Convenience stores appeal to the masses

Beverage purchases key driver of convenience stores sales

Forty-four percent of consumers are visiting convenience (C-stores) stores more often — and half say they are visiting significantly more often than they did just two years ago, according to Chicago-based Datassential, which surveyed 1,000 consumers and 150 operators for its June “C-Store Keynote Report.” While visiting C-stores, these consumers also are buying more prepared food and beverages, the report notes.

In the first half of 2016, convenience store sales surged as lower gas prices fueled more driving, and Americans embraced the continued addition of fresh and healthy food options, according to the Alexandria, Va.-based National Association of Convenience Stores (NACS).

“More than two in three convenience retailers (70 percent) say that in-store sales in the first half of 2016 were higher than the same period last year, while a majority (54 percent) stated that fuel sales also were higher compared to the first half of 2015,” according to Jeff Lenard, vice president of strategic industry initiatives for NACS, citing a July survey released by the association.

Warmer weather in the summer months also heats up sales, as overall C-store sales from June through August were nearly 5 percent higher than the rest of the year, according to NACS. Additionally, cold drink and ice sales spiked over the July Fourth weekend as more travelers hit the road and bought beverages or bags of ice to keep their drinks chilled, it adds.

“Store sales from June through August are 4.5 percent higher than the rest of the year,” Lenard says. “And the sales of packaged beverages — soda, water, juices, teas, and sports and energy drinks — are 18 percent higher over the hot summer months.

“Convenience stores account for more than 42 percent of all packaged beverage sales in the country, factoring in all sales from convenience stores, grocery, drug and mass merchandisers, according to Nielsen data,” he continues. “C-stores also sell the majority of beer purchased in the country (59 percent), … and beer sales at convenience stores increase 9 percent over the summer months.”

In its June “Future of Food Retailing” report, Long Grove, Ill.-based Willard Bishop, an Inmar Analytics Company, notes that convenience stores continued to see modest in-store sales growth with a 5.8 percent increase totaling $188 billion in 2015, which generated an almost 0.5 percentage-point increase in market share, bringing it to 15.5 percent last year.

With nearly 161,000 convenience stores, and 130,468 of them selling gas, Willard Bishop predicts that convenience store sales will increase 1.4 percent in stores that sell gas, while C-stores without gas sales will experience a nearly 2 percent increase. “Market share will remain relatively consistent for the convenience format with an overall market share of 15.4 percent by 2020,” the report states.

In its March report titled “Convenience Stores US,” Chicago-based Mintel estimates that 2016 revenues for the channel will grow by 3.6 percent to reach $451.3 billion and will continue on a forward path of growth.

Yet, C-stores face increasing competition when it comes to consumer packaged goods (CPG) because consumers can often get their fast-run products for a lower price from supermarkets or mass merchandisers, the report states.

Chicago-based Euromonitor International expresses similar sentiments in its report titled “The Evolution of Convenience in Retailing,” which was published in May. “As players from different channels offer convenience in both products and services, existing convenience stores and forecourt retailers in developed markets are responding by evolving their stores to remain competitive.

“… Convenience stores in developed markets seek to live up to their name and truly become a one-stop shop,” it continues. “Recently added services in convenience stores include ATMs, ticket reservations, copy/fax/printer services, expanded grocery offerings, delivery services, microwaves and more.”

Beverage sales booming

Chicago-based Information Resources Inc. (IRI) notes that in the past year, the convenience channel outperformed the industry average and competing channels, like traditional grocery stores, drug stores and wholesale club stores.

“For the year, units are plus 3.5 percent; dollars are plus 5.6 percent in the C-store channel. In comparison, IRI’s multi-outlet geography grew units plus 0.1 percent and dollars plus 1.9 percent,” says Susan Viamari, vice president of Thought Leadership at IRI.

Viamari notes that beverage sales are booming in C-stores, boasting the strongest growth rate, a positive 6.7 percent in dollars and 5.1 percent in units. “This is important since beverages (including liquor) account for one-third of channel sales,” she says.

Experts note that a better variety of spirit and liquor brands, healthier options and premium products are key drivers of the channel’s dollar sales growth.

“High-end coffee — single cup, crossovers from restaurant to CPG aisles — is doing very well and has been for several years,” Viamari says. “Premium ingredients, organic/Fair Trade options, exciting flavors, healthier-for-you options [and] protein enhanced are all doing well and driving premium prices.

“… Spirits/liquor is up 16.9 percent, driven by [an] increasing assortment, increased ‘cocktail’ behavior, entertaining at home and [the] proliferation of flavor variety,” she continues. “On the struggling side: carbonated beverages is flat — [it] has been struggling for several years as consumers seek healthier options and show favor to items like teas and juices.”

Yet, NACS’ Lenard says bottled water sales remain king in C-stores, noting that 48 percent of retailers have expanded their bottled water offerings, while 59 percent have increased their nutraceuticals and enhanced-water selections.

“Convenience stores sell an estimated 50 percent of all single-serve bottled water purchases in the United States,” he adds. “… Throughout the year, Americans are more likely to visit a convenience store to quench a thirst than for any other reason. … Nearly half of all convenience store customers (49 percent) said that they primarily stopped to purchase a beverage on their most recent visit.”

Additionally, bottled water units are up 8.5 percent, while energy drinks are up 6.6 percent and are the fastest growing non-alcohol beverage category sold in convenience stores, IRI’s Viamari notes.

