Voss Water of Norway expands to retail, international markets

Ultra-premium bottled water finds success in non-traditional channels

As the bottled water market has ridden a high tide of success in the past several years, many players in the market have experienced likened success. Founded in 2001, New York-based Voss Water of Norway established itself as an ultra-premium bottled water brand that was exclusively offered in high-end on-premise accounts. In 2010, the company gained a new group of leaders who had a larger vision for the brand.

“[The founders] didn’t have as broad of a vision of what the brand could be that we have,” says Jack Belsito, group chief executive officer. “They were fearful of expansion into more channels and how that might detract from that super-premium position, so they were guarded originally, the founders. … We also think the brand itself has potential to expand into other categories, which we haven’t done much yet. We think it’s there for us, when we’re in a position where we think we can make that make sense or bring value to something that isn’t there yet.”

The current executive leadership has brought the once exclusive high-end brand into the off-premise market while maintaining its super-premium brand status. With this broader vision has come great reward, Belsito notes. “The fourth quarter this year [2016] is our 28th consecutive quarter of growth, so that’s seven straight years that we’ve been growing at over double-digit rates each of those quarters. We grew another 15 percent [in 2016],” he says.

CREATING THE BRAND

Originally, the company was founded with a very distinct goal. “We give a lot of credit to the individuals who launched this brand and its concept,” says Patrick Larkin, senior vice president of U.S. on-premise sales. “They had tremendous vision, and they also did something that, quite frankly, is impossible to do ever again, certainly in this space in this industry. They launched a super-premium brand with no marketing, no advertising whatsoever. They did it by exclusively limiting the distribution to very high-end properties. … Tremendous patience, tremendous discipline, but in doing so, it instantaneously became a premium brand, just by the exposure and association.”

In the early years, more than 90 percent of the company’s business was from its on-premise accounts, and it offered two SKUs: sparkling and still varieties packaged in 800-ml glass bottles, Larkin says.

As the years have progressed, the brand recognized the opportunity to expand into different outlets in the on-premise market. “[The founders] thought that this brand was only viable in very specific locales. What we’re seeing in 2017 [is] that’s not the case anymore. This brand is viable in any occasion,” Larkin says.

The company divides its on-premise business into four segments: hotels and resorts, dining, night life, and non-traditional, Larkin says. About 60 percent of that business is hotels and resorts, he adds.

“Hotels are impactful because of two things,” he explains. “No. 1 is … we offer still and sparkling, glass and plastic, and so what’s really a selling position for the hotel operator is that they can have one supplier that offers everything they need to offer for every outlet. … And properties like that will do an excess of 2,500 cases a month because of just the sheer scale of it. So, hotels are incredibly impactful just for the sheer volume and the magnitude of business they offer.”

The non-traditional segment of its on-premise business also is gaining ground, he notes. “Five years ago, we were entirely focused on calling on licensed, on-premise dining, restaurants, hotels, night life,” Larkin says. “Today, we call on all of those, and we’ll always continue to call on them, but … now, all of a sudden, luxury retailers are looking at us and saying we would make sense for them. Spas are coming to us now [and] are actively engaged with us. We’re getting contacted by doctor’s offices. We’re selling to [car] dealerships — it’s that kind of involvement. It’s 100 percent non-traditional.”

Ken Gilbert, group chief marketing officer, notes that on-premise is an ideal branding opportunity for Voss. “For me, the best way to sell Voss is to put a bottle in front of them in a Voss World environment. And people remember that. When I meet people and tell them I work for Voss, a lot of them will tell me exactly when they had their first bottle. Our marketing, which is largely focused on social media, duplicates that experience.”

MAKING VOSS AN OPTION

With a much broader vision for the brand, the leadership team at Voss also saw the opportunity in expanding to retail, Belsito says.

The move to retail fostered challenges along with much success, Larkin says. “I think we’ve worked in concert very well with the retail development of our business, and it’s seen in terms of our pricing strategy to retail. We did run up against some different partners of ours who, when we aggressively expanded our retail positioning, all of a sudden some of our strong partners said: ‘Wait a second, part of the early selling to Voss was that you could not buy it in retail. You could only by it in these types of environments,’” he explains. “So there was some of that happening, but the bigger picture was … that we’ve been strong in terms of our pricing position to the retailer. … So what, if anything, it substantiates for our on-premise customer is two things. No. 1 is we have one of the fastest tracking brands in the industry, and No. 2 is consumers will pay more [for it], and there’s a tremendous profit story with our brand.”

