Ingredient Spotlight

Tea varietals flourish, as consumers seek out functionality and flavor

Tea ingredients expand beyond traditional beverage models

In his eighth century monograph, “Classic of Tea: Origins and Rituals,” Chinese tea master Lu Yu writes: “Tea tempers the spirits and harmonizes the mind, dispels lassitude and relieves fatigue, awakens thought and prevents drowsiness, lightens or refreshes the body, and clears the perceptive faculties.” Although these words were written more than a 1,000 years ago, it seems that today’s tea drinkers are seeking these same attributes from the teas they consume and more.

In fact, Chicago-based Mintel’s “The US and RTD Tea Market Report 2021” describes tea as a go-to drink in the COVID-19 pandemic as people are looking for ways to support immunity.

“The pandemic and the quest for comfort, relaxation and immunity set tea up for success, but in an already very competitive non-alcoholic beverage market that was thriving,” it states. “Tea drinkers are thirsty for more options, especially ones that may contribute to well-being rituals, even after a year of, or perhaps because of, increased consumption. Nearly a third of tea drinkers cite increased consumption compared to a year ago and have plans to continue.”

Anuhya Bhaskara, Certified Food Scientist and research and development manager for Florida Food Products, Eustis, Fla., notes that demand for brewed tea extracts is definitely growing.

“During the pandemic, tea has evolved from being just a refreshing beverage to a drink with promising ‘health halo,’ a nutraceutical and a functional ingredient across multiple delivery systems, which is driving the category’s growth,” Bhaskara says. “There are over 100 published scientific studies on [tea] varietals for its cancer preventive effects ― skin, lung, breast, prostate and other cancers.

“Tea has been researched for its beneficial effects on gut health and against stress, arthritis, diabetes and obesity,” he continues. “Green tea and black tea also have been commonly known to have immunity boosting, cardiovascular, cholesterol regulating and cognitive health benefits.”

Additionally, while green tea (25% market share) and black tea (70% market share) continue to lead the tea category, innovative functional blends and indulgent applications with black tea or green tea are gaining traction, according to Bhaskara.

Image courtesy of Brew Dr.

Emerging flavors, functionality

As emerging herbal teas like hibiscus, rooibos, chamomile and yerba mate are gaining a loyal consumer following, these varietals are further driving tea growth by offering flavor, color and functionality, experts note.

Philip Caputo, marketing and consumer insights manager for Brooklyn, N.Y.-based Virginia Dare, notes that certain ingredients in herbal varietals invoke flavors associated with health and well-being.

“Dark berries such as açaì, elderberry, and goji are known as rich sources of antioxidants, while ginger and mushrooms are known for anti-inflammatory properties,” Caputo says. “By integrating wellness flavors into their applications, tea brands can underscore their focus on targeted nutrition categories such as immunity, brain health, aging and digestion.”

Additionally, therapeutic botanicals and essential oils work well in applications such as infused teas. Flavors like chamomile, green tea, hibiscus, mint and cinnamon emphasize the functional aspects of these wellness-oriented products, he notes.

“When it comes to wellness flavors, formulators have a broad palette available and should be emboldened to experiment with innovative combinations and formats,” Caputo says.

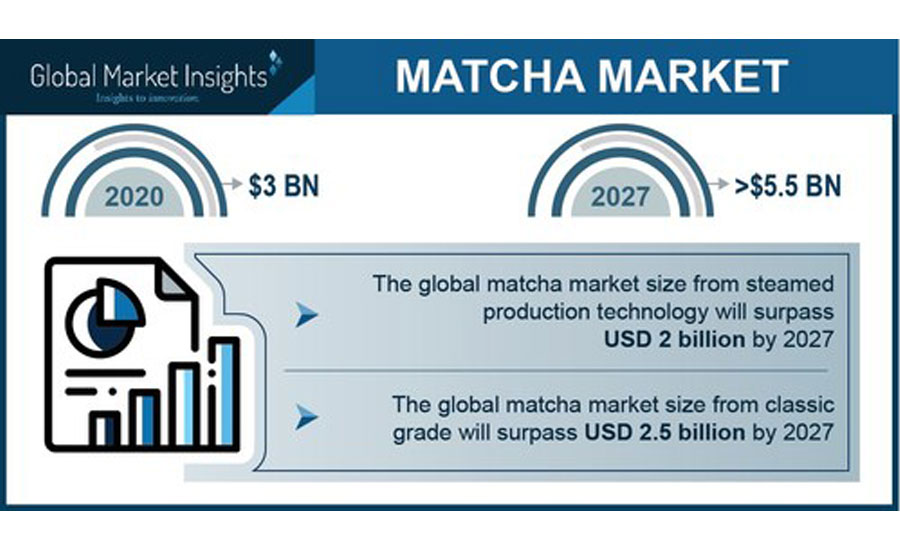

Meanwhile, with the increasing demand for a variety in tea flavors, green tea’s matcha market value is expected to cross $5.5 billion by 2027, according to the Selbyville, Del.-based Global Market Insights Inc. research report “Matcha Market.”

