Mid-America Trucking Show's future uncertain

PC-11 oil classification hot topic at 2016 MATS

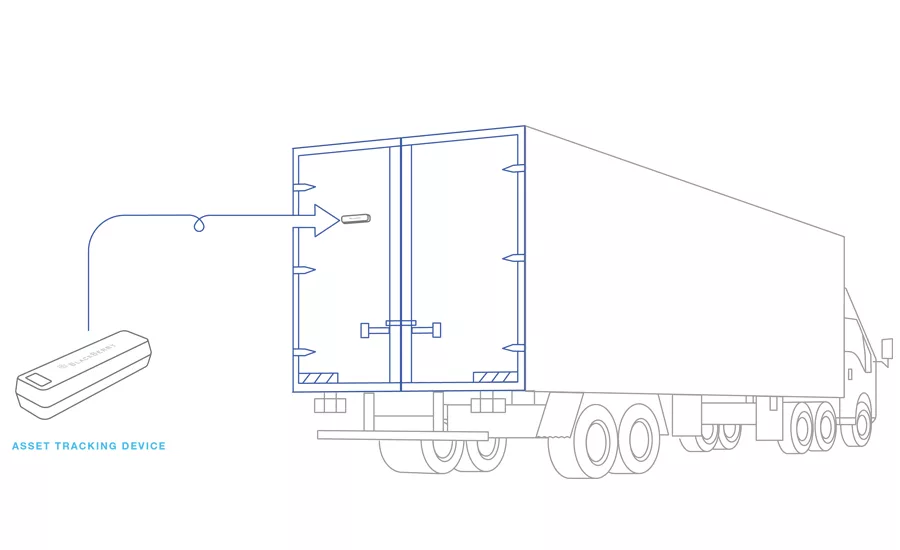

With BlackBerry Radar, fleets can optimize utilization of their equipment, improve on-time delivery, reduce theft, and generate more revenue from each vehicle, without having to invest in costly IT infrastructure. (Image courtesy of BlackBerry Ltd.)

OnLane is a camera-based LDWS that continuously monitors the vehicle’s position within lane markings. (Image courtesy of WABCO)

Traditionally an occasion for much of the truck industry’s news each year, the annual Mid-America Trucking Show (MATS) was as noteworthy this year for its lack of news as it was for the news that did come out of the show.

Various truck manufacturers forewent attendance at this year’s show, opting instead for the biennial schedule followed by many European tradeshows; most notably the IAA, the commercial truck mega show that takes place this fall in Hannover, Germany.

The truck manufacturers cited that the long product development cycles for commercial vehicles makes it difficult to have significant and relevant news ready to debut every year on the current annual schedule for MATS.

The long product development cycles, the significant differences between trucks for Europe and those for North America, and the current even-year schedule for the IAA show have combined to lead truck manufacturers to plan on an odd-year cycle for new product introductions going forward in North America.

Additionally, because of long-term commitments with the host-facility in Louisville, Ky., MATS isn’t in an easy position to shift to a biennial schedule any time soon. Sensing an opportunity to step into a role as the go-to biennial show for North America’s truck industry, two groups recently announced plans for odd-year truck shows as soon as 2017.

The bottom line for fleet managers, aside from potentially uncertain travel plans for the next few years, is that product updates from the truck original equipment manufacturers (OEMs) already have shifted to an odd-year biennial schedule for North America. With many other elements of beverage distribution equipment currently in flux, it likely will be productive to have a bit more stability in the truck market because of the new biennial product cycle.

Here’s a look at news highlights from the MATS 2016, and other similarly timed industry events:

This PC Goes To 11

No, not “politically correct,” but rather, “Proposed Candidate 11,” the oil industry’s insider term for the next generation of diesel engine motor oil. Considering that the existing oil classification, CJ-4, dates back to 2007, and also considering how much diesel engines have changed since then, PC-11 will be a bit overdue when it hits the market later this year.

Preliminary information about the PC-11 oil classi-fication was the subject of numerous educational sessions on this year’s MATS schedule.

Given today’s wide scope of demands on engine oils, PC-11 actually will debut under two separate API classifications. The CK-4 classification is designed not only to meet the requirements for new engines that conform to the latest carbon dioxide emission standards, but also is backward-compatible with existing engines already in service.

The FA-4 classification is designed to be the most fuel-efficient oil option for the newest, lower-emission diesel engines. Not only will it meet all of the other API performance requirements, but it also will provide higher potential for improved fuel economy.

Given the engine operating conditions and mixed-age fleets at most beverage distributors, the API CK-4 classification will be the default choice for virtually all beverage fleets. While the backward-compatible CK-4 might not deliver as much fuel-economy as its FA-4 counterpart, both classifications are expected to deliver fuel-economy improvements versus the CJ-4 classification. Engine oils meeting the new classifications should be available by early December.