Additionally, the company needed to develop a distribution network. “We built out an entire distribution system in the first few years we were here and continue to upgrade that system,” Belsito explains.

Voss utilizes a platform anchored by direct-store delivery (DSD) systems in each state, says Mark Zettle, senior vice president of U.S. retail sales. “We have identified and partnered with a variety of networks that specialize in non-alcoholic beverage distribution with a major focus on national chain retailers,” he explains. “Additionally, our distribution strategy features a well-developed overlay of national wholesale distributors. These systems have deep penetration and cover retailers in natural, convenience and specialty, giving Voss a balanced approach to meeting the needs of all of our customers.”

In the initial move, retail, supermarkets and natural grocers were the company’s primary off-premise targets, Zettle says. “We knew that Voss would be a good addition for many retailers, not necessarily in every store or in every set, but we knew there was a place for the brand, and we worked hand-in-hand with many retailers to identify the right selection of locations,” he says. “We also made some tactical adjustments to encourage supermarket trial. In 2010, we opened up our entire portfolio to the retail trade with a proposition that would complement every usage occasion with our retailer partners.”

In order to keep its appeal in the aisle, the brand maintains a consistent approach that utilizes guidelines for pricing and promotion, Zettle says. “Our everyday pricing solidifies our brand positioning in the premium segment while providing healthy margins all along the value chain,” he explains. “Equally as important is the appeal to the consumer. Our approach to consumer engagement has always been purity, distinction and responsibility, and these concepts flow all the way through our merchandising and promotional efforts in the trade.”

As retail has grown, sales of Voss now are divided 50-50 between retail and on-premise worldwide, according to Belsito. For the United States, the divide is skewed toward retail, with two-thirds of business coming from retail and one-third from on-premise sales, he adds.

Although 70 percent of the company’s business is in the United States, its international presence continues to grow, Belsito notes.

GOING WORLDWIDE

Branching out into nearly 50 other countries around the world, Voss started out by focusing on five major markets when it began expanding in 2010: the United States, China, Australia, Dubai and the United Kingdom, says Joe Bayern, group chief operating officer. “Instead of trying to be everything to everybody, which is kind of the shot-gun approach that the people before we got here set, we said, ‘Let’s build in a couple of core markets, and then expand,’” he explains.

Similar to its U.S. launch, Voss begins its international distribution in on-premise outlets, building its luxury, premium status, says Siri Titlestad, president of International. Currently, the majority of international business is through on-premise accounts, but retail could overcome on-premise soon, she adds.

“We still have certain markets internationally where you can’t buy it. So people only get it in the best hotels [and] the best restaurants, that’s why the perceived value of the product has been extremely high,” she explains. “Markets like Dubai, which is our biggest single market in the world, it’s the water that the entire royal family drinks. It’s just considered the best product that’s out there.”

However, Titlestad notes that the international business does have an added layer of complexity. “I would say the overall challenge is that each market is different. You can’t use the same marketing material or sales material that you could use in the U.S. … [For] international, you have to custom-make a lot of things; language, of course, needs to be translated, but then you also have references, like Dubai … a lot of our references [in the U.S.] were to wine and wine pairing. You can’t even mention alcohol [in Dubai], so we had to change our thinking. In China, in local Chinese restaurants, they don’t serve bottled water, it’s not on the menu. People get tea, that’s what they drink with their meals, so there’s also the educational part. How do you succeed somewhere where it’s not a part of the culture?”

While Voss uses its in-house marketing capabilities for its international business, it also has brought on local PR agencies to assist in giving its marketing local appeal. “In our focus markets, we’ve engaged with local PR agencies, and we’ve also established local Instagram accounts so that we have a voice,” she explains.

Although the international business has some added complexities, Voss used its U.S. business model as the blueprint for expansion. Titlestad says that although the business model is the same, each market is different and requires a unique outlook.

“I’ve been a part of it in the U.S., so when I did it internationally, we kind of followed the same procedure. … Each market is different, so you have to cater to that,” she says. “Bottled water is also differently perceived. You have markets where you absolutely cannot drink any tap water at all, you can’t even make your coffee with it, and then you have markets [that are] the birth of bottled water, like France and Italy, where they’ve had bottled water for hundreds of years, but the way we went about it was the same.”