“The matcha industry’s size from steamed production technology is set to surpass $2 billion by 2027. The increasing adoption of steamed production technology, owing to its ability to retain the green color of the tea leaves and low production cost, will boost product demand,” the report states. “The tea leaves are steamed using a machine and then air-dried, locking in the young tea leaves for a bright green color and a sweet and vegetal flavor. The demand for high-quality tea worldwide will fuel the adoption of steamed production technology in turn stimulating the overall industry statistics.”

Virginia Dare’s Caputo adds that the race for innovation and the willingness to challenge the status quo are driving all new processing approaches, expansion opportunities and enhanced flavor blends.

“What’s the most exciting for us at Virginia Dare is that as part of the innovation race, you’re seeing a focus on clean labels and properly sourced ingredients, which may be another consumer trend itself to point out.” he explains. “More than ever before, people want to know what they’re ingesting and where it came from. Based on Mintel data, in 2018 alone, ethical food and drink sales reached $8.2 billion.”

Image courtesy of Global Insights Inc.

Future trends

Across the board, tea usage has been increasing because of higher demand for ready-to drink (RTD) and powder tea beverages, experts note.

During the past decade as consumers have continued to move away from carbonated soft drinks, they often migrate to a healthier alternative like tea, according to Virginia Dare’s Caputo.

“A lot of this growth early on was a rising tide that helped all brands. Now consumers are looking to experience tea in different ways,” he explains. “All indications are that the tea market will continue to grow and adapt to consumer demands. Consistency of quality and taste is key in this market especially with the growth of the premium tea beverages.”

Florida Food Products’ Bhaskara adds that consumer preferences for organic and natural products has become a prominent trend, especially post-pandemic. Clean label, preservative and chemical-free products are gaining recognition. This trend is fueling growth across the organic tea market.

Additionally, tea-based hard seltzers, hard kombuchas, cocktail mixers, wine spritzers and low alcohol cocktails are driving the hybridization trends, Bhaskara says.

“We know the RTD tea category will continue to grow as consumers fulfill their desire to have a beverage that is as nutritionally beneficial as it is flavorful,” he explains. “Tea is also making strides as a powerful ingredient in other food markets such as ice cream, yogurt and confectionery, as well as soups and sauces. The many varietals of tea can offer unique flavor profiles that can bring in a worldly taste experience to many everyday food items.”

Caputo notes that as new growth in the tea realm is attributed to consumers wanting a more premium tea, single origin RTD beverages and unsweetened artisanal/herbal teas are in high demand as opposed to the traditional sugar sweetened, fruit-flavored iced teas where the tea impact was less relevant.

“Today’s consumers want to be able to taste the different tea flavors and distinguish the differences between different varieties, from jasmine to dandelion to rooibos,” he says.

Market research also is demonstrating the evolution of tea. Mintel’s tea report notes that launch activity shows a continued focus on ethical, natural, functional and sugar-free claims.

“Brands are launching more sugar-free teas to market; products with added dietary fiber that target mealtimes are gaining traction; hōjicha green tea is inspiring innovation,” the report states. “RTD teas increasingly convey a high-quality, craft image. Tea brands are extending the use of biodegradable material beyond tea bags to other elements of packaging.

“In five years and beyond, the environmental impact of tea farming will move into focus,” it continues. “Eye health and enhanced sensorial experiences offer new routes for brands to explore.”

Yet, one of the biggest flavor hurdles that functional tea beverages face is climate change. Fluctuating temperatures, extreme weather patterns and a lack of biodiversity already are changing the resulting base taste profile of many established teas, according to Virginia Dare’s Caputo.

“This brings a level of unpredictability in the flavoring process that wasn’t there before. How do you adjust when your source is the issue? As active members of FEMA and OIFI, it’s an issue we’re focused on solving,” Caputo says. “Ethically and intentionally sourced tea ingredients is the core of Virginia Dare, so we’re amped about any product that works to expand that vital narrative.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!