Private-label beverages performing well in changing marketplace

Jet.com launches new private-label brand, Uniquely J

Although the economy is fairly stable, today’s consumers view the consumer packaged goods (CPGs) market differently, buying products first based on need and second based on brand, a plus for private-label marketers, says Susan Viamari, vice president of Thought Leadership for Chicago-based Information Resources Inc. (IRI).

“As detailed in our private-label trends report, private label is viewed as a viable CPG solution, not just a low-priced alternative to a national brand option,” Viamari says. “Today’s consumers, particularly younger consumers, increasingly make product selections to address specific needs/wants, and secondarily [based] on the name on the front of the package.”

In its September report titled “Realigning for Growth: Win by Innovating across CPG Market Segments,” the market research firm notes that American consumers are guided by such attributes as single-serve packaging, minimal calorie counts, high protein or gluten free.

“The shift in thinking — and buying behaviors — has come about quickly,” the report states. “In just the last decade, consumers’ choices have moved away from a focus on form (water or coffee, for instance) and a spotlight on brand to an emphasis on the benefits for the buyer. The beverage sector has been changing at a much faster clip than many other CPG segments.”

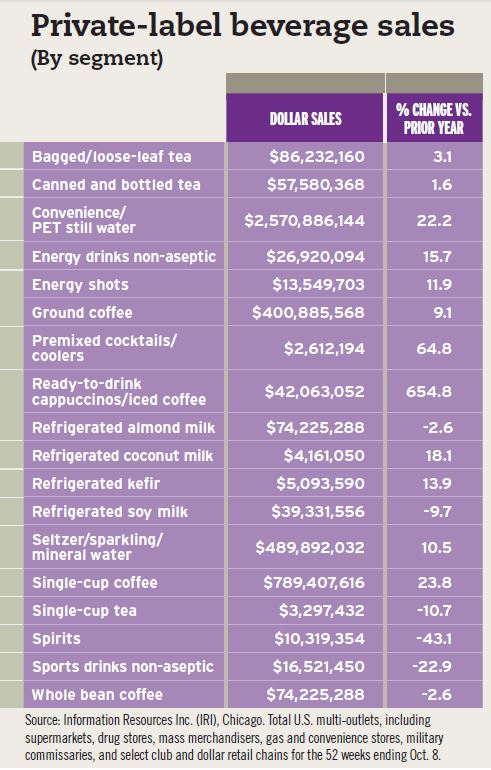

As a result, private-label beverages are performing well. In U.S. multi-outlets, private-label beverages generated dollar sales of more than $7.8 billion for the 52 weeks ending Oct. 8, a 7 percent increase compared with the prior-year period, IRI data indicates. National and private-label beverage brands combined accounted for sales of more than $92.4 billion, a 1.2 percent increase year-over-year, according to the data.

“Both non-alcoholic and alcoholic private-label beverages outperformed the industry overall and the private-label sector of the industry,” Viamari explains. “Liquor has been a standout, with double-digit growth on a much smaller base.

“In the alcoholic private-label sector, premixed coolers and wine saw phenomenal growth (coolers up 64.8 percent; wine up 70.3 percent),” she continues. “Growth in this area is largely attributed to rapidly increasing assortment. Additionally, private-label wine is moving more units with promotional support, and price is higher versus prior year due to more premium selection and price increases.”

Total liquor dollar sales increased 1.9 percent, while private-label liquor sales rose nearly 17 percent, she adds.

Within the private-label alcohol market, wine is outperforming spirits, says Eric Schmidt, director of alcohol research at New York-based Beverage Marketing Corporation (BMC).

“Wine already has plenty of choices, and companies like Costco and 7-Eleven are giving similar quality wines priced 20 percent lower than competing brands,” he says. “In alcohol, the main factor is price. Private label offers the consumer great value for the money.”

To that end, Irving, Texas-based 7-Eleven Inc. announced the expansion of its selection of private brand wines with the launch of Trojan Horse white wines in Chardonnay and Pinot Grigio varietals. Each 750-ml bottle has a suggested retail price of $6.99.

