Consumable eCommerce expanding throughout US

Click-and-collect models offer opportunity to low-income shoppers

Last December, Adobe Digital Index indicated that online consumers spent more than $3 billion on Cyber Monday, 16 percent more than in 2014. That was on top of the more than $8 billion spent online during the four-day Thanksgiving weekend. Although the vast majority of purchases were for non-consumable consumer packaged goods (CPG), consumable products are finding their place in the eCommerce channel as well.

According to the “2016 Future of Food Retailing” report from Long Grove, Ill.-based Willard Bishop, an Inmar analytics company, eCommerce sales for food and other consumables increased 20.9 percent in 2015 to $29.5 billion. The market research firm also anticipates continued double-digit growth for eCommerce food and consumables with a growth rate of 23.1 percent a year through 2020.

Even with the growth in eCommerce, the channel still remains small on a volume basis compared with traditional models. “ECommerce is roughly 2 percent of sales today, but increasingly it is generating the majority of growth for CPG firms who are engaging,” says Sam Gagliardi, senior vice president of eCommerce for Information Resources Inc. (IRI), Chicago.

Chicago-based Mintel’s Diana Smith, associate director of retail and apparel, also notes the progress eCommerce has made within the consumables markets. “Online grocery shopping is unequivocally on the incline and is slowly changing the way people shop,” she says. “However, this sector still falls behind other retail sectors due mainly to consumers’ concerns about freshness of items purchased online and/or the general unwillingness to give up control of selecting items like fruits and vegetables themselves.

“Over one-third of the surveyed population purchased groceries online in the past year and most plan to repeat this behavior,” Smith continues. “Interest also climbed substantially among those who have yet to turn to online means, indicating there is still ample runway ahead for this sector. The percent unwilling to buy online has also declined nearly 20 percentage points in three years, but still, over a third of consumers remain skeptical enough to avoid the online channel altogether.”

Leading the charge

Among the leaders in the eCommerce channel, Seattle-based Amazon.com Inc. continues to post double-digit growth.

The company announced in its third quarter financial results, which ended Sept. 30, that net sales increased 29 percent to $32.7 billion for the quarter. Although many company highlights were technology based — new Amazon Studios releases, launching Amazon Music Unlimited as well as the all-new version of the Echo Dot, a hands-free, voice-controlled device powered by Alexa — the consumables business also has proliferated.

For example, it noted in its financial results that AmazonFresh, which offers grocery items for sale and home delivery, expanded to northern Virginia, Maryland, Dallas and Chicago. Consumers in all locations now can shop for groceries through AmazonFresh directly on the Amazon.com website, it stated.

Amazon also launched a partnership with Fresh Thyme Farmer’s Market. Prime Now members in Indianapolis now can shop for groceries from Fresh Thyme Farmer’s Market and have those items delivered to their home within two hours, the company says.

In addition to Amazon, consumable eCommerce has seen other companies gain in popularity, like Los Angeles-based Thrive Market and Jet.com Inc., which was acquired earlier this year by Bentonville, Ark.-based Wal-Mart Stores Inc. for approximately $3 billion.

As of Sept. 2, Thrive Market, which offers wholesome products at wholesale prices through its membership subscription services, has more than 300,000 paid members generating $200,000 in daily sales, on top of its membership fees, it says. In its first year, Jet reached $1 billion in run-rate gross merchandise value and offered 15 million SKUs. It also has more than 400,000 new shoppers added monthly and an average of 25,000 daily processed orders, the company says.

Despite the increasing access to consumable eCommerce, most categories within the beverage market remain niche. However, the coffee category has seen its eCommerce sales account for a 7 percent share, IRI’s Gagliardi says. In comparison, carbonated soft drinks are 2 percent, while energy drinks are 4 percent, he adds.

“The main difference between why coffee has such a high penetration, or high share rather, versus why water and soda does not, is that coffee is also sold in the context of ground coffee and single-serve cups,” Gagliardi explains. “In that context, those items ship better via the mail, which is the traditional Amazon way to deliver, versus whenever you’re shipping liquid [as] those are expensive.”

He also points out that the brands that dominate traditional channels do not have the same dominance in eCommerce.

“[Y]ou need to understand that right now across the board — all the different categories in eCommerce — the brand or brands that have the highest share in the store environment, their share online is not as high as their share in-store. In fact, the index that we’ve calculated across many different categories is that the share of online and in-store for the brand leaders of each category ranges between 60 and 75 percent of what their share is in-store.

“That’s happening because, unlike in the in-store physical world, they cannot control their shelf space any longer and a lot of third parties are coming in and, because they are better digital marketers, they’re winning that consumer,” he continues.

The equalizer

Yet, the ability for more beverage categories and brands to capture online purchases could come from traditional retailers expanding their eCommerce programs, experts note.

For example, before Wal-Mart Stores acquired Jet, it already had announced that it would be investing $2 billion a year for the next three years to expand its eCommerce capabilities, Gagliardi says. Target announced a similar strategy of $2 billion a year for the next two years, he adds.

When it comes to online food and beverage purchases, Gagliardi notes that other geographic markets already have found ways to fulfill this need. “The U.K. market is about seven years ahead of the U.S. market in the context of the percentage of the households fulfilling their need and want of food and beverage in the online space,” he says. “What we’re discovering, what actually tips the needle for those categories that do well online, was the fact that retailers actually built the capability for shoppers to fulfill their need to want online.

