Category Focus

Increased demand for no/low alcohol drinks brings opportunities

Consumers are becoming more familiar, accepting of no/low alcohol beverages

Photo from Tamara Davis at PriceWeber/courtesy of Flavorman Beverage Trends

Originated in Robert Browning’s 1855 poem “Andrea del Sarto,” the proverb “less is more” was adopted as a mantra in 1947 by designer and architect Ludwig Mies van der Rohe for architecture, art and design. Today, as the expression applies to numerous different situations, many new beverage innovations have jumped on the “less is more” bandwagon, as there now are more no/low alcohol wines, spirits and beer options available than ever before.

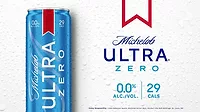

Although non-alcohol beer has been available to consumers for many years, new innovations are better meeting health and wellness desires for consumers looking for lower ABV, lower sugar and lower calories, experts note.

Whereas it’s difficult to pinpoint the exact impact health and wellness has on the no/low alcohol segment, the trend and demand continually is increasing, says Scott Scanlon, executive vice president of beverage alcohol at Information Resources Inc. (IRI), Chicago.

Image courtesy of Ransom Spirits

“Increased focus on calorie, sugar and sweetener claims across the store and North American beverage categories indicate consumers use these claims to monitor intake,” Scanlon explains. “Awareness is likely a key contributor to the non-alcoholic segment.”

Additionally, the COVID-19 pandemic heightened consumer’s personal health, mental health awareness, immunity support and sustainability focus, leading to a greater uptake in an already growing category, Scanlon notes.

“Spirits has gained throughout the pandemic as consumers have become ‘home mixologists’ trying different combinations at home with reduced frequency to on-premise locations,” he explains. “Healthier lifestyles, once thought of as a fad that would pass, is now engrained with regular consumption not just during a dieting phase.”

In October, at the Distilled Spirits Council’s 2021 DISCUS conference, Kim Cox, senior vice president of account development for New York based NielsenIQ, noted that online non-alcohol and low-alcohol beverage dollar sales in the latest 12 months was up 315% vs. a 26% increase in online sales of beverage alcohol categories of beer, wine and spirits.

“There are many health and wellness trends emerging across center store that are causing alcohol consumers to take a second look at their beverages,” Cox said in a statement. “The market for no/low alcoholic beverages is still relatively small at less than 5% household penetration, but is an interesting area to watch, as it now represents $3.1 billion in sales and a 3.5% total alcohol market share.”

Additionally, while wine has benefited the most in terms of no/low alcohol contribution to category growth, spirits has benefited the most in terms of item proliferation ― increasing by three times the amount versus 2017, according to IRI’s Scanlon.

Helping to increase the options within the no/low alcohol space, McMinnville, Ore.-based Ransom Spirits developed Dhōs, a handcrafted non-alcohol spirits brand that is available in three varieties: Bittersweet, Gin Free and Orange. Handcrafted at an organic farm and distillery in Sheridan, Ore., Dhōs is formulated without harmful contaminants and toxins, the company says.

Image courtesy of Suntory

Global reach

Although beverage alcohol experienced its challenges in 2020, consumer demand for no/low alcohol beer, wine, spirits and ready-to-drink (RTD) cocktails and mocktails continued their upward trajectory across the globe, experts note.

According to the “No- and Low-Alcohol Strategic Study 2021” from London-based IWSR Drinks Market Analysis, the “buoyant” no/low category gained share within the total beverage alcohol market to 3% in 2020, and total volume is forecasted to grow 31% by 2024.

Although the traditional alcohol market’s greater exposure to bars and restaurants saw it struggle in the wake of mass venue closures across the world, no/low categories have seen largely positive, albeit muted growth, according to the IWSR study.

“No/low alcohol beverages overall are on the rise globally, but some markets proved more resilient than others over the last year,” it states. “Germany, the largest no/low alcohol market by volume, experienced almost a 5% drop in consumption in 2020, due to reliance of the no/low beer segment in the on-trade at bars and restaurants. Meanwhile, the U.S., as the next largest market, is currently the most dynamic, with the no/low segment registering over a 30% increase in 2020 despite the enormity of the challenges faced by the industry.”

Additionally, as beer dominated no/low alcohol, spirits posted the largest volume increases, the IWSR study notes.