OEM News

Although manufacturers’ decisions to forego MATS 2016 paired down the news cycle, announcements that were working their way through the pipeline before the tradeshow have been making waves. For example, Volvo Trucks North America made a significant news splash with the announcement of its latest powertrain updates just after the close of MATS.

Although beverage distributors traditionally have avoided Class 8 tractors, this quickly is changing as more cargo van trailers are being deployed for beverage applications. Similarly, although Volvo always has had a strong focus on long-haul applications, the company has been increasing its focus on distribution applications. These factors combine to bring Volvo and beverage distributors together.

Instead of viewing the 2017 Environmental Protection Agency’s emission regulations as an obstacle to overcome, Volvo chose to pursue the occasion as an opportunity to further optimize many of its powertrain offerings. From simple friction improvements on engines, to innovative productivity-enhancing solutions on transmissions, Volvo’s powertrain announcements paint a positive picture for fleet operators.

Obviously, the engines were the starting point, specifically the D11 and D13, Volvo’s best sellers for regional and local distribution applications. In meeting the 2017 goals, Volvo benefited from being able to rely on the solid foundation of its medium-block architecture.

At a time when emission compliance strategies can place an undue focus on merely cutting displacement or performance, Volvo chose to pursue a path of first getting as much as possible out of every drop of fuel consumed. Fuel that leaves the engine unburned does nothing to help fuel economy or performance and has a negative impact on exhaust emissions.

A common rail fuel system’s finer control allows quicker, more accurate fuel injection for improved fuel economy, while the new-wave design on the face of the piston increases cylinder efficiency by optimizing flame propagation toward the center of the cylinder. Elsewhere on the engine, an improved intake throttle speeds engine warm-up, allows better control of after-treatment temperatures and smooths engine shutdown.

When it comes to powertrain news, new engine features frequently overshadow transmission technology, but for 2017, Volvo’s I-Shift automated transmissions also benefited from upgrades. Combine I-Shift with an intelligent cruise control and the result is I-See, a system that learns the topography of the road. Later, it automatically uses its knowledge to save fuel when the intelligent cruise control is engaged.

Expanding solar panel

As the available choices in the craft and draft beer markets continue expanding, so, too, does the demand for transport refrigeration units in beverage distribution operations. Transport refrigeration supplier Carrier Transicold used its presence at MATS 2016 to announce the expansion of its line of Thin Film Flexible Solar Panels. The solar panels are designed to help maintain peak performance of transport refrigeration unit (TRU) batteries in a more environmentally sustainable way.

Carrier Transicold now offers 18.5 watt (1.2 amp) and 9.24 watt (0.6 amp) solar panels, in addition to its original 28 watt (1.8 amp) panel, accommodating a wider range of user needs and budgets. The solar panels are designed to specifically maintain TRU battery charge and can be easily installed on the roofs of refrigerated trailers and truck bodies.

Solar panels can offset the draw from accessory electrical loads, significantly reducing service calls related to the battery. Solar panels also can help conserve fuel by minimizing the need to run the TRU engine to charge the battery.

“Our amorphous silicon, or a-Si, solar cell technology provides high performance in real-world environments where daylight may be indirect or low,” said Jason Forman, Carrier’s marketing manager, in a statement. “Unlike some other solar technologies that require several days of sun soaking to bring the panels up to full functionality, a-Si panels deliver maximum performance without sun soaking. They also begin charging at a higher voltage at a lower angle of light than some other technologies, allowing charging over a longer portion of the day, which is especially helpful in northern regions and in the winter.

“Fleets located farther south in warmer climates will appreciate that a-Si panels do a better job of retaining their efficiency on hot days, in contrast to some other types of solar panels that can lose considerable efficiency when their temperature increases,” he continued.

When exposed to daylight, the solar panels continuously charge TRU batteries, ensuring ample power for system starts and helping to avoid issues and costs associated with a weak or dead battery. Refrigeration system batteries often are tapped to power additional trailer electronics, such as telematic devices, fuel-level sensors, interior lighting and other accessories. If the TRU has not been operated for some time and these accessories continue to draw power while the unit is off, its battery might not have enough charge to start the engine.

Carrier Transicold’s solar panels are lightweight, highly flexible and measure less than one-eighth of an inch thick, the company says. Designed to withstand the harsh transportation environment, they are waterproof and puncture-resistant and have a five-year limited warranty on power output, it adds.

Tracking assistance

Also unveiled at MATS was BlackBerry’s Radar, a new end-to-end asset tracking system for fleet operators. With BlackBerry Radar, fleets can optimize utilization of their equipment, improve on-time delivery, reduce theft and generate more revenue from each vehicle, without having to invest in costly IT infrastructure.

BlackBerry Radar provides everything needed to track highly mobile assets, including a self-powered tracking device, world-class security and visual reports that make it easy to pinpoint the location and status of each asset, the company says.

The freight transportation industry constantly is striving to boost productivity and efficiency in order to reduce operational costs. However, existing tracking solutions, with their complex user-interfaces and infrequent data updates, make it difficult to maximize asset utilization and stop theft. BlackBerry Radar solves this problem by providing timely, actionable information in a solution that is easy to deploy, use and maintain, it says.

