Category Focus

Off-premise spirits sales strong throughout pandemic

Super-premium, high-end spirits segments lead charge

The idiom “you look a bit off” often is used to alert someone that they look physically distracted or unwell. This past year, however, “looking a bit off” is taking on a whole new meaning for the U.S. spirits market.

“In 2020, the U.S. spirits market had a bifurcated performance, with the off-premise measured channels showing strong growth, while the on-premise channel suffered,” says Carolyn Lemoine, director of alcohol research for New York-based Beverage Marketing Corporation (BMC). “Overall, this led to total spirits market volume growth of 3 percent, while retail dollars were down 12-13 percent due to channel shifting to off-premise from on-premise, including eCommerce.”

According to data from Chicago-based Information Resources Inc. (IRI), the spirits market saw dollar sales increase 27 percent, totaling $10.1 billion for the 52 weeks ending Feb. 21 in total U.S. multi-outlets. Case sales also posted strong growth with an increase of 23.8 percent, IRI reports.

Chris Lombardo, team lead and senior analyst at Los Angeles-based IBISWorld Inc., denotes how the pandemic resulted in the distilling market experiencing a bump in off-premise sales at the expense of on-premise performance.

“The distilleries industry in the United States is expected to perform relatively well in 2020 amid the COVID-19 pandemic, particularly in comparison with other domestic alcoholic beverage producers, such as breweries,” he says. “Demand for alcoholic beverages remained high in 2020, as many consumers turn to alcoholic beverages during periods of distress or volatility due to its perceived effects. However, many distilleries were forced to close their in-house tasting rooms and bars amid the pandemic, and key on-premise markets, such as restaurants, bars and night clubs, experienced significant operational difficulties amid the pandemic, resulting in a substantial decline in demand from such markets.”

Although economic downturns typically have an adverse effect on super-premium and luxury spirits segments, early data suggests that has not been the case this time around.

“Conversely, operators benefited from increased off-premise sales and a rise in premium and super premium brands, bolstering revenue growth,” Lombardo explains. “While sales of super-premium brands generally suffer during periods of economic downturn due to their high price point, particularly in on-premise channels where they experience significant mark-up, the prices are more affordable at off-premise channels. Thus, consumers in relatively stable financial positions opted for such luxuries due to their relative lower costs, greatly benefiting revenue growth.”

Danelle Kosmal, vice president of beverage alcohol practice for Chicago-based NielsenIQ, details the bullish performance within the high-end spirits subset.

“For COVID [year-to-date], the high end of spirits grew by 37 percent, compared to the rest of spirits at 16 percent,” she explains, noting the timeframe is from March 7, 2020, to Feb. 27 in NielsenIQ off-premise channels. “Since the onset of the pandemic in the U.S., the high end of spirits gained 3.7 share points (dollars) of the spirit categories, compared to the previous year. High-end tequila was a big driver of this, gaining 2 share points of the spirits high end in 2020.”

In its “Market Information for Distilled Spirits” report, the Washington, D.C.-based Distilled Spirits Council also highlights the growth of high-end premium and super-premium tequila from the 2002 to 2020 timeframe.

“While value and premium brands are the backbone of the U.S. market, the fastest growth has been in high-end and super-premium brands,” the report states. “High-end brands have grown 663 percent in volume since 2002. Virtually unknown in 2002, super-premium tequila volumes have skyrocketed 1,330 percent and today account for 5.1 million 9-liter cases.”

IBISWorld’s Lombardo notes that the increase of premium spirit sales during the pandemic is somewhat expected because of their higher price point of value brands coupled with its perceived higher quality. But the rise of super-premium spirits was less predictable.

“The increase in the super-premium segment is a bit more surprising,” he explains. “As mentioned, amid the pandemic and economic downturn, most consumers are tightening their wallets. However, super-premium brands benefit from strong brand loyalty, and for consumers in relatively stable financial positions, purchasing super-premium spirits from off-premise channels is far more affordable than on-premise channels, where such brands experience substantial markups. Thus, with the primary outlet for purchasing industry goods being off-premise channels, such as liquor stores, consumers who can are splurging for the brands they would typically refrain from purchasing in on-premise establishments.”

On the rise

Although many of the spirits category’s segment posted growth in the past year, some have fared even better than the overall market’s performance.

“[Ready-to-drink] (RTD) cocktails experienced tremendous growth in 2020, as they met consumers’ needs for a convenient cocktail to drink at home,” BMC’s Lemoine says.

Lemoine highlights the following product attributes that have aided this segment’s growth:

- Easy and a wide variety of flavors.

- Cost-efficient.

- Portable for outdoor gatherings.

- Health-and-wellness attributes with low calories, carbohydrates and alcohol content.

According to IRI data, the premixed cocktail segment saw sales exceed $661 million, an increase of 88.2 percent for the 52 weeks ending Feb. 21.

NielsenIQ’s Kosmal notes that growth “spurts” among spirits categories emerged during different phases of the pandemic.

