2021 State of the Beverage Industry: Juice category sees bump during pandemic

Refrigerated lemonades, juice smoothies register double-digit growth

Commonly viewed as a breakfast beverage, juice and juice drinks saw their status change once the COVID-19 pandemic hit, as consumers sought healthful, immune-supporting products, leading to a resurgence in juice and juice drinks.

In Chicago-based Mintel’s June 2020 report “Juice and Juice Drink: Incl Impact of COVID-19, US,” Madelyn Franz, cross-category research analyst at Mintel, defines the nearly $19 billion juice and juice drinks market as “sizable but struggling.”

“Juice has been going through an identity crisis of sorts, which has put the category in a tough spot,” Franz explained in Beverage Industry’s January eMagazine. “Products tend to toe the line between healthy and indulgent without committing to either position, leaving consumers confused and disengaged. While it’s been relegated to very specific consumption occasions as a result, the COVID-19 outbreak has granted brands a chance to break free from the category’s downward trajectory.

“Thanks to the pandemic and subsequent recession, consumers’ needs have actually aligned with the benefits that juice has been offering all along: comfortable, cost-effective, vitamins,” she continued. “More than that, it’s created a brief window of opportunity for the category to reset, retarget and recover in the longer term.”

Gary Hemphill, managing director of research for New York-based Beverage Marketing Corporation (BMC), agreed that the pandemic and more people staying at home have positively impacted the category’s performance.

“After several consecutive years of soft market performance, juices and juices drinks are experiencing modest volume growth in 2020,” he said in the January eMagazine. “Fruit beverages are one of the few categories that have actually experienced improved performance due to the pandemic. More people staying at home have improved the category’s performance.

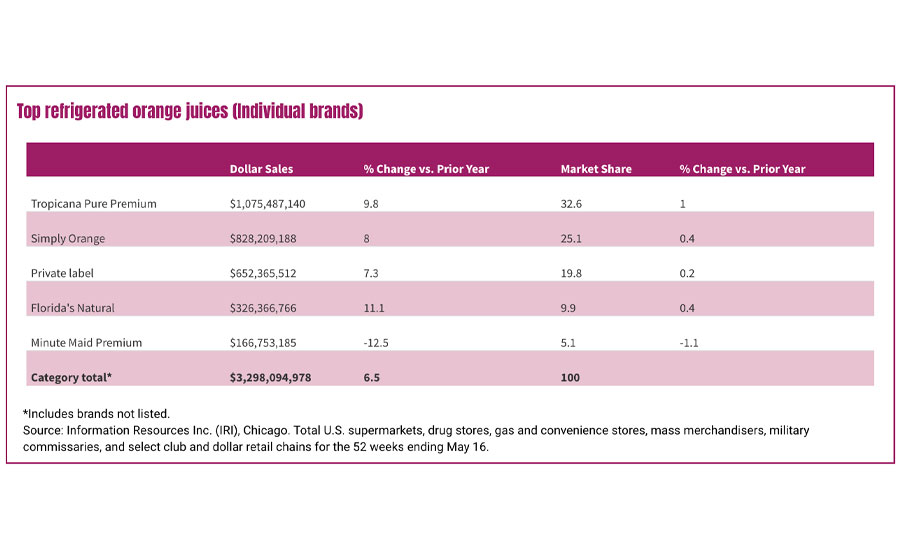

“Citrus juice, especially orange, is performing well, driven by a jump in take-home sales,” he continued. “Fruit beverages have been rejuvenated in 2020, due to improved take-home sales performance driven by the impact of the pandemic.”

According to data from Chicago-based Information Resources Inc. (IRI) the refrigerated juice/drinks category accounted for $7.4 billion in sales for the 52 weeks ending May 16 in total U.S. multi-outlets. This is an 8.9% increase from the prior year. The refrigerated orange juice segment, which represents approximately $3.3 billion of the category, was up 6.5% for the time period. Other segments bolstering the refrigerated juice category are lemonades, up 18.2%, and juice and drink smoothies, up 12.5%.

Adding to the power of the lemonades segment, SUNNYD, a brand of Harvest Hill Beverage Co., released two limited-edition flavors: Lemonade and Raspberry Lemonade. Like other SUNNYD flavors, Lemonade and Raspberry Lemonade contain 100 percent of the daily recommended value of vitamin C and 60 calories in each 8-ounce serving.

Meanwhile in the juice and smoothies segment, Naked Juice, a brand of PepsiCo, added Rainbow Machine, a blend of seven fruits and veggies, to its line of juice smoothies. Rainbow Machine is a nutrient-rich juice featuring red beets, apples, mangoes, bananas, kiwis, blueberries and blackberries. Providing an excellent source of vitamins B, C, E and calcium, Rainbow Machine also is a good source of vitamin D and fiber, the company says.

