually willing to pay more for non-alcohol canned cocktails than non-drinkers, according to Veylinx. At premium price points, the disparity between consumers who are trying to drink less and the general population is even more pronounced — demand from these consumers for non-alcohol canned cocktails is 71% higher at $20 for a four-pack, it says.

“Driven by younger consumers, the non-alcoholic beer, wine and cocktails category is surging in popularity. People trying to cut down their drinking are finding more and more alternatives on retail shelves and in bars and restaurants,” said Anouar El Haji, CEO of Veylinx, in a statement. “Our research found that they’re willing to pay premium prices for non-alcoholic versions of ready-to-drink cocktails. The rise of the ‘sober curious’ movement gives brands countless opportunities for growth in this segment.”

As it’s becoming more apparent that the sober curious movement’s influence reaches beyond “Dry January” or months like “Sober October” — I guess I’m not alone in trying to change certain habits before the clock strikes twelve. To read more about alcohol-free and low-alcohol trends, check out this month’s Category Focus.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!