Coconut water market growth continues, but at smaller rate

Unflavored varietals dominate market, health and wellness drives sales

Previously known for bikini tops and one of Harry Nilsson’s hit songs, coconuts have gained a much more respectable persona in the minds of U.S. consumers within the past several years. Now known for an ever-increasing number of health benefits, coconut products have exploded within the United States. The growth of the ready-to-drink (RTD) coconut water category largely has been driven by the United States, which also is the largest market for the product, according to an October 2015 report from Technavio, London, titled “Global Coconut Water Market 2015-2019.”

The growing interest in health and wellness has been the main driver for the U.S. coconut water market, according to experts. “There has been a shift in the consumer marketplace,” New York-based Nielsen’s Director of Strategic Insights Andrew Mandzy says. “People are more proactive with their health, and they are seeking healthier food and beverage options with simpler ingredients. In the highly competitive beverage category, we see many more healthy and less sugary options. There is a movement to ‘back to basics’ eating and drinking, seeking out foods and beverages with simpler ingredients. Coconut water is very firmly within this group and has benefited as a result.

“Growth in coconut water has been impressive the past few years,” he continues. “By growing distribution in retail, and by riding the broader trend of consumers seeking out healthier beverage options, the category has outpaced established beverage categories like bottled water and energy drinks. Coconut water has grown around 50 percent over the last two years, and grew 16 percent last year alone.”

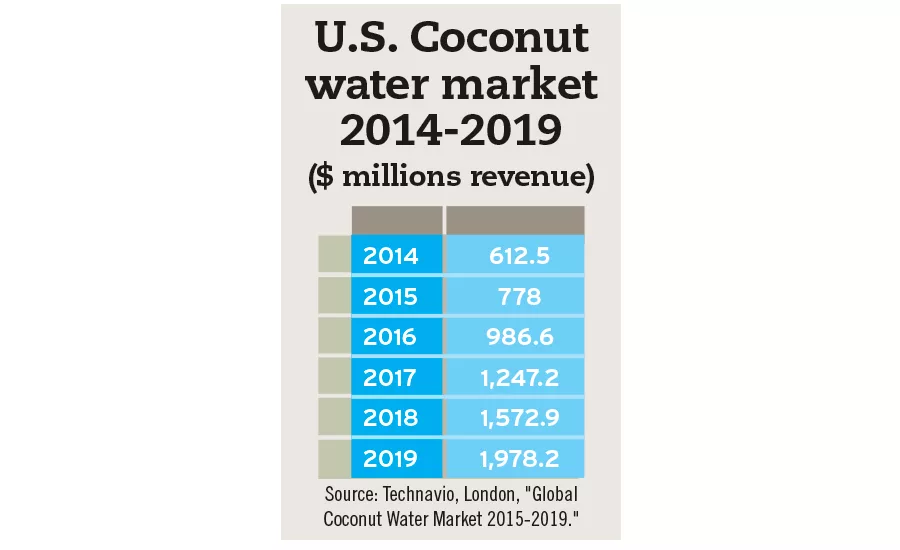

According to Technavio’s report, the U.S. coconut water market growth rate exceeded the global growth rate in 2015, with growth of 27 percent and $778 million in revenue. Although growth will continue for the category, the market research firm expects the global growth rate will outperform the United States by 2019. Technavio estimates that by 2019, coconut water will accumulate nearly $1.9 billion in revenue for a growth rate of 25.8 percent in the United States. However, this is lower than the 2019 global growth rate, which it estimates at 28 percent.

Nielsen’s Mandzy also foresees growth for the category. “There are some really strong tailwinds helping this category,” he says. “First and foremost is that consumers have shown, and likely will continue to show, a clear appetite for fresher, simpler and healthier ingredients in their foods and beverages. This positions coconut water very well for strong growth into the future.”

Technavio’s report highlights that the U.S. coconut water market is dominated by three players — Vita Coco, O.N.E. and Zico.

New York-based All Market LLC, doing business as Vita Coco, leads the market and offers three lines of coconut beverages: Vita Coco pure coconut water, Vita Coco Café Latte and Vita Coco Kids. According to Chicago-based Information Resources Inc. (IRI), All Market was the top-grossing vendor among aseptic juices with $186.5 million in sales, a 17.5 percent increase in dollar sales for the 52 weeks ending Dec. 27, 2015, in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains.

For aseptic juice drinks, the Vita Coco brand amassed $7.1 million in dollar sales, an increase of just under 8 percent; however, Vita Coco Kids experienced a 35.3 percent drop in dollar sales generating approximately $2.3 million in sales for the 52 weeks ending Dec. 27, 2015, according to IRI data.

Purchase, N.Y-based PepsiCo’s O.N.E brand also experienced varying results. Its aseptic juice drinks experienced a 29.3 percent decline, generating approximately $7.3 million in dollar sales for the 52 weeks ending Dec. 27, 2015, while O.N.E. aseptic juices experienced a decrease of less than 1 percent, amassing sales of nearly $25.1 million, according to IRI data.