The bottled juice category also fared well for the 52 weeks ending May 16. According to IRI data, bottled juices increased 7.8%, totaling nearly $7.8 billion. The cranberry cocktail juice drink segment was among the top performers registering a 16.5% increase for a total of $1.2 billion.

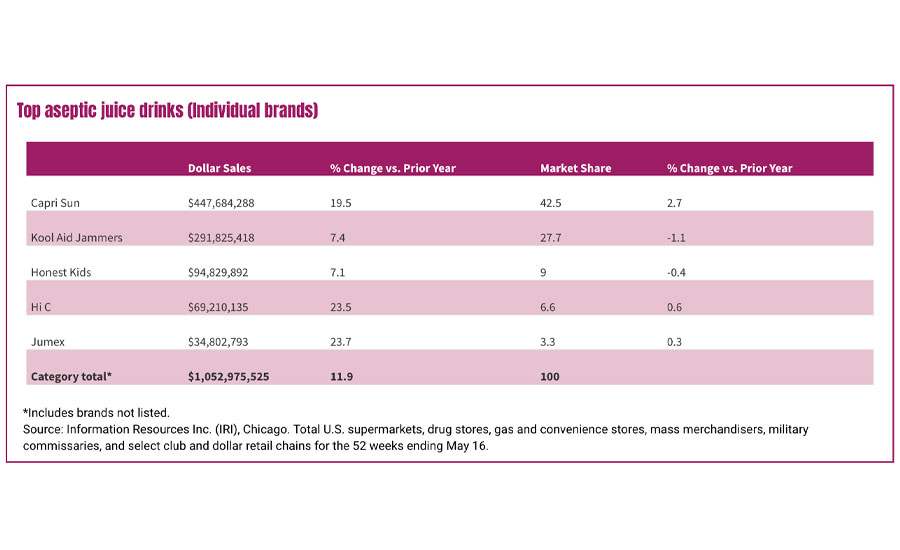

Meanwhile, the aseptic juices category was up 9.8%, totaling $1.5 billion. Aseptic juice drinks was the strongest segment posting an 11.9% increase and more than $1 billion in sales.

Experts note that the pandemic has sparked a demand for such ingredients as vitamin C and probiotics to promote immunity and digestive health, respectively.

In its December 2019 “Juice in the US” report, Chicago-based Euromonitor International states that unlike other health trends, interest in digestive health has consistently grown as evidenced by increased sales of brands that offer added probiotics.

“Good Belly has been a standout brand within nectars and demonstrates the potential for juices which promote gut health,” the report states. “Long-declining juice drinks saw growth in value sales in 2019 thanks to the notable performance of the Bai brand.”

The importance of a healthy immune system is top-of-mind for most consumers, renewing interest in a familiar functional ingredient: vitamin C, states Mintel’s June 2020 Juice and Juice Drinks report.

Image courtesy of Caribe Juice Inc.

“As a result, demand for orange/citrus juice has skyrocketed, driving the category’s unprecedented growth. Industry giants (e.g., Tropicana, Minute Maid) and lesser-known brands (e.g., Uncle Matt’s Organics, Natalie’s Orchid Island) have both seen increased year-over-year sales,” the report states. “Consumers’ standing investment in wellness will make immunity claims a priority in the longer term. However, brands will need to address the pre-pandemic concerns that plagued the juice category (e.g., high sugar content, limited functional benefits) to maintain growth once hype surrounding the virus subsides.”

To compete with the growing list of niche better-for-you beverages such as still and sparkling waters, and nutritional drinks, juice brands will need to deliver on consumers’ definition of “healthy” in 2021, including the addition of premium added-value claims.

WTRMLN WTR, a brand of Caribe Juice Inc., released new functional blends that are made with watermelon juice, which is a source of natural hydration, and new functional ingredients, such as superfruit acerola juice, sea salt, turmeric, cayenne, hibiscus, ginger juice and tart cherry. Available in four varieties ― Hydration, Recover, Immunity and Antioxidant ― the functional watermelon blends contain 320 mg of electrolytes, 300 percent of the recommended daily amount of vitamin C and six times more potassium than traditional sports drinks, the company says.

Although the juice and juice drinks category is reinventing much of its offerings, experts still remain cautious about its performance in the long term.

“We believe once the impact of the pandemic has subsided, sales are likely to be softer and the category may see declines once again,” Hemphill said in the January eMagazine.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!