RTD tea proliferates with health and wellness trends

Loose-leaf, bagged teas experience stagnant growth

Continued interest in health and wellness, back to nature and proactive health trends have resulted in consumers turning to products that boast a natural, healthy halo. Although bottled water has experienced the most notable gains from these trends, bagged, loose-leaf and ready-to-drink (RTD) teas also have benefited from their associations as better-for-you products.

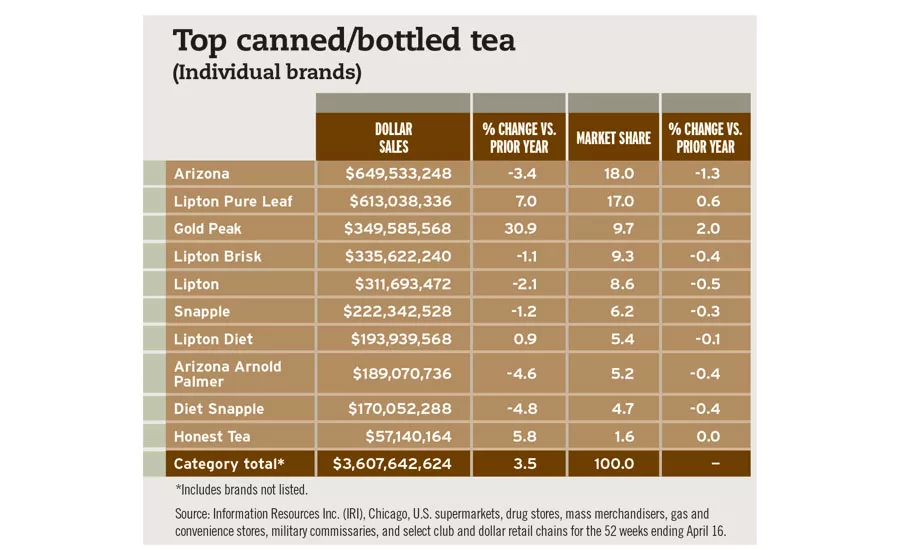

Despite the fact that the tea market has remained relatively stagnant, category growth is largely a result of the performance of the RTD tea segment, says Gary Hemphill, managing director of research at New York-based Beverage Marketing Corporation (BMC). “The overall tea market has been essentially flat, but growth is coming from the RTD category,” he says. “The RTD tea category is experiencing mid-single digit growth driven by the category’s healthy halo, innovation and strong performance in the super-premium segment. … We believe the RTD tea category will continue to have healthy growth in the years ahead due to its healthy positioning and assortment of strong brands in the category.”

Chicago-based Mintel also notes this trend in its August 2016 report titled “Tea: Spotlight on Bagged/Looseleaf Tea.”

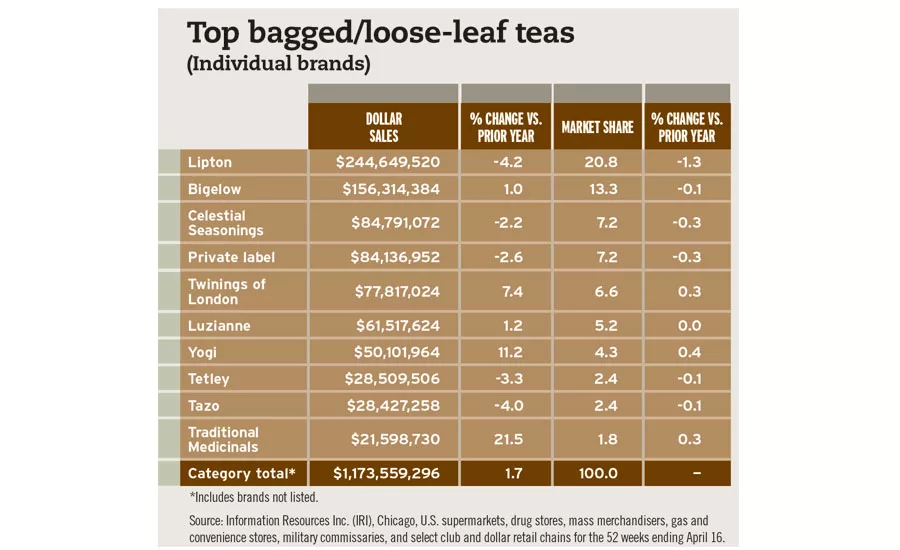

“Canned/bottled RTD (ready-to-drink) teas and the smaller refrigerated tea segment experienced healthy growth in estimated 2016, which helped to offset losses from bagged/loose-leaf teas,” it states, noting that bagged tea declines might reflect the specialty and premium offerings hitting the market.

