Category Focus

Energy drinks performance continues to shine

Better-for-you offerings offer growth opportunities for energy market

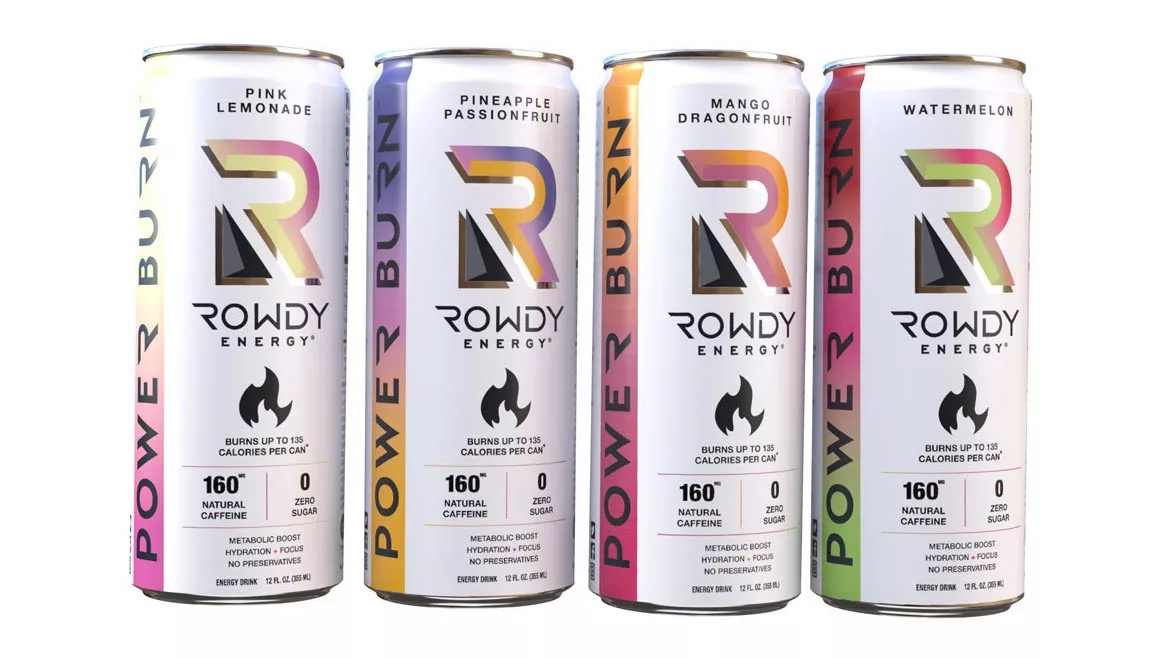

Available in four flavors ― Watermelon, Pineapple Passionfruit, Pink Lemonade and Mango Dragonfruit ― Power Burn has 5 calories, zero sugar and provides 160mg of natural caffeine from green tea and green coffee beans.

Image courtesy of Rowdy Energy

In the Sonic the Hedgehog video game series, one of the signature moves of the character is the Sonic Boost where Sonic moves at increased speeds to not only cover more ground, but breakup obstacles that might be in its way. Just like how gamers can tap the right buttons on a controller to enact the Sonic Boost, consumers increasingly are turning to energy drinks and shots to get them through their day.

In its “US Energy Drinks Market Report 2022,” Chicago-based Mintel highlights that energy drinks performance is driven by a dedicated base of highly engaged consumers, as 52% of these consumers drink these beverage multiple times a week or more.

Noting that the energy drink market thrived throughout the pandemic, Mintel’s report notes that consumers altered their shopping patterns with more purchasing energy drinks in multipacks from traditional retailers.

Caleb Bryant, associate director of food and drink reports at Mintel and the author of the report stated: “Energy drink sales soared throughout 2020 and 2021, driven by pandemic-related stressors and increased work and home responsibilities. Sales will remain strong as more consumers continue to purchase energy drinks in multipack formats. Brands face an opportunity to celebrate consumers’ return to social activities and increased consumer interest in health and wellness indicates opportunities for [better-for-you] (BFY) energy drinks.”

|

|

DOLLAR SALES | % CHANGE vs PRIOR YEAR | MARKET SHARE | % CHANGE vs PRIOR YEAR | |

| 1 | Red Bull

|

$6,873,108,322 | 12.6 | 41.3 | -0.8 |

| 2 | Monster | $5,017,298,270 | 12.4 | 30.2 | -0.7 |

| 3 | VPX | $1,309,978,291 | 0.2 | 7.9 | -1.2 |

| 4 | Rockstar | $704,623,081 | -4.7 | 4.2 | -0.9 |

| 5 | Celsius | $504,226,037 | 220.8 | 3 | 2 |

|

|

Category Total* | $16,638,123,618 | 14.8 | 100 | --- |

*Includes brands not listed

Source: Information Resources, Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending June 12.

