2020 State of the Beverage Industry: Carbonated soft drinks sees value sales up

Coronavirus stockpiling drove sale surges in March

In George Harrison’s song “It’s What You Value,” the rock legend harmonizes, “But I’ve found it’s all up to what you value down to where you are, it all swings on the pain you’ve gone through getting where you are.” The upbeat tune focuses on the different values that people place on actions and the costs associated with those actions to get to where they want to be. For the carbonated soft drink (CSD) market, the new values rest with value sales.

In Beverage Industry’s April issue, Aga Jarzabek, research analyst for Chicago-based Euromonitor International, noted how the CSD market has been challenged by volume declines.

“Volume sales are expected to continue declining,” she said. “Value sales will continue to grow, but will slow slightly each year over the next five years. The unhealthy perception of carbonates will only accelerate among consumers, leading to falling consumption rates.

“In turn, manufacturers will increase unit prices consistently to at least preserve value sales growth,” Jarzabek continued. “Higher unit pricing will come from smaller pack sizes and focus on single-serve through convenience and at register displays.”

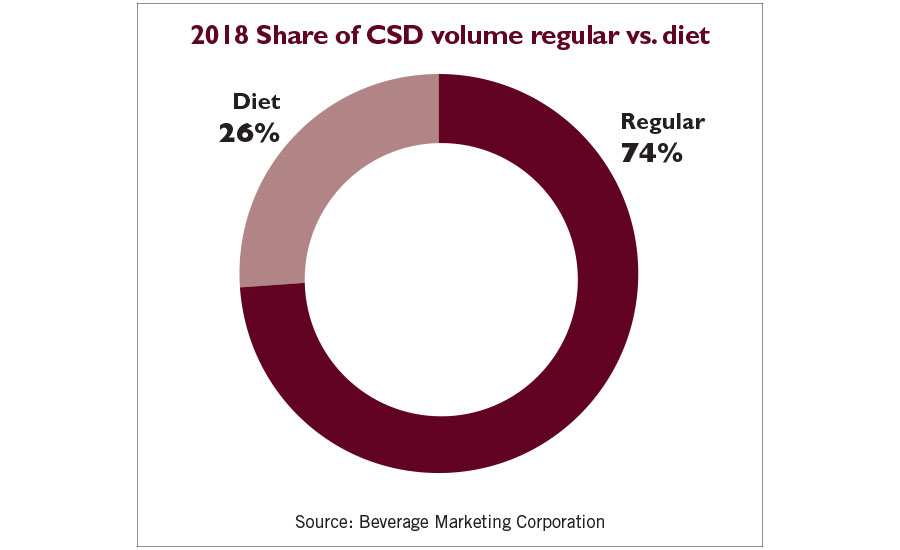

In the same article, Gary Hemphill, managing director of research for New York-based Beverage Marketing Corporation (BMC), noted how the category has seen volume sale declines for 15 consecutive years. “Today’s consumers want both variety and healthier refreshment, trends which have negatively impacted carbonated soft drinks,” he added.

However, these interviews were shared prior to consumer stockpiling as a result of the coronavirus pandemic, and numerous state and local municipalities enacting various forms of shelter-in-place orders.

According to a March 19 report titled “COVID-19 Impact: Consumer Spending Tracker” comprised by Chicago-based Information Resources Inc. (IRI) and the Boston Consulting Group (BCG), regular soft drinks showcased modest growth with sales up 1.8 percent for the week ending March 8, while low-calorie soft drinks posted a 10.1 percent increase.

However, the weeks following showed more consumers applying their dollar spend. Regular CSD sales had increased 19.5 percent for the week ending March 15. Meanwhile low-calorie CSD sales were up 33.9 during the same period.

Double-digit sales continued for the categories as regular CSD sales had increased 19.5 percent for the week ending March 22. Meanwhile low-calorie CSD sales were up 28.1 during the same period.

Sales for regular soft drinks and low-calorie soft drinks looks have stabilized during the week ending March 29 as regular CSD sales were up 1.2 percent while low-calorie CSD posted 4.7 percent growth.

These moments of stockpiling helped contribute to the category’s overall value performance. According to IRI data, carbonated beverage sales totaled $29.4 billion for the 52 weeks ending May 17 in total U.S. multi-outlet and convenience stores. This is up 4.6 percent from the previous year. However, case sales still look to be in decline as carbonated beverages were down 1.4 percent, according to IRI data.

Despite the short-term sales boost, analyst noted in April the consumer trends that had contributed to the category’s years of decline.

Jacqueline Hiner, industry analyst for Los Angeles-based IBISWorld, pointed out the impact that health and wellness has had on the refreshment category. “The most prominent driver of this trend is the higher number of health-conscious individuals in conjunction with rising per capita disposable income,” she stated. “Rising disposable income levels enable consumers who enjoy the taste of carbonated beverages to splurge on craft beverages that are made with natural ingredients. However, growth in this market is expected to be tempered by the continued increase in health consciousness driving consumers to drink water.”

Given consumers’ appetite for better-for-you beverages, analysts highlighted that beverage-makers should look to expand the product attributes of CSDs to increase their relevance.

“One big trend that has been negatively impacting big CSD brands is functionality,” Euromonitor’s Jarzabek said in April. “Carbonates simply do not offer enough in this regard and even run counter to this trend. Carbonates’ consumers are switching to water to avoid sugar or to energy drinks and RTD coffee for functional benefits.

“Though small, the only category within carbonates that has experienced significant and sustained growth is fortified functional non-cola carbonates,” she continued. “Many products within the category have found success by blurring the line between carbonates and sparkling waters, offering a flavorful beverage that preserves the sweetness of a soda without the sugar.”

To provide consumers with an approachable option to the energy drink category, Atlanta-based The Coca-Cola Co. launched Coca-Cola Energy.

With 114 grams of caffeine, about as much caffeine as a cup of coffee, guarana extracts and B vitamins, Coca-Cola Energy combines energy ingredients with the taste of Coca-Cola in four varieties: Coca-Cola Energy, Coca-Cola Energy Zero Sugar, Coca-Cola Energy Cherry and Coca-Cola Cherry Zero Sugar.

Purchase, N.Y.-based PepsiCo’s Pepsi brand also is furthering its hybrid portfolio with the launch of Pepsi Café, which blends the taste of coffee with Pepsi. With nearly double the amount of caffeine of a regular Pepsi, Pepsi Café Original is designed for those who enjoy their regular cup of Joe, but also love the sweeter caramel undertones of a Pepsi, the company says. Pepsi developed its Pepsi Café Vanilla to be a sweeter and creamier beverage, providing consumers with a new twist on the indulgent vanilla flavor, it adds.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!