Also within aseptic juices, Zico, a brand of Atlanta-based The Coca-Cola Co., experienced a 13.3 percent increase in dollar sales, garnering nearly $19.2 million in sales for the 52 weeks ending Dec. 27, 2015, according to IRI data. Additionally, Zico aseptic juice drinks generated approximately $3.5 million in sales, an increase of 8.2 percent, for the same timeframe.

Adding some flavor

As coconut water grows in popularity, beverage-makers are adding new varieties to innovate the juice product. According to Nielsen’s Mandzy, flavored coconut water makes up approximately 12 percent of category sales and were up 15 percent versus last year.

“Pineapple coconut water, which has the most sales among the flavors, has grown 54 percent over the past year,” he says. “Other popular flavors include lemonade, chocolate and mango, all with varying levels of growth.”

Coffee, watermelon and tea flavors also are popular, notes New York-based Beverage Marketing Corporation’s (BMC) Analyst Roger Dilworth.

In line with this, Harmless Harvest Inc., New York, launched 100% Raw & Organic Coconut Water with Fair Trade Coffee last year in Whole Foods Markets nationwide. The beverage mixes raw coconut water with organic Peruvian coffee beans, the company says.

Playing on the interest in both lemon and tea flavors, Vita Coco launched Vita Coco Lemon Tea this month. A play on an Arnold Palmer, the new flavor is a blend of black tea, sugar, lemon puree and natural lemon flavoring, the company says. The new varietal is available in 500-ml sizes and are sold exclusively at Kroger stores with a suggested retail price of $2.99 each.

Last March, Zico launched a watermelon-raspberry flavor. Zico Premium Watermelon Raspberry Flavored Coconut Water combines 100 percent coconut water with natural fruit-forward flavors of watermelon and raspberry, the company says. With 90 calories in a 14-ounce bottle, it does not contain artificial flavors or added preservatives, it adds.

However, Nielsen’s Mandzy notes that although flavored coconut water has seen steady growth, the varietals lag behind plain coconut water. “Tropical varieties, such as pineapple coconut water, continue to be amongst the strongest performing flavors,” he says. “Based on Nielsen data, sales have grown 54 percent versus last year, and the year before that, pineapple grew 31 percent. There is still opportunity for growth for this variety because retail distribution is not even at the level of plain coconut water.”

BMC’s Dilworth illustrates this through the performance of Vita Coco’s various lines. He says that according to the company, although Vita Coco Sport (discontinued), Vita Coco Kids and Vita Coco Café have not performed to expectations, the core line has enjoyed growth domestically.

He adds that Vita Coco’s 1-liter aseptic unflavored SKU now is the company’s top-selling item.

Additionally, Technavio’s report highlights the prominence of unflavored varieties. “In terms of number of new launches in 2014, the unflavored segment dominated with 32.3 percent, followed by the flavored ones,” it states.

It lists pineapple, green tea, mango and orange as the top new flavored coconut water launches in 2014, and highlights the natural properties of unsweetened/unflavored coconut water for its growth in popularity.

In December 2015, New York-based Pure Brazilian launched its self-titled coconut water in the United States. The company uses hand-cut añao coconuts in the product. The coconuts are cold-pressed and never heated or concentrated, the company says. Each 13.5-ounce bottle is the equivalent of two fresh coconuts, it adds.

Additionally, BMC’s Managing Director of Research Gary Hemphill notes that coconut waters' positioning as nature’s sports drink as another factor driving category growth. Beverage-makers recently have launched flavored coconut water-based sports drinks to play on the growing understanding of coconut waters’ benefits to athletes.

Huntington, N.Y-based ROAR Beverages launched the first product in its Odell Beckham Jr. Series of sports drinks late in 2015. ROAR OBJXIII is a strawberry- and watermelon-flavored, coconut water-based sports drink, the company says.

Finding the supply

Since 2004, the category’s robust growth has come with some potential challenges — namely, sourcing. Although, the market is expected to begin experiencing smaller growth numbers in the next few years, a shortage still could be a threat, the Technavio report notes. “The main challenge faced by the coconut water market in the U.S. is the shortage in supply of fresh, tender coconuts,” the report states. “As the U.S. imports most of its coconuts from the South Asian countries, the lower production rate is negatively affecting the demand.”

According to the report, nearly 90 percent of the global production of coconuts comes from five countries: Indonesia, which produces 18 million metric tons; The Philippines, producing 15.9 million metric tons; India, contributing 10.6 million metric tons; Brazil, which produces 2.9 million metric tons; and Sri Lanka, which contributes 2 million metric tons of coconut.

“Initially, coconut water companies in the U.S. sourced their coconuts from Brazil,” the report states. “But gradually the demand increased and supply was not able to meet demand. Hence the companies started to source their coconuts from the [Asia-Pacific] (APAC) region. Most of the coconut groves in the APAC region consist of coconut trees, which are more than 50 years old. The most useful period of coconut trees is between 10 and 30 years. Thus, over the coming few years, the world may face an acute shortage of tender coconuts, which would become a hindrance to the growth of the market.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!