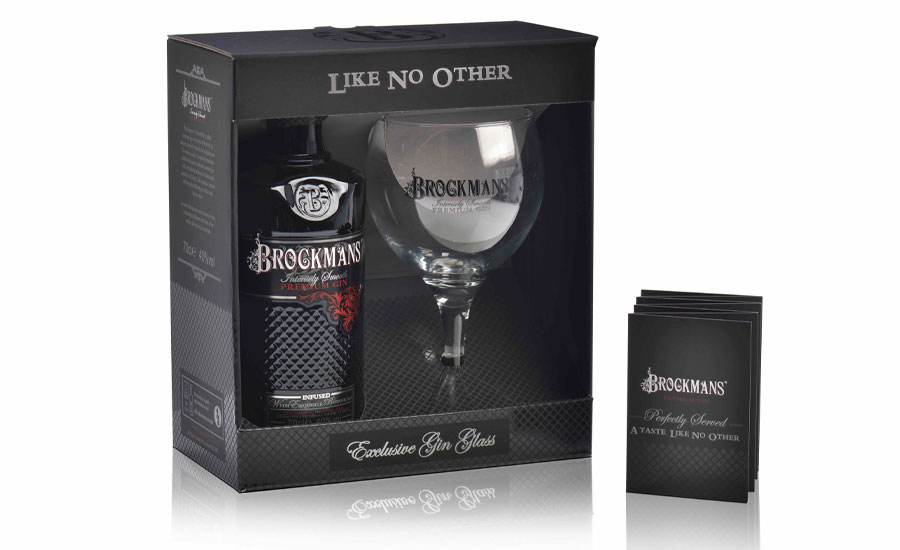

“For example, gin experienced stronger growth within the first months of the pandemic, up 45 percent in dollar growth for March/April/May, compared to growth rates of 40 percent for the total spirits category during that same time period,” she says. “It’s likely that during those initial months, some consumers were reaching for spirit products that offered familiarity and simplicity, like a gin and tonic. During the strongest growth weeks for gin, tonic water and lemon and lime juice were the fastest growing non-alcoholic beverage segments in NielsenIQ measured channels.”

Kosmal adds that cordials was another segment that outperformed the category as it was up 35.4 percent during the COVID year-to-date timeframe, which can be attributed to consumers’ shift to at-home consumption, and desire to create cocktails and indulge at home.

Although all spirits segments posted growth, some posted more modest growth performances in comparison to others.

“Vodka in particular is a spirits category that grew at a much slower pace (plus 16 percent) than other spirits categories,” Kosmal says. “However, it is important to note that there were pockets within vodka that had very strong performance, including Tito’s, which grew 34 percent in dollars, and was the top ranking brand across all of spirits, in terms of actual dollar growth in NielsenIQ off-premise channels.”

Also helping to boost the U.S. spirits market has been proliferation of eCommerce sales, experts note.

“In 2020, total online alcohol sales grew by 232 percent, with online spirits leading growth, up 396 percent,” Kosmal says. “Spirits also gained 6.4 share points of online alcohol dollars in 2020.”

BMC’s Lemoine adds the beverage alcohol eCommerce size and growth hit an all-time high as companies such as wine.com and Minibar have reported record growth. Meanwhile Vivino recently closed on Series D investments of $155 million and Drizly announced a $1.1 billion acquisition deal with Uber. Given this and consumer preferences, she expects online migration will continue.

“Consumers have now normalized eCommerce orders/deliveries of food/beverages in their everyday lives, and the migration to online will continue,” Lemoine suggests.

Areas of concern

Given the strong off-premise performance as well as signs showing on-premise is beginning to rebound, there are many reasons to be optimistic about the future for U.S. spirit sales. However, experts note the industry still has some outstanding challenges it’s eager to address.

“Particularly for spirits that can only be produced in the United States, such as bourbon, rising tariffs significantly affected distilleries’ export business,” IBISWorld’s Lombardo says. “Distilleries specializing in bourbon distilling reported experienced declines in exports of up to 60 percent due to the tariff spikes from key international importers. This plagued the industry for most of the second half of the five-year period and continued into 2020 amid the pandemic.”

Following the confirmation of Katherine Tai as the United States Trade Representative, the Distilled Spirits Council released a statement noting its eagerness to work with Tai regarding the issue of tariffs.

“The immediate and critical trade issue facing our industry is the urgent need to return to duty-free trade in distilled spirits between the U.S., EU and UK,” the statement reads. “While there has been some important progress in de-escalating trade tensions and suspending certain tariffs on EU spirits, it is essential that American whiskeys, including America’s native spirits, bourbon and Tennessee whiskey, are not left behind.

“The continued application by the EU and UK of a 25 percent tariff on American Whiskeys in response to the steel and aluminum dispute is having a devastating impact on our exports,” it continued. “Since the EU’s tariffs were imposed, American whiskey exports to the EU have declined by 37 percent and to the UK by 53 percent. American whiskey exports will nosedive even further with the scheduled doubling of the EU’s tariff to 50 percent on June 1, which cannot be allowed to happen.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!