Packaging Materials

Sustainability drives future of beverage packaging materials

Plastic, aluminum, glass suppliers all taking steps to deliver on sustainability

In the Hanna-Barbera TV special “Yogi’s Ark Lark,” Yogi Bear and numerous animals gather for a meeting to discuss the poor state of the environment and its impact on their homes. To flee the perils they are facing, the cartoons animals decide to leave their homes as they search for a new perfect home free of pollution and other environmental flaws. Through their journey, the animals find there is no perfect place and ultimately decide to return to their homes and clean up the messes there, thereby reclaiming their perfect homes.

In today’s fluid consumer packaged goods (CPG) market, where sustainability reigns supreme, many brand owners are taking the same proactive attitudes as the Hanna-Barbera animals when choosing the most environmentally friendly primary packaging option.

“Consumer awareness of their environmental impact continues to rise, and as such, sustainability continues to be a top priority for many consumers and a driving force behind brand packaging decisions within the industry,” says Sara Axelrod, director of sustainability for beverage packaging of North and Central America at Ball Corp., Westminster, Colo. “Beverage-makers are proactively seeking packaging options that will help reduce environmental impact and overall waste.”

In the beverage market, aluminum cans, plastic containers and glass bottles are among the most utilized primary packaging solutions, and all three are doing their part to further the future of sustainable beverage packaging.

Axelrod notes that the infinite recyclability of cans make them a sustainable solution for beverage packaging.

Scott Breen, vice president of sustainability for the Washington, D.C.-based Can Manufacturers Institute (CMI), also touts the material’s recyclability as well as its conversion rate.

“A significant amount of the valuable aluminum in beverage cans is recycled since aluminum beverage cans are the most recycled beverage packaging in the United States and the world,” he says. “In fact, in 2019 in the United States, there were more than 40 billion aluminum beverage cans recycled, the equivalent of 11 12-packs per person.

“The vast majority of the beverage cans that are recycled are turned into new cans making it the textbook example of the circular economy,” Breen continues. “This is how the recycled content of aluminum cans in the United States averages a whopping 73 percent.”

The glass packaging market also is connecting beverage manufacturers to their sustainable packaging goals. Scott DeFife, president of the Glass Packaging Institute (GPI), Arlington, Va., notes that, on average, glass bottles made in the United States contain approximately 30 percent recycled glass content.

“This attribute speaks to much more than a recycling or recovery rate ― it is a fact that brands choosing glass for their beverages should receive credit for within their sustainability portfolios,” he says.

Another attribute aligning glass packaging with sustainability goals is its lifecycle usage. “Further bolstering the appeal of glass as a choice for packaging is the circular nature of a bottle ― it is 100 percent and endlessly recyclable,” DeFife says. “Glass doesn’t degrade over time and is largely made (and recycled) near local and regional markets.”

DeFife adds that the fact that glass is made from non-toxic and natural materials, it offers brand owners another key sustainability attribute.

When it comes to the plastic containers markets, experts highlight how the industry is taking major steps to support the demand for sustainable solutions.

John Maddox, president of SBA-CCI Inc., Jacksonville, Fla., explains that “recent commitments for higher recycled content by several brand owners has thrown the PETE industry into high gear.”

“Hundreds of millions of dollars are being invested in recycling and sustainability,” Maddox says. “New technologies, which were heretofore considered impractical or too costly, are now being reconsidered and in many cases being prepared for implementation in order to meet 2025 goals.”

Michael Zuckerman, president and chief executive officer of Zuckerman Honickman, King of Prussia, Pa., notes that beverage manufacturers still depend on plastic packaging because of its resealability and lightweight attributes. As such, major beverage manufacturers such as The Coca-Cola Co., PepsiCo and Keurig Dr Pepper (KDP) are investing in post-consumer recycled content.

“They continue to innovate with new packaging formats designed to improve recyclability — increasing use of post-consumer recycled (PCR) content ― as they approach their own sustainability commitments,” he says.

