Energy market maturing, growth expected to slow

Organic, functional innovation essential for energy drink and shot growth

During the past decade or so, the energy drinks and shots category has experienced solid growth. In 2016, wholesale dollar sales for energy drinks grew 7.3 percent to $7.8 billion, according to Roger Dilworth, senior editor at New York-based Beverage Marketing Corporation (BMC). Energy shots, on the other hand, experienced 2 percent wholesale dollar sales growth in 2016, to reach $651 million. However, as the market begins to mature, growth is expected to slow.

“Energy drinks have already performed better than anyone could have expected, so inevitably their growth will slow to the 4.5 percent to 5 percent annual range in the next five years,” Dilworth says.

Los Angeles-based IBISWorld also forecasts slower growth in its October 2016 “Energy Drink Production in the US” report.

“The energy drink production industry has experienced substantial growth over the past five years,” it states. “While the industry attained double-digit growth during parts of this period, its growth has significantly decelerated from the previous decade. This deceleration is characteristic of a growing industry that is approaching saturation.”

In its September 2016 “The U.S. Energy Drink Market” report, BMC forecasts moderate growth through 2020.

“Wholesale dollar sales are anticipated to advance at a 7.6 percent compound annual growth rate (CAGR) to finish 2020 at $10.5 billion,” it states. “Although retail dollars won’t grow as fast from a percentage standpoint, 2020’s anticipated sales of $18.5 billion would not be anything to sneeze at.”

Category growth has largely been a result of the energy drinks segment, according to Chicago-based Mintel’s May “Energy Drinks – US” report. The energy drinks segment makes up approximately 90 percent of the total energy market, it states.

The energy drinks segment remains dominated by Austria-based Red Bull GmbH and Corona, Calif.-based Monster Beverage Corp., which maintain 38.3 percent and 26.8 percent of the market, respectively, according to IBISWorld’s report.

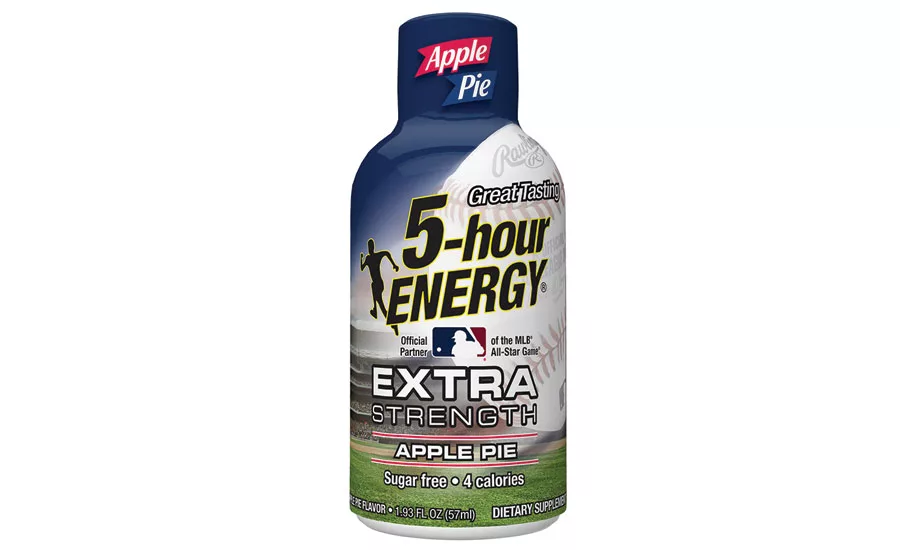

Comprising 27.5 percent of the market, energy shots are expected to continue to grow through 2021, the report states. The success of Farmington Hills, Mich.-based Living Essentials LLC’s 5-hour Energy, which dominates the market, has drawn competitors into the energy shots market, it notes.

“Energy shot products differentiate themselves from the larger energy drinks segment by providing a drink that is quickly consumed and provides immediate energy,” it states. “5-hour Energy also attempts to differentiate itself by marketing itself as a healthier alternative than larger energy drinks, and it also emphasizes the lack of sugar and caffeine in its products.”

The report notes that health concerns about many energy drinks and shots could negatively impact the energy category. However, BMC’s Dilworth explains that these concerns have begun to subside. Because of regulatory threats and mainstream media headlines, some consumers might have been deterred from the category, he says.

“However, energy drinks’ core audience seems to be less likely to change their consumption behavior due to these scares, so the few that are turned off might not have been steady energy drink consumers in the first place,” Dilworth adds.

Naturally energized

Despite current growth, market research firms expect that in new product development will be essential to ensure future category success. Although the category benefits from a loyal consumer base, mostly consisting of young men, reaching potential energy drink/shot consumers will help to maintain growth.

“Opportunities for market growth lie in conversion of light users of energy drinks/shots and those who currently express limited interest,” Mintel explains in its report. “The Top 3 qualities these consumers say would lead them to increase usage of energy drinks include less sugar, longer lasting energy and refreshing flavors. Simpler, natural formulations and quality ingredients could be an effective way to expand the market and especially to reach women.”

Although energy enhancement is the top reason consumers site for energy drink consumption, other benefits also are cited, according to Mintel’s report.

