The 2015 State of the Beverage Fleet Industry

Tires remain top cost for beverage fleets

Earlier this year, Beverage Industry conducted its third annual Fleet Study to offer a snapshot of the size and makeup of today’s delivery fleets, as well as an understanding of the operational concerns and strategies that beverage fleets face every day. Key trends from this year’s survey include the continued popularity of small vans as more options enter the market as well as a continuing split in favor for end-load trucks and trailers compared with traditional side-load equipment.

Vehicle choices

On the light-duty side of fleets, responses showed a split between passenger vehicles (sedans and SUVs) and light trucks (pickups and small/large vans) has shifted significantly in favor of light trucks. This shift is being supported, in part, by the expanding variety in the small-van segment, which is becoming an increasingly popular choice for multi-role use by sales, merchandising and service personnel.

Although this year’s respondent base was smaller than last year, the continuing shift from side-load to end-load equipment and from straight-trucks to tractor-trailers again was reflected in the survey responses.

Regardless of a generally upward trend in new vehicle sales, survey respondents indicated a low level of new vehicle purchases planned for the next 24 months. Of those respondents who are planning new vehicle purchases, just more than half are replacing existing vehicles, while less than half are expanding their fleets.

Fuel cost strategies

Similar to previous surveys, route optimization is the most popular fuel cost-reduction strategy among respondents, by a margin of nearly four to one.

Driver training/coaching, a low-cost option, moved up to a distant second place, with 14 percent of respondents indicating it as their top strategy for reducing fuel costs. Considering that a driver can impact fuel economy by as much as 30 percent, driver training/coaching still deserves more consideration as a fuel-saving strategy.

Maintenance & downtime

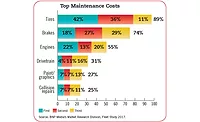

Respondents were asked to rank their Top 3 maintenance costs. Tires continue to be ranked as the top maintenance cost for the majority of our respondents with 63 percent indicating this as their top cost. It was indicated as a No. 2 cost by 11 percent and No. 3 by another 11 percent. A total of 85 percent of respondents placed tires in their Top 3 maintenance costs. In comparison to last year’s study, brakes were the No. 2 cost, ranking in the Top 3 for 75 percent of respondents. This year, the expense moved down to fourth on the list with only 47 percent of respondents placing it in their Top 3. Engine maintenance curiously has moved up to second place, likely driven by the continued trend toward longer replacement cycles.

Engine and drivetrain failures continue to rank among top causes of downtime/unplanned repairs, another symptom of longer replacement cycles. Collision repairs also are ranked quite high, but moved down to third place among the causes for downtime. Although this is likely related to driver hiring challenges, it’s important to remember that in purely relative terms, collision repair should rank high on the unplanned repair scale, as most other types of repairs can be scheduled to avoid downtime when properly managed.

Among the changes to last year’s study, brakes moved down the list to No. 5. As an unplanned downtime/repair, the item was No. 3 in the 2014 Beverage Fleet Study.

Operational concerns

Likely reflecting the decline and relative stabilization of fuel prices during the past 12 months, fuel price volatility has made a welcome drop from first to third place among the top operational concerns, according to respondents. However, still in the top half of operational concerns by a wide margin, it’s interesting that those options that best address price volatility for reduction of fuel cost still rank low on the scale.

Although not unexpected in the first and second ranking, vehicle lifecycle costs and insurance cost also outrun other operational concerns by a wide margin, at 90 percent and 75 percent, respectively. This heightened cost-sensitivity likely is a reflection of the the size of respondents’ companies, which suggest smaller-run operations.

Beverage Industry’s 2015 Fleet Study was conducted by BNP Media’s Market Research Division. The online survey was conducted between Aug. 31 and

Sept. 14, and included a systematic random sample of the domestic circulation of Beverage Industry.

Geographically, the respondents were well distributed across the United States, with slightly stronger representation from the Southern region than in the Midwest, West Coast and Northeastern regions. No U.S. territories were included in this survey. More than half of the respondents were distributors/wholesalers while slightly more than one-third labeled themselves as a producer/bottler. Four percent of respondents indicated that they operated in the retailer industry and the remaining 9 percent listed other for their industry involvement.

When it comes to company size, one-third of respondents reported annual sales volume between $1 million and $10 million, and 29 percent indicated a sales volume between $10 million and $50 million. More than a quarter of those completing the survey have between four and 10 years of industry experience, while 57 percent indicated that they have the authority to approve and authorize purchases within their operations. Thirty-five percent of respondents listed their job duties as other corporate management and administration, and slightly more than a quarter works in marketing and sales. Vice president of operations and warehousing/distribution/logistics both were represented by 13 percent of respondents, respectively. Eighty-seven percent of respondents were male.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!