Category Focus

Low/no alcohol spearheading growth for market

Volume CAGR for segments expected to continue through 2026

Image courtesy of Diageo plc

The phrase “a buzz of activity” is commonly used to denote that a space is filled with many actions and conversations driving an event or gathering. In the beverage market, many will note that the activity in terms of innovations is coming from the low- and no-alcohol beverage space.

“There has been tremendous activity in the non-alcoholic space between beer and mocktails,” says Brian Sudano, managing partner at Beverage Marketing Corporation (BMC), New York and Wintersville, Ohio. “With strong innovation and support the non-alcoholic market is up in the high double digits. The low alcoholic market is a little more mixed.

“Consumers are increasingly being exposed to the sober curious concept and some are considering relationships with alcohol. Health considerations are playing a role as consumers consider the impact of alcohol, with a range of sources, from the World Health Organization to social media influencers."

— Kelsey Olsen, food and drink consumer insights analyst at Mintel

“Brands like Modelo Oro and Heineken Silver have had good reception and performance while Ultra and Corona Premier continued to grow, albeit at low rates in 2023,” he continues. “On the spirit side, RTD spirits continue to grow in the 40% to 50% range driving low alcohol performance in spirits. On the flip side, overall lower alcohol light beer in aggregate continues to decline. There is also a trend toward higher alcohol brands in craft, FMBs and RTDs.”

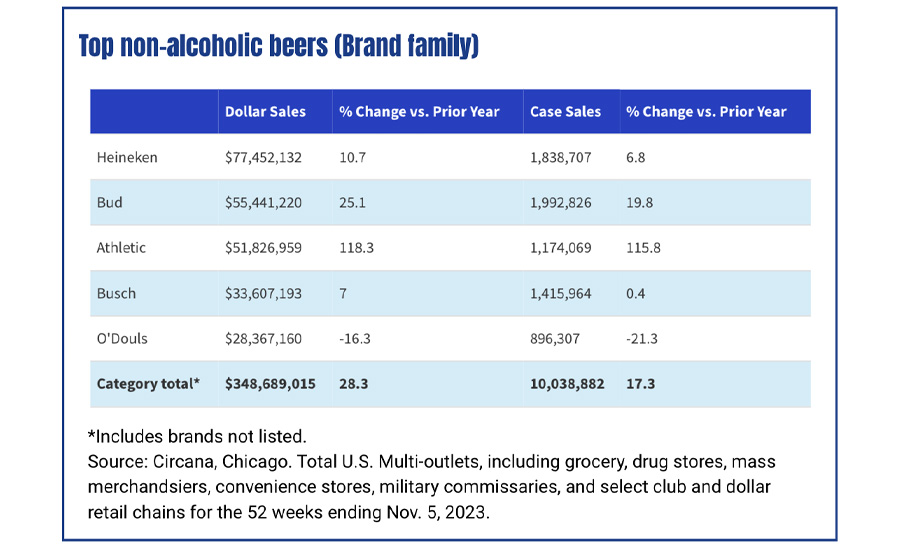

IWSR released an analysis titled “The No- and Low-Alcohol Market” where the market research firm highlights that no-alcohol products are spearheading growth in the overall category.

The market research firm reports that no-alcohol volumes grew 9% in 2022, thereby increasing its share in the overall low- and no-alcohol market in the 10 leading world markets for low- and no-alcohol. It further predicts that the compound annual growth rate (CAGR) for volume sales will continue to increase for the segments.

“The pace of growth of the no/low-alcohol category is expected to surpass that of the last four years, with forecast volume CAGR of plus 7%, 2022-26, compared to plus 5%, 2018-22,” the insights states. “No-alcohol will spearhead this growth, expected to account for over 90% of the forecast total category volume growth. IWSR expects no-alcohol volumes to grow at a compound annual growth rate (CAGR) of plus 9% between 2022 and 2026.”

Understanding the consumer

In terms of the U.S. consumer, IWSR reports that 43% of those who consume low- and no-alcohol products are millennials, which is an increase from the previous year. What could be prompting the increase is a growing sect of sober curious consumers.

“Consumers are increasingly being exposed to the sober curious concept and some are considering relationships with alcohol,” says Kelsey Olsen, food and drink consumer insights analyst at Mintel, Chicago. “Health considerations are playing a role as consumers consider the impact of alcohol, with a range of sources, from the World Health Organization to social media influencers.

“Both physical and mental health are of consideration. When asked about reasons consumers follow or would follow a sober curious lifestyle, physical health is at the top of the list,” she continues. “Forty percent of millennials who are drinking less alcohol are doing so to improve/manage mental health.”

However, when comparing U.S. consumers’ low- and no-alcohol usage, experts note that it remains less developed than other world markets.

“The U.S. market is significantly underdeveloped when compared to Europe,” BMC’s Sudano says. “In many European countries, e.g., Italy, [they] have near 10% [share] of beer at zero alcohol while in U.S. it is around a 1% share. Demographics, lifestyle and variety of products make 10% share a little beyond reach in U.S. over the next 10 years but marketers feel that a significant upside does exist as exhibited by the number of new brands from major brewers.”

Mintel’s Olsen also highlights the proliferation of brands entering the low- and no-alcohol space, particularly those with a premiumization focus.

“Many brands are entering the alcohol alternatives space with premium identities,” she says. “These brands are looking to maintain the elevated experience of alcoholic beverages, sometimes utilizing a complex list of ingredients to create a complex taste experience replicating the ‘bite’ of alcohol or creating a different flavor experience than alcohol. These premium ingredient lists come with a premium price point, though, meaning that, just because the alcohol isn’t there, the product doesn’t cost any less.”

Olsen adds that functionality can play a role in consumers’ interest in low- and no-alcohol solutions.

“Low and no-alcohol products that can offer some functional benefit or experience to consumers will differentiate and, perhaps more importantly, help justify the price points of these products compared to traditional liquid refreshment beverages,” she explains. “Functional ingredients, packaging, and aesthetics can all contribute to this experience ― whether a consumer is looking to enjoying the beverage at a social event or in the comfort of their home.”

Although premiumization might be a driving force for low- and no-alcohol products, BMC’s Sudano notes that brands have exploited the trend through the use of “superior graphics, communicating differentiated taste.”

Yet, Sudano adds that a number of tailwinds will contribute to the performance of the segments going forward.

“The new diet drugs GLP-1, continue to penetrate larger parts of the population and consumers are discouraged to drink alcohol when on the drug,” he says. “The continued expansion and legalization of cannabis substituting for alcohol is beginning to play a role. Healthier lifestyles and awareness of what is put into consumers bodies is also on the rise. These tailwinds will likely continue to drive growth in the low and no alcohol market.”

Mintel’s Olsen also anticipates growth for low- and no-alcohol markets going forward, but says that education and awareness will be vital to recruiting new consumers.

“Exposure to the sober curious concept and alcohol alternatives innovation is likely to grow in the next year,” she says. “In order to garner curiosity that translates into purchases, though, low and no-alcohol brands will have to hone in on messaging and positioning that continues to modernize perceptions of low/no-alcohol offerings. Proving the value and quality will likely be a hurdle. Education surrounding ingredients and showcasing the versatility of these products will be key.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!