Technomic, BMC release on-premise report

Report reviews drink sales in restaurant, bar business

Drink sales remain a dynamic and important part of the restaurant and bar business, but finding growth continues to be a challenge for operators and brand marketers alike. Slowed consumer traffic at on-premise locations and stagnancy in occasions involving adult beverages translates to flat total alcohol volume in restaurants and bars in 2017, according to the recently released “On-Premise Intelligence Report,” jointly developed by Technomic, a Chicago-based Winsight company, and New York-based Beverage Marketing Corporation (BMC).

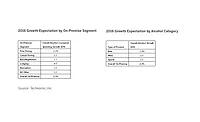

The following are some of the key findings from the report:

- Adult beverage category dynamics continue to evolve, with spirits outpacing beer in volume growth.

- Wine is challenged, experiencing its fourth consecutive year of volume decline on-premise in 2017.

- Year-end dollar sales are expected to increase 2.1 percent, primarily driven by higher drink prices and the continued growth of premium products at bars.

- The appeal of differentiated and flavorful adult beverages and the importance of supplier support is evident in the roster of the fastest-growing brands in on-premise, which are led by Tito’s Handmade Vodka.

“Growth categories remain aged spirits — whiskey, brandy, cognac and aged rum — while vodka volume is down slightly,” said Eric Schmidt, director of alcohol research at BMC, in a statement. “In beer, imports and craft are gaining share, propelled by Mexican brands and smaller craft labels. We are tracking mixed results from leading domestic table wine brands, while imported sparkling wine continues to find relevance at the bar.”

Although volume growth is elusive, drinks remain an important aspect of going out for consumers, according to Donna Hood Crecca, associate principal at Technomic. “Consumers prioritize adult beverages, with one-third overall and half of those aged 21 to 34 confirming that the drink offering influences their decision of where to go,” she said in a statement. “Today, consumers have more choices, as venues ranging from sports stadiums to winery and brewery tasting rooms are in the consideration set, which raises the bar for traditional locations like restaurants. Improving and differentiating the drink experience is key to success.”

The “On-Premise Intelligence Report” includes channel, category and brand performance metrics; consumer and operator insights; and menu trend information developed via primary research conducted by Technomic and BMC, the companies say.

To provide enhanced consumer insights, profiles of Technomic’s Drinker Archetypes are included in the report. This on-premise adult beverage consumer segmentation tool uses psychographic and attitudinal metrics to identify five archetypes and deliver insights around motivations and decision drivers, it says. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!