Category Focus

Flavors, ready-to-drink varieties ‘brewing up’ expanded coffee occasions

Coffee market generates 11% growth, Mintel reports

Ready-to-drink is the hottest coffee segment, driven by double-digit growth in 2020, Innovations like cold brew and nitro also have helped boost coffee sales, BMC’s Gary Hemphill says.

(Image courtesy of Riff)

July 2021 was the hottest month recorded in human history, according to data from the National Oceanic and Atmospheric Administration (NOAA). Although July typically is the world's warmest month of the year, July 2021 was 0.02 degrees higher than the previous record set in July 2016, which was then tied in 2019 and 2020, the agency reported. But not all hot items are causing the same concern. Whether hot, iced, cold brew, nitro, ground or in pods, coffee is a hot beverage category and consumers can’t get enough of this caffeinated treat.

A staple of mornings, coffee is “brewing up” new drinking occasions due to the availability of new, exciting flavors and convenient, ready-to-drink (RTD) formulations.

Sally Lyons Wyatt, executive vice president and practice leader at Chicago-based Information Resources Inc. (IRI), notes that the coffee market saw an uptick in sales through 2020, with double-digit growth in multi-outlets and conveniences stores due to more at-home occasions.

“The category currently boasts $10.8 billion in sales across the U.S., which is up 2.1% versus a year ago,” she says. “Price per unit has increased by $0.26 in the last year helping fuel growth. Price changes driven by general upsizing trend across formats, as major manufacturers put more ounces/cups in their offerings at a naturally occurring higher price.

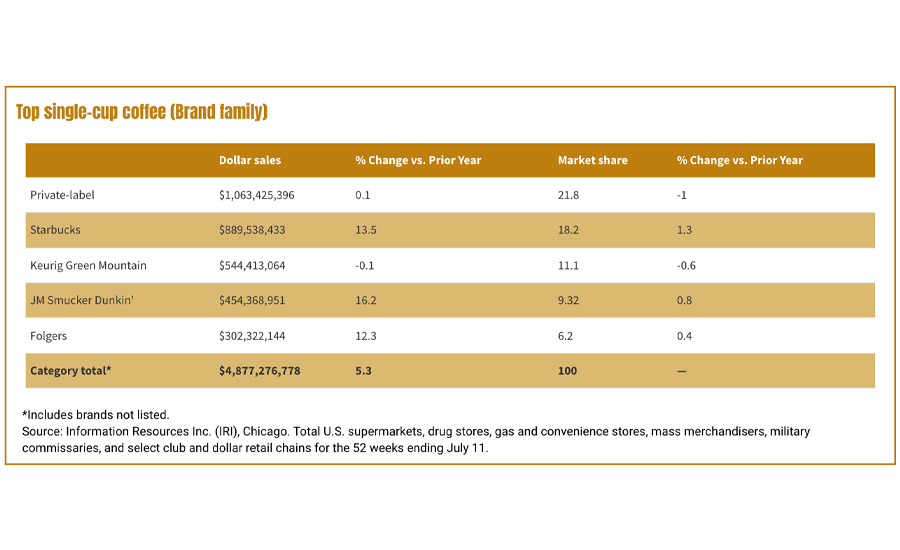

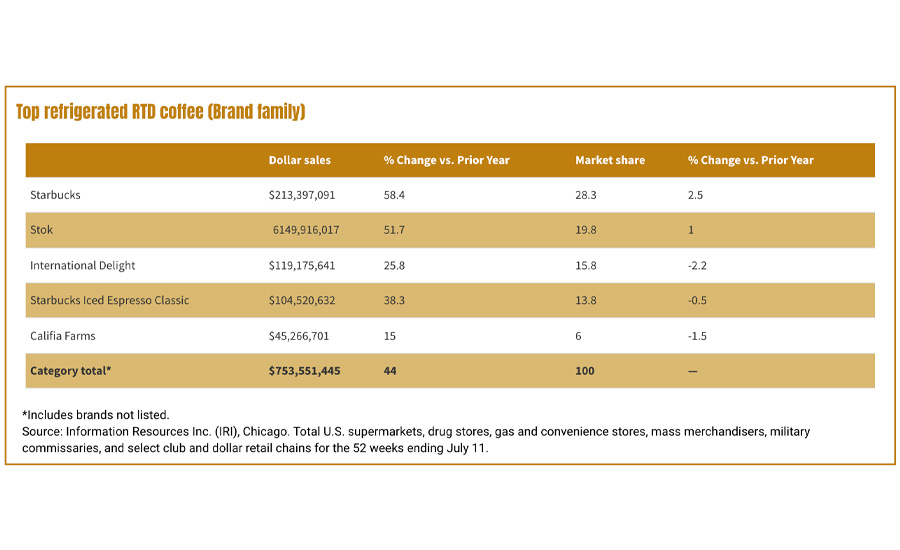

“Ready-to-drink and single-cup are the segments driving coffee growth, with 21% and 5% dollars growth in MULO+C in the latest 52 weeks,” she continues. “The easy, convenient nature of brewing a single cup at home has increased in popularity since the start of COVID. Single-cup coffee remains the largest segment with dollar sales are up 5.3% vs. year ago and units growing by 1.2%.”

