Special Report

Craft brewers captivating consumers with innovative creations

Brands adapt to ever-changing demands of consumers

Image courtesy of Best Day Brewing

In the Zac Brown Band’s song “Chicken Fried,” the opening lines are: “You know I like my chicken fried / A cold beer on a Friday night / A pair of jeans that fit just right / And the radio up.” The singer is describing the simple things in life that bring him joy, one of them being a cold beer.

Consumers continue to find joy within the craft beer market, although not as much as they used to.

Brian Sudano, managing partner at New York-based Beverage Marketing Corporation (BMC), says that the U.S. market has continued to benefit from buying local and destination consumption from taprooms and brewpubs.

To combat increasing competition from beyond beer brands, Sudano notes that many craft brewers are extending into the ready-to-drink (RTD) spirits and flavored malt beverage (FMB) space.

“They also have different beer styles that incorporate flavor, especially citrus,” he adds. “Overall, the impact on craft beer trends overall have been nominal. For national brands that are more driven by retail business, especially large format, the movement to beyond beer has had an impact, but many factors aside from beyond beer have present challenges.”

Ryan Toenies, client insights consultant at Chicago-based Circana, describes U.S. craft beer sales as declining.

“Craft beer sales continue to slow and have been on the decline in four of the last five years in Circana Total U.S. Multi-Outlet and Convenience data,” he says. “The only year there was growth was 2020 due to the shift to off-premise that year due to the on-premise shutdown during the pandemic.”

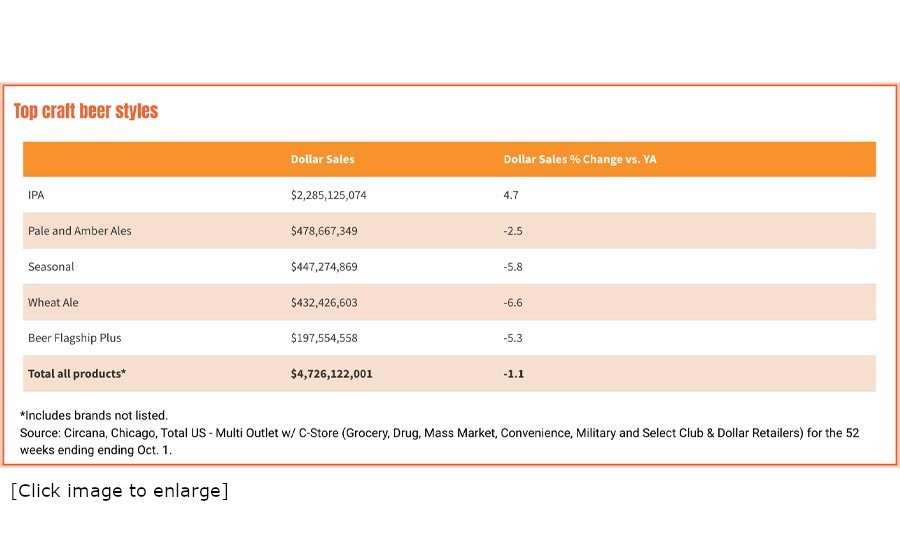

Pointing to Circana data, Toenies notes that craft beer dollar sales were $4.7 billion in the last 52 weeks ending Oct. 1 — down 1.1% versus a year ago. The segment has a three-year compound annual growth rate (CAGR) of minus 2.4%.

Toenies states that some beyond beer brands have shifted away from beer seltzers to FMBs these past few years, with brands like Twisted Tea and crossovers like Simply Spiked, driving growth and boosting the competition with craft beers.

“Some craft brewers had success with innovation in the beer seltzers space, and a potential opportunity might be to move into FMBs,” he says. “Additionally, craft has had some success with innovation in IPAs in 2023.”

However, BMC’s Sudano notes that younger consumers are moving toward different flavor experiences and feeling “some IPA fatigue.”

Circana’s Toenies states that the import beer market has been “consistently growing over the last five years,” which has impacted the craft beer market. He goes on to say that non-alcohol beer has a three-year CAGR of 23.9%, as the segment is becoming more premium-focused.

