Consumers shop for quality products at discount retailers

Discount retailers stocking more beverage brands

Between 2010 and 2015, high unemployment, stagnant disposable income, volatile energy costs and a changing mass-market perception of dollar stores contributed to a 3.3 percent growth rate, $66.7 billion in revenue and a $2.6 billion profit for the channel, according to IBISWorld’s September 2015 report titled “Dollar & Variety Stores in the US.”

The economic pressures faced by consumers and retailers in the recessionary years fundamentally changed the nature of the discount channel, leading to new pricing- and channel-management strategies, a changing landscape of stores, and an increased variety of products offered, the report states. Yet, the Santa Monica, Calif.-based market research firm notes that the channel’s growth has slowed since 2013 and predicts a decline of 0.5 percent in 2015.

The discount retail channel’s 2.6 percent growth rate in 2015 — the best of all grocery channels, but only by a slim margin — accounts for less than 2 percent of all grocery and is gaining much margin, says Tim Barrett, retailing analyst for Chicago-based Euromonitor International.

“A few standout brands do very well, like Aldi, but ultimately the channel is still very niche,” Barrett says. “Established value-driven attitudes from the recession haven’t gone away. We haven’t experienced the ‘price wars’ that other countries have, which has drawn attention to the discounter model, so it has remained a bit of a mystery to many in light of America’s largest low-price retailer, Wal-Mart.

“…People can be put off by the discounter model at first because they have to rent carts [and] pay for their own bags,” he continues. “…but once they try them, a lot appreciate the combination of value and quality of the products.”

With the discount retail channel’s relatively flat dollars and volume, the consumer packaged goods (CPG) industry has been exploring growth opportunities for several years, particularly as consumers make fewer shopping trips and face intense competition from retail channels, including dollar retail chains and online retailers, according to Chicago-based Information Resources Inc.’s (IRI) Susan Viamari, vice president of thought leadership.

Beverage: a bright spot

Beverage purchases accounted for about 11 percent of discount channel sales, a slight increase compared with the past year, while consumables accounted for about one-quarter of channel sales and consumable refrigerated items generated 4 percent of industry sales, both flat year-over-year, Viamari says.

New York-based Kantar Worldpanel’s Lauren Masotti, client manager of consumer insights, adds that an additional 8 million weekly consumers — an increase of more than 9 percent from 2014 — are purchasing beverages, including bottled water, coffee and carbonated soft drinks (CSDs), from discount stores.

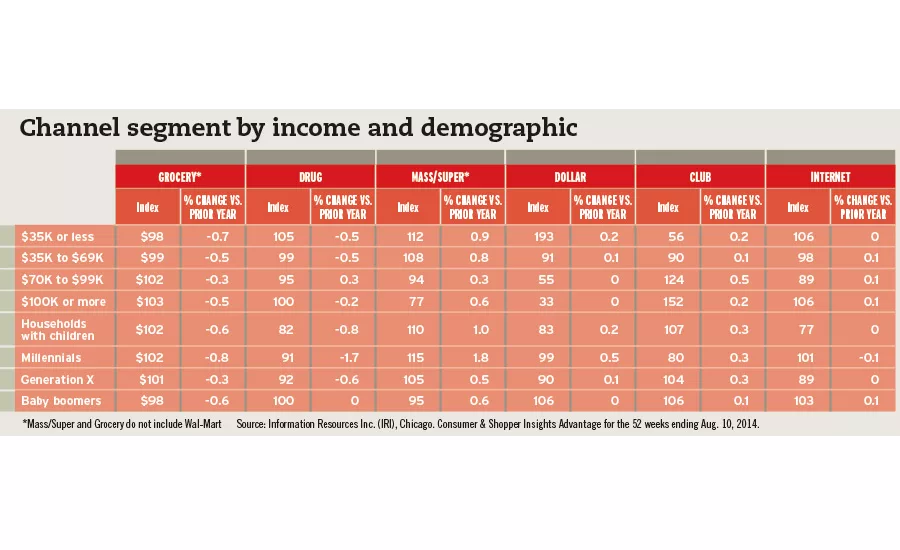

IRI’s Consumer & Shopper Insights Advantage for the 52 weeks ending Aug. 10, 2014, notes that consumers earning less than $35,000 annually have a

93 percent higher likelihood of shopping at a dollar retail store but points out that lower-earning households disproportionately spend in the dollar channel — nearly double the average rate.

As dollar retail chains seek to entice consumer shopping trips, they also are the structure of their retail market evolve. Dollar General Corp., Goodlettsville, Tenn., at 30.8 percent of market share, is the largest U.S. discount variety chain, according to IBISWorld. In its third quarter 2015 financial earnings, the retail chain reported having 12,396 stores in 43 states and net sales of $15 billion, with approximately $11.5 billion coming from consumables.

Additionally, Family Dollar Stores Inc., the second-largest discount retailer with a 16.3 percent market share, operates more than 7,800 stores in 45 states and the District of Columbia, IBISWorld notes.

In July 2015, Chesapeake, Va.-based Dollar Tree Stores Inc. completed its acquisition of Family Dollar Stores.

The combined organization resulted in an operation of more than 13,000 stores in 48 states and five Canadian provinces, with sales exceeding $19 billion annually and more 145,000 associates.

A keen eye on spending

Although the discount retail channel remains flat, millennials, at 35 percent, are the No. 1 demographic shopping for beverages at discount stores, which also is skewed toward African Americans and acculturated Hispanic consumers, Kantar’s Masotti says. “These two groups make up nearly 30 percent of the consumer base versus 25 percent of the population,” she says. “About 20 percent of weekly beverage occasions come from the discount retail channel, which has experienced small growth over the past three years, stressing the continued importance of the discount store retail channel.”

Euromonitor’s Barrett echoes similar sentiments. “Consumers are looking for value, which includes the less affluent, but many who were converted when times were tough continue to maintain that mindset and brand loyalty thanks to the quality of the goods,” he says.

“Discounters have become more aggressive in bringing name-brand drinks like Coke and Gatorade to help make their product selection more palatable to the masses,” he continues.

In addition to incorporating more name brands, discounters are improving the aesthetics of their stores, by making aisles bigger and brighter, adding more cooler-space and improving check-out areas to increase impulse purchases, says IRI’s Viamari.

Additionally, grocery and drug stores are losing share to competing channels, including eCommerce. “Internet spending is consistent across most consumer segments. Gen X households earning $70,000-$99,999 annually and those with children are not exceptions. Here again, though, discount retailers are effectively defending their base,” she adds.

IBISWorld notes that external competition will increase as mass merchandisers and club stores like Wal-Mart, Target and Costco aggressively expand.

However, the report adds that major players in the discount retail channel will continue to compete in tough market conditions by increasing market penetration and improving efficiencies.

“Consumers are beginning to see discount channels as viable, holistic options, and I believe they will see steady growth over the next year or two,” Kantar’s Masotti says. “Having channels that allow for the ‘one-stop-shop’ component will positively affect beverage sales and consumption at discount stores.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!