Sustainable bag-in-box, carton materials demand grows

Packaging suppliers invest in new solutions, production facilities

American chemical engineer and Nobel Laureate Frances Arnold is quoted as saying, “All my projects are about sustainability, bioremediation, making things in a cleaner fashion.”

For the beverage industry, packaging materials play a crucial role in sustainability. As such, bag-in-box (BIB) and carton companies are working toward creating more environmentally friendly packages.

According to a recent “Bag-in-Box Container Market Size” report from Grand View Research, the focus of manufacturers for creating sustainable packaging by using biodegradable materials is anticipated to benefit them over the forecast period.

The report notes that the global bag-in-box container market size was estimated at $4.26 billion in 2023 and is projected to reach $6.77 billion by 2030, growing at a compound annual growth rate CAGR of 6.9% from 2024 to 2030.

Aside from sustainability trends, the report further notes that the increasing consumption of bag-in-box container products by various wine brands is likely to propel the growth of BIB containers over the forecast period.

“The U.S. economy is one of the largest wine producers,” the report states. “In addition, the manufacturers are exhibiting increasing demand for the product on account of the advantages offered by the container in wine packaging including easier dispensing, storage, extended freshness, and reduced cost per unit volume.

“In addition, the large surface area offered by the bag-in-box container offers more space coupled with colorful text and graphics than the conventional bottle labels and is expected to propel the market growth over the forecast period,” the report continues.

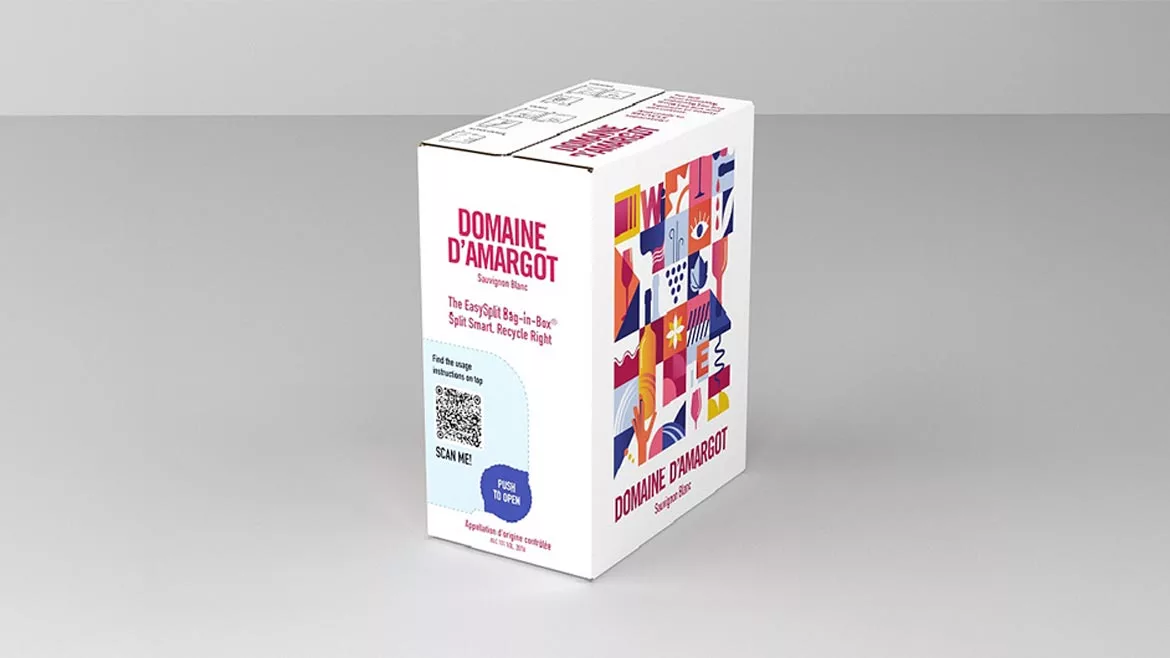

Keeping up with beverage packaging trends, last November, Smurfit Westrock unveiled its EasySplit Bag-in-Box, a new innovation specifically developed to meet the upcoming requirements of the Packaging and Packaging Waste Regulation (PPWR).

PPWR will mandate that all packaging achieves at least 80% recyclability. For Bag-in-Box products, this means ensuring the box and bag are easily separable to facilitate recycling. When the bag and box are properly separated, each component can be recycled in its respective stream, increasing the overall recyclability rate to over 90%, the company noted in a press release.

“With the European Commission set to decide on the methodology within the next three years, it is imperative to act swiftly and demonstrate a viable solution to the challenge,” said Massimiliano Bianchi, CEO Smurfit Westrock Bag-in-Box, in a statement. “Smurfit Westrock is leading the charge in preparing the packaging industry for future regulations by launching our EasySplit Bag-in-Box design. As we continue to educate consumers and stakeholders about the importance of proper recycling practices, Smurfit Westrock remains dedicated to driving positive change and demonstrating environmental stewardship.”

Recyclability drives growth for cartons

Similar to bag-in-box, the global market for beverage cartons is anticipated to grow significantly.

In a recent Fortune Business Insights "Beverage Cartons Market Size” report, the market research firm notes that market size was $16.51 billion in 2020. Meanwhile, the market is projected to grow from $16.77 billion in 2021 to $ 22.44 billion in 2028 at a CAGR of 4.2% during the forecast period 2021-2028.

Further, the beverage cartons market in the United States is projected to grow significantly, reaching an estimated value of $4.19 billion by 2032, driven by adopting eco-friendly materials by manufacturers, according to Fortune Business Insights.

“The key feature that defines the global growth of beverage cartons is their recyclability,” the report states. “According to the ACE, developed economies have a higher share in the recycling initiative. For instance, in Italy, recycling infrastructure covers around 80% of the population. Similarly, in the U.S., a report by the Carton Council estimates that about 61% of the total population in 49 states has access to recycling facilities for their beverage cartons.”

The Fortune Business Insights report also notes that many countries across the globe have regulations or are planning to put restrictions on the usage of non-sustainable materials such as plastic linings to produce these pouch cartons.

“These regulations make the companies invest heavily in developing alternative resources that fulfill the functions of conventional materials, thus affecting the growth potential for the market players operating in the market, especially in developing economies,” it states.

Furthering its sustainability efforts, Elopak, creator of the Pure-Pak gable-top cartons made using renewable, recyclable, and sustainably sourced materials, opened a state-of-the-art production plant in Little Rock, Ark., to produce Pure-Pak cartons for liquid dairy products, juices, plant-based drinks, and liquid eggs.

“Demand for our low-carbon, sustainable cartons in North America has been growing at an unprecedented rate for several years,” said Elopak CEO Thomas Körmendi in a statement. “This new factory will serve both new and existing customers across the United States, reaching millions of Americans every day.”

Elopak also plans to add a second production at the plant, which will be fully operational in 2026.

As beverage manufacturers seek out sustainable packaging solutions, suppliers are investing the resources to make these goals come to life.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!