2017 Craft Beer Report: Regional brewers a bright spot for craft beer

Beer segment looks to address deceleration

On Instagram, the hashtag #shoplocal has been used more than 11.9 million times as of Oct. 16. The posts with this hashtag published by influencers and consumers alike show that local shopping trends continue to proliferate. Within the beverage market, one segment in particular has shown the power of “local” — craft beer.

“I think the smaller breweries continue to be the positive segment in the market,” says Eric Schmidt, director of alcohol research for Beverage Marketing Corporation (BMC), New York. “Consumers have embraced authenticity and local, and I think that while a lot of these brands won’t go national — they have done very well near their home market. These smaller breweries are also engaging consumers through events at the breweries, taprooms at the brewery, in an effort to gain more consumers.”

The positive performance of smaller craft breweries has happened at the same time that the beer segment is experiencing decelerated growth following years of strong volume and dollar sale performance.

“The craft beer market overall is experiencing a slowdown in growth, largely due to the decline of the larger brands in the segment,” Schmidt explains. “The slowdown is being stemmed by smaller breweries and [the] continued influx of new breweries.”

A September report from Moody’s Investors Service about alcohol beverages in the United States titled “Craft beers lose some cachet, but still outperforming declining mainstream brews,” also highlights the positive effect craft beer has had on the overall beer market in recent years.

“Craft beer has been the fastest growing segment of the beer industry,” stated lead report author Linda Montag, Moody’s senior vice president, in the report. “Craft shipment volumes have more than tripled in the last 10 years while mainstream beer volumes declined. Together with premium imports, craft beer’s success allowed total U.S. beer sales to grow in the low-single digits in some recent years despite declines in most larger beer categories. We estimate that craft beers — both independent and those owned by large brewers — now comprise around 15 percent of U.S. beer volumes, up from about 7 percent in 2010. We also believe that craft beers account for as much as 25 percent of total U.S. beer sales, given crafts’ higher price points.”

In Chicago-based Mintel’s January 2016 report titled “Beer – US,” the market research firm highlights the segment’s growth as well as the importance that local has played as part of its messaging.

“The craft share of the beer category nearly doubled from 2010 to 2015 (5.2-10.2 percent),” the report states. “There are several reasons for this growth, including a consumer base interested in trying new products, a savvier group of shoppers interested in where their products come from and how they are made, and more premium variants that are notably different from mainstream beers. Many craft beer brands lay claims to being local, small batch and handmade, some with a long heritage.”

Following these growth years, the slowdown began. Some of this deceleration comes as consumers are becoming more educated about the differentiators of independent craft brewers and craft-like brands from mass beer producers. However, acquisitions of smaller craft brewers by large corporations have helped make up for some of the deceleration of craft-like brands, Schmidt notes.

“When you talk of craft-like brands that larger brewers own, there are two types: the brands like Blue Moon and Shocktop that have seen their growth decrease over the past year or so, while some of the craft brewers acquired by a company like AB InBev, like Golden Road, Blue Point, Goose Island have done well, however, not at rates we saw a few years ago,” he says. “I think consumers are more aware of brands and their stories and now know that brands previously thought of as craft have declined due to awareness but more so by the constant influx of new styles, breweries and much more options. While growth for craft-like brands have declined so have a lot of the larger brands within craft, while smaller crafts have done well.”

In its June report titled “Beer in the US,” Chicago-based Euromonitor International addresses that the proliferation of craft beer brands has caused saturation in the segment, thereby impacting the overall beer market.

“Craft beer, long a driver of beer volumes, underwent what will undoubtedly be noted as the early stages of saturation in 2016,” the report states. “Although not explicitly researched or defined by Euromonitor International, ale, weissbier/weizen/wheat beer and stout, Euromonitor International defined categories where craft beers are most prominent, [and] recorded combined total volume growth of just 2 percent in 2016, sharply contrasting with growth at an 11 percent [compound annual growth rate] (CAGR) posted over the review period.

