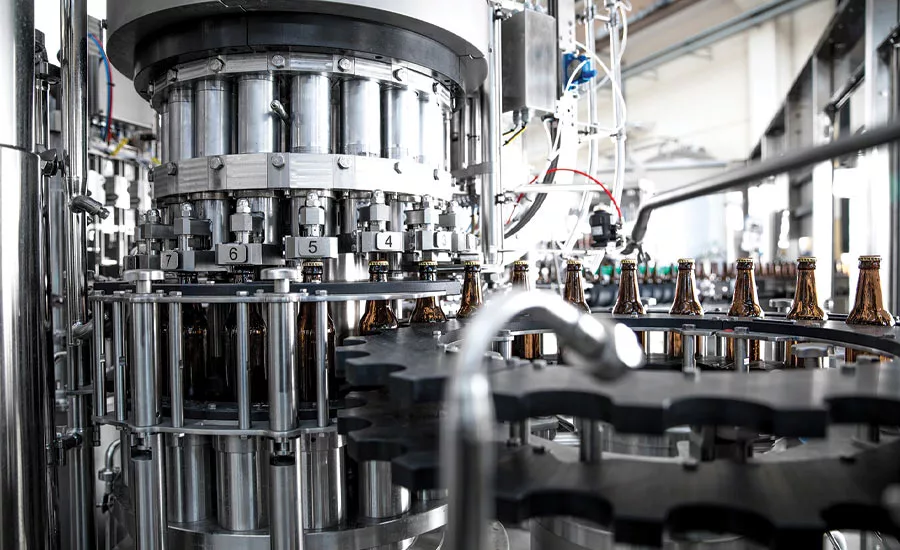

Packaging Equipment

Manufacturers demand flexible, eco-friendly filling technology

New filling technology to cut production time, environmental impact

The ultra-clean crowner manufactured by Sidel has stainless-steel construction with dedicated nozzles for the washing of the crimping area, helping ensure optimal hygiene and product safety.

Image courtesy of Sidel

In the fast-paced beverage market, safety, accuracy, flexibility and sustainability are of utmost importance. For industries such as food and beverage where manufacturing processes must be contamination-free, as well as quick and accurate, increasing demand for products filled by automatic filling machines rather than by humans is projected to grow the automatic filling machine market.

In its “Growth, Trends and Forecast (2020-2025) for the Liquid Filling Market” report, Hyderabad, India-based Mordor Intelligence reports the automatic liquid filling market is valued at more than $2.4 billion for 2020, and is expected to reach more than $3.6 billion by the end of 2025, at a compound annual growth rate (CAGR) of 7 percent during 2020-2025, largely because of the demand for processes that optimize product safety, accuracy and speed.

“Drink manufacturers need greater performance to match the overall rising demand for their products, while at the same time guaranteeing absolute food safety, minimizing the total cost of ownership (TCO) and preparing for future production needs,” says Stefano Baini, product manager of filling at Octeville-sur-Mer, France-based Sidel.

Safety and accuracy prove essential

Coupled with safety measures, SKU proliferation is having a great impact on filler technology. Bob Adamson, director of marketing for global filling systems and prime labeling at Promach Filling Systems, Waukesha, Wis., says that beverage manufacturers managing a growing number of SKUs and product types are doing shorter production runs that require quick, consistent product changeovers.

“Hand-in-hand with more frequent changeovers is the ever-present need to produce safe, high-quality products, requiring hygienically designed fillers with excellent clean-in-place (CIP) capabilities,” Adamson says. “Based on what customers are telling us, older filling equipment cannot keep up with these changing requirements, meaning lost productivity from longer changeover times and longer, more labor-intensive CIP cycles.”

To address this, Adamson says beverage manufacturers are focusing on proactive maintenance programs that reduce downtime, and are training personnel to effectively operate and maintain fillers.

“Beverage manufacturers also are buying new fillers, upgrading existing fillers when possible, or both,” he says. “Virtually all [our] customers are very interested in aftermarket upgrades and new filling system components that improve the performance of their fully amortized capital assets.”

Adamson also notes that interest in highly accurate, high-performance net weight filling systems is growing due to their extreme filling accuracy, especially with expensive, organic or exotic ingredients and non-GMO or value-added products.

