2021 State of the Beverage Industry: Weight control, sports beverages growing steadily

Most fitness beverage subcategories see notable growth

For fitness buffs, 2020 presented a year of closed gyms, parks and more, and many typical fitness-conscious consumers were likely forced to find ways to maintain fitness and wellness from home. As such, better-for-you drink options, already on the rise in recent years, surged in 2020 as consumers began demanding beverage options that could optimize their health in the midst of a health-challenging year.

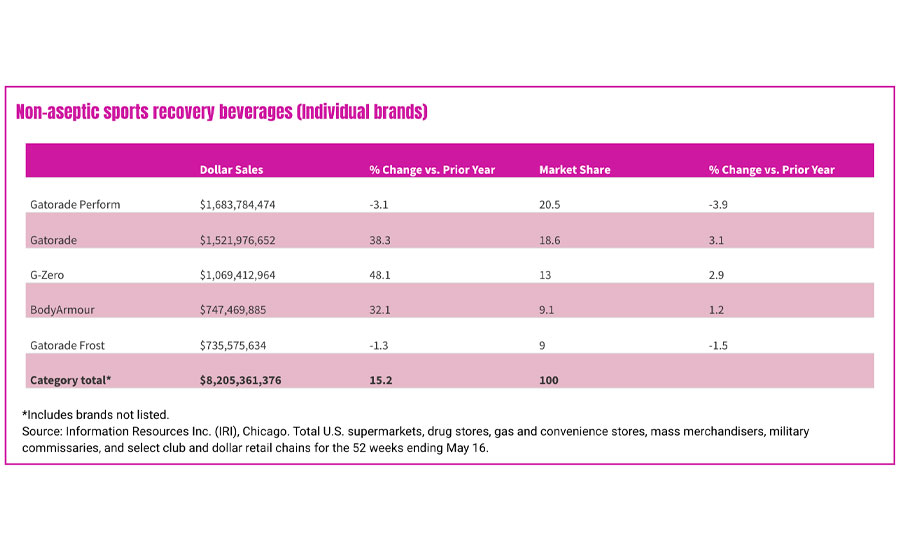

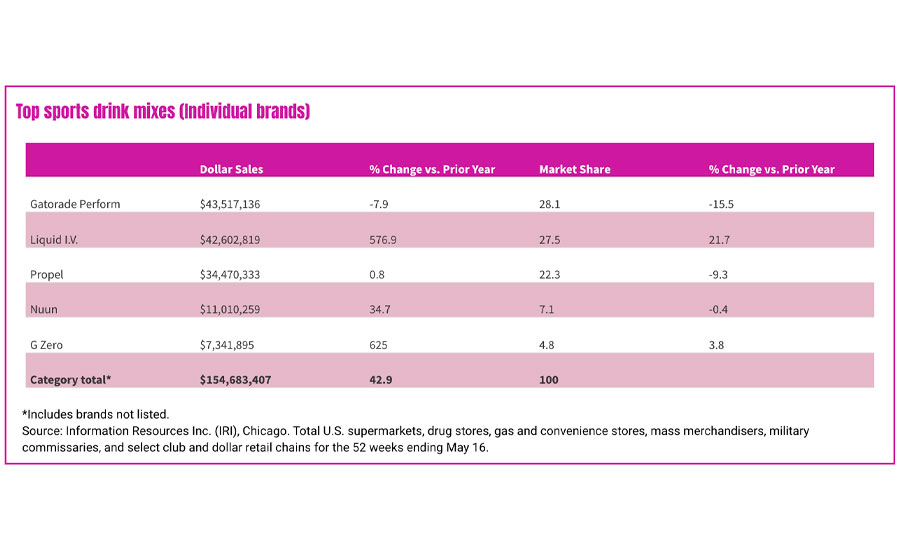

With energizing, hydrating and reparative attributes, the sports and performance drink market exemplified this trend. The overall sports drinks category grew in total U.S. multi-outlets by 15.6% for the 52 weeks ending May 16, according to data from Information Resources Inc. (IRI), Chicago, totaling more than $8.3 billion. Its most dominate segment ― non-aseptic sports drinks ― grew 15.2%, notching $8.2 billion in dollar sales for the same time period. Aseptic sports drinks grew 64.8%, while sports drink mixes grew by 42.9% for the same timeframe.

Although the pandemic presented a challenge for many beverage categories, it seems to have provided a positive opportunity for sports and performance drinks. For instance, 39% of adults said that maintaining their exercise routines has been a higher priority because of COVID-19, Mintel’s January 2021 “Health Management Trends – US” states. Additionally, when the pandemic first began and consumers started stocking up on grocery essentials, many selected sports and performance drinks, Mintel reports.

Mintel’s report states that by adding function to sports and protein drinks, beverage brands can achieve a broader range of health-and-wellness benefits, thereby appealing to a diverse range of consumers. This could help brands appeal to consumers seeking health benefits from their beverages, often from their sports drinks.