“This slowed growth of craft-dominated categories affected the overall performance of beer in the U.S., which posted a flat performance in total volume terms in 2016, compared to growth at a 1 percent CAGR over the review period,” the report continues. “Although substantial consumer interest in the U.S. craft beer market remained, the proliferation of brewers and the offerings they produce quenched consumers’ thirst for well-crafted beers, ushering in a new era of competition.”

Moody’s Montag also addressed the effects of market saturation. “One reason for the slowdown is the influx of new entrants to craft,” she said in the report. “Wooed to the sector by years of success, craft brands have proliferated, competing for limited shelf space. Brewpubs doubled their numbers from 2006 to 2016, regional brewers tripled their numbers and microbreweries expanded nearly tenfold from 370 to 3,132, according to Brewers Association, an industry trade group. Retailers have been pressured by consumers to expand their offerings to include not just traditional beers and large national craft brands, but also the local craft brand brewed ‘down the street.’”

BMC’s Schmidt expects that the craft beer market will address the saturation challenge with smaller craft beer brands remaining the bright spot for the segment.

“I think the larger brewers in the segment will continue to struggle due to the engagement of consumers by local brewers through events and taprooms,” he says. “In addition, consumers embrace local and authentic, which has also helped spur growth for them. I think looking ahead the segment growth will remain positive, but not near the rates we previously saw. There will also be an eventual shakeout with too many brewers in a marketplace that can’t sustain them all.”

Buzz-worthy creations

Unique innovations in the segment have been a part of what has helped the craft beer market thrive throughout the years.

In Mintel’s report, the market research firm identifies the trends and product attributes that helped the segment double its share of the beer market between 2010 and 2015.

“A perfect storm of factors can be pinpointed as the cause, including a consumer base interested in trying new products; a savvier group of shoppers invested in where their products come from and how they are made; and a market that responded with a stepped-up version of a familiar product that ticks all the boxes,” the report states. “Craft beer lays claims to being local, small batch and handmade, with an identifiable heritage. The segment also benefits from being a premium version of a relatively affordable alcohol category that hit as recession-wary consumers started exercising a willingness to invest a little more in their experiences at and away from home. Mimicking the traits of the craft segment, such as through conveying the feel of small scale and quality, should help the category as a whole to grow.”

Another unique aspect to the craft beer market has been collaborations among “rivals” in the market. This amalgamation of brewing styles has allowed for new beer taste profiles.

“We’re seeing more collaboration between brewers, examples like Sierra Nevada and Tree House Brewing with their East Meets West IPA with the breweries in Chico, Calif., and Mills River, N.C., blending a hoppy beer with nuances of their taste profiles combined in this example,” BMC’s Schmidt says. “I think the consumer is always looking for new, innovative products, and getting brewers together helps them push that envelope. There are also collaborations where brewers age their products in used wine casks and bourbon barrels to give a unique taste profile.”

Earlier this year, Sierra Nevada announced that it was partnering with Brauhaus Miltenberger, a German craft brewer, for a seasonal Oktoberfest collaboration beer.

“Cornelius and his team from Brauhaus Miltenberger embody the spirit and tradition of Oktoberfest,” said Brian Grossman, second-generation brewer for Sierra Nevada, in a statement. “It was great to host them at our brewery in Mills River, N.C., for the creation of this year’s fest beer. They brought literally centuries of family brewing experience to the mix and helped us create the ultimate festival beer.”

Sierra Nevada Oktoberfest is a golden lager weighing in at 6.1 percent alcohol by volume (ABV) with an authentic, rich and layered malt flavor balanced by traditional German-grown hops, the company says. In addition to 12-ounce bottles and draft offerings, a 12-ounce can format was made available for this year’s Oktoberfest.

Although creative beer styles have helped brewers test the limits of consumer exploration, this creativity stems from the “styles” that have become associated with craft beer — India Pale Ales (IPAs) and Seasonals.

