State of the Beverage Industry: Wine, spirits markets grow in traditional, premium offerings

Sparkling wine, seltzer-centric spirits drive beverage alcohol categories

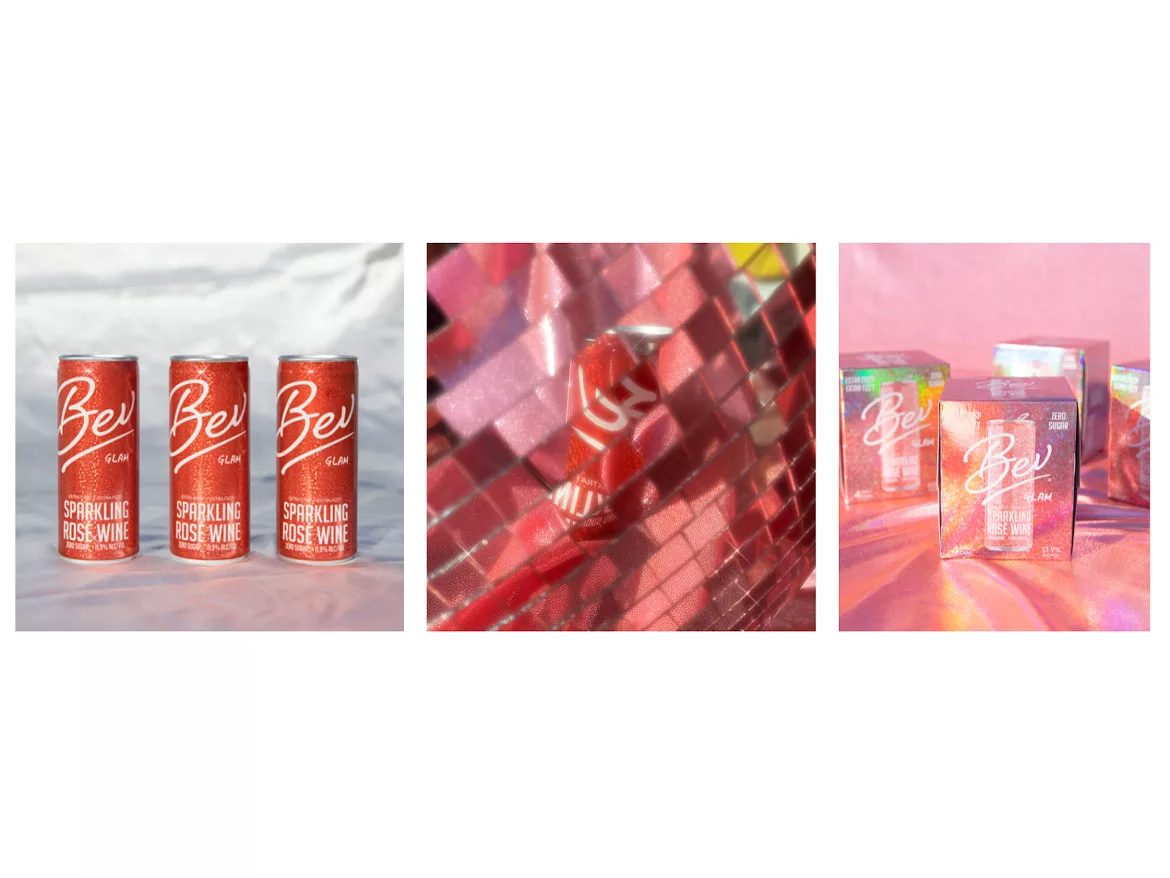

Bev Glam is a sparkling rosé with only 100 cals, 3 carbohydrates, and no added sugar, it says. At 11.9% ABV, the sparkling wines in the series boast that they bring refreshment to consumers “without the hangover.” (Image courtesy of Bev)

The way wine and spirits are made and marketed has continued to shift and change over the past several years. However, when broken down into their separate categories, the wine category has been inundated with current and new brands, which experts note has had an impact on the category in the past 12 months.

In Beverage Industry’s February eMagazine, Carolyn Lemoine, senior project director for New York-based Beverage Marketing Corporation (BMC), noted that the U.S. wine market for domestic and imported wines had been flattening out over the past several years, culminating in a slight downturn in volume in 2019.

“The industry has been facing the challenge of having an oversupply, as well as flagging consumer demand,” Lemoine said. “The good news is that sparkling wines, especially Prosecco and Rosé, had healthy growth, and the entire category was benefiting from a premiumization trend, as consumers traded up.

“2020 has been a tough year for wine,” she continued. “BMC estimates that while only about 19 percent of total wine volume is sold in the on-premise (restaurants/bars, etc.), a whopping 41 percent of wine’s retail dollar sales comes from this channel. With the shuttering of restaurants and bars due to COVID-19, the industry suddenly lost a large part of a major source of category dollars.”

