2017 State of the Beverage Industry: Sports and protein drinks see steady growth

Women, seniors growing demographics for sports, protein products

With health-and-wellness trends driving product innovation, sports and protein drinks are benefiting from a changing consumer base beyond hard-core athletes to a widening demographic including women and seniors. In 2015, sports drinks experienced volume growth of 5.5 percent to 1.5 billion gallons, with wholesale dollars up 7.8 percent to $6.8 billion, according to an October 2016 report from New York-based Beverage Marketing Corporation (BMC) titled “U.S. Sports Beverages through 2020.”

The report forecasts the market to have a compound annual growth rate of 4.4 percent to reach $8.5 billion by 2020, with volume growth at 3 percent to 1.7 billion gallons, it states.

Protein drinks also are faring well. The market experienced high single-digit increases in 2016 to more than $600 million wholesale, BMC’s Senior Editor Roger Dilworth said in Beverage Industry’s May issue.

Like the sports drinks category, the protein drinks market is benefiting from an increasingly diverse consumer base as well as an influx of protein sources, as more consumers are entering the category for everyday consumption as a way to experience the benefits of protein.

“Protein drinks should continue to benefit from changing consumer attitudes toward carbohydrates as more people seek out paleo or ketogenic dietary solutions,” Dilworth said in Beverage Industry’s May issue.

Benicia, Calif.-based CytoSport Inc.’s Muscle Milk brand leads the segment as it continues to innovate with new products. In fact, the company launched a new product, Evolve, at the beginning of the year, which is its first plant-based and vegan ready-to-drink protein line, it says.