Chrystalleni Stivaros, industry research analyst at Los Angeles-based IBISWorld, notes that the convenience and portability attributes of RTD tea products have benefited the segment. “The RTD tea industry has grown considerably over the past five years,” she explains. “RTD beverages cater to the on-the-go lifestyles of modern consumers and are often found in locations where most impulse purchases are made (e.g., convenience stores and vending machines).”

Although RTD teas are driving growth within the tea category, the premium segment appears to be the primary driving force, experts note. “Premium teas, packaging and preparation methods have piqued consumers’ interest in the tea space,” Mintel’s report states. “More than a quarter find premium brewed tea worth the extra cost, significantly driven by older millennials and those with higher household incomes. Cold brew is a form of premiumization recently popularized by the coffee category. Now, interest in cold brew is expanding to the brewed tea segment, with more than one in five expressing interest.”

In line with the premiumization trend, real-brewed teas are gaining ground within the RTD tea market, notes Chicago-based Euromonitor International’s February 2017 “RTD Tea in the US” report. “One of the most-developed premium RTD tea trends is that of real-brewed tea, whereby producers create RTD tea from brewing tea with tea leaves as opposed to the more conventional use of tea extracts or concentrates,” the report states.

In fact, the Lipton Pure Leaf brand, which boasts being a real-brewed tea, maintains the No. 2 spot for RTD tea sales in U.S. multi-outlets in the 52 weeks ending April 16, according to data from Chicago-based Information Resources Inc. (IRI). Lipton Pure Leaf saw sales increase more than 7 percent during that time period and accounts for 17 percent of the market share in the RTD tea segment, IRI data indicates.

The brand recently introduced two new flavored RTD teas: Mint and Pomegranate.

Premiumization also is playing a role in the loose-leaf tea segment. Due to its association with premiumization, loose-leaf tea offerings are gaining in the U.S. tea market, according to Euromonitor’s report. “As the interest in hot tea has flourished in the U.S., and as consumers grow more sophisticated in their consumption, loose-leaf tea has made strong gains,” the report states. “Within black tea, loose (standard and specialty combined) grew by 5 percent in off-trade volume terms compared with a 3 percent decline for bags (standard and specialty combined). Despite the loss in convenience, well-versed tea consumers take great care over preparation and place value on the flexibility allowed by loose-leaf tea.”

Noting the growth of premium teas, Argo Tea introduced its most-premium product line to date earlier this year. The Argo Tea Garden Direct collection features a total of 24 single-estate, loose-leaf teas, including varietals like English Breakfast, Chamomile Blossoms and Rooibos, which range in price from $10.96 to $39.95.

Pure Leaf also has begun to play in this space. Last year, the Unilever-owned brand introduced its first line of bagged and loose-leaf teas, which are offered in 10 hot and iced varieties. The long-leaf teas share the brand’s passion for realness, giving consumers a genuine tea experience, the company says.

Exponential options

Currently, the RTD tea market is comprised of 57.7 percent black tea, 22.5 percent green and white teas, and 19.8 percent herbal tea, according to IBISWorld’s April 2017 report titled “RTD Tea Production in the US.”

Although black, green and white teas dominate the market, herbal and other tea varietals are gaining some traction. “In 2016, ‘other’ tea accounted for a 7 percent share of retail value sales,” states Euromonitor’s January 2017 report titled “Tea in the US.”

Among up-and-coming tea varietals, Mintel highlights matcha tea in its report, noting that although the market is growing for the varietal, it has yet to reach its full potential.

“Matcha teas have been slowly gaining traction in both the brewed and RTD tea space and may not be catching on as fast as the industry would like. Only 15 percent of consumers drink powdered loose-leaf teas like matcha on at least a weekly basis, and only 8 percent think matcha tea is healthier than bagged or loose-leaf tea varieties,” the report states. “While there is great potential for matcha, particularly in the health-centric market consumers currently find themselves in, the drink has not fully caught on yet.”

Among those that have introduced matcha products to the marketplace, Davidson’s Organics recently launched its new Ceremonial Matcha Powder, which is designed to be consumed pure, without added flavors or steamed milk, it says.

Guayusa also is making a place for itself in the market, notes Brian Zapp, director of marketing at Austin, Texas-based Applied Food Sciences Inc. (AFS). “Guayusa is a caffeinated leaf of the holly species that grows only in the upper Amazon region,” he explains. “Guayusa (Ilex guayusa) is a cousin plant to yerba mate. However, guayusa is uniquely different than yerba mate in that it tastes sweet, not bitter, and has a distinctively different polyphenolic antioxidant makeup.”

Still less common than matcha tea, guayusa has appeared in some RTD product launches. For example, Purity.Organic’s Super Premium Tea line was introduced with a guayusa flavor: Brewed Guayusa Tea with Pomegranate and Peach.