Data from New York-based Beverage Marketing Corporation (BMC) also supports this trend, as coffee and RTD coffee is experiencing steady retail dollar growth. In fiscal year 2020, six sub-segments — roast/ground, whole bean, coffee pods, instant coffee, coffee mixes and RTD coffee — registered $56.5 billion in retail dollar sales compared with a fiscal year 2021 projection of $58.2 billion.

Roast/ground coffee, the largest sub-segment, saw retail dollar sales of $35.1 billion in fiscal year 2020 versus a fiscal year 2021 projection of $35.4 billion. Coffee pods and whole bean coffee had fiscal year 2020 sales of $10.1 billion and $4.9 billion, respectively, compared with fiscal year 2021 sales projections of $10.6 billion and $5 billion. Coffee mixes and instant coffees, however, saw year-over-year declines.

When it comes to the overall performance of the U.S. coffee market, Caleb Bryant, associate director of food and drink reports at Chicago-based Mintel notes, “Total coffee sales increased 11.2% from 2019 to 2020.”

Image courtesy of Super Coffee

What’s hot is cold

Currently what’s hot in the coffee category is cold. RTD coffee has solidified its position as a staple category that continues to grow. “Ready-to-drink is the hottest coffee segment — driven by double-digit growth in 2020,” says BMC’s Managing Director of Research Gary Hemphill. “Once primarily a category dominated by single-serve packaging, ready-to-drink coffee in chilled, take-home format packaging has burst onto the scene and is driving much of the growth.”

Cold-brew coffee also is performing well. The sales of cold-brewed coffee are forecast to reach nearly $1 billion by 2025, growing at a compound annual growth rate (CAGR) of 24% from the base year of 2015, reports Hamburg, Germany-based Statista. In terms of demographics, millennials looking for a healthier alternative to carbonated soft drinks, as well as older adults who appreciate the energy benefits are typical consumers, the research firm notes.

Hybrid beverage trends are “mixing things up” for the coffee category. Hemphill has seen more energy coffee drinks entering the market and notes that innovations like cold brew and nitro are helping to boost coffee sales.

Paul Evers, co-founder and CEO of RIFF, a Bend, Ore.-based premium coffee company, unveiled a “Let’s Riff” RTD line that fulfills the need for caffeinated cold-brew coffees that contain just two ingredients: high-quality coffee and Cascade mountain water. The varietals are Off The Cuff, an organic, Peruvian cold brew with notes of dark chocolate and toffee; Arm In Arm: an Ethiopian cold brew with notes of red berry and stone fruit (also available in a concentrate); and Southpaw, which contains half the caffeine and features natural tasting notes of cocoa nibs and nougat. In addition to packaging in 10.5-ounce glass bottled, Boxed Cold Brew is available in 50.7- and 96-ounce to-go cartons.

With sustainability in mind, in 2021 Riff Energy+ was released in 12-ounce cans in three flavors — Get-It Guava, Booyah Berry and Pick-it-Up Pomegranate. The functional natural sparkling beverage contains the same amount of caffeine as a cup of coffee but also provides plant-powered energy, antioxidants and immune-boosting properties through the use of the often discarded superfruit cascara, the dried skins of the coffee cherries, Evers explains.

“Energy+ Immunity has promise of scale so it can help reduce coffee’s contribution to climate change, inject greater economic opportunities for struggling farmers, and introduce greater sustainability for the coffee industry,” Evers says. “Riff’s mission is to save the world one coffee plant at a time … and to make a global impact through celebrating and utilizing 100% of the coffee plant’s agricultural value while creating a sustainable and clean energy beverage that is good for both you and the planet.”

According to Mintel’s Global New Products Database, 59% of all coffee products launched in the United States in 2020 carried an ethical and/or environmental on-pack claim, Bryant says. “Climate change represents an existential threat to the future of the coffee market, brands have an opportunity to invest in highly sustainable sourcing and production practices and communicate to consumers how brands are working to save the future of coffee. Thirty-seven percent of coffee drinkers cite ‘sustainably-sourced’ as an important claim/initiative coffee and tea brands should prioritize.”

Sustainability also is driving innovations within coffee packaging for Keurig Dr Pepper, Burlington, Mass., and Frisco, Texas, which published its third annual Drink Well. Do Good. report. Among the key achievements and goals met are that 100% of K-Cup pods now are made from recyclable plastic, meeting the company’s long-standing 2020 goal that advances to 90% the percentage of KDP packaging that now is recyclable or compostable, positioning KDP to achieve its goal of 100% by 2025, it says.

