Channel Strategies

Consumers’ one-stop shopping lifts club store channel

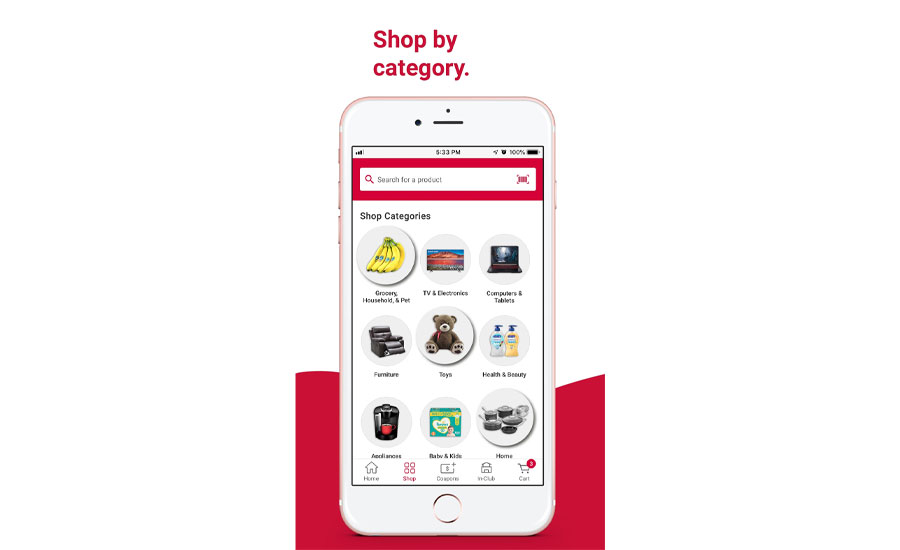

Mobile apps streamline shopping process

For those in search of peace and mindfulness, self-care guides often will instruct people to clearly define and list their top priorities. When it came to shopping this past year, many consumers prioritized one-stop shopping and cost savings as they dealt with the complexities of the pandemic. These priorities aided the warehouse clubs and supercenters channel as more consumers stockpiled goods and dealt with reduced shopping options.

“During the height of the pandemic, many consumers prioritized one-stop shopping as a way of reducing their risk of being exposed to the virus,” says Jack Daly, industry research analyst at Los Angeles-based IBISWorld Inc. “Industry operators benefited from this as they already stocked a wide array of items, including groceries, toys, clothing, electronics and personal care goods. In addition to offering all of these items in one place, they also offered them in bulk. As a result, consumers flocked to club stores to buy items in bulk so that they would be able to make fewer trips to grocery stores in the future.”

Daly explains that remaining open during the early months of the pandemic aided the warehouse club store channel, but it also was able to support consumer needs throughout the year.

Image courtesy of Sam’s Club

“Throughout the rest of 2020, depressed demand for restaurants due to pandemic-related restrictions and concerns helped keep demand for groceries high,” he says. “Furthermore, economic uncertainty caused many consumers to prioritize cost-savings, which they were able to find by purchasing in bulk at industry establishments. Overall, industry revenue is expected to have grown by 5.4% in 2020 to reach $538.3 billion.”

In its February report titled “Warehouse Clubs in the US,” Chicago-based Euromonitor International also pinpoints the unique position that allowed warehouse club stores to flourish during the past year. “In terms of sales growth, no store-based retailing channel in the U.S. performed better in 2020 than warehouse clubs,” the report states. “In a year unlike any other, retailers in the channel were largely able to capitalize on the explosive shopping trends that resulted from COVID-19 upending the industry.”

Going digital

Although club and warehouse stores benefited from consumers turning to the channel for not only grocery needs, but also toys and clothing, that didn’t stop the retail sector from taking a more vested interest in technology.

“Many operators in this space have worked to improve customer experience and engagement by providing their members with access to mobile applications designed to streamline their in-store visits,” IBISWorld’s Daly says. “In addition, some mobile applications offer customers the ability to purchase food online and schedule an at-home delivery.”

Image courtesy of BJ’s Wholesale Club

For example, Sam’s Club, Bentonville, Ark., has offered its Scan & Go app since 2016, which allows consumers to scan the UPC barcode in-club and check out directly on the app. Once the purchase is complete, consumers show the digital receipt to the associate at the door as they are leaving.

“This provides shoppers with the ability to bypass checkout lines and streamline their shopping experience,” Daly explains. “Consumers are also able to use this application to purchase alcohol if they are able to provide the associate with proof of age when showing their digital receipt.”

Euromonitor’s report also highlights the retailer’s digital adoption.

“Sam’s Club has long prioritized building a strong omnichannel infrastructure, giving the chain a significant leg up when demand for contactless services skyrocketed in 2020,” it states. “Given parent company Walmart’s large share of U.S. eCommerce, behind only Amazon, it is perhaps unsurprising that Sam’s Club has made expanding its online offering a key strategy of its own.”

BJ’s Wholesale Club, Westborough, Mass., also offers its Express Scan app, which allows consumers to scan as they shop and then proceed to a dedicated pay station. The retailer also offers handheld scanners at BJ’s Express Scan kiosks at the front of the store.

“Important to note, however, is that the service is only currently available at seven out of 210 locations the company operates in the United States,” Daly explains. “It is likely that the service will become available at more locations as internal competition continues to build within the industry.”

The retailer, however, has been making strides with its BJ’s app. In February, BJ’s Wholesale announced the app features a refreshed homepage where members can easily reorder their favorite items, quickly clip digital coupons and conveniently shop using digital services, such as same-day delivery, buy online, pick up in-club and curbside pickup, it says.

“The BJ’s app is the easiest way to get the most out of your BJ’s membership, from clipping coupons and tracking your savings to reordering your favorite items and discovering deals,” said Monica Schwartz, senior vice president and chief digital officer at BJ’s Wholesale Club, in a statement. “These exciting app features are the latest example of how we continue to invest in our digital experience and platforms to make it even more convenient to shop at BJ’s.”

Costco Wholesale Corp., Issaquah, Wash., also offers an app that supports eCommerce shopping and delivery; however, it does not offer a scan and check out feature like its competitors, IBISWorld’s Daly says.

“Although Costco, the largest player in the industry, does not currently have a service similar to Sam’s Club’s Scan and Go service, they do have a mobile application that helps consumers to streamline their shopping experience to some extent,” he says. “Using the Costco app, shoppers are able to browse current promotions, check gasoline prices, make shopping lists, and submit pharmacy requests. In addition, they can use the app to purchase items remotely and have them delivered directly to their homes.”

In Costco’s 2020 Annual Report, the retailer highlighted the importance of adapting to a more digital future for its consumers.

“Omnichannel retailing is rapidly evolving, and we must keep pace with changing member expectations and new developments by our competitors,” the report states. “Our members are increasingly using mobile phones, tablets, computers and other devices to shop and to interact with us through social media, particularly in the wake of COVID-19. We are making investments in our websites and mobile applications. If we are unable to make, improve, or develop relevant member-facing technology in a timely manner, our ability to compete and our results of operations could be adversely affected.”

Competitive advantage

After a year in which the warehouse clubs and supercenters channel flourished, it is expected that 2021 will not produce the same growth results, experts note.

“In 2021, industry revenue is expected to expand by 2.5% to reach $556.4 billion,” IBISWorld’s Daly says. “Many consumers are expected to have signed up for club store memberships for the first time amid the height of the pandemic. For example, in fiscal 2020, Costco reported total paid memberships reached 58.1 million, representing a 7.8% increase compared to the year prior. This is compared to [year-over-year] growth of 4.5% in paid memberships in both fiscal 2019 and fiscal 2018.”

Although 2.5% is a deceleration from the 5.4% the market research firm identifies for 2020, Daly notes that channel still is in a comfortable position in terms of financial expansion.

“Due to the membership-based model common within this industry, operators are considered to have a competitive advantage in being able to generate repeat business from consumers who have enrolled,” he says. “As a result, the explosive growth in membership seen during the pandemic is expected to continue paying dividends for operators moving forward, helping to drive revenue even after the direct impacts of the pandemic have faded.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!