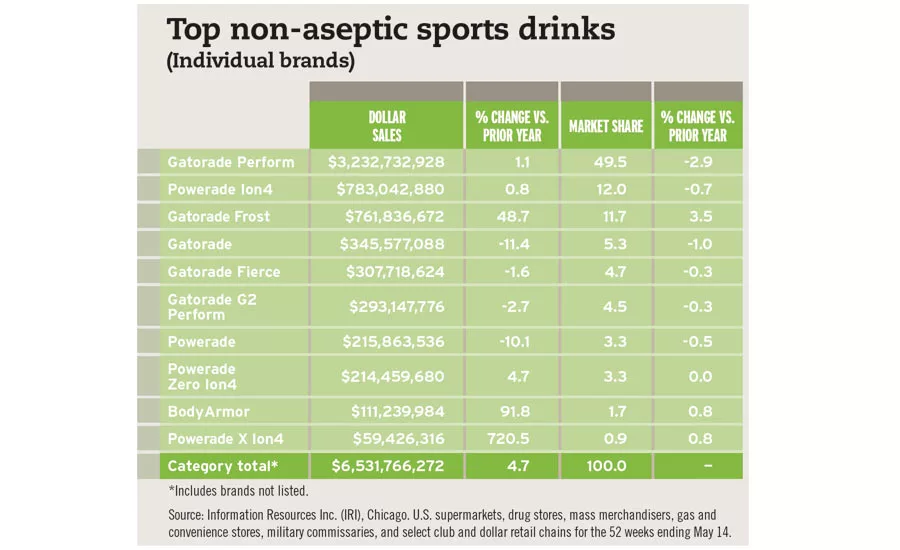

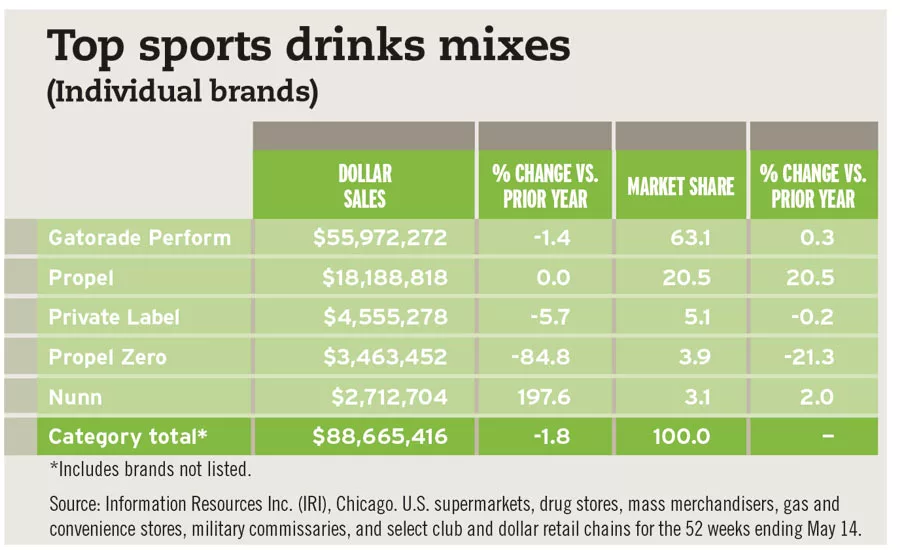

According to data from Chicago-based Information Resources Inc. (IRI), non-aseptic sports drinks saw sales rise to more than $6.5 billion in U.S. multi-outlets and convenience stores for the 52 weeks ending May 14. However, sports drink mixes didn’t fare as well, experiencing a contraction of 1.8 percent in sales for the same timeframe.

A mixture of carbohydrates that supply energy and electrolytes that maintain fluid balance, sports beverages, like Purchase, N.Y.-based PepsiCo Inc.'s Gatorade and Atlanta-based The Coca-Cola Co.’s Powerade, are the fifth largest new age category by dollars and third by volume, BMC stated in Beverage Industry’s May 2016 issue. Gatorade and Powerade comprise 90 percent of the volume in the sports drink industry, it states.

However, the Top 2 sports drink brands aren’t the only ones appealing to consumers' health-and-wellness desires. BodyArmor, a brand of Queens, N.Y.-based BA Sports Nutrition LLC, is one brand that experts highlight as making an impact within the market due to its functional and healthy associations with coconut water.

Chicago-based Euromonitor International’s February 2017 report “Sports Drinks in the US” states: “Following years of sports drinks and coconut water players stating that they swim in different ponds, one brand manufacturer, BodyArmor, showed that certain sports drinks and coconut water could, in fact, mingle. And, while a growing subset of consumers have become apprehensive of sports drinks’ sugar content, new products with a higher content of naturally occurring sugar may be able to assuage skeptical consumers.”

Driven by the growth of crossover products and consumers’ mainstream desire to lead healthy lifestyles, the sports and protein drink market has expanded its reach from a targeted base to a more mainstream group of consumers, said Eleanor Dwyer, research analyst at Euromonitor in Beverage Industry’s May issue. The eCommerce channel will play a role in growth going forward, she added.

“The online channel will continue to grow in importance, particularly for young sports nutrition companies as eCommerce allows retailers to stock a wide variety of products [that] appeal to both casual and hard-core sports enthusiasts, while keeping costs relatively low,” she said. BI

Top non-aseptic sports drinks

(Individual brands)

| Gatorade Perform | $3,232,732,928 | 1.1 | 49.5 | -2.9 |

| Powerade Ion4 | $783,042,880 | 0.8 | 12.0 | -0.7 |

| Gatorade Frost | $761,836,672 | 48.7 | 11.7 | 3.5 |

| Gatorade | $345,577,088 | -11.4 | 5.3 | -1.0 |

| Gatorade Fierce | $307,718,624 | -1.6 | 4.7 | -0.3 |

| Gatorade G2 Perform | $293,147,776 | -2.7 | 4.5 | -0.3 |

| Powerade | $215,863,536 | -10.1 | 3.3 | -0.5 |

| Powerade Zero Ion4 | $214,459,680 | 4.7 | 3.3 | 0.0 |

| BodyArmor | $111,239,984 | 91.8 | 1.7 | 0.8 |

| Powerade X Ion4 | $59,426,316 | 720.5 | 0.9 | 0.8 |

| Category Total* | $6,531,766,272 | 4.7 | 100.0 | - |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 14.

Top sports drinks mixes

(Individual brands)

| Gatorade Perform | $55,972,272 | -1.4 | 63.1 | 0.3 |

| Propel | $18,188,818 | 0 | 20.5 | 20.5 |

| Private Label | $4,555,278 | -5.7 | 5.1 | -0.2 |

| Propel Zero | $3,463,452 | -84.8 | 3.9 | -21.3 |

| Nunn | $2,712,704 | 197.6 | 3.1 | 2.0 |

| Category Total* | $88,665,416 | -1.8 | 100.0 | 0 |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 14.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!