“It’s not that consumers don’t want to buy online; it’s not that they don’t have the technology to buy online; it’s that the capability [and] the infrastructure at the retail level are not quite there yet,” he continues.

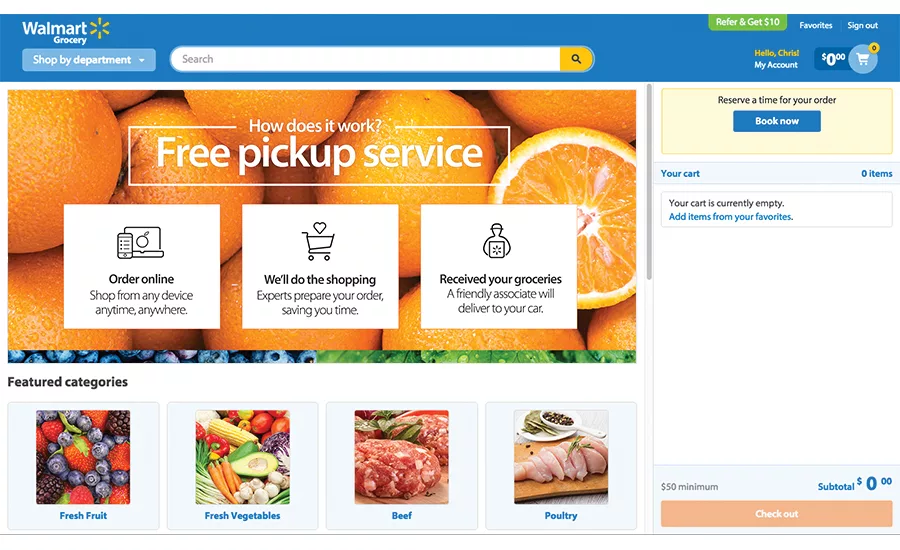

Among the ways retailers and brands can expand eCommerce food and beverage in the United States will be through the click-and-collect model, Gagliardi explains. “That’s what’s really going to take food and beverage specifically from the less than 2 percent range to the 5 up to 10 percent total volume range,” he says.

Through the expansion of click-and-collect, more consumers will be able to shop online for their food and beverage products and pick them up at a local retailer, Gagliardi says. This also could help the channel to expand its demographic reach.

“The current user is very diverse in terms of age, which is where everyone always goes,” Gagliardi says. “They don’t believe that older people buy online and that’s a falsehood. What we’re seeing right now is that it’s definitely in households that are making more than $70,000 per year. The dynamic that’s driving that is really access to credit. What I mean by that is when shoppers buy online, they buy online with credit. This is also another point why click-and-collect will be a big equalizer in the industry.

“That process should allow consumers who are in the low-socioeconomic realm, who don’t necessarily have access to banking and access to credit, to be able to take part in eCommerce,” he continues. “What I mean by that is they can easily because they have the technology already through phones, their mobile devices as well as their desktops and laptops [to] be able to order products they need, but it’s very different then how it is today — they’ll be able to pay cash or even use federal subsidies to pay for their products when they pick them up at the click-and-collect center.”

Mintel’s Smith also recognizes the potential of click-and-collect models. “One of the biggest growth opportunities currently for eCommerce and food/beverage is the continued development of click-and-collect services (aka BOPUS, buy online and pick up at the store),” she says. “Many grocers and retailers are opting to go this route instead of jumping straight into the delivery game as it can be more affordable and less logistically challenging to implement.

“Shoppers favor this option as it allows them to choose the timeframe that works best for them to make a stop at the store rather than needing to make sure they are at home within a certain timeframe,” Smith continues. “It also allows them to inspect the selected items first before leaving the store to make sure they meet their approval, overcoming the top barrier for online shopping.”

Although technology and consumers’ growing familiarity have allowed eCommerce to reach a more diverse audience, some analysts think that its usage will remain with a younger audience.

“The one area, demographically speaking, where you are seeing a lot of potential from the get-go is the youngest generation — the digital natives,” says Tim Barrett, retailing analyst at Euromonitor International, Chicago. “They have not known a life that isn’t hyper-connected, so buying online is just another extension of that. You can see some retailers like Wish catering specifically to this crowd. They are increasingly mobile-only but have yet to really gain much purchasing power, so speaking of them is more speaking of potential.

“The most interesting question is which retailers will figure out how to best serve them,” he continues. “I wouldn’t bet against Amazon, but I’m sure some specialists will pave the way in helping establish the shopping behaviors of the future.”

Yet, in order to understand the future of the eCommerce channel, IRI’s Gagliardi suggests thinking of this market less as a sales channel and more as a media platform channel.

“Amazon actually is getting almost as many unique visitors per month — plus 186 million per month — as Facebook is getting, and in that context, unlike Facebook, shoppers go to Amazon to actually shop,” he says. “In that context, now what the non-CPGs have embraced well is that eCommerce platforms are media platforms that allow them to shorten the path to purchase. When you embrace that and reallocate your team and reallocate your visual spend and how you approach digital, you are able to shorten the path to purchase for your shopper and become more relevant and that’s really the upcoming future that’s happening in the industry.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!