“I think IPAs will always do well, although some brewers are really pushing the limit of [International Bittering Units] (IBUs) in some of the products,” Schmidt says. “Seasonals have done well but not as well as previous years due to the sheer amount of offerings in the industry. However, beers like pumpkin beers will always have a place in autumn for consumers and since they’re not available all year, consumers look forward to their introduction, but you can see how important these are for brewers as they keep getting introduced earlier and earlier in the year. [For example,] pumpkin beers in mid-August.”

Although Seasonals and IPAs are among the top-performing styles within craft beer, consumers also are showing a growing acceptance of emerging styles.

“There are pockets of consumers that have embraced styles like sours and porters,” Schmidt says. “Brewers are also making hybrid styles where they take a hop-forward IPA and kettle sour it. There are also other sour types like goses and Berliner Weisse that have their own unique taste profiles. Porters, similarly, will always have their consumers due, in part, to the styles of porters available, from American porters that include coffees, vanilla and mocha to a higher ABV Baltic porter that is similar to a stout.”

Also helping to spread the creativity of craft brewers, particularly in regional operations, has been the proliferation of growlers and crowlers.

“This trend has really helped the craft brewers that have taprooms and allow consumers to take growlers home for consumption,” Schmidt explains. “For brewers, the margins for products for this are really high, with consumers paying deposits on growlers, no transportation cost and no wholesale tier to sell through.”

However, craft beer’s future growth opportunities might reside outside of the United States. Moody’s Morgan highlights how exports could serve as a growth outlet that large-scale brewers could tap for their craft-like and craft-purchased brands.

“While craft typically means small and local, certain U.S. craft brands will have appeal in other markets, simply because they are American ‘craft’ brands,” Morgan stated in the report. “The craft beer craze has spread beyond the U.S. to many international markets where local brewers are building their own craft portfolios. Large international brewers may be able to breathe new life into established brands by taking them to select non-U.S. markets.

“Molson Coors has identified Blue Moon for such an opportunity,” she continued. “ABI has also talked about taking Goose Island to certain international markets, having identified retail sites in at least six cities globally. It also has plans to expand distribution of beers produced by [the] Craft Brew Alliance, in which it holds a 31.6 percent stake, to more international markets.”

Whichever way craft brewers and craft brand owners seek to address the deceleration of craft beer sales, it seems as though change will be on the horizon for this “local” segment. BI

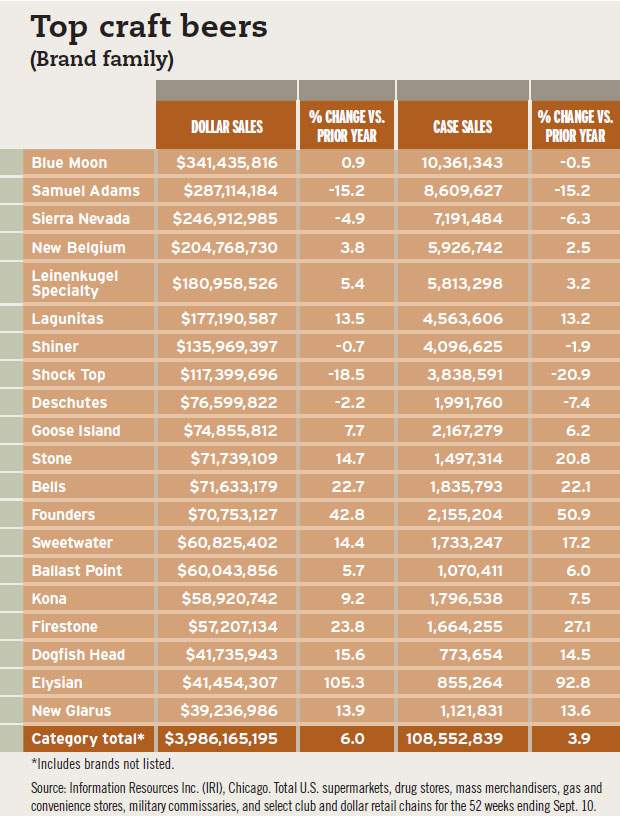

The Top 20 craft beers by brand family, according to Information Resources Inc. (IRI)

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!