2021 Beer Report: Amid COVID’s impact, craft beer turns to off-premise outlets

Craft beer category project to see volume growth through 2023

When the pandemic shut down on-premise outlets throughout the United States last year, craft brewers felt the pinch as they lost sales from traditional on-premise outlets as well as their own taprooms.

“Craft brewers experienced significant challenges amid the pandemic, as many, particularly nascent craft brewers, are reliant on on-premise sales, either at in-house bars or local food service establishments,” says Chris Lombardo, team lead and senior analyst for New York-based IBISWorld. “With these channels restricted, craft brewers have been forced to adapt quickly, with many offering on-site pick-up options or attempting to establish local off-premise channels. Many have been successful with such tactics, especially as consumers seek out different alcoholic beverages or reallocate money they would have spent at bars and restaurants on more expensive beverages.”

Although craft brewers have found ways to navigate the pandemic, Lombardo adds that the success of these tactics depend on the brands’ established consumer base prior to the shutdowns.

“Still, this is largely dependent on how established the craft brewer was prior to the pandemic and how well they have marketed to retain their core market and branch out,” he says. “Though many operators in this segment are expected to perform better than the industry’s goliaths (AB InBev, Molson Coors, etc.), operators in this segment are also at greatest risk of significant loses simply due to their not having as established of market connections as larger, well established breweries.”

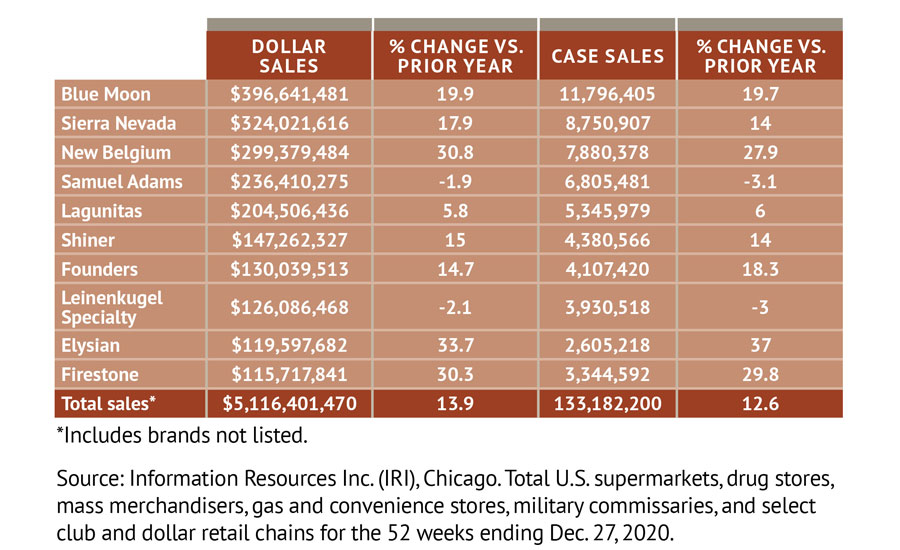

As noted, the category saw consumers shift to off-premise outlets to satisfy their taste for their favorite craft brews, helping offset years of deceleration for the beer category.

“Prior to the pandemic (52 weeks ending Feb. 29, 2020), craft beer off-premise sales were essentially flat, up 0.6 percent in dollar growth compared to the previous year,” says Danelle Kosmal, vice president of beverage alcohol practice for Chicago-based NielsenIQ. “However, given the shift in volume from on-premise to off-premise, sales in off-premise retail stores grew a lot in 2020, up 14 percent for the year, and up 16.1 percent during COVID months of 2020.”

IBISWorld’s Lombardo notes that prior to the pandemic, the craft beer market was reaching a maturation point likely because of overcrowding, which contributed to its deceleration of growth.

Despite this factor, experts anticipate that craft beer will be able to regain footing as on-premise outlets open up.

“[T]he macro trend of consuming local craft remains intact and it is likely that taproom strength will return post COVID,” says Brian Sudano, managing partner for New York-based Beverage Marketing Corporation.

In Chicago-based Mintel’s November 2020 report “Beer: Incl Impact of COVID-19 – US,” the market research firm projects that craft beer, along with imported beer, will avoid volume losses in 2020 and even experience gains through 2023. This stems from craft beer’s ability to appeal to consumers’ desire for unique beer styles.

“Craft drinkers are more engaged in the beer market, showing higher frequency consumption and an interest in brand and style exploration,” the report states. “The category as a whole has aptly taken a cue from craft success, leading to a slight dilution of the ‘craft’ claim. But the messaging holds and needs to be further emphasized. Beer drinkers want more, not less: flavor, artisanship, strong brand identity, natural brewing methods that can imply [better for you], help with moderation and all around excitement.”

Founders Brewing Co., Grand Rapids, Mich., is supporting consumers’ demand for more flavor with its KBS Espresso added to its 2020 Barrel-Aged Series last fall.

Originally released in late 2019, KBS Espresso was the very first variant of KBS, its bourbon barrel-aged chocolate coffee stout. KBS Espresso is amplified with a flavor that is already at the heart of the beer – coffee, the company says. KBS Espresso’s dark, roasted flavor come from espresso beans, roasted by its Grand Rapids neighbors Ferris Coffee & Nut. It gets some extra oomph, namely more aging on espresso beans after barrel removal, the company says.

“This beer was so much fun, we had to bring it back for another go ‘round,” said Brewmaster Jeremy Kosmicki in a statement. “There’s a lot of flavors going on in a bottle of KBS, as those who’ve had it before can attest. If the coffee is your favorite characteristic, then KBS Espresso is definitely for you.”

Craft brewers also are capitalizing on better-for-you beverage trends.

Stone Brewing, Escondido, Calif., launched Stone Features & Benefits IPA, a low-calorie, low-carbohydrate, gluten-reduced and low alcohol-by-volume beer. A sessionable brew, Stone Features & Benefits IPA is light bodied and crisp with orange, pear, white peach and melon hop character, the company says.

“We knew that making a vibrant, full-bodied IPA that's this low in calories, carbs and alcohol was going to be a huge challenge,” said Jeremy Moynier, Stone Brewing senior manager of brewing and innovation, in a statement. “Calories and carbs contribute a lot to the things we like in food and beer. But we weren't willing to just water down an IPA and call it a day. So, we went through countless iterations, mixing up the process and engaging in fermentation experimentation techniques. Even when we thought we'd landed it, we went back once more, working to make it even better. It became an all-company effort with our brewers here in Escondido, in Richmond, Va., and our Innovation Teams at the Stone World Bistro & Gardens – Liberty Station and Stone Brewing Napa all pooling our expertise to get this done to Stone's standards.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!