As such, smaller brands that benefited from consumer trial of an unknown wine when purchasing “by the glass” on-premise were losing valuable sales as purchasing shifted to quick trips to off-premise grocery stores and wine shops, Lemoine added.

The suspension of travel and tourism and the shutdown of tasting rooms also had been negatively impacting wineries, which instead opted for online happy hours and tastings to reach consumers.

Scott Scanlon, executive of Beverage Alcohol Vertical for Chicago-based Information Resources Inc. (IRI), noted that the wine category experienced its first downturn in 24 years in 2019 and still had not fully recovered in early 2021 due to fierce competition from beer, flavored malt beverages (FMBs) and spirits.

Yet, COVID-19 has led to “a strong rebound, driving growth rates of four times of that of recent years,” Scanlon said in the February eMagazine. “Dollar sales and volume per trip are up, while trip frequency is relatively flat (i.e., stock-ups). There’s been a strong shift to eCommerce with these ‘trips’ up 130% and sales nearly 3.5 times higher than a year ago.”

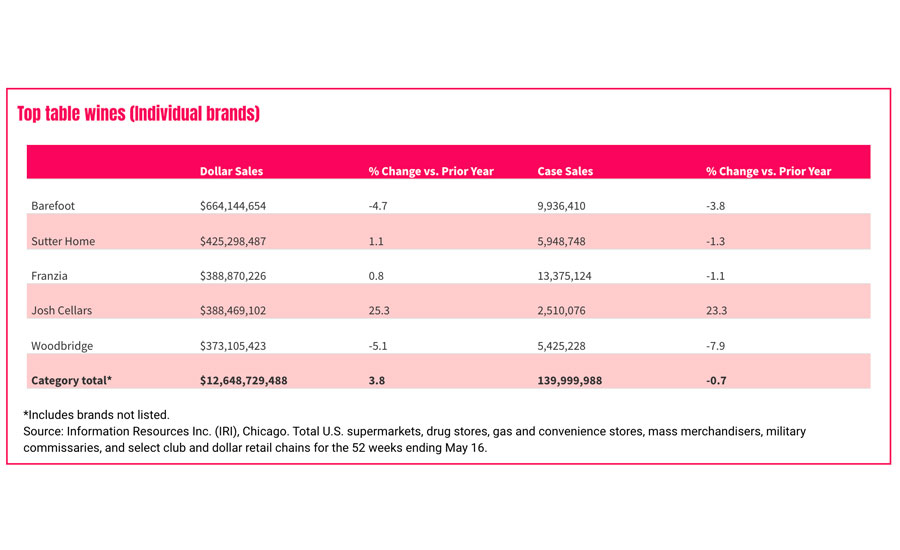

For the 52 weeks ending May 16, table wine as an overall category sat at $12.7 billion in dollar sales in total U.S. multi-outlets, a 3.8% increase over the prior year, according to IRI data.

When it came to the type of wine being consumed, red wine was No. 1 with around 46.7% market share, slightly eclipsing white wine at 45.5% and pink wines at 5%, according to Nielsen’s December 2020 “COVID Impact on the Alcohol Industry” report. Cabernet Sauvignon, Chardonnay, Sauvignon Blanc, Red Blends, Pinot Noir, Pinot Grigio and Moscato along with sparkling wines also were doing well.

There’s also been a resurgence in sparkling wines, driven largely by Prosecco, IRI’s Scanlon said in Beverage Industry’s February eMagazine. For the 52 weeks ending May 16, sparkling wine posted 20.3% growth over the year prior, totaling $1.8 billion, according to IRI data.