“Import, flavored malt beverage and non-alcohol beer growth have retailers shifting additional distribution to these segments at the expense of the craft segment,” Toenies explains.

“Even with the basic building blocks of hops, malt, yeast and water, brewers are finding new ways to reconfigure their recipes into new flavors.” – Bart Watson, chief economist at the Brewers Association

Bart Watson, chief economist for the Boulder, Colo.-based Brewers Association (BA), suggests that craft brewers have always adapted to reflect changes in consumer preferences.

“Bar and restaurant trends really matter for craft beer, since craft has about 30% of the draft market,” he says. “So things like to-go, delivery and shifts in time of day (less late night since COVID-19) can affect craft sales. The economy always matters as well.”

Watson adds that the association is watching how the restart of student loan payments will affect consumer trends in the craft beer market.

In Mintel’s 2022 Executive Summary report on the U.S. beer market, the Chicago-based market research firm anticipates that 2023 and 2024 will be years of flat or weak growth due to greater financial freedom allowing for exploration.

“As financial constraints improve, consumers will be drawn away from beer and toward categories that pull them out of their drinking ruts and deliver on excitement,” the report states. “The growing audience of those aiming to drink mindfully are likely to find their solution outside the beer category.”

Brewing up innovation

Given that craft brewers frequently are associated with creative and unique formulations, it is likely this will continue with new entrants.

BA’s Watson says that, because there are thousands of breweries each making multiple beers, it’s difficult to narrow down innovations into categories. He notes that there is a variety of flavors and ingredients going into new brews: pina colada, carrot, cucumber and guava, to name a few.

“We also continue to see brewers play with ingredients in new ways,” Watson explains. “West Coast pilsners that infuse new hop flavors into lighter beers, or new yeast strains that create different flavors in fermentation. Even with the basic building blocks of hops, malt, yeast and water, brewers are finding new ways to reconfigure their recipes into new flavors.”

Watson also notes that the beer styles dominating the market right now are double/imperial IPAs.

“IPA continues to be the biggest part of craft beer, but we’re also seeing more interest in lower-ABV styles including lagers, lighter ales and even non-alcoholic options,” he says. “So, craft is seeing growth on both ends of the ABV spectrum.”

BMC’s Sudano suggests that hazy IPAs and citrus beers are capturing the attention of consumers lately, as well as beverages with higher alcohol-by-volume (ABV) extensions. He notes that IPAs continue to dominate the craft beer market, but recently, ales are “making some inroads.”

Like the other experts, Circana’s Toenies considers IPAs to be the dominant craft style, and feels that the IPA sector is where innovation lies.

“The Top 2 craft innovation brands in 2023 are fruit flavored IPAs,” he says. “Specifically, New Belgium Voodoo Ranger Fruit Force Hazy Imperial IPA and Sierra Nevada Juicy Little Things Hazy IPA. This could be another way to source consumers from the near beer space into the craft segment.”

Toenies mentions that the non-alcohol segment might be for a sub-segment where craft brewers could see success.

According to data from Circana, in the 52 weeks ending Oct. 1, the IPA style saw sales of $2.2 billion, up 4.7% from the same time period past year. Pale and amber ales, seasonal, wheat ales, beer flagship plus, and pilsners and pale lager styles were all down in sales compared with last year.

“IPA style remains the dominant craft style and is a 48.4 dollar share of craft, and is up 2.7 points versus a year ago,” Toenies says. “Pale and amber ales is the next largest craft style, but it is a 10.1 dollar share of craft, then seasonals and wheat ales are both about 9 dollar shares of craft beer. The Top 5 styles are over an 80 dollar share of craft beer.”