For instance, KDP’s CORE is using 100 percent PCR for its bottles and PepsiCo’s Pure Leaf Tea’s bottle is 50 percent PCR, Zuckerman says. The Coca-Cola Co. also recently rolled out a 100 percent recycled PET bottle for Coca-Cola trademark brands in select markets.

John Cullen, director of PET resins sales and marketing for Charlotte, N.C.-based DAK Americas LLC, an Alpek Polyester business, further emphasizes the industry’s commitment to sustainability.

“Given the importance of packaging to the consumer experience, there is tremendous focus on choosing the right materials that will fulfill the sustainability needs while meeting the practical and economic demands of commerce,” he says. “PET packaging has delivered sustainability, value and consumer appeal for over 40 years and continues to be the material of choice for many brands and retailers. Its lightweight, clarity, break- and tamper-resistance, and recyclability are all features that improve the consumer experience and help achieve a sustainable cycle.”

Driving change

Although sustainability remains a top priority for packaging suppliers, experts also highlight the diverse variables affecting the future of beverage packaging materials.

“The ongoing COVID-19 pandemic has demonstrated the value of plastics in general and plastic packaging in particular,” Cullen says. “The change in consumer behavior toward more home-based activities has driven demand for existing and new packaged beverages that were previously consumed in the office, restaurants and other retail spaces. Teas, juices, coffee, enhanced water and carbonated flavored waters have all gained market share. Many of these products are packaged in PET.”

Cullen notes that smaller pack formats have been a growing trend for brand owners and retailers.

“Portion control is one aspect to the reduced size,” he says. “The smaller packages also support the desire to have an individual serving that is not intended for sharing in an environment where that is a concern. In some parts of North America, there is also increased interest in larger formats where the packages can be refilled in addition to being recycled. PET is particularly suited to the multiple cycles of filling, consumption, cleaning, and refilling required to be economically viable.”

Likewise, SBA-CCI’s Maddox notes that convenience typically has been a key driver for packaging size evolutions, but the onset of the pandemic altered some of the more recent trends throughout the plastic container market.

“During 2020 we saw a major shift in consumer needs and preferences,” he explains. “Far less mobility. Economic concerns. Fewer stops for gasoline and the abandonment of [convenience/gas]-store traffic. Take-home packaging displaced 20-ounce single-serves and nearly all fountain service. Demand surged for multi-packs of PETE, aluminum cans, and we even saw growth in the venerable 2-liter PETE bottle.”

Megan Easterling Sanford, director of marketing operations for beverage packaging of North and Central America at Ball Corp., also notes the impact that the pandemic has had on aluminum beverage packaging.

“Demand for aluminum cans has seen significant growth even prior to COVID-19 due to consumer behavior shifts,” she says. “Emerging trends including convenience, eCommerce, and health and wellness have been heightened by the pandemic, and we’re seeing beverage-makers reacting with new innovations and product launches showcasing these product attributes. Consumers are leaning into the ‘grab-and-go’ model and seeking more convenient and portable options.

“As local ordinances and restrictions have kept restaurants and bars closed or operating at very limited capacities, home drinking occasions shifted demand away from fountain drinks and draft and into already-growing aluminum beverage packaging,” Easterling Sanford continues.

The proliferation of online delivery services “also amplified the demand for aluminum beverage packaging,” she says, particularly as aluminum’s composition aligns well with transport and storage.