The ability to offer both glass and PET bottles also has been beneficial to the company’s expansion abroad, Titlestad adds. “Because we’re still bigger on-premise than we are in retail, glass is still by far the biggest SKU internationally,” she says. “But we see in markets where we just introduced retail [like] in Dubai … that’s a big PET market when it comes to retail because … you can’t drink the tap water at all. The people buy in bulk, and they need to carry water with them at all times to help combat the heat. As that business grows, PET will become a much bigger part of the portfolio. Australia, on the other hand, we have a retail business, which is quite big, but at this point it’s still 95 percent glass, because the Australian consumer, they really prefer glass when it comes to path of consumption.”

Belsito says that continued expansion is in sight for the brand, but it will be strategically planned. “We’ve got way more opportunity than we can even begin to address. We try to sequence it right and address it right so we can move forward, and so we can continue to grow like we have,” he says. “We’ve been really good at that part, I think, being disciplined and saying ‘Okay, we’re not going to try to do everything next year, we’re going to do these three things next year,’ and that’s really worked for us.”

In order to keep up with this growing global demand, Voss expanded its Norwegian facility in 2016 and has plans to continue to expand the plant, which will include the installation of a rail line this year, Bayern says.

“We’ve done a lot of work in Norway on a plant expansion — we are now one of the largest exports coming out of Norway,” he says. “… We’ve doubled the size of the plant [in 2016]. We put a new line in, which added about 50 percent more capacity.”

The Norway plant has three lines and now produces about 80 40-foot containers of product each week, Bayern says. “The beauty is that the community is behind us. We’ve been expanding, we’re a big source of employment there [and] we put in community programs there.”

DEFINING VOSS

When carving its niche in the beverage market, Voss executives highlight the company’s three brand values: purity, distinction and responsibility. When it comes to purity and distinction, Belsito points to the actual water as an example.

“We have an exquisite water,” he says. “People tend to sort of overlook that. We’ve got a water that we don’t touch. It’s all natural. We bottle it from the source, and we sell it. It’s an artesian water, and it’s very, very low in total dissolved solids.”

The responsibility value is broken into two areas: the Voss Foundation and environmental consciousness. “We have a distinct line with the foundation and the way we think about responsibility, and we call that an unconditional love for it, which means you’re not going to see from Voss: ‘Hey, if you buy this water from us, we’ll give to a foundation,’” he explains. “We’re not going to make a condition on you loving us to do that. So we say, ‘here’s what it is, it’s Voss, we do this, if you want to reward us for that, great, if you don’t, that’s fine too, we’re going to do it anyway.’ It’s not relying on you the consumer or you the customer.”

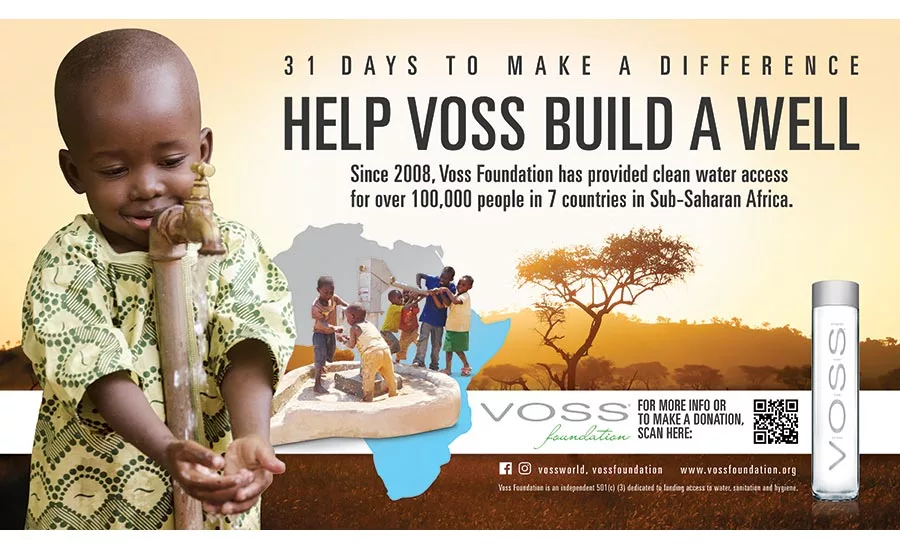

The Voss Foundation works to bring clean water and sanitation points to Sub-Saharan Africa and has built more than 180 sanitation points in the area during the past five years, Belsito adds.