Healthy minded

Encouraging consumers toward tea, the health-and-wellness trend has played a significant role in the demand for tea products, especially RTD products, experts note. “From a health-and-wellness perspective, tea is one of the best-positioned categories,” BMC’s Hemphill says. “This has helped to drive the growth of the category in the RTD format. … Tea carries with it a healthy halo, which is in keeping with what today’s consumers want.”

According to Mintel’s report, the health-and-wellness benefits of tea play a role in a consumer’s decision-making. “Health-and-wellness benefits are influential to consumers when selecting a tea beverage,” it states. “Nearly all consumers believe in the general health-and-wellness benefits of tea. When it comes to more specific benefits like longevity or therapeutic benefits of those health-and-wellness claims, there is a following by at least a third of brewed-tea consumers.”

Increased consumer aversion of soft drinks in favor of better-for-you options also has been a driving factor for RTD teas, the IBISWorld report notes.

“As per capita soft drink consumption fell and consumers sought healthier substitute beverages, RTD tea producers experienced increased demand and revenue growth over the past five years,” the report states. “Tea, which is high in compounds that may boost the metabolism and fight cancer, has benefited greatly from increased consumer health consciousness in recent years.”

Among the well-known attributes for which consumers turn to tea are antioxidants, experts note.

“Tea’s antioxidants have been well-studied in the human diet and can decrease oxidative stress, thereby enhancing cardiovascular health, glutathione activity, skin repair and healthy digestion,” AFS’ Zapp says.

Antioxidants also are thought to help boost the metabolism and have helped green tea, in particular, gain traction due to its high level of antioxidants, according to IBISWorld’s report. “Antioxidants have also been rumored to have metabolism-boosting properties, which can aid in weight loss; since green tea is particularly high in antioxidants, green tea sales have benefited from widespread interest in weight loss as a result of the national obesity epidemic,” it states.

Additionally, herbal teas are known for their medicinal and calming properties, IBISWorld’s Stivaros notes. On the other hand, many teas contain caffeine, another highly desirable attribute, AFS’ Zapp adds.

Euromonitor also notes the value of caffeine to consumers in its “RTD Tea in the US” report, noting it as one reason black tea has dominated the RTD space. “While other tea types in the U.S. are growing in popularity, such as green and white teas, chilled black tea is valued not only for its refreshing properties, but also [for] its ability to provide consumers with heightened levels of caffeine relative to other tea types.”

Natural and organic traits also bolster the better-for-you perception of teas, according to Mintel's report. “Additionally, consumers tend to perceive natural and organic products as healthier and [as] better for you than those laden with artificial ingredients,” it states. “Approximately one in five consumers find natural and organic claims important to their brewed tea selection.”

IBISWorld’s Stivaros also notes the impact of natural and organic trends. “Natural and organic trends have had a tremendously positive effect on RTD teas,” she says. “Many tea drinkers choose tea in the first place due to its health benefits; therefore, added health benefits further solidifies this consumer base.”

Potential for innovation

In line with health-and-wellness trends, functionality and innovation are thought to be key factors in the tea and RTD tea segment going forward.

“Consumers do need a reminder on how teas can be a versatile beverage that fits many drinking occasions in order to encourage greater consumption of brewed teas,” Mintel’s report states. “The category also has opportunity to engage consumers through innovations focused on premiumization and functionalities while challenging perceptions that may have drinkers limiting their consumption.”

Functionality is the third most-desired trait for RTD tea innovation, according to the report, which adds that antioxidants lead in demand.

BMC’s Hemphill also notes that tea is well-positioned for innovation, and companies are experimenting with new varietals and flavors.

The incorporation of probiotics in RTD teas also is offering a functional, value-added benefit to premium tea products, IBISWorld’s Stivaros notes. For example, kombucha teas have gained a following. Caffeine is another functional property of many teas, which can be promoted, she says.

“As an alternative to coffee (or soda), some consumers drink tea for caffeine,” she explains. “Companies can take advantage of this through products and marketing strategies for RTD teas to jump-start your day.”

Mintel’s report notes that finding new drinking occasions could help the bagged, loose-leaf and RTD tea segments.

“Consumers need to be reminded of tea’s versatility as a beverage, as limited drinking occasions hinder greater consumption by core drinkers,” it states. “Only one in five consumers drink brewed teas in hot weather, while RTD teas seem to enjoy greater versatility in both hot and cold temperatures. Hot tea has also been bucketed as something consumed during an illness — nearly one in five consumers indicate hot tea is only good when they are sick. This sentiment is driven by millennials, who are core consumers of teas and may benefit the most for a look at the category through a new lens.”

Although the RTD tea segment has experienced a deceleration as of late, the mainstay beverage will continue to entice consumers as innovation persists. “Tea will remain a staple beverage alongside coffee and other functional beverages,” IBISWorld’s Stivaros says. “The initial skyrocketing gains seen by the RTD segment when it was introduced will slow; however, continuous innovation will push revenue up.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!