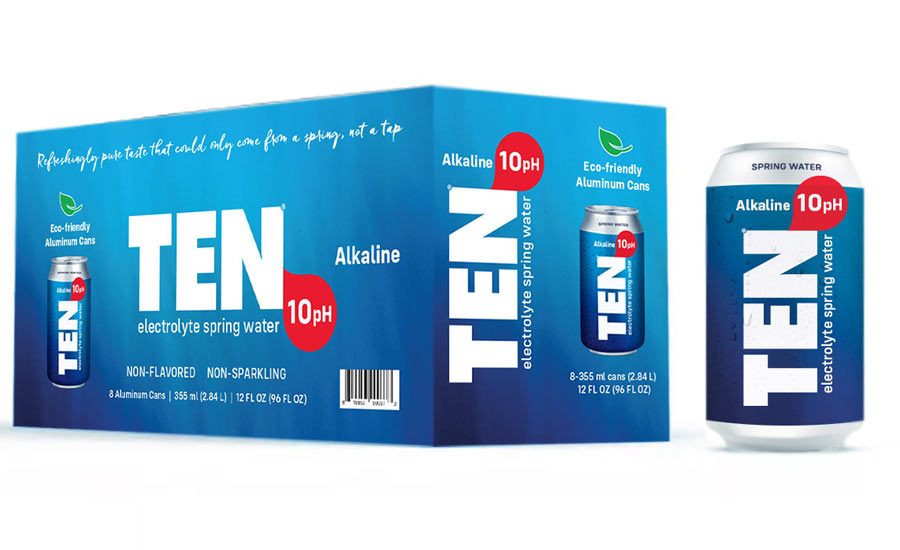

CCL Containers, Hermitage, Pa., which manufactures aluminum packaging sizes ranging from 4 to 32 ounces, has seen the greatest shifts emanating from the packaged water market.

“The trends we’re seeing is it’s more about water,” says Kimberly Kizer, vice president of sales for CCL Containers.

John Bischoff, director of research and development and product development at Toronto, Ontario-based CCL Industries, agrees, noting that five to six years ago, the company had seen many coming to the supplier from the energy drinks market, but that new business now is originating from water brands.

“If you ask me today what is our biggest consumption of bottles, it’s water,” Kizer says.

However, she notes that the shape and design features that its technology can produce, offers capabilities beyond this, helping beverage manufacturers meet important attribute points.

“The other thing is they want sustainability and recyclability in the venues like sports arenas as the pandemic is beginning to wind down and cruise ships and things of that nature,” Kizer says. “… We just now are dabbling our feet into the wine section. That’s an undertaking as there’s not a lot of players out there that can produce the 750-ml wine bottles. We have the capability to produce a diameter that large so we’re looking at that as well. It’s just looking at a little bit of everything.”

Lorne Paskin, principal and executive vice president at Zuckerman Honickman, also points to the popular beverage market shifts impacting the aluminum packaging market.

“The 250-ml can has become very popular in the high-end specialty beverages such as coffee, mixers, etc.,” Paskin says. “Also, with the advent of the hard seltzer category 12-ounce sleek can demand has gone off the charts. In craft brewing, the 19.2-ounce can has gained in popularity in outdoor venues and cash and carry establishments.”

CMI’s Breen also highlights the proliferation of aluminum packaging to the vanguard beverage categories.

“Beverage cans have seen significant increases in sales over the past several years, in part due to sustainability attributes,” he says. “Most new beverages that have been introduced in recent years have been packaged in aluminum cans. The aluminum beverage can has taken market share in craft beer, wine, kombucha, hard seltzer, ready-to-go cocktails and other emerging beverage categories.”

Premiumization also is making an impact on the latest developments within glass beverage packaging.

“The glass container industry has seen an increasing demand from customer bases and brands for premium higher-end decorated and specialty glass,” GPI’s DeFife explains. “Overall increases in glass bottles shipments for the wine and spirits categories reflect that trend. The glass industry has a new plant and entrant into the market this year, with the opening of the Arglass Yamamura plant in Valdosta, Ga. This is a reflection on the outlook for glass in the U.S., and new approaches addressing product offerings and options.

“Arglass’ Georgia plant is tied into on-demand manufacturing capabilities, which allows the customer to choose the shape and size of a bottle, along with specialized and enhanced decorating techniques,” he continues. “Saverglass’ Jalisco, Mexico facility, which opened in 2018, combines both of these services under one roof and focuses on high-end wine and spirits bottles. Manufacturing both the container and the ability to apply decoration together allows for quicker delivery and more customer input.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!