“Driven by early innovation and investment in quality, the no/low beer and cider category dominates the overall no/low market, commanding a 92% share of the total no/low alcohol segment,” it states. “Thanks to the investment in the category from the major brewers, consumers are becoming more familiar and accepting of no/low beer as a quality product.

“While several key beer players continue to steer the category, the market is fragmented with a number of smaller brands vying to establish themselves as market leaders in this space,” it continues. “The segment is likely to become even more of a focus for smaller craft producers who are able to bring a diverse range of products to the market in future.”

In the United Kingdom, while the no/low category has seen unusual success amid COVID-19, no/low beers and fruit ciders have the opportunity to grow significantly, said Ryan Whittaker, consumer analyst at London-based GlobalData, during an October UK Budget announcement by Chancellor Rishi Sunak

“Many consumers have been unusually focused upon their hygiene and health and have viewed the no/low category as a healthier alternative,” Whittaker stated. “In Q2 2021, almost one-third (32%) of UK consumers reported that they either consumed alcohol-free beer or mocktails in moderation or were actively trying to increase their consumption.

“Much higher rates of no/low consumption were reported among consumers who described themselves as quite or extremely concerned about their health, reflecting the clear link between lower alcohol and higher health-consciousness,” he continues. “Furthermore, in Q3 2021, almost half (45%) of UK consumers have reported that they are quite or extremely concerned about their health, suggesting that no/low brands remain a significant opportunity for new product development in the UK.”

Moreover, as no/low wine increased by 4.9% in 2020, having made strong gains in the United Kingdom and the United States, both categories are projected to continue on their growth trajectory through to 2024, each expected to command a 7% to 8% volume compound annual growth rate (CAGR) 2020 to 2024, according to ISWR Drinks Market Analysis.

Meanwhile, no/low ready-to-drink (RTD) volume grew by 10.2% in 2020, largely driven by a trend for functional alcohol-free RTDs in Japan, it adds.

“What we’re seeing is a moderation trend that’s sweeping across key global markets, and that’s bringing with it increased demand for reduced alcohol, or alcohol-free drinks,” said Mark Meek, CEO of IWSR Drinks Market Analysis, in a statement. “Brand owners will have an important role to play in the future development of no- and low alcohol, as increasing the breadth of products available to consumers and their price points will support category growth and broaden its appeal.”

A new drinking culture

As the United States is a world leader in beer consumption, as well as a lifestyle trendsetter, its increased health-conscious consumerism is essential to the overall growth of the non-alcohol beverage market, says Takeharu Nakai, director of U.S. marketing and sales at Suntory, Osaka, Japan.

“We think that the U.S. [non-alcoholic beverage] (NAB) market has the potential to continue to expand,” he says. “American consumers are increasingly becoming health-conscious, which contributes to consumers abstaining from drinking. In fact, this movement has resulted in a shift of the trend toward alcohol-free consumption, as seen in Dry January, Sober September and October and dry bars serving exclusively non-alcoholic beverages.

“Consumers have just begun to look for NABs, discover them, and try them,” Nakai continues. “In addition, the percentage of NAB within the beer market in the U.S. is less than 1%, which is very tiny compared to the European countries and Japan. From those perspectives, there are opportunities for the U.S. NAB market to further grow in 2022 and beyond.”

With the expansion of the non-alcohol beer market in Japan, and after having launched ALL-FREE in 2010 in Japan, Suntory has since adapted its zero calorie, zero sugar, zero alcohol beer for American consumers, Nakai explains.

“For the past four years, we have been developing a new taste profile for the American market. During this period, we visited the U.S. many times and tasted approximately 300 craft and non-alcoholic beers,” Nakai says. “Through our survey, we discovered that U.S. consumers are sensitive to flavor and aroma, and additionally, they tend to be more cautious about artificial flavors and sweeteners. After that, we repeated trial production many times in search of an aroma that would suit the American palette.”

Further, Suntory believes opportunities still are available in daily occasions in which consumers do not usually drink beer, but feel like enjoying beer-like taste. As such, the company is aiming to cultivate a new drinking culture by presenting how to enjoy ALL-FREE in new occasions such as when relaxing, after exercise and sports or on a picnic, Nakai says.

“By focusing our efforts on that, we positioned ALL-FREE not only as a substitute for an alcoholic beverage, but as a health-conscious choice and good option for a refreshing drink,” he explains. “A non-alcoholic beverage has the potential to become a refreshment option, which goes beyond just an alternative drink for an alcoholic beverage.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!