Although private-label performance varies by category, liquid refreshment beverages are growing faster than the total market, notes Gary Hemphill, managing director of research at BMC.

“A significant part of that growth is driven by water — both sparkling and still,” Hemphill says. “In refreshment beverages, bottled water is the star private-label performer, likely driven by the reality that consumers are less brand loyal in that category. Some other categories are doing well also, but most of them from a very small private-label base such as energy and [ready-to-drink] (RTD) coffee.”

Brewing savings

Jordan Rost, vice president of consumer insights at New York-based Nielsen, also highlights the positive performance of private-label tea and coffee, citing Nielsen data ending Sept. 30.

“For example, the refrigerated liquid tea category is growing at 4.5 percent in dollars overall. Private label varieties are up 4.7 percent, slightly outpacing branded growth at 4.5 percent,” Rost says. “Despite the fact that the coffee category is actually contracting, posting declines of close to 1 percent this year, … store-branded coffee saw growth of 13 percent. Private-label coffee has grown nearly two share points to represent 15 percent of coffee category dollars.

“Similarly, herbal tea has seen double-digit growth (up 11 percent in dollars versus [a] year ago) from private-label products, which far outpaces branded herbal teas, which saw 3 percent growth,” he continues.

IRI’s Viamari notes several non-alcohol private-label categories are experiencing “mid-size” double-digit growth, including milk flavoring/cocoa mixes, up 37.4 percent; energy drinks, up 14.8 percent; coffee, up 14.8 percent; and shelf-stable non-fruit drinks, up 12.7 percent. The RTD coffee and tea market is seeing triple-digit growth of 206.7 percent, she adds.

“Coffee is one of the largest private-label categories; the others are ‘mid-size’ based on dollar sales,” Viamari says. “These categories support key beverage trends — on-the-go energy, healthier-for-you, exciting flavors and experiences.”

In its October report titled “Private Label 2017: The Evolution of Private Label in a Transforming Marketplace,” IRI notes that the private-label marketplace is rapidly evolving, particularly as new market entrants turn “the old way” on its head.

“Costco is focused on driving private label penetration from the current rate of about 25 percent of sales to 37 percent of sales; focus is on Kirkland Signature natural and organic products and increased scope of co-branded products,” the report states. “… Amazon.com’s private-label sales (all-inclusive) are expected to top $4 billion this year, including $700 million in private-label sales from newly acquired Whole Foods.”

Evolving marketplace

As eCommerce and its private-label presence continues to grow, more online companies are launching private-label brands as well.

For example, in October, online retailer Jet.com, a division of Bentonville, Ark.-based Walmart Stores Inc., announced the release of its new private-label brand, Uniquely J, which aims to disrupt the eCommerce experience by “injecting more fun into shopping for groceries online,” the company said in a statement at the time of release.

Brand design consultant Elmwood designed the brand experience for Uniquely J, which premiered more than 50 SKUs in the coffee, cleaning, paper and food storage categories. The brand's packaging features illustrations and is designed to meet the unique needs and shopping behavior of the 21st century urban millennial, the statement says.

The positioning of products in-store continues to be a factor in the success, or lack thereof, for foods and beverages, states Chicago-based Mintel in its February report titled “Private Label Food and Drink Trends – US.”

“Looking across beverage categories, private-label items typically found on or near the perimeter of the store, such as bottled water, almond milk and yogurt drinks, have done well. According to Mintel’s ‘Bottled Water – US, January 2016’ report, private-label brands saw some of the strongest growth from 2014 [to] 2015 since price is important to 62 percent of consumers when purchasing bottled water,” the report states.

Private-label dairy products also are resonating as they represent 58.9 percent of dairy milk sales, while the popularity of almond milk led to a 50.8 percent increase in private-label almond milk sales from November 2014 to November 2015, according to Mintel’s March 2016 “Dairy Milk – US” report.

Niche categories like almond milk are helping private-label marketers expand their product offerings, BMC’s Hemphill says.