“Whether because of an energy slump, a desire for energy throughout the day or for an afternoon pickup, wanting more energy is, not surprisingly, the core factor driving usage of energy drinks or shots,” it states. “However, secondary reasons related to taste, mood, mental acuity and workout energy suggest additional benefits to energy drinks, which can set them apart from competing beverages.”

Brian Zapp, director of marketing at Applied Food Sciences Inc. (AFS), Austin, Texas, also notes the evolution of energy consumers.

“The changing landscape of energy drink consumers has a lot to do with this surge in natural caffeine and energy ingredients,” he says. “The rate of inquiries is a response to consumers seeking cleaner, better-for-you, more natural ingredients. Another major influence on this growing market is the demand for more hybrid offerings where more than one functional benefit is provided to the consumer.”

Added health benefits or functionality could be advantageous for energy drinks and shots, according to Mintel’s “What’s Next?” report. In the report, Mintel highlights that 48 percent of consumers would be more interested in category products that contain antioxidants, while 23 percent would be in those that contain superfoods.

Because energy products have a consumer perception for containing artificial ingredients or having a high sugar content, the demand for better-for-you (BFY) alternatives, healthier, natural and organic options could offer growth opportunities, according to Mintel.

“In a context where consumers are concerned with weight gain and overall health, the high sugar content, synthetically sourced caffeine, artificial ingredients and additives associated with traditional energy drinks pose a challenge to traditional suppliers,” the “Energy Drinks – US” report states. “… Mintel’s research shows that energy drinks are widely associated with caffeine, sugar and artificial ingredients, which creates challenges in a context in which many consumers are drawn to BFY beverages.”

The report notes that as more consumers enjoy the benefits of BFY beverages, they’re now looking for the BFY traits in the energy category.

“Interest is also high for energy drinks offering more specialized, natural, premium ingredients and enhancements associated with added health benefits,” it states. “Interest in such innovations reflects consumer readiness for energy drinks that integrate qualities from BFY beverages. Consumer exposure to functional drinks such as kombucha, with its digestive advantages, antioxidant-laden teas, enhanced juices and vitamin waters suggests the time is ripe for energy drink offerings with more hybrid qualities, including enhanced health benefits. Consumer interest is highest for energy drinks offering antioxidants and probiotics, supporting the expansion of product lines with these qualities.”

In fact, the report notes that about 25 percent of respondents to its survey say that they’re unfamiliar with the ingredients in energy drinks/shots, and 16 percent say that labels should show the origins of the ingredients.

“Among consumers who are interested in but don’t regularly use energy drinks, factors they cite as likely to incite greater usage include more natural flavors (31 percent), ingredients they recognize (28 percent) and organic options (21 percent),” Mintel states in its “What’s Next?” report.

Despite growing demand, the “What’s Next?” report notes that most large suppliers have not launched products with these cleaner-label traits.

“With the exception of Rockstar, which has introduced an organic variation, most mainstream suppliers still use a mix of nonorganic, artificial and natural ingredients,” it explains. “However, a number of fast-growing smaller suppliers in the energy drink segment reflect consumer demand for more premium and organic offerings.”

As consumers look for more healthful energy alternatives, IBISWorld expects energy drink/shot manufacturers to begin offering more of these products.

“As a result of growing demand for all-natural beverages, manufacturers are expected to introduce a variety of all-natural and organic energy drinks, appealing to consumers who are wary of the negative health consequences of artificial ingredients,” it states in its report.

Game on

More entrants and a growing number of hybrid, caffeinated beverages are increasing competition for energy drinks and shots, Mintel notes in its “Energy Drinks – US” report.

“While energy drinks have enjoyed strong growth from 2011 to 2017, many competing beverages are available and widely consumed, including caffeinated tea, coffee, enhanced water, juices and hybrid drinks, many of which promise energizing benefits,” the report states. “The sheer number and range of competitive beverages, including many associated with more natural ingredients, poses an underpinning challenge to the energy drinks market.”

As competition grows, one-fifth of consumers say that they’re “overwhelmed” by the amount of choices available for energy enhancement, Mintel reports.

Going forward, competition will continue to grow, according to Mintel. Addressing consumers concerns and innovating new product offerings with value-added traits will be beneficial, it states.

“High levels of engagement among males 18-34, millennials, Hispanics and parents have supported market growth and should continue to propel future sales,” the report states. “Competition from BFY beverages, however, as well as from [ready-to-drink] (RTD) coffee and tea, is substantial and growing. To ensure continued growth, suppliers will need to address consumer concerns about safety and ingredient transparency. They will need to innovate flavors and formulations, including development and promotion of more natural, organic, enhanced formulations.”

AFS’ Zapp adds that eCommerce also will play a role in the energy market going forward. Consumers now search for products online first, and energy companies can capitalize on making personal connections via social media, he says.

“Energy companies are realizing that consumers search first on Google for a product and then on social media,” he says. “The world of consumer behavior now has more options than ever, and [consumers] look to buy more energy drinks based on emotional connection and loyalty as compared to price in the past. Therefore, energy companies will need to create better ways to connect with their consumers online that use social platforms on a daily basis and spread by word of mouth to their friends and family.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!