“As product value increases, over-filling becomes an unnecessary expense and under-filling is a huge marketing black eye if consumers feel they have been shortchanged,” he says.

Flexibility aids production variety

Consumers’ beverage packaging preferences also are shifting, causing manufacturers to use nontraditional packaging for certain beverages.

Barry Fenske, product manager of technical sales in the filling division of Franklin, Wis.-based Krones Inc., notes an increased demand for aluminum cans, causing Krones to see can-filling gain traction.

“With demand for cans on the rise, customers are searching for canned products that haven’t traditionally haven’t been in cans, such as wine and water,” Fenske says. “As a result, designers will need to allow for a wider range of products to be able to flow through their filler, from clear to pulpy and low- to high-viscosity liquids.”

As a result, manufacturers are demanding flexible filling solutions that adapt to changing packaging requirements without incurring too much cost. Therefore, automatic filling machines that adapt to varied filling volumes, speeds and types of containers are a solution, experts note.

“Successful filling methods are those that are flexible regarding products and SKU proliferation in the market, which can make the difference between operating one filler instead of two,” Fenske says.

He explains that emerging filling technology with linear flow rate control through a filling valve with a combined filler/capper unit versus a typical two-speed control can mean filling a bottle in 0.5 vs. 7.2 seconds. In bulk quantities, this can save significant amounts of time, Fenske explains, suggesting that the days of fillers designed for just one product are gone.

Sidel’s Baini adds, “Flexible filling solutions need minimal changeover times and have the ability to handle both still and carbonated beverages, as well as hot-, ambient- and cold-filled beverages.”

Sidel’s EvoFILL Can filler is catering to this demand. Filling carbonated soft drinks (CSDs) at ambient temperature, the machine also can handle still drinks in hot-fill, accommodating a wide range of beverage applications. EvoFILL Can is particularly suitable for producers requiring speeds from 40,000 to 130,000 cans an hour.

Minimizing environmental impact

Along with efficiencies, manufacturers are requesting filling machines that use less energy, water, chemicals and raw materials to help reduce operating costs and help manufacturers lower their environmental impact, Sidel’s Baini says.

To address this, Sidel’s EvoFILL Can and EvoFILL Glass, which leverage the Sidel Matrix platform, are hygienic, flexible and sustainable approaches to high-speed output bottling lines, Baini says. EvoFILL Glass holds dissolved oxygen pick-up down to 10 parts per billion, processing a wide range of filling levels without probe adjustments. Additionally, its 48 to 192 filling carousel valves enable filling speeds of 25,000 to more than 80,000 bottles an hour for bottles ranging from 200 ml to 1-liter in size.

“Increased flexibility and product diversification, coupled with a growing attention to environmental gains and a continuous search for utmost product quality are some of the most significant factors currently driving filling developments in the beverage industry,” Baini says.

Krones’ Fenske notes that beverage manufacturers also are facing the challenge of creating a smaller carbon footprint, and using less water and carbon dioxide (CO2) for carbonated beverages. He also recommends that manufacturers aiming to improve environmental impact invest in newer, volumetric can-filling technology.

Krones’ Dynafill technology, for example, processes more than 100,000 containers an hour and consumes 20 percent less CO2 in a smaller footprint. The Dynafill features a closed hygienic filling and capping area that eliminates return gas feedback into the product bowl and uses high-pressure injection to ensure product purity and eliminate product loss during filling, Fenske says.

“[Krones] currently utilizes low-pressure CO2 can flushing prior to filling, which uses less carbon dioxide,” he explains. “To use less water, we capture rinse water for bottles and reuse it for the post-crowner bottle exterior wash-off. We also get better yields with filling valves that police their accuracy and adjust filling to maintain it.”

On the horizon

Looking ahead, implementing new filling technology initiatives requires manufacturers to consider many factors to determine which equipment is right for their operation to ensure the equipment runs smoothly and can adapt to meet future needs.

“The choice of technology, the size of the selected equipment, the definition of line controls and automation, the actual footprint of the line, management of raw materials and other resources are all essential decisions in engineering a line,” Sidel’s Baini says. “As a result, we see complete line solutions as a logical choice for simplifying the customers’ reality from purchasing, installation and commissioning and, most importantly, throughout the line’s operational lifetime.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!