The BlackBerry Radar tracking device only takes minutes to install and generates rich, frequently updated information that enables operations managers, load planners and dispatchers to make the most profitable decisions, the company adds. For example, the device can send real-time alerts whenever a vehicle has crossed a user-defined geo-fence or when a cargo door has opened or closed. It also monitors GPS location, temperature, humidity and the presence of cargo.

“BlackBerry Radar is fully integrated and provisioned, so fleets can hit the ground running. Within minutes of installing our tracking device, users can access timely information on their assets to help make agile decisions that can dramatically improve an organization’s profitability,” Blackberry Senior Vice President Derek Kuhn said in a statement. “And because BlackBerry Radar is cloud-based, it offers the ultimate in convenience. All you need is a smartphone, tablet or computer equipped with a web browser, and you can access information for real-time decision-making — wherever you are, and whenever you need it.”

BlackBerry Radar encrypts all transmitted data. It also authenticates the device and cloud endpoints to ensure a high level of security and privacy between users and the service. Moreover, fine-grained permissions allow other participants in the supply chain to access relevant data and improve productivity. For instance, as a trailer approaches a warehouse, BlackBerry Radar can issue a notification, enabling warehouse staff to prepare for the incoming shipment and unload the trailer more efficiently.

The expansion of Internet-based solutions has been a key catalyst in the current transformation of the global freight shipping market. The ever-improving capabilities and costs of connected sensor systems have made tracking the precise location of assets, real-time monitoring of their detailed physical condition and associated data analytics the basis of a new standard for the industry.

Select trucking companies and private fleet operators currently are participating in a customer pilot test of BlackBerry Radar. The system is scheduled to be available for purchase this summer.

Warning system

As part of its participation at MATS 2016, WABCO, a global supplier of technologies designed to improve the safety, efficiency and connectivity of commercial vehicles, unveiled the company’s next generation OnLane lane departure warning system (LDWS). The advanced driver assistance system features a new, high-resolution camera integrated with a SmartDrive video-based driver performance management system.

OnLane is a camera-based LDWS that continuously monitors a vehicle’s position within lane markings. It alerts the driver by visual, audible or haptic warnings when it detects unintentional lane changes. OnLane now links to SmartDrive’s driver performance management system, which incorporates video recording and near real-time video analysis. SmartDrive’s capabilities enable driver coaching to improve driving efficiency and support enhanced road safety.

OnLane features a camera that combines the functionalities of lane-marking detection and video streaming. It also delivers improved lane-marking recognition because of an intelligent lane-tracking algorithm. These newly combined capabilities eliminate the need for two forward-looking cameras, which previously were required to provide the same functionality as the new OnLane, according to the company.

“WABCO is proud to demonstrate its technology leadership by offering the industry’s first and only lane departure warning system with integrated video analytics,” WABCO President Jon Morrison said in a statement. “WABCO’s OnLane demonstrates the powerful connectivity of comprehensive real-time data gathered from our advanced monitoring, control and braking systems, and SmartDrive’s in-depth video analytics of driver behavior. Vehicle fleet owners gain access to a powerful new tool to help advance the safety and efficiency performance of their drivers and vehicles.”

Global sales plans

Known for its performance and racing tires, the Pirelli Group plans to begin serving the commercial truck market in the United States and Canada through a new entity dedicated to the region.

The move represents an expansion of Pirelli’s industrial business unit into North America, which supplies commercial truck tires and fleet solutions to the global market. The drive into the United States and Canadian markets, which are the world’s largest in terms of value for commercial truck tires and fleet management solutions, is part of Pirelli’s aggressive global growth strategy. The pilot phase, currently underway, aims at establishing the best strategy for local product development, distribution and sales. Currently, there are more than 40 fleets participating in the testing and development of Pirelli commercial truck tires for several North American applications.

Clif Armstrong will manage the project as vice president of sales and marketing for the United States and Canada. Armstrong brings more than 20 years of commercial experience to this venture, and will be based in Rome, Ga., at Pirelli’s North American headquarters.

“Pirelli’s strategy for car and light truck products in North America has been focused on premium products customized for the particular needs of the market,” Armstrong said in a statement. “With the launch of the commercial truck business, we plan to do the same thing — adapt the excellent technology and leadership of the Pirelli industrial product line to the specifications and demanding requirements of these markets.

“North American fleets have unique needs, which require unique designs, sizes and compounding to deliver the premium performance for which the Pirelli brands are known and respected,” he continued. “Entering this market is no easy task, but the strength of our future product portfolio coupled with the extensive research and development we are devoting to the project, will provide North American fleets best-in-class cost performance and services.”

Pirelli owns and operates tire manufacturing facilities in Brazil, China, Egypt and Turkey. All technical specifications for its products and production are controlled through its global research and development center in Milan, Italy, the company says.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!