In fact, in Beverage Industry’s May issue, Kishan Vasani, co-founder and CEO of Spoonshot, a Minneapolis-based food and beverage intelligence company, said that consumer interest in sports drinks grew in 2020,

“Consumer interest in functional beverages is on the rise — increasing by 11% in 2020 — as they become more health conscious,” he said. “Consumers today don’t just want their beverages to taste good and help them stay hydrated; they also want added health benefits. This is true of functional drinks with specific purposes, like sports and protein drinks. Further, consumers don’t just want recovery and hydration from these drinks to enhance overall physical performance; they also want these drinks to improve mental focus.”

Spoonshot predicts interest in cognitive health to grow around 12% in the coming year.

“Cognitive health is gaining ground among sportspersons and athletes to help with faster decision-making capabilities and focus for enhanced sporting performance,” Vasani explained. “This in turn will help such functionalities become popular among mainstream consumers of sports and protein drinks.”

Another functional option is energy, Vasani added. He noted that interest in energy support is set to grow by 35% in the coming year.

Furthermore, because of COVID-19, many beverage-makers began (or continued) using immunity-supporting ingredients to fortify their sports and protein drinks. For instance, Abbott Park, Ill.-based Abbott introduced Pedialyte with Immune Support, featuring prebiotics, vitamin B12, vitamin C, vitamin E and zinc.

Similarly, Purchase, N.Y.-based PepsiCo Inc. launched Propel Immune Support, featuring vitamin C and zinc. In the protein drink segment, Abbott released Ensure Plus, a nutritional shake boasting 16 grams of protein (75% more than Ensure Original) as well as essential nutrients for immune support.

“Adding value beyond hydration will encourage daily consumption behavior and increase the percentage of users that say these products are an essential part of their wellness routine,” Mintel’s report stated.

Beverage Industry’s September 2020 eMagazine referenced another report by Mintel titled “Sports and Performance Drinks,” and the ways in which sports drinks were expanding beyond traditional “clientele” in the climate at that time.

“Performance drinks have struggled to gain a foothold in the market as these types of beverages appeal to a niche group of consumers — avid athletes — who prioritize their fitness goals and gains above holistic wellness,” the report stated.

However, the functional beverage category continued to slowly bring performance drinks into the mainstream. Within the three months prior to the September 2020 article, Mintel reported that 40% of its survey respondents had consumed a sports drink, 22% had consumed a no-sugar sports drink, 14% had consumed a natural sports drink, and 8% had consumed a pre-workout drink mix.

Several of the essentials for sports drinks and recovery drinks beyond hydration has turned out to be not only protein, but also other vital nutrients for various active lifestyles, including herbs, vitamins and minerals, adaptogens, and more which have all been boosting the weight control beverage category. These ingredients cater to consumers beyond the traditional clientele to which Mintel referenced in its report.

For the 52 weeks ending May 16, weight control products rose 10.2% to become a $4.8 billion category overall. Of the sub-segments, powdered and liquid protein drinks rose the most, by 11.1% for the same time period.

Entries into the category include Protochol, a brand that creates sparkling hard beverages with an 8% ABV along with its 11 grams of protein, designed to cater to the college student demographic, the company says.

Another offshoot is Boobie Body, a brand that developed weight-control protein drink mixes for active lactating moms. With just one net carbohydrate, the beverage offers protein as well as nutrients to support lactation, along with no sugar, and a healthy dose of “good fats,” it says.

Plant-based ingredients began to have more of an influence on the protein drinks segment in 2020 as well.

Image courtesy of Boobie Body

“The protein drink category is starting to be transformed by the plant-based foods and plant protein craze,” said Roger Dilworth, senior analyst at Beverage Marketing Corporation (BMC), New York, in Beverage Industry’s May eMagazine. “Brands like OWYN, which are probably being looked at by strategists, have influenced competitors to pay more attention to plant-based protein, as PepsiCo recently announced in relation to its Evolve brand.”

According to Spoonshot’s Vasani, consumer interest in alternative protein had grown by more than 500% in the five years prior, which he projected could increase by as much as 32% in the coming year.

BMC’s Dilworth also expects plant-based protein to continue growing in the future.

Image courtesy of Protochol

“Plant-based protein drinks should continue to gain share as some consumers move away from whey and other dairy-based protein,” he says.

According to a February sports drink market report by India-based Fortune Business Insights the global sports drink market is expected to reach $32.61 billion by 2026.

“Rising emphasis on improving body’s performance and endurance level by athletes will fuel demand for sports drinks, which in turn will boost the sports drink market share,” the report states. “In addition, the rising R&D investments by key players for the development of innovative sports drinks aimed at athletes will enable healthy growth of the market.”

According to the report’s data, the market is expected to grow at a compound annual growth rate of 4.2% between 2019 and 2026. Since the category shows no signs of slowing down, innovative, fresh new products likely will continue to hit store shelves.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!