Image courtesy of Riff

At-home consumption

Although more consumers are working remotely, they still desire a “coffee shop experience at home” as the pandemic dramatically drove at-home consumption, according to IRI’s Wyatt. During peak pandemic, visits to Starbucks and Dunkin’ shops declined 60%, she says, citing AdWeek. Based on an IRI COVID survey, 27% of respondents said they would be drinking coffee at home rather than going to coffee shops.

“While sales remained elevated throughout 2020, ground and single-cup coffee shifted to declines in 2021. Ready-to-drink formats have exploded in popularity. Coffee concentrates, cappuccino/iced coffee, cold brew, and refrigerated RTD coffee dollar and unit sales are all up double digits versus a year ago,” Wyatt says. “Growth trends are strong and consistent, and expected to stay that way thanks to consistent innovation and strong growth from coffee leaders. There was a shift to the eCommerce channel, which grew tremendously in 2020, as consumers shifted from brick and mortar to online shopping.

“… Cold brew and nitro cold brew are very small segments but are growing fast,” she continues. “Forms such as cold brew, iced coffee, nitro, etc., have given consumers the ability to have a specialized drink without the hassle and mess of making a cup at home.”

The pandemic also marked a period of experimentation and exploration among coffee drinking consumers. Twenty-seven percent tried a new coffee, 22% made specialty coffee drinks at home and 13% purchased a new coffee appliance, creating long-term growth opportunities for the coffee market and premium coffee blends, additives (e.g., flavored syrups, creamers) and coffee appliances, Wyatt says.

“Coffee flavor additives/flavors dollar sales are up 40.3% ($91.4 million). Using flavors/additives can boost your old cup of classic coffee into a unique, tasty offering,” Wyatt says.

New wave of flavors

Thanks to heightened interest in functional ingredients, innovative styles and plant-based ingredients, new product development is fueling the RTD coffee market.

Founded by the DeCicco brothers, Jimmy, Jake and Jordan, out of a dorm room in 2015, Austin, Texas-based Super Coffee released an 80-calorie Blueberry Latte that is naturally sweetened with monk fruit and packed with 10 grams of the brand’s unique blend of pea protein and 200 mg of caffeine. The dairy-free enhanced coffee blends sweet and creamy blueberry with MCT oil for sustained energy and focus.

Most recently, Philadelphia-based La Colombe Coffee Roasters released its first-ever non-dairy pumpkin beverage: Pumpkin Spice Oatmilk Draft Latte. The company also is jumping on the nitro cold-brew train with La Colombe Extra Bold Nitro Cold Brew, its first, single-origin nitro coffee that contains sun-dried coffee from Brazil. The coffee is dark roasted, brewed extra bold and infused with nitrogen for a subtle texture that compliments its bold taste.

A plant-based functional beverage brand, REBBL, Emeryville, Calif., launched REBBL Stacked Coffee, a plant-powered cold-brew with additional health benefits. Available in four flavors ― Cafe Mocha, Vanilla Latte, Hazelnut Latte and Straight Black, Stacked Coffee is certified organic, fair-trade, non-GMO, dairy-free, soy-free, gluten-free, vegan and made without cane sugar or artificial flavors.

Founded by first time entrepreneur Madeline Haydon, nutpods is a plant-based coffee creamer featuring carefully selected ingredients and zero grams of sugar or carbs in each serving. In addition to an unsweetened line with zero grams of sugar, the company unveiled a naturally sweetened coffee creamer, with zero sugar in each serving and 5 calories in three flavors: Sweet Crème, French Vanilla and Cookie Butter.

With added functionality and flavors, the coffee market is expected to remain stable and to see steady growth resulting in a 5-7% dollar growth over the next few years, IRI Wyatt says.

To keep coffee manufacturers and consumers thirsting for their daily cup of Joe, she suggests finding ways to bring the coffee shop experience home.

“This might mean partnering with an additive brand or offering a line of creamers and additives to create the perfect cup at home,” Wyatt explains. “They should continue to innovate with new flavors, and café style coffees to entice people to consume more at home, keeping it as the affordable alternative to a café. In addition, manufacturers should maintain core items with new and thoughtful innovation.”

The coffee market is projected to reach $18.9 billion by 2026, representing a 14.2% increase from 2020, Mintel’s Bryant says. He predicts functional coffee will increase in demand.

“Functional coffee has been a slow burning market trend but one that is set to take off due in large part to the pandemic as 57% of consumers say the pandemic made them want to take better care of their physical health and 30% of coffee drinkers are interested in purchasing coffee with additional functional benefits,” he says. “From immune support ingredients to anti-inflammatory ingredients, there are multiple opportunities for functional coffee beverages.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!