“In refreshment beverages, private-label marketers have been quicker to move into niche segments because these are the fastest-growing segments,” he explains. “Historically, private label was more focused on the largest categories because they offered the greatest volume opportunities but this has changed as the marketplace has shifted.”

BMC’s Schmidt adds, “Within alcohol, with the growth of the big box and convenience channel, we’ve seen a proliferation of brands in the marketplace.”

Looking across all categories, Nielsen’s Rost notes that private-label products comprise approximately 20 percent dollar share on average at a total channel level.

“By comparison, the value grocery channel stands out as the most private-label focused. With 49 percent of dollars represented by private label, these deep-discount retailers hold store brands close to their strategic priorities,” Rost says. “… While store brands represent just 16 percent of coffee sales in conventional grocery, private labels comprise 48 percent dollar share in the value grocery channel. The same divergence is present among soft drinks (15 percent store brand share of soft drinks in value grocery vs. 7 percent store brand dollar share in conventional grocery) and shelf-stable juices and drinks (41 percent store brand share of shelf-stable juices and drinks in value grocery vs. 16 percent store brand dollar share in conventional grocery).”

IRI’s Viamari adds: “The convenience channel is historically a very strong beverage channel. Private-label performance within c-store is solid, but private-label beverages are outperforming by a significant margin. Sales are still relatively low, but assortment and growth is quite strong.”

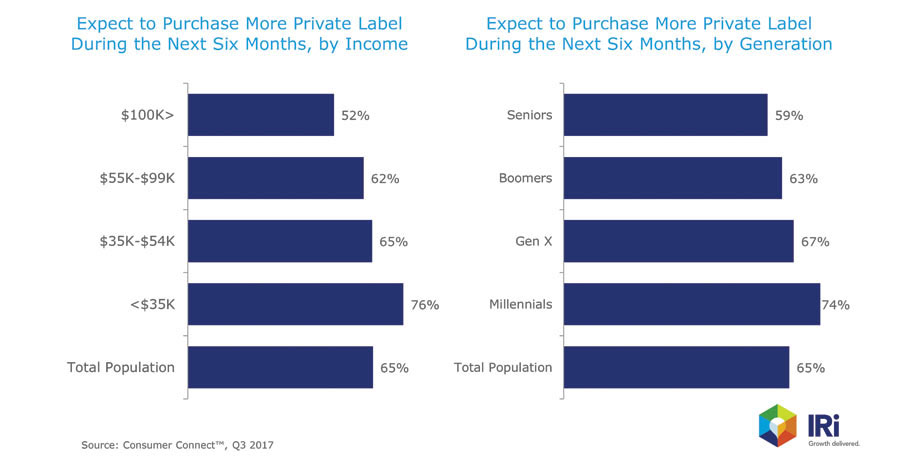

Consumers also continue to rely on private-label products to help make ends meet particularly because 31 percent of U.S. households are struggling to afford groceries in the third quarter of 2017, according to IRI Consumer Connect survey results.

Click image to expand

A majority of consumers anticipate more frequently purchasing private-label options during the next six months, particularly millennials and lower-income consumers, IRI’s Susan Viamari says. (Image courtesy of IRI)

“As a result, 89 percent of these lower-earning shoppers and 90 percent of millennials are buying private-label brands to save money,” the market research firm says. “Seven out of 10 millennials prefer stores that offer a wide selection of private-label products; nearly 66 percent often buy private label over name brands.”

Driven by more product options and cost-conscious consumers, private-label beverages are expected to continue growing, market research analysts say.

“With the growth in beverage alcohol, the future for quality, lower-priced alternatives to name brands looks positive, particularly as the consumer becomes more cost conscious,” BMC’s Schmidt says.

IRI’s Viamari adds: “Prospects for private label growth are good. Consumers see private label as a viable option — good value and good quality.” BI

Private-label beverage sales by segment for the 52 weeks ending Oct. 8, according to Information Resources Inc. (IRI).

A majority of consumers anticipate more frequently purchasing private-label options during the next six months, particularly millennials and lower-income consumers, IRI’s Susan Viamari says. (Image courtesy of IRI)

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!