Each year, the company supports the foundation through its 31 Days To Make a Difference marketing campaign, which aims to educate consumers about the Voss Foundation, Gilbert says. It starts on World Water Day (March 22) and ends on Earth Day (April 22), while involving retailers who have a strong sense of corporate social responsibility, he adds.

For its other environmental efforts, the company is carbon neutral, Belsito explains. “We use 3 Degrees, an outside company, that audits us every year, it’s a very state-of-the-art process,” he explains. “… We have high offsets in the marketplace that would equal the amount of carbon we put in, so we have a methane capture facility, we have a windfarm in China, and we have a landfill mediation place in Missouri.”

Through these efforts, the brand has built a level of trust with its consumers. In order to continue building these relationships, it places a strong emphasis on social media to communicate, Gilbert says.

“In general, I use social media to reinforce the brand position [and to] raise awareness, but it’s not quite advertising,” he explains. “We have this concept called Voss World. … People associate Voss World with the finer things in life or unique, adventurous experiences. So, what we do is we portray Voss World in our social media effort, that’s a nicely branded invitation from Voss rather than a direct hard sell. Our rule of thumb is if it looks like advertising, we don’t do it. It’s got to feel organic, and that’s why we do so well with engaging consumers.”

Looking ahead, opportunities are on the horizon for Voss, Bayern says. “Long-term … I think that this is definitely a billion-dollar brand,” he says. “… It’s a great brand, and you could try to spend a lot of money in marketing to create brands, and there’s some that just are organic brands, and this is one of those organic brands that people just seem to love. We don’t spend a lot of money on marketing, people gravitate toward it and they like it, and it’s the experience, and they understand the Voss story. I think really it’s just about how we phase this. Rather than will we get there, it’s a matter of how we get there.”

The iconic Voss bottle

When creating New York-based Voss Water of Norway in 2001, the founders of the brand understood the impact that a unique and distinct package can have. Established by a group of Norwegians with a non-beverage background, Voss uses a now iconic bottle with a design from an unlikely source.

“It was young guys who were the founders. They went to school on the West Coast and stayed here. They saw a bunch of people walking around with Evian bottles, and they said, ‘We come from a place where the water is exquisite, we can do this.’ So they set out to do a premium water business, and they accomplished exactly what they intended to do,” Group Chief Executive Officer Jack Belsito explains.

Looking to add value to the category, the founders wanted to create a package that would add value to the brand, Belsito explains.

“… They said, ‘We think we can do this, let’s do it in a better way. Let’s do it in a way that adds value.’ So they actually pitched designers, rather than go to a bottle designer, they went to a fashion designer,” he says.

With the help of Neil Kraft, a fashion designer who previously worked for Calvin Klein, the founders developed what would become an iconic image for the brand.

“If you show that bottle to a beverage person, they [would] say ‘are you crazy?’ It’s hard to produce, they tip over. No right-minded beverage person would have introduced this bottle, but because they weren’t [beverage people], they were kids, that’s what they did,” Belsito explains.

Since its creation, the company has been able to refine the production process and has made substantial efforts to protect the brand equity that the packaging has helped to build.

“We’ve spent a lot of money defending it, and it’s worked very hard for us,” he adds. “… Almost everything we show a consumer will have a picture of our bottle in it. People will recognize our bottle, even above our name, and that’s an incredible thing.”

After many variations, the PET version of the iconic bottle was launched in 2005, motivated by on-premise accounts, like hotels, looking to place the product in outdoor locations. According to Belsito, creating the plastic version took some time because it was important to the brand to capture the look of the glass bottle in a PET version.

“We introduced PET because of our on-premise customers who actually wanted more Voss presence in their outside locations,” Belsito explains. “… The first ones didn’t work quite as well, they weren’t quite as close. Now, if you look at the package, if you don’t touch it, you wouldn’t know it isn’t glass.”

He notes that the PET bottles also offer some functional benefits, like a wider mouth, which has benefited the brand with the growth of fruit-infused water.

Regardless of whether its glass or plastic, the iconic Voss water bottle has helped the brand to achieve success as consumers worldwide have embraced the brand. “I’ve been here since day one, and I’ve seen regardless of culture, religion, language, they’re all different, but the emotional reaction that consumers have to Voss is the same all over the world,” says Siri Titlestad, president of international. “People remember the bottle, people want to take the bottle with them. We see that in restaurants in Beijing, Sydney, Qatar, [and] Dubai. It’s universal. People are drawn to the bottle.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!