The 2014 State of the Beverage Fleet Industry

End-load trucks favored over side-load equipment

Beverage Industry recently conducted its second-annual fleet survey to get an updated picture of the size and makeup of current delivery fleets as well as operational concerns and strategies. Key trends in this year’s results include an increasing popularity of small vans as more options enter that market segment and a widening split in favor of end-load trucks and trailers over traditional side-load equipment.

To get the latest look into fleet operations, 78 completed surveys were submitted as a representative sample of our readers.

The average fleet size among the respondents continues to be smaller than typical for the industry, at just fewer than 20 vehicles.

Vehicle choices

Among the light-duty vehicles in the respondents’ fleets, the split between passenger vehicles (sedans and SUVs) and light trucks (pickup trucks and small/large vans) remains about even, but the expanding variety in the small-van segment is becoming an increasingly popular choice for multi-role use by sales, merchandising and service personnel.

The continuing industry shift from side-load to end-load equipment and from straight trucks to tractor-trailers again was reflected in the survey responses. While individual side-load vehicle types slightly outnumber some individual end-load types in current fleets, the overall split between side-load and end-load vehicles is widening in favor of end-load equipment.

In spite of a generally upward trend in new vehicle sales, respondents appeared to indicate a negligible level of new vehicle purchases planned for the next 24 months. Of those who are planning new vehicle purchases, the majority plan to replace most or all of their fleets, catching up from the deferred replacement strategies employed during the past few years.

Maintenance and downtime

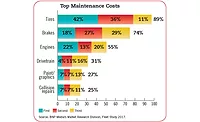

As expected, tires and brakes continue to be ranked as top maintenance costs for the majority of respondents. Ninety percent of respondents listed tires as one of their Top 3 maintenance costs, and 75 percent named brakes as one of their Top 3 maintenance costs. Engine maintenance again followed in third place, though by a wider margin than last year. Engine maintenance costs still are higher than they should be because of longer replacement cycles, but the decline from last year likely reflects fewer problems with emission control systems as fleets gain experience with the late-model hardware.

Engine and drivetrain failures continue to rank as two of the Top 3 causes of downtime/unplanned repairs — another symptom of longer replacement cycles. Collision repairs ranked quite high, moving up to second place overall on the downtime scale. While this could be related to driver hiring challenges experienced by respondents, in purely relative terms, collision repair should rank high on the unplanned repair scale, as most other types of repairs can be scheduled to avoid downtime when properly managed.

Operational concerns

Even with fuel prices declining somewhat in the past 12 months, fuel price volatility still ranks as the top operational concern of respondents by a huge margin. Despite this concern, it’s curious that the options that best address price volatility still rank low on the scale.

While not unexpected in their second- and third-place rankings, insurance and vehicle lifecycle costs are again quite close behind the top overall operational concern of fuel price stability. This heightened cost sensitivity continues to reflect the smaller company size of our respondents.

Fuel cost strategies

Again, by a margin of 4-to-1 over the next highest option, route optimization still is the most popular fuel cost reduction strategy among respondents. Driver training/coaching, a low-cost option, remains stubbornly in third place with less than

10 percent of respondents indicating that as their top strategy for reducing fuel costs. BI

Beverage Industry’s Fleet Study was conducted by BNP Media’s Market Research Division. The online survey was conducted between Aug. 26 and Sept. 17 and included a systematic random sample of the domestic circulation of Beverage Industry.

Geographically, the respondents were well distributed across the United States, with a slightly stronger showing in the Southern, Western and Northeastern regions than in the Midwest and U.S. territories. Roughly one-third of the respondents were producers/bottlers; 29 percent were distributors/wholesalers; and 21 percent were retailers.

When it comes to size, more than half of the respondents reported an annual sales volume of less than $5 million, and nearly three-quarters had a sales volume of less than $15 million. More than 60 percent of those completing the survey had 10 or more years of industry experience. More than 90 percent of those providing the survey responses have authority to specify, recommend or approve purchases of fleet products and services; however, many identified themselves as senior corporate executives rather than dedicated fleet managers.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!