BFY’s expansive reach

The growing interest in BFY beverages has touched many beverage categories, and energy drinks is no different.

In its 2021 report titled “Energy Drinks in the US Through 2025,” New York-based Beverage Marketing Corporation (BMC) highlights the proliferation of the low-calorie energy drink market.

“Low-calorie energy drinks have risen from 17.3% of energy drink volume in 2006 to 41.7% in 2020,” the report states. “Low-calorie energy drinks had only come into existence in January 2003 with the launch of Red Bull Sugarfree.”

The report details that diet energy drinks have outperformed full-calorie energy drinks (in terms of volume) for a number of years, and predicts this trend will continue.

“As noted, low-calorie energy drinks outperformed their higher-calorie counterparts in 2020, a trend which should continue in the next five years,” the report states. “Diet energy drinks should increase their share of volume from 41.7% in 2020 to 42.1% in 2025. Their share of wholesale dollars is expected to grow from 39.2% to 40.0% in the identical five-year period.”

Corona, Calif.-based Monster Energy Corp. is supporting the demand of the low-calorie energy drink market with its Rehab Monster line. Adding to the lineup, Monster recently announced the launch of its newest Rehab flavor: Watermelon. The new energy drink is packed with added functional benefits to restore energy and conquer fatigue, it says. Loaded with 150 mg of caffeine, Rehab Monster Watermelon has only 25 calories in each can and less than 5 grams of sugar, it adds.

“Functionality has been one of the most important drivers to innovation in the beverages market for the past decade,” said Dan McHugh, Monster Energy chief marketing officer, in a statement at the time of the release. “Rehab Monster Watermelon combines perfectly sweet and tangy watermelon flavor with incredible recovery benefits to create the perfect formula for the drink of the summer.”

This spring, San Diego-based Rowdy Energy took its BFY approach to another level when it released its Power Burn line. Available in four flavors ― Watermelon, Pineapple Passionfruit, Pink Lemonade and Mango Dragonfruit ― Power Burn has 5 calories, zero sugar and provides 160mg of natural caffeine from green tea and green coffee beans.

“We’re thrilled to introduce this new line as the initial response has been overwhelmingly positive with consumers loving the taste and being excited about the calorie burning aspect,” said Jeff Church, CEO and co-founder of Rowdy Energy, in a statement. “It’s important for Rowdy to continue to stand out in the growing energy drink category and having this new health-forward, thermogenic line allows us to be at the forefront of innovation within the industry.”

Sally Lyons Wyatt, executive vice president and practice leader at Chicago-based Information Resources, Inc. (IRI), notes that the energy drink category will keep moving in a BFY direction.

“The energy drink category growth story has and will continue to move towards becoming energy drinks with healthy features, like zero calorie, added vitamins, lower caffeine content and/or innovative health additives,” Wyatt says. “Today, the most common attributes include: no sugar, natural caffeine extract from green tea, vitamins added and creatine added. The majority of brands are focused on the traditional energy shot/drink aspects; however, a few brands are targeting fun-loving trendy/hip product designs, flavors and brand ambassadors to represent them.”

However, reduced calories and sugar is not the only BFY trend impacting the energy drink market. In November 2021, Glanbia Nutritionals released its insights titled “Energy Drink Trends: What to Expect in 2022.” In that, it identifies the inclusion of sports nutrition ingredients as a growing trend.

“Sports nutrition is another area of expansion for energy drink brands, as more brands are adding performance and recovery ingredients like protein and amino acids,” it states.

Healthy forecast

The U.S. energy drinks market continues to show its dominance. According to data from IRI, the energy drinks category’s sales totaled nearly $17.8 billion, an increase of 14.1% for the 52 weeks ending June 12 in total U.S. multi-outlets.

Of its respective segments ― non-aseptic energy drinks, energy shots, energy drink mixes and aseptic energy drinks ― the non-aseptic energy drink segments continues to drive the market. With sales totaling $16.6 billion, a year-over-year increase of 14.8%, the majority of the Top 10 individual brands experienced strong growth. Only a few brands were flat in sales saw declines.

“Overall, the category should continue to grow in both unit and dollar sales in the year to come,” IRI’s Wyatt says. “The growth will be driven primarily by the energy drink mixes and non-aseptic. Helping fuel the growth will not only be the big brands, but also newer brands offering unique/better offerings. Energy shots should continue to grow online, but growth in-store may continue to face challenges.”

The global market also looks to be poised for continued growth. London-based Future Market Insights (FMI) anticipates that the global energy drink market will reach a value of $68.1 billion in 2022. With a compound annual growth rate (CAGR) of 7% for the forecast period of 2022-2032, it projects to reach $98.8 billion by 2032.

“Increasing popularity of energy drinks coupled with a wide variety of products offered in the market and growing consumer base are factors that will presumably boost the market over the forecast period,” FMI states in a release.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!