New York-based Beverage Marketing Corporation (BMC) also points to this trend in its November 2015 report titled “US Energy Drinks Through 2019.” The report states that convenience stores and gas stations were among the first channels to make energy drinks widely available.

“Energy drinks and convenience/gas stores are a near-perfect fit. C-stores are oriented toward impulse purchases, particularly by males, in an environment where price sensitivity is not as acute as in take-home channels like supermarkets,” the report states.

BMC anticipates the convenience channel will continue to build on its dominance of energy drinks sales. “In the next five years, convenience/gas stores are expected to expand their already-dominant share of energy drink volume,” the report states. “As a result, the channel will constitute a majority of the market (50.2 percent in 2019) for the first time since 2005.”

Mintel’s report identifies that convenience stores need to capitalize on their core audience: highly mobile young men between the ages of 18 and 34, affluent young people earning more than $75,000 a year and Hispanics.

“While most respondents view C-stores primarily as a place for getting gas and the occasional drink or snack, these core customers are clearly getting a lot of meals at C-stores and also are using them as ‘fill in’ shopping trips that allow them to avoid supermarkets and big-box retailers,” the report states.

Innovation, quality reign supreme

Innovation will continue to be a key driver for convenience stores, according to experts.

“Consumers are 22 percent more likely to try a new C-store prepared food or beverage item if it is new, unusual or interesting; this was the only new line motivator, at 3 percent, that saw growth since 2012,” said Ann Golladay, senior project director at Datassential in its June report.

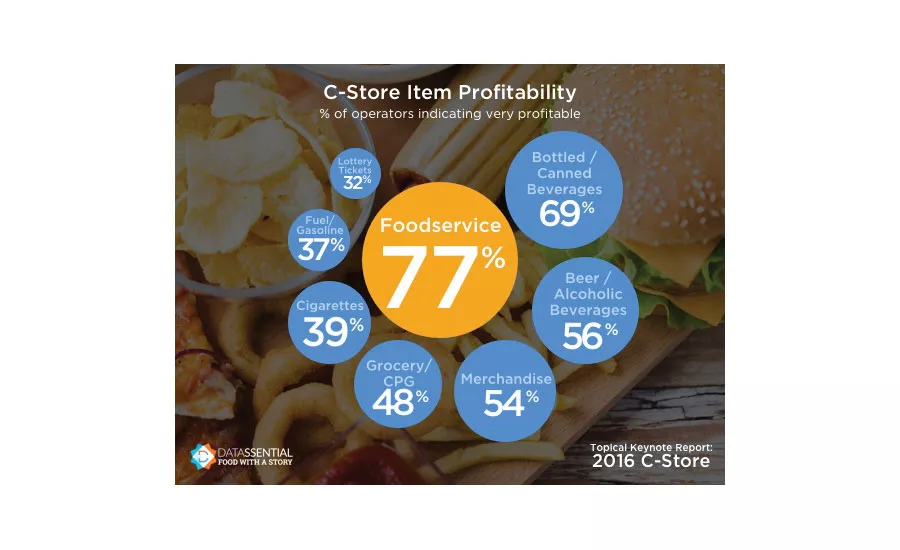

When it comes to which segments are very profitable, 77 percent of operators reported foodservice as No. 1, followed by bottled/canned beverages and beer/alcohol beverages at 69 and 56 percent, respectively.

Additionally, consumers increasingly are choosing C-stores for their quality products and loyalty programs. “The number of consumers who chose a C-store based on it having the highest-quality products increased 23 percent compared to four years ago, and one-third of consumers say the overall quality has improved,” Golladay said.

Mintel’s report notes that “a chain needs to have at least 1,000 stores to adequately compete against the brand recognition, marketing muscle and product innovation offered by larger players such as 7-Eleven, the industry’s biggest operator with 7,800 stores.”

The convenience store chain continued to flex its muscle this summer by partnering with Austin, Texas-based Big Red Inc. Through the partnership, 7-Eleven introduced the Big Red Slurpee drink at more than 650 7-Eleven stores throughout Texas. 7-Eleven also has partnered with delivery apps, such as Postmates and Tapingo, to make Slurpees just a swipe away, it adds.

Taking advantage of technology and loyalty apps are important ways for C-stores to engage consumers, market research firms note. “C-stores need to be tech-savvy in order to meet consumers’ needs and gain their loyalty,” Mintel’s report states. “Loyalty apps and self-checkout are a couple of … the features that customers crave, and smart C-store chains are delivering.”

Upping the game

To capitalize on the market, C-store operators also are paying attention to which products and services are gaining consumers’ interest and updating their offerings to provide consumers with a fresh variety of dining choices, according to Datassential’s Golladay.

“C-store operators plan to keep upping their game with a focus on fresh, healthy, natural options in the future,” she said. “Twenty-nine percent of operators plan to add fresh fruit cups and fresh-cut raw vegetables. … On the beverage side, nearly one-fifth of operators are planning to add a fresh-brewed iced tea machine.

“… C-stores are adding more ethnic food options, adventurous [limited-time offers] (LTOs), and even beer taps where consumers can pick up a local brew,” she continued. “Some newly designed C-stores take cues from modern fast-casual restaurants or cozy coffee shops with … seating areas and Wi-Fi connections.”

IRI’s Viamari also highlights the latest trends impacting the channel and its products and service offerings. “Health and wellness, flavor/taste excitement, experiences, personalization — all [are] key trends in CPG today,” she says. “Beverage manufacturers are doing a great job of answering the call in all of these areas. Now, manufacturers and C-store retailers need to work together to get the right mix of products/attributes in front of the right consumers.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!