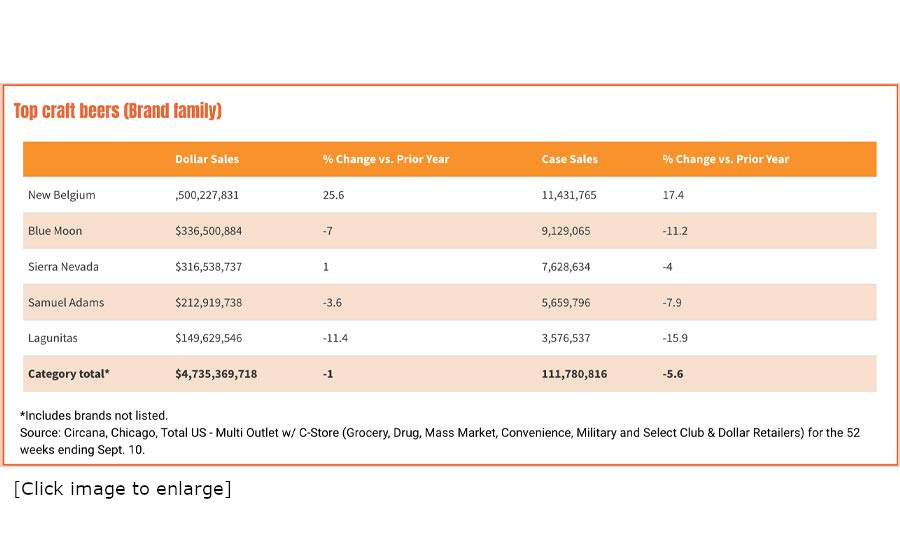

According to data from Circana, in the 52 weeks ending Sept. 10, the top craft brands were from the following brand families, respectively:

- New Belgium

- Blue Moon

- Sierra Nevada

- Samuel Adams

- Lagunitas

- Shiner

- Elysian

- Founders

- Firestone

- Bell’s

Mintel’s 2022 Executive Summary anticipates that, in future years (between 2025 and 2027), beer innovation will match consumer demand.

“As the mature, market dominant category, beer innovation will catch up with consumers needs in experience, wellness and flavor,” the report states. “Following years of turbulence, sales will assume the trajectory expected off a category of its size; moderate year-over-year growth. Competition from adjacent categories will continue to strengthen, threatening beer’s leadership.”

Despite the suspected growth in competition, the report suggests that the beer category will regain good growth in the future.

Outside impacts and influences

Taprooms and on-premise continue to affect the health of the craft beer market.

Circana’s Toenies says on-premise remains competitive for craft brewers to gain distribution.

“Taprooms are an opportunity for craft brewers to build a brand locally and create a memorable experience for consumers to enjoy their product,” he notes.

BMC’s Sudano states that most of the growth of the craft beer segment is occurring in the taproom environment. This is due to factors such as supporting local, destination visitors, unique styles only available in taprooms and dining entertainment, all of which Sudano says complement beer tasting.

In a September report from the Brewers Association titled “Diving Into POS Data and Trends With Arryved,” Watson examines data from the point of sale (POS) system Arryved, which was designed with brewery taprooms in mind. He received Arryved data from January 2021 through May 2023, with the total data set covering more than 2,000 locations and 300 million transactions.

One point in the report examines beer as a percentage of sales by month from that period of time. Watson specifically looks at May 2021 onward, when sales “get out of a clear COVID-19 period.”

Watson writes: “… Regardless of when you start, it’s pretty clear that beer sales, while still the majority of sales, are declining as a share of overall sales at these locations.”

Watson also points to price increases and time of day as contributing factors of the decline in craft beer’s popularity during that time period.

“Beer dominates until about 11 p.m. at which point it falls off,” he writes. “While we’re using a same store set here, some of this may be based on opening hours. Stores that sell liquor may be more likely to be the ones still open at that point.”

Going forward, BMC’s Sudano expects that the craft beer market will continue to face challenges.

“The erosion of craft beer retail continues to challenge the craft beer market, along with IPA fatigue, in addition to overall traditional beer (non-beyond beer) declines,” he says.

Circana’s Toenies echoes similar sentiments.

“With the continued success of the import, flavored malt beverage and non-alcohol beer segments, expect them to continue to outsource distributions/shelf space from craft beer at retail,” he says. “This will continue to keep the craft beer shelf space very competitive and make it very difficult for the segment to grow overall.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!