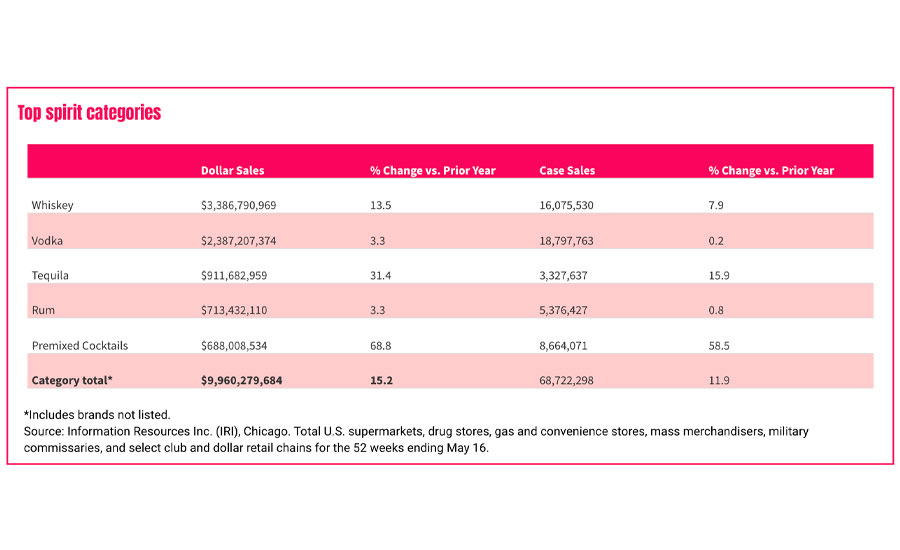

The spirits category also posted strong growth. For the 52 weeks ending May 16, spirits sales in total U.S. multi-outlets amassed nearly $10 billion in sales, a 15.2% increase over the prior year, IRI data reports.

Of note, tequila was up 31.4%, while brandy/cognac was up 21.6%, cordials saw a 17% rise in dollar sales and whiskey was up 13.5%. However, the biggest gains came from seltzer-centric spirits, which increased 203% for the same timeframe, IRI data states. Among these subcategories, premium beverages were taking the lead.

In Beverage Industry’s April eMagazine, Chris Lombardo, team lead and senior analyst at Los Angeles-based IBISWorld Inc., denoted how the pandemic had resulted in the distilling market experiencing a bump in off-premise sales at the expense of on-premise performance.

“The distilleries industry in the United States is expected to perform relatively well in 2020 amid the COVID-19 pandemic, particularly in comparison with other domestic alcoholic beverage producers, such as breweries,” he said. “Demand for alcoholic beverages remained high in 2020, as many consumers turn to alcoholic beverages during periods of distress or volatility due to its perceived effects. However, many distilleries were forced to close their in-house tasting rooms and bars amid the pandemic, and key on-premise markets, such as restaurants, bars and night clubs, experienced significant operational difficulties amid the pandemic, resulting in a substantial decline in demand from such markets.”

Image courtesy of Happenstance

Although economic downturns typically have an adverse effect on super-premium and luxury spirits segments, data at that time suggested this had not been the case this time around.

“Conversely, operators benefited from increased off-premise sales and a rise in premium and super premium brands, bolstering revenue growth,” Lombardo explained. “While sales of super-premium brands generally suffer during periods of economic downturn due to their high price point, particularly in on-premise channels where they experience significant mark-up, the prices are more affordable at off-premise channels. Thus, consumers in relatively stable financial positions opted for such luxuries due to their relative lower costs, greatly benefiting revenue growth.”

Danelle Kosmal, vice president of beverage alcohol practice for Chicago-based NielsenIQ, also weighed in on the bullish performance within high-end spirits.

“For COVID [year-to-date], the high end of spirits grew by 37%, compared to the rest of spirits at 16%,” she explained, referencing the category’s performance from March 7, 2020, to Feb. 27 in NielsenIQ off-premise channels. “Since the onset of the pandemic in the U.S., the high end of spirits gained 3.7 share points (dollars) of the spirit categories, compared to the previous year. High-end tequila was a big driver of this, gaining 2 share points of the spirits high end in 2020.”

In 2020, total online alcohol sales grew by 232%, with online spirits leading growth, up 396%,” Kosmal said in the February eMagazine. “Spirits also gained 6.4 share points of online alcohol dollars in 2020.”

BMC’s Lemoine adds the beverage alcohol eCommerce size and growth hit an all-time high as companies such as wine.com and Minibar have reported record growth. Meanwhile, Vivino recently closed on Series D investments of $155 million and Drizly announced a $1.1 billion acquisition deal with Uber. Given this and consumer preferences, she expects online migration will continue.

“Consumers have now normalized eCommerce orders/deliveries of food/beverages in their everyday lives, and the migration to online will continue,” Lemoine suggests.

Along with major growth of eCommerce, experts note trends among several prominent demographics may be ones to watch in regards to impact on the wine and spirits category.

Quinton Jay, Bacchus Consulting Group, San Francisco, says that demographic breakdowns show millennials as more agnostic when it comes to what they drink as of late.

“Millennials gravitate toward craft beers, imported wines, and have less loyalty to a specific type of adult beverage,” he says. “Baby boomers are more traditional and tend to stick with what they know, what they like, and what they’ve always had. They are brand loyal to stick to more of the wine; however, there has been a shift to brown spirits like whiskey and bourbons.”

In a post-COVID world, Jay notes that direct-to-consumer beverage purchasing is on the rise, and concurs with other experts that omnichannel commerce makes beverages far more accessible to consumers, and will continue to have a growing impact on sales.

“This allows companies to be everywhere the customer is, from brick-and-mortar establishments to mobile, online marketplaces,” he